Against the challenging backdrop of 2022, LGT continued to grow profitably and reported strong net asset inflows.

Assets under management increased year on year and LGT remains well positioned to achieve further solid growth in 2023. Following the announcement of the company’s annual results, we speak to LGT Wealth Management CEO Ben Snee about the key takeaways.

Clearly, the macroeconomic environment at the moment is turbulent. What do the financial results released this week indicate about LGT’s ability to weather market instability?

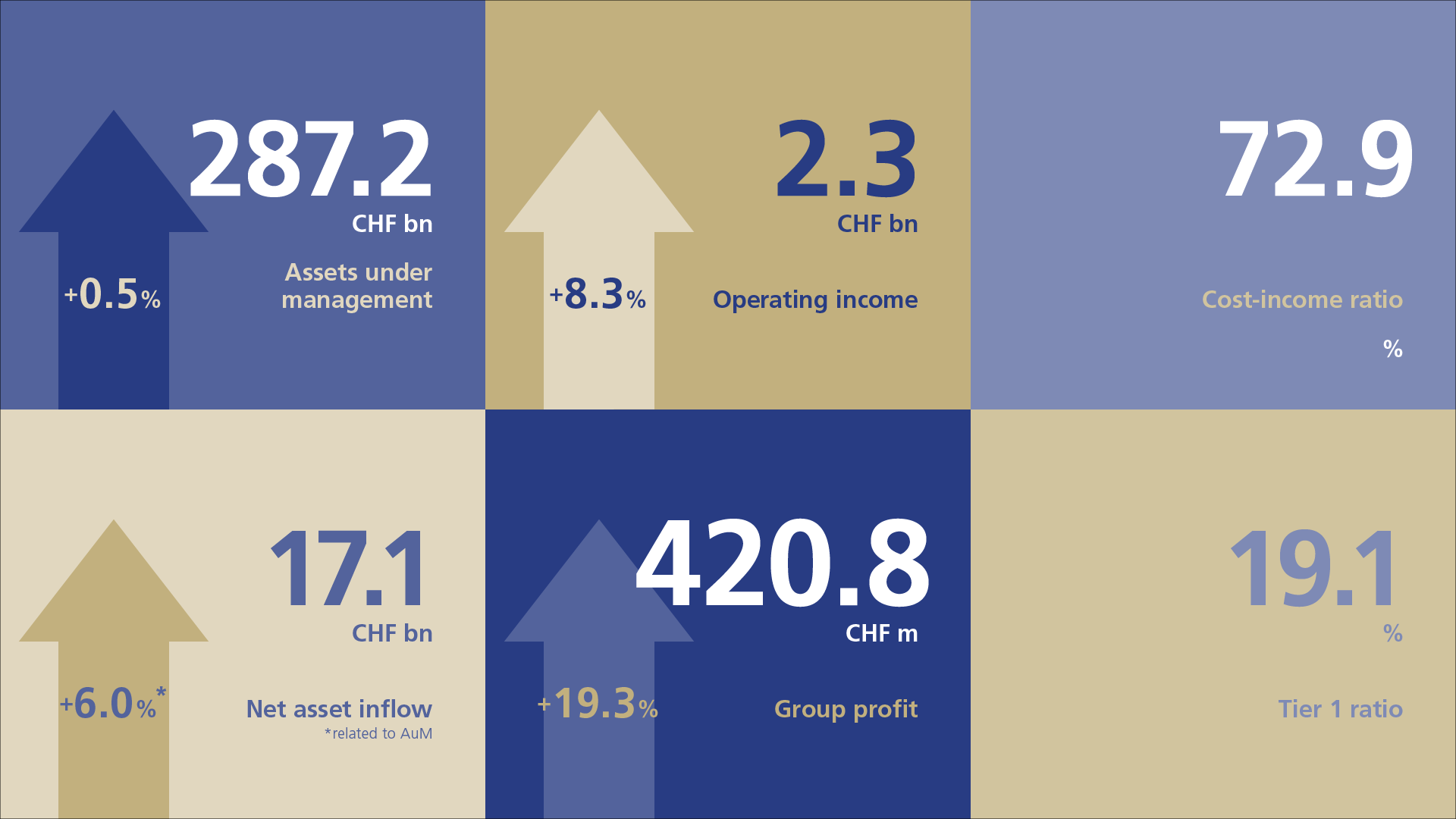

Ben Snee: LGT Group remains extremely well-capitalised, with a tier 1 capital ratio of 19.1%, putting the bank amongst the most financially secure of their global peer group. The stable ownership, continuity of management and conservative approach to the balance sheet all ensure that LGT remains robust in the face of macroeconomic turbulence, including the recent events in the banking sector.

LGT remains robust in the face of macroeconomic turbulence, including the recent events in the banking sector.

What are the strategic priorities for LGT Wealth Management in 2023?

Ben: We are excited about the prospects for the business this year. Our priority remains unchanged: to provide clients with an excellent service and ensure we continue to deliver good outcomes from an investment perspective, helping to navigate challenging financial markets.

A clear strategic focus is the completion of our acquisition of abrdn Capital and the integration of this business into LGT Wealth Management. Other priorities include delivering further advances in our sustainable investment offering, development of our regional expansion plan and the continuation of our digital transformation programme. It will be a busy but productive year!

How does LGT’s company culture ensure we remain a stable and trusted partner for clients, advisers and employees?

Ben: Our client-centric approach and drive to deliver excellent outcomes for all of our stakeholders remain undiminished and are well-embedded in the business, even as we continue to grow.

The support of LGT Group, with its family ownership structure, is a constant that should provide much comfort. The long-term view of the business, stable strategy and focus on non-financial issues – such as the ambition to reach carbon net zero by 2030 and the donation of 10% of annual dividends to philanthropic causes – all ensure a genuine alignment of interests with clients, the people who work in the business and wider society.

View LGT’s annual results here.