An update from LGT chief investment officer Scott Haslem

Are markets on the cusp of a pivot? And in exactly which direction? For some time now, equity markets have been grinding higher—and bond yields have been trending lower—underpinning solid investor returns. Indeed, US equities haven’t seen a cumulative pull-back of more than 3% since April this year. Much of this reflects a combination of calming geopolitical developments (despite some that have stressed our social fabric) and accelerating enthusiasm regarding Artificial Intelligence’s (AI) ability to drive new forms of growth across the globe.

We believe our central case scenario for markets to consolidate within their recent trading ranges in the near-term is intact. Post a re-basing, markets should be able to continue navigating higher as global growth slows (but doesn’t collapse), inflation stays benign (at least outside the US) and central banks trim rates just a few more times. Recent data suggest the risk of a more sinister disinflationary shock shouldn’t entirely be dismissed. Yet, as we discuss inside, the more prescient risk may be one of ‘reflation’—more growth, less disinflation, and a renewed rise in bond yields.

This month we trim our overweight to fixed income back to neutral and initiate an under-weight to global government bonds. US rate cuts were expected. But have we under-assessed the pent-up demand in US housing activity and the potential for US (and European) savings to drive consumer spending in 2026? Could the AI capex boom be unstoppable for a few more years? Could the US Supreme Court invalidate the Trump tariffs, leaving the tax cut package unfunded? Could China and European fiscal stimulus contribute more to 2026 global growth than many currently expect?

Are markets on the cusp of a pivot? And exactly which direction will that be? For some time now, equity markets have been grinding higher and bond yields have been trending lower, underpinning solid investor returns. Indeed, US equities have not seen a cumulative pull-back of more than 3% since April, and US 10-year yields have fallen sharply from over 4.7% in January to around 4.1%.

Yet, arguably, little else in the world feels ‘at ease’. Our western social fabric, many believe, is being stretched at the seams. The assassination of a well-known US commentator has seemingly challenged the right to free speech, Europe is navigating the collapse of another French government, peace remains elusive in the Middle East and Ukraine, while the future independence of US monetary policy appears under some threat.

Over the next few weeks, equities are the most vulnerable to a downside move since the April lows, in our view. High volatility names are as extended as they have been. Sentiment remains complacent.

BTIG Technical Strategy,

26th September 2025

Geo-macro developments (and AI optimism) have been constructive for markets, fostering enthusiasm regarding the sustainability of future growth. Despite the shock of the Liberation Day, most countries have negotiated less punitive tariffs than expected, and the inflationary impact in the US has been more delayed and more muted than anticipated. US corporates continue to ‘eat’ the bulk of those tariff cost increases (though for how long remains uncertain). The eye-boggling growth in tariff revenue (a tax on the US economy) has also widely been seen as the antidote to Trump’s fiscally profligate One Big Beautiful Bill, calming for now the US bond market (with lower yields also a tailwind for equities). And while there’s been limited progress in terms of geopolitical hotspots in the Middle East and Ukraine, markets continue to view the tactical success of the US’s action in Iran as limiting the risk for renewed incursions elsewhere.

The macro backdrop has also proved constructive for markets. At a global level, growth has been slowing moderately, but generally resilient jobs markets (including Europe, the UK, Japan, and Australia) have given comfort that a collapse in global demand is not imminent. While further progress on disinflation has been limited, prior moderation toward central bank targets has afforded scope for ongoing modest rate cuts, albeit this journey is closer to its end than the beginning (at least outside the US). Regionally, optimism about the European growth outlook has persisted, and Japan continues to recover from deflation. While in the US, slower H1 2025 growth and emerging weakness in the jobs market has fostered the long-awaited resumption of US central bank rate cuts, supporting both bond and equity markets.

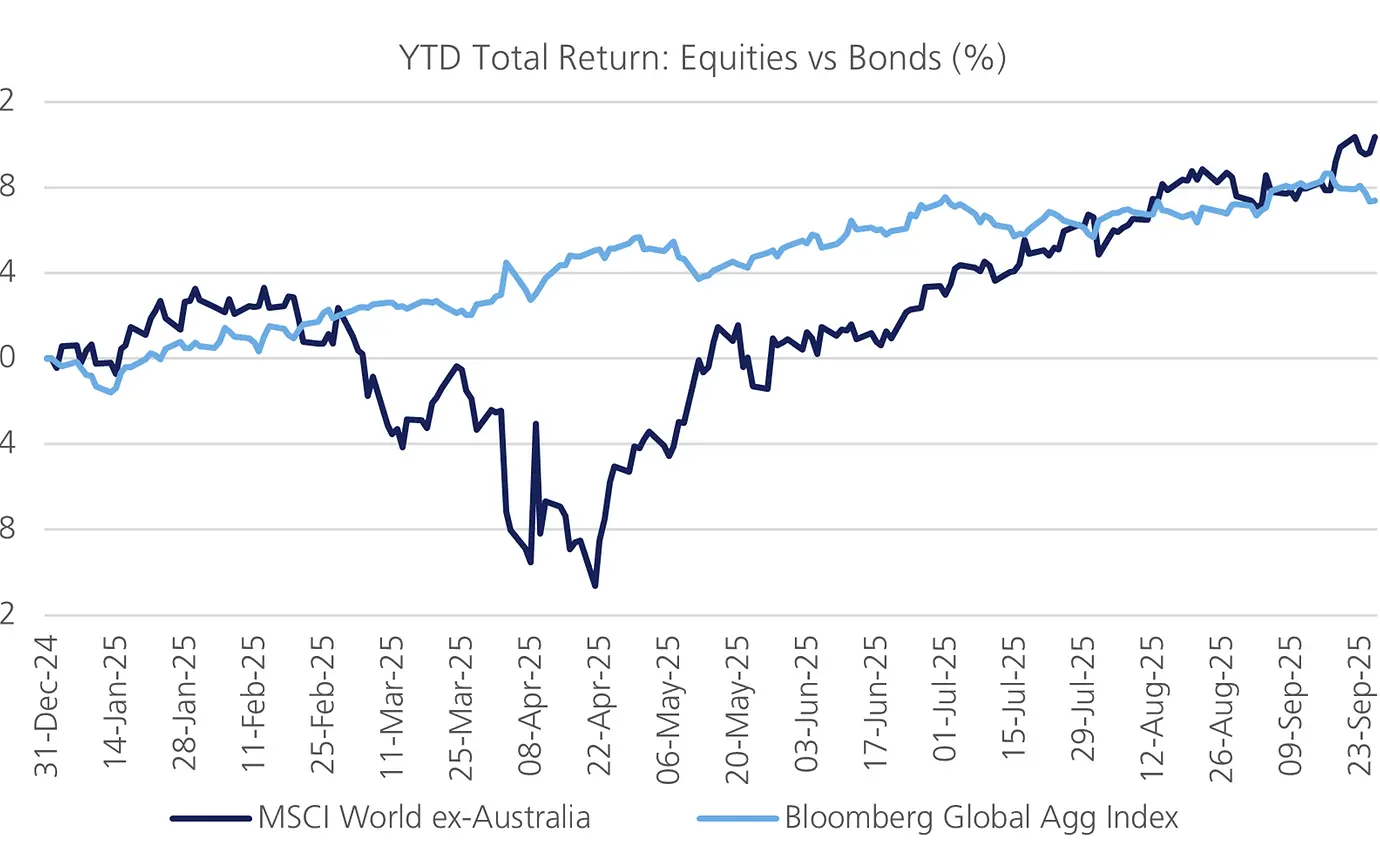

Our preference for remaining underweight cash and deploying tactically across both fixed income and equities (while maintaining strong allocations to private markets) has proved accretive over recent months. We’ve maintained a preference for non-US global equity markets (notably Europe and Japan) while harvesting the significant return on offer in quality credit. Despite this, given the heightened dispersion and volatility that has persisted across markets, being diversified across and within asset classes has made the most significant contribution to portfolio risk-adjusted returns, reflecting a gain of over 3% for diversified portfolios so far, this financial year.

This combination of geopolitical and macro factors has seen global equity and fixed income markets deliver broad-based positive returns over recent months. And we believe there is a reasonable basis to expect these conditions—our central case—will continue in the months ahead.

Political interference in the Federal Reserve's independent decision-making on interest rates could have serious economic repercussions, including higher inflation, worsening growth, and increased unemployment.

Austan Goolsbee, President of the Chicago Fed. April 2025

This combination of geopolitical and macro factors has seen global equity and fixd income markets deliver broad-based positive returns over recent months. And we believe there is a reasonable basis to expect these conditions—our central case—will continue in the months ahead.

Equity and bond returns have trended higher in tandem over the year to date

A period of moderating global growth and modest rate cuts for the rest of 2025, that gives way to a cyclical recovery through 2026—while undoubtedly one of the more market friendly scenarios one could embrace—remains our central case. And credit where credit is due, central banks globally do appear to have done a heroic job thus far, returning inflation close to target with at best limited damage to jobs markets.

But as any forecaster who’s been around a while has learnt, the central case doesn’t always play out, at least rarely to its fullest form. Whether it’s the ‘landing’ or expiration of a central case that naturally forces the next phase of the cycle to arrive, or the reality that there are just better or worse scenarios that are evolving, we now judge the probability that our central case wins true have ebbed lower over the past couple of months (and the risks it becomes unstuck have risen).

Could global growth prove materially worse than we are expecting? If so, could this scenario significantly challenge company earnings, at a time most equity markets are arguably fully valued? There have clearly been some signposts in the most recent data:

China’s activity data—after 5% growth in H1 2025—has deteriorated materially in July and August. Consumer spending has slowed at a time the property sector remains a stark headwind.

Europe and UK growth has stalled in Q3, in part due the tariff-shock on trade. This has led to weaker near-term capex and consumption in the UK, while EU energy grants are set to fade.

The US’s jobs market (with non-health/social assistance jobs now falling) could drive sharply weaker consumer spending over the coming months as real income growth slows.

The genesis of this risk sits comfortably at the feet of the US Liberation Day tariff shock, which has disrupted global trade, challenge the ability of global businesses to cement future capex plans, while convincing US consumers that being taxed 20–30% on their imported goods purchases is making America great again. The lagged impact of prior global central bank monetary tightening, the reversal of which has likely been somewhat delayed by uncertainty related to the tariff outcomes, also has the potential to prove a more meaningful headwind to growth over coming months.

Of course, an unexpected collapse in global growth aligns with the risk of a ‘disinflationary shock’ which we wrote about in our August Core Offerings, with slower US growth and the redirection of China’s previously US-bound consumer goods elsewhere key catalysts. While such a scenario could tilt the balance tactically in favour of fixed income over equites, we judge that the risk of such an outcome has not increased over recent months, not least because it would likely be relatively swiftly met by more aggressive central bank interest rates cuts that combine with healthy corporate and consumer balance sheets to stabilise and re-accelerate activity.

AI has already become a major driver of equity markets, even in the absence of measurable economic gains.

BCA Research, September 2025

For the economists, ‘reflation’ technically describes that period where economies are recovering from below-target inflation (even deflation), and where interest rates are being cut to drive inflation back to target. For financial markets, it has become more common to refer to reflation as any period where growth is accelerating and inflation is rising, and from virtually any starting point. With global inflation barely back to its target post the pandemic uplift, this is our frame of reference.

Looking ahead, we now see a range of risks that suggest the next phase of the cycle—the next pivot for the global economy—could be toward reflation. And one where the reflationary impulse is concentrated more highly on the growth front than inflation (at least for the next year or so). This could see our central case of consolidation (positive for both equities and fixed income) shift to one where growth is cyclically recovering, supported by recent monetary easing and (unexpectedly strong) fiscal stimulus. This would likely forestall any further central bank rate cuts and swiftly shift market focus toward limited further progress on disinflation, followed eventually (think H2 2026) by tighter monetary policy. While this scenario may eventually challenge both equities and fixed income, in the immediacy, it is without question a most challenging scenario for government bonds.

While this [reflation] scenario may eventually challenge both equities and fixed income, in the immediacy, it is without question a most challenging scenario for government bonds.

US households have enormous equity ‘wealth’ that rate cuts could help unlock

A range of factors have impacted our scenario analysis, leading us to favour (or worry) more about emerging reflation than deflation risks:

How so I hear you say? Surely lower US rates were a key aspect of our central theses, and the expectation of which has led us to remain constructive on equities, and indeed overweight through all of 2025, protecting capital and harvesting strong equity (and credit) returns.

But have we under-assessed the pent-up demand in US housing and the potential for US savings to drive a powerful reacceleration in consumption in 2026? Mortgage rates (linked to long term yields) are unlikely to fall as low as they have in the past given debt concerns. However, 30-year mortgage rates have already fallen below where a significant share of 2024’s loans were written, and likely to see households refinance and equity released. The chart above reveals the extent of ‘home equity’ US households possess, which may be brought to bear as the US Fed cuts further over coming months. With mortgage applications now accelerating, and US housing construction near cycle lows, there is the potential for the US economy to respond quickly to even modest rate cuts. It is worth noting that the European consumer also has a significant saving rate—over 15%, its highest since 2021—which could also support future European activity given official interest rates have already been halved from 4.0% to 2.0% over the past year.

Finally, we remain reasonably comforted that President Trump’s US Federal Reserve (US Fed) appointees will remain credible, given they need to be approved by the Senate Banking Committee. However, as Olivier Blanchard, a world-renowned economist and one of the most influential figures in modern macroeconomics penned, monetary policy is more art than science. And the subjectivity of the process leaves the door open for more dovish (and still credible) central bankers to trim rates more than otherwise, raising the risk that the bond market may smell reflation earlier than we have already pencilled in. This would particularly be the case if US Fed actions started to signal 3% inflation was the new 2%, with little effort forthcoming to drive it back there.

As Olivier Blanchard, one of the most influential figures in modern macroeconomics penned, monetary policy is more art than science. And the subjectivity of the process leaves the door open for more dovish (and still credible) central bankers to trim rates more than otherwise, raising the risk the bond market may smell reflation earlier than we have pencilled in.

Over the past month or so, a relatively new risk has emerged, with the potential for the US Supreme Court to strike down the Trump Administration’s reciprocal tariffs. If the tariffs are deemed unlawful, this would likely impart significant upside risks to bond yields, as it would remove a key revenue pillar supporting the OBBBA fiscal stimulus. The Supreme court is expected to begin its deliberations on 5 November and has committed to a decision by end 2025.

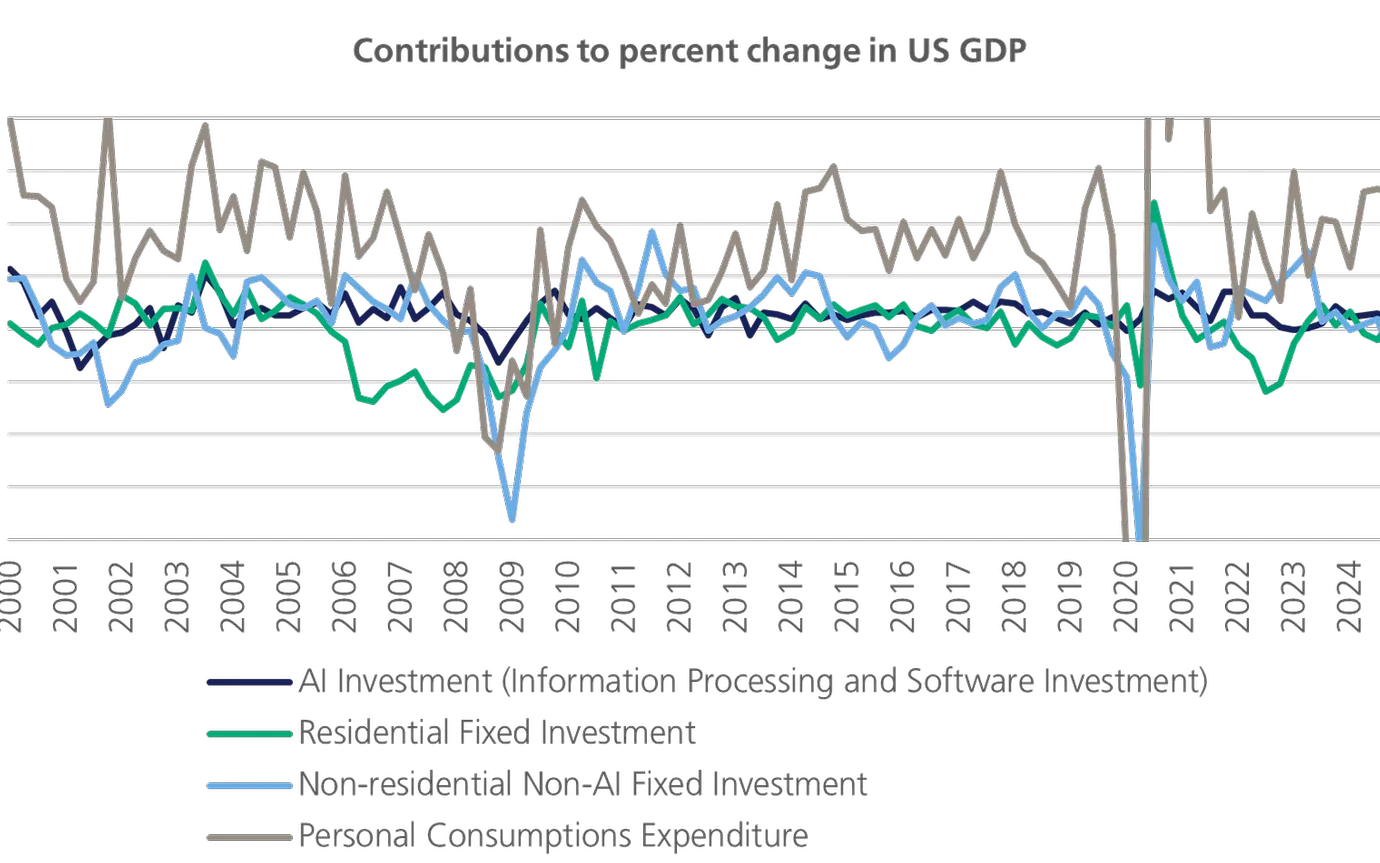

Over the first half of 2025, AI capex outpaced both consumption and all other investments in its contribution to US growth. As the chart below shows, it is now almost rivalling consumer spending in its contribution to US growth momentum. The scale and persistence of US hyperscaler capex has the potential to meaningfully drive US growth over the coming year or more. Microsoft, Amazon, Alphabet and Meta are executing multi-year investment pipelines in data centres, AI chips, and power capacity, with consensus estimates pointing to annual spend in the low hundreds of billions of US dollars. It also has the potential to drive broader growth, with demand for construction, equipment, semiconductors, and supporting infrastructure.

As BCA Research notes, “Like all other capex cycles this one will end in tears”. This may be true. However, even they acknowledge that the indicators they are tracking suggest the AI capex boom can continue supporting growth and markets for now. We are also cognisant of and carefully monitoring for signs that the AI capex boom may be approaching a tipping point. But as yet, any such inflection point does not appear to be a six-month risk given still-strong demand and the ongoing competition amongst hyperscalers and related companies. As Deutsche Bank noted recently, “aggressive AI-related capital expenditure…may currently be sustaining the US economy.”

Chart 2: AI capex beats all other combined and now rivals consumer spending contribution

While a re-awakened European (German-led) fiscal stimulus for 2026 is not ‘new news’ and has been key to our more constructive outlook and limited risk of a global recession, it nonetheless adds to the case for a cyclical upswing as 2026 gets underway that could limit the potential for long-dated interest rates to fall. Indeed, UBS believes the European Central Bank’s (ECB) window for further easing closes by Q1 2026, ahead of a likely rate hike in late 2026 as policy makers prepare for higher 2027 inflation.

For China, fiscal stimulus to date has been largely focused on the consumer, in an attempt to stabilise growth, rather than drive a property or commodity led upswing. Given the extent to which recent activity data has weakened in China during Q3, announcement of more meaningful stimulus remains a possibility.

Reflation—even if it’s initially mostly about faster growth—typically involves (or leads to) inflation. Of course, one could argue the productivity dividend forestalls this, though it might still be too soon to know if and when AI will deliver on that promise. However, for now, we think reflation—led by growth—might be reflected more as a positive equity market driver, given the recent fall in rates (and existing spare capacity across economies).

Reflecting this, we remain modestly overweight global equities (favouring non-US markets) and look for opportunities to deploy should any downside volatility occur. To capture the greater probability now assigned to our ‘reflation’ scenario, we have trimmed our fixed income overweight back to neutral, adding to cash to provide flexibility for any future opportunities to deploy. We now believe the market is over-pricing the number of US Fed cuts, and there are upside risks to bond yields, particularly as we look towards H1 2026.

We have made the following changes

Global government bonds—we have moved 2 percentage points underweight global government bonds (reflecting concern around reflation and term premia, and post US 10-years having rallied from 4.7% to 4.1% since January 2025). We have shifted the balance into,

Cash—by 1 percentage point, reducing our underweight and replenishing our dry powder to deploy into a more attractive buying opportunity, and

High Yield credit—by 1 percentage point, positioning us to take advantage of still-attractive all-in yields, noting our comfort around admittedly tight spreads given the relative health of the high yield market in aggregate and reflationary dynamics should be supportive of credit markets vs bonds.

Finally, given the heightened dispersion and volatility that is likely to persist across markets, being truly diversified across and within asset classes—global and local, listed and unlisted—will likely continue to make the most significant contribution to portfolio risk-adjusted returns in the year ahead.

Global equity markets have continued to rally, buoyed by easier US monetary policy and financial conditions, as well as ongoing optimism around the AI build-out. We maintain our cautiously optimistic positioning, though we are closely monitoring the clear and present danger signs flashing from a slowing US economy, and recognise that expensive and over-exuberant markets are vulnerable to downside shocks.

We continue to believe that US trade and global geopolitical uncertainty has peaked, reducing negative risks to global markets and the global economy. We continue to believe that tariffs are ultimately disinflationary, particularly outside the US, allowing global central banks to continue modestly cutting rates into the back end of 2025. A key risk event to monitor on the tariff front is the Supreme Court’s expected ruling on the Trump Administration’s reciprocal tariffs. If the tariffs are struck down, we believe that could lead to upward pressure on US bond yields as it could remove a key revenue pillar supporting the fiscal stimulus in the One Big Beautiful Bill Act.

More broadly, the pulse of easier global monetary policy should continue to act as a tailwind for the global economy. Further modest easing of mortgage rates in the US could help to further unlock the significant excess homeowners’ equity on US household balance sheets. In the meantime, the ongoing AI build-out is contributing as much to US economic growth as the US consumer (which typically makes up 66% of the US economy) and if sustained, has the potential to almost singlehandedly circumvent US recessionary risks. In addition, potential proliferation of AI benefits and easier financial conditions could support a broadening of the admittedly extended equity rally to smaller and mid-sized companies and to regions outside the US. Of course, we must also acknowledge increasing angst amongst market commentators that a potential bubble may be forming in this space.

Given these developments, we assess that risks are tilting towards more reflationary scenarios, where resilient economic activity imparts renewed underlying inflationary pressures as we enter 2026, limiting the extent to which central banks can cut and introducing upside risks to government bond yields.

Reflecting this view that reflationary risks have risen, we have neutralised our fixed income overweight and initiated an underweight to global government bonds. We retain our overweight to investment grade credit and introduce an overweight to high yield credit to take advantage of still-attractive all-in yields and as we believe reflationary dynamics should lead to credit outperforming bonds. We also retain our modest overweight to global equities, with a preference for Japan and Europe.

Key cyclical views

Has policy uncertainty peaked? Our frameworks tell us that trade and geopolitical uncertainty has peaked, pointing to moderating (though still-present) risks to the global economy.

Reflationary risks are rising; US rate cuts could help unlock the significant levels of excess homeowners’ equity on US household balance sheets, which could further support already-resilient consumer spending. In the meantime, the ongoing AI build-out has the potential to single-handedly support the US economy over the next 6–12 months. Both of these dynamics point to rising reflationary risks as we look to 2026, an environment that should support equities and credit relative to bonds.

Can central banks keep cutting? Progress on inflation and the ultimately disinflationary impact of tariffs should allow central banks to continue the global rate cutting cycle they started in 2024. US policy uncertainty and rising reflationary risks present a key challenge in balancing downside risks to growth with perceived inflation fears.

Opportunities are ripe for ‘active’ hunters vs ‘passive’ gatherers: The best opportunities will likely lie beneath the broad index level, rewarding more active ‘hunter’ versus passive ‘gatherer’ investors. This has proven particularly true so far this year.

Fortune favours the bold: 2025 is likely to continue to favour investors who can digest and exploit the opportunities that come with market volatility. Prudent portfolio diversification and active management will be important tools in the astute investor’s arsenal.

Key structural views

Welcome to a multi-polar world: The global community is increasingly realising that we have entered a multi-polar world, an environment that will likely create more volatility and uncertainty but also present more growth and opportunities for investors.

The energy transition is growing more challenging: Policy uncertainty, cost, energy security, and more extreme physical impacts are likely to complicate an already-challenging energy transition.

The rise of artificial intelligence: AI presents significant challenges and opportunities for the global economy and human society.

Higher base rates increase investor options: We expect interest rates to remain higher-for-longer, particularly relative to the post-GFC zero rate policy environment. Higher base rates increase forward-looking returns across all asset classes, giving investors more options to build robust, multi-asset portfolios.

Download the full document here:

Important information About this document [Disclaimer] This document has been authorised for distribution to ‘wholesale clients’ and ‘professional investors’ (within the meaning of the Corporations Act 2001 (Cth)) in Australia only. This document has been prepared by LGT Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (LGT Wealth Management). The information contained in this document is provided for information purposes only and is not intended to constitute, nor to be construed as, a solicitation or an offer to buy or sell any financial product. To the extent that advice is provided in this document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your ‘Personal Circumstances’). Before acting on any such general advice, LGT Wealth Management recommends that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the product before making any decision about whether to acquire the product. Although the information and opinions contained in this document are based on sources we believe to be reliable, to the extent permitted by law, LGT Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances. LGT Wealth Management, its associated entities, and any of its or their officers, employees and agents (LGT Wealth Management Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The LGT Wealth Management Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The LGT Wealth Management Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the LGT Wealth Management Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document. Credit ratings contained in this report may be issued by credit rating agencies that are only authorised to provide credit ratings to persons classified as ‘wholesale clients’ under the Corporations Act 2001 (Cth) (Corporations Act). Accordingly, credit ratings in this report are not intended to be used or relied upon by persons who are classified as ‘retail clients’ under the Corporations Act. A credit rating expresses the opinion of the relevant credit rating agency on the relative ability of an entity to meet its financial commitments, in particular its debt obligations, and the likelihood of loss in the event of a default by that entity. There are various limitations associated with the use of credit ratings, for example, they do not directly address any risk other than credit risk, are based on information which may be unaudited, incomplete or misleading and are inherently forward-looking and include assumptions and predictions about future events. Credit ratings should not be considered statements of fact nor recommendations to buy, hold, or sell any financial product or make any other investment decisions. The information provided in this document comprises a restatement, summary or extract of one or more research reports prepared by LGT Wealth Management’s third-party research providers or their related bodies corporate (Third-Party Research Reports). Where a restatement, summary or extract of a Third-Party Research Report has been included in this document that is attributable to a specific third-party research provider, the name of the relevant third-party research provider and details of their Third-Party Research Report have been referenced alongside the relevant restatement, summary or extract used by LGT Wealth Management in this document. Please contact your LGT Wealth Management investment adviser if you would like a copy of the relevant Third-Party Research Report. A reference to Barrenjoey means Barrenjoey Markets Pty Limited or a related body corporate. A reference to Barclays means Barclays Bank PLC or a related body corporate. This document has been authorised for distribution in Australia only. It is intended for the use of LGT Wealth Management clients and may not be distributed or reproduced without consent. © LGT Wealth Management Limited 2025. |

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.