Our Australian investment team’s view of the markets and insights into our latest strategic and tactical positions

The Australian fixed income market has undergone a renaissance. What was once a narrow, single-sector market focused primarily on government bonds has evolved into a broad, diversified investment universe. Today, investors can access multiple sectors, including semi-government, supranational, and corporate credit bonds, each offering distinct benefits and characteristics.

This wasn’t always the case. In the early 1980s, the corporate credit represented only a small portion of Australia’s capital markets, with total non-government bond issuance amounting to less than AUD 1 billion. This limited depth and breadth led not only to low liquidity but also to low awareness, particularly among retail investors, since the market was largely viewed as the domain of institutions.

Today, the Australian bond market exceeds AUD 2 trillion in size, with corporate bonds accounting for roughly half of the total issuance. Growth has been driven by demand from superannuation funds and banks, while foreign investors have been drawn to Australia’s stable regulatory environment, strong credit profile, and relatively attractive yields. More recently, the phasing out of bank hybrids and higher outright yields have encouraged greater participation from the wealth sector. This diversification of the investor base has further strengthened the depth and resilience of the Australian bond market.

Read the full PDF report:

Over the coming few quarters, the global macro backdrop should be relatively supportive for fixed income assets, as H225 global growth slows, inflation remains benign and most central banks continue to modestly trim interest rates. But as we wrote in our October Core Offerings, we are now assigning a higher probability to a global ‘reflation’ scenario emerging from mid-2026, one in which central banks face renewed growth momentum, complicating their efforts to deliver further rate cuts beyond mid-2026. This is a scenario where global bond yields could retrace higher toward the top of their recent ranges. Importantly, we anticipate the impact of this will be concentrated in the US, where the fiscal dynamics are less robust, central bank independence is more at risk, and an AI-induced growth upswing has more potential to pressure cyclical inflation higher.

Within this backdrop, and as we discuss in this month’s Core Offerings, Australia’s fixed income market remains well positioned. A now structurally deeper and more resilient market – helped by a more robust starting fiscal position than many key global economies – should combine with a likely less challenging cyclical pick-up in growth and inflation during 2026, to see both sovereign and corporate exposures deliver strong diversifying returns to portfolios.

Australia’s recent strong Q3 inflation print will certainly challenge those expecting a rate cut this month, coming in above the market’s and the Reserve Bank of Australia’s (RBA) forecast. Adding pressure to the near-term rates outlook is our belief that after a year and a half of a ‘per capita’ recession (and mid-2024 private sector activity near zero), that Australia is now amidst a mild cyclical growth recovery, led by an improving consumer and housing sector. Despite this, from an inflation perspective (which lags the growth cycle), Australia remains ‘late cycle’. After several years of robust employment gains, job vacancies are now easing, and the unemployment rate has risen to 4.5% from a cycle low of 3.5%. Wage growth, while still elevated, is showing signs of peaking as businesses respond to slowing revenue growth and higher operating costs.

Reflecting this, and with the RBA still forecasting below-trend growth over the coming year, core inflation (which has already halved from a peak of over 6% mid 2022 to 3% in Q3) should still return to the mid-point of the 2-3% inflation target during 2026. This suggests further modest rate cuts remain the most likely direction for policy, as the RBA returns rates to a more neutral setting (from 3.6% currently, to around 3.0%). This should still see duration exposures perform well, with elevated yields continuing to attract both domestic and offshore investors.

The demand side of the equation

In the Australian bond market, the investor base has broadened significantly, an evolution driven by both supply and demand dynamics. The Australian credit market presents a compelling opportunity to gain exposure to high-quality issuers, with Australian banks among the most highly regulated and best-capitalised globally. Investors can access these opportunities within a market characterised by a stable macroeconomic backdrop, a consistent issuance pipeline, lower volatility, and an attractive credit spread premium relative to other regions.

This favourable environment, together with the increasingly diversified investment universe outlined earlier, provides investors with ample scope to remain active and fully invested. These advantages extend to both domestic and offshore investors. Notably, recent new-issue data highlight growing participation from Asia-based investors, who have become increasingly active in the Australian market. As offshore participants are typically more accustomed to fixed-rate structures, demand in recent transactions has tended to skew towards fixed-rate tranches.

Figure 1: Australian credit spreads reflect an attractive premium to other regions

Source: Bloomberg, as at 24 October 2025

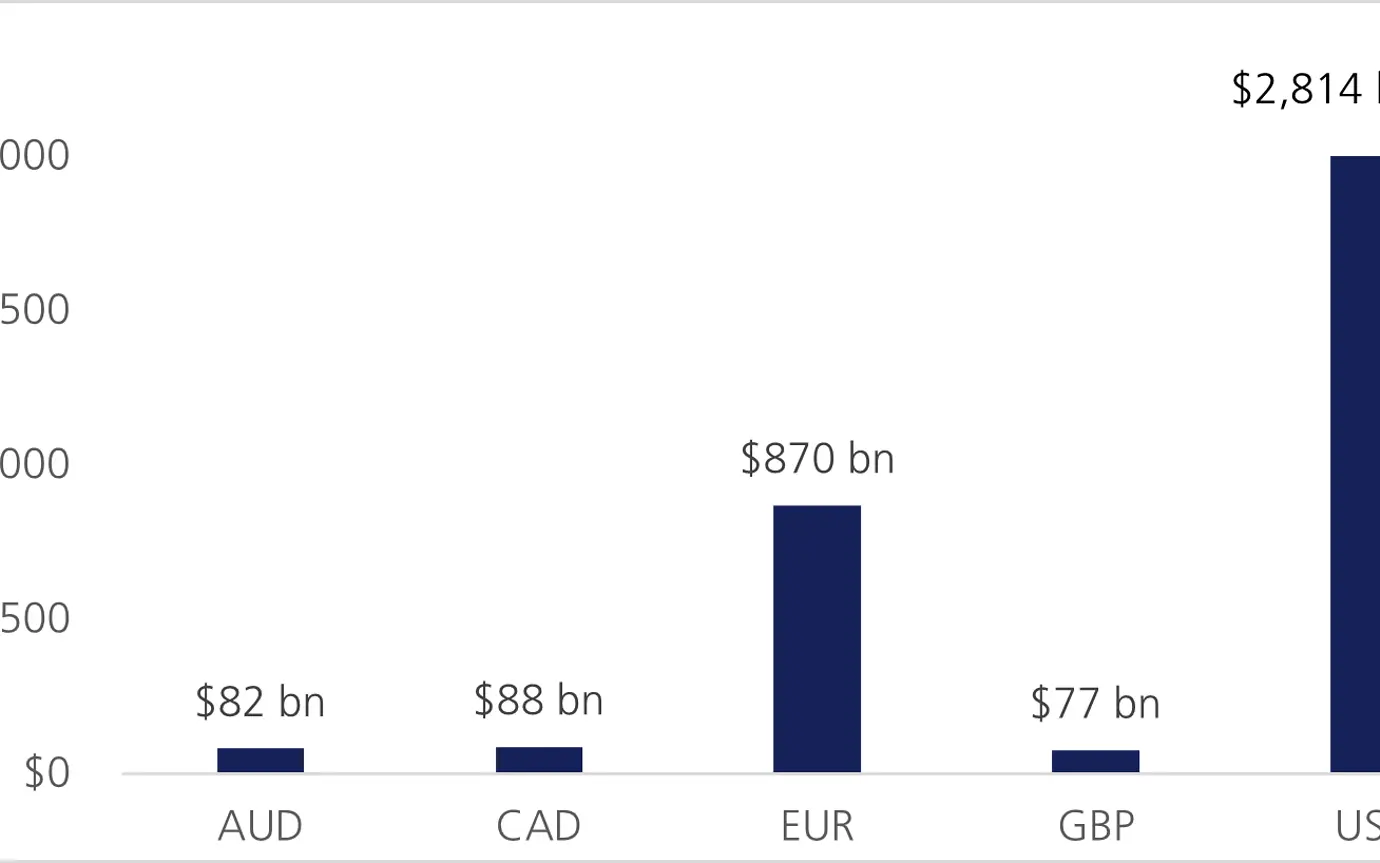

On the supply side, the Australian credit market has experienced a notable surge in issuance this year, ranking fourth globally, with CAD issuance recently overtaking AUD issuance, and the market now sitting behind EUR, USD, and CAD year to date. While investment grade spreads remain near historically tight levels (see Figure 1, above), outright yield levels have continued to attract strong investor demand. This supportive backdrop has given local issuers, both financial and corporate, the confidence to bring new transactions to market, including innovative formats across different maturities and parts of the capital structure.

The Australian market has also welcomed a growing number of new participants over recent years, including offshore borrowers, known as “Kangaroo” issuers, who are increasingly turning to Australia as an attractive funding source. Their presence has further enhanced diversification within investors’ fixed income portfolios, broadening the pool of high-quality investment grade issuers available in the domestic market.

The development of a corporate subordinated debt market

Investor demand for exposure to high-quality, investment grade issuers has driven significant growth in the Australian corporate subordinated debt market. Issuing investment grade bonds that are subordinated within the capital structure allows issuers to receive equity credit from rating agencies, helping them maintain investment grade status, while offering investors an additional yield premium.

Figure 2: Australia ranks fourth globally in terms of year-to-date issuance

Source: Bloomberg, as at 30 September 2025

In 2025 alone, we have seen over AUD 6 billion in subordinated issuance, led by infrastructure and real estate names. These subordinated instruments, often referred to as “corporate hybrids,” combine characteristics of both debt and equity. To qualify for equity treatment, they typically carry very long maturities, often 30 years or more, but include call options within 5 to 10 years. If the issuer fails to call the bond at the first call date, the rating agencies withdraw the equity credit, potentially affecting the issuer’s credit rating and leverage metrics. This dynamic generally incentivises issuers to call, though a deterioration in credit quality could impair their ability to do so.

Pushing the boundaries on tenor

In August, ANZ bank launched and priced a landmark 20-year bullet subordinated Tier 2 bond at a yield of 6.171% (ASW +180 basis points). Historically, Australian investors have become accustomed to 10NC5 (10-year maturity, 5-year non-call) or 15NC10 (15-year maturity, 10-year non-call) structures. By contrast, many offshore investors, such as insurers and pension funds, prefer to liability-match through 10-year or 20-year bullet structures.

Given this was the inaugural 20-year subordinated bullet transaction in the Australian market, there was some initial uncertainty about investor reception. However, the deal attracted over AUD 3.5 billion in demand, demonstrating strong participation from both domestic and offshore investors, particularly across Asia. The success of this issue has set the stage for future long-tenor deals from other major banks and corporate issuers.

While a 20-year tenor introduces meaningful duration risk to portfolios, the bond has performed strongly in secondary markets and is currently yielding around 5.80%, highlighting continued investor appetite for quality duration exposure.

Will we see more perpetual AT1 instruments?

Although bank hybrids are being phased out in Australia, Additional Tier 1 (AT1) instruments continue to feature prominently in offshore markets, and can still be issued in Australian dollars by offshore institutions.

In September, UBS issued its first AUD AT1 contingent convertible (CoCo) bond since 2019, attracting over AUD 7 billion in demand and pricing at a 6.375% yield. Despite UBS not being a local major bank, the strong bookbuild highlights significant investor appetite for high-quality, yield-enhancing instruments. This may encourage other offshore issuers to consider tapping the Australian market.

However, investors should remain mindful of the structural and regulatory differences of these instruments. AT1 securities are perpetual if not called and are governed by offshore regulatory frameworks, which can materially affect risk and return dynamics.

We believe investors should adopt a more active approach to managing hybrid exposures, taking advantage of capital gains opportunities before call dates, when spreads remain tight and liquidity is still strong.

The Australian Prudential Regulation Authority’s (APRA) decision to phase out the AUD 40 billion bank AT1 hybrid market by 2032 will reshape fixed income portfolios for our investor base. We have previously discussed the implications of this change (see “Phasing out of Bank Hybrids…where to next?”, February 2025)”, which unfortunately removes a well-recognised and historically popular investment opportunity. Bank hybrids have been favoured due to the familiarity of major bank issuers and their historically attractive credit spread pickup, although spreads have now compressed considerably in the wake of that decision.

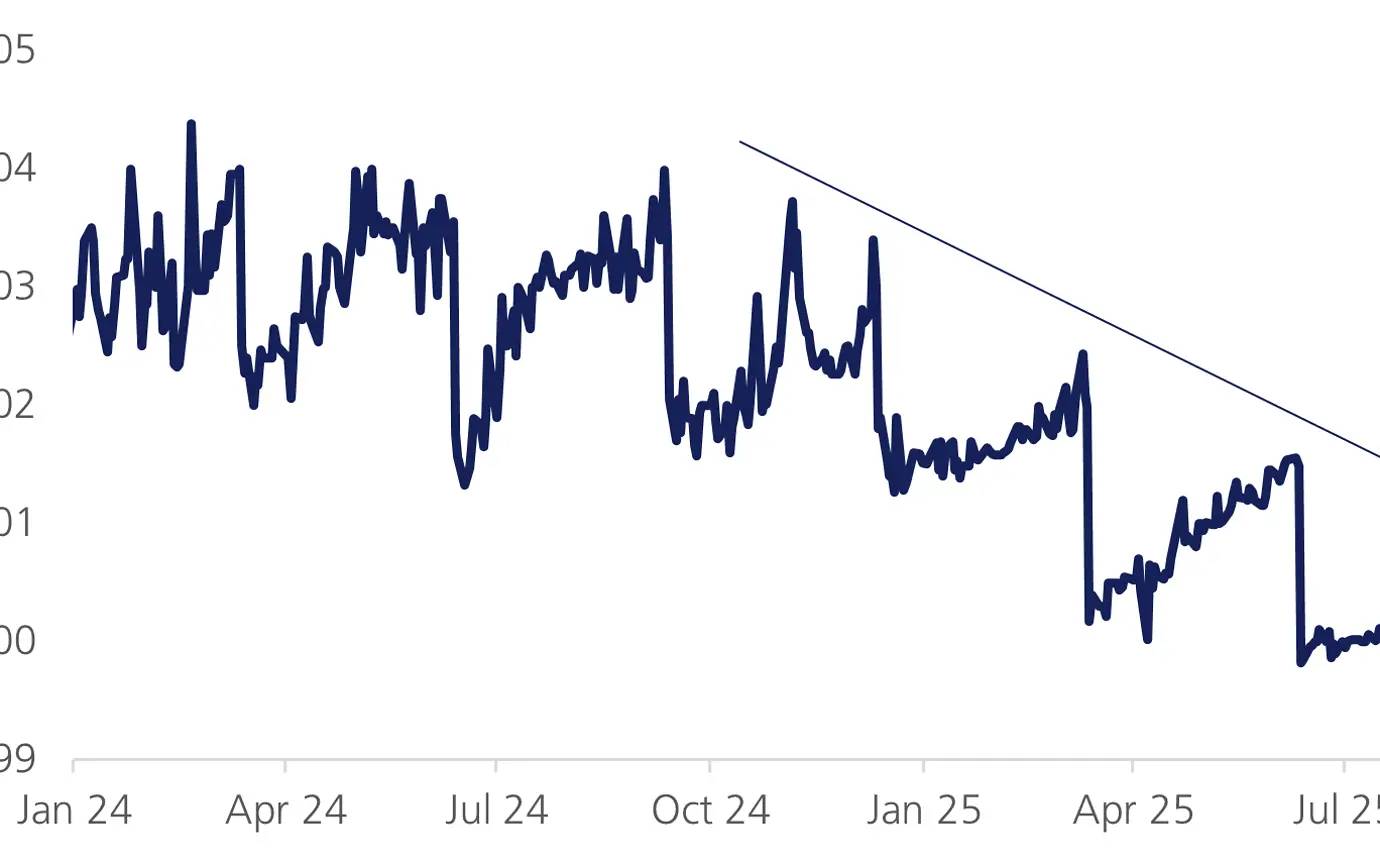

With APRA’s policy now formalised, issuers are opting to call rather than refinance existing hybrids. For instance, Westpac redeemed its Westpac Capital Notes 5 (WBCPH) in September. As the call risk has been removed and hybrids transition to Tier 2 classification from 2027 onwards, credit spreads have tightened sharply, with many now trading below BBSW +200 basis points.

We believe investors should adopt a more active approach to managing hybrid exposures, taking advantage of capital gains opportunities before call dates, when spreads remain tight and liquidity is still strong.

Figure 3: WBCPH Price – with call risk removed, credit spreads have tightened sharply

Source: Bloomberg

As illustrated in the chart above, hybrids typically trade closer to par as they near their call date, while liquidity diminishes as active investors exit their positions earlier. For those prepared to manage timing actively, there are opportunities to realise capital gains ahead of redemption, especially as hybrid credit spreads have continued to compress.

While we may lament the phasing out of bank hybrids, we remain confident that this shift will prompt investors to look more broadly across the Australian fixed income landscape. The market offers a diverse and evolving opportunity set that continues to deliver strong fundamentals and compelling value.

The Australian investment grade fixed income market stands out for its ability to provide steady and predictable income, lower volatility through market cycles, and meaningful diversification benefits within multi-asset portfolios. These characteristics remain as important as ever, helping investors navigate a multi-polar, changing global environment, where neutral interest rates are likely to stay higher for longer.

In our view, this backdrop reinforces the case for maintaining an active, well-diversified allocation to Australian fixed income as a core component of long-term portfolio strategy. The market is continuing to evolve and provide investors with new opportunities for investment.

This backdrop reinforces the case for maintaining an active, well-diversified allocation to Australian fixed income as a core component of long-term portfolio strategy.

Global equity markets have continued to rally, brushing off short-lived intra-month US-China trade tensions, as investors remained focussed on global policy easing and the AI build-out. We maintain our constructive positioning. While we continue to recognise that expensive and over-exuberant markets are vulnerable to downside shocks, we are also mindful that political and geo-political risks have receded significantly since April.

We continue to believe that US trade and global geo-political uncertainty peaked in Q2 2025, reducing negative risks to global markets and the global economy. While headline noise around the mid-October US-China trade spat was loud, our constraints-based analysis proved invaluable once again. We already knew from Liberation Day that US bond markets would not allow an effective trade embargo between the US and China to stand, therefore we knew that the 100% tariffs that the US threatened on Chinese imports were most likely a negotiating tool. We stayed invested based on this analysis, which has so far proven to be the right decision

We continue to believe that tariffs are ultimately disinflationary, allowing global central banks to continue modestly cutting rates to see out 2025. The Supreme Court’s expected ruling on the Trump Administration’s reciprocal tariffs is a key near-term event to monitor between now and Christmas. If the tariffs are struck down, that could lead to upward pressure on US bond yields as it would remove a key revenue pillar supporting the fiscal stimulus in the One Big Beautiful Bill Act.

More broadly, the pulse of easier global monetary policy should continue to act as a tailwind for the global economy. Further modest easing of mortgage rates in the US could help to further unlock the significant excess homeowners’ equity on US household balance sheets. In the meantime, the ongoing AI build-out is contributing as much to US economic growth as the US consumer (which typically makes up 66% of the US economy) and if sustained, has the potential to almost singlehandedly circumvent US recessionary risks. In addition, we are seeing more anecdotal evidence of the proliferation of AI applications across the broader economy, including around ‘agentic AI’. This could support a broadening of the admittedly extended equity rally to smaller and mid-sized companies and to regions outside the US. Of course, we also acknowledge the justified angst that a potential bubble may be forming in this space.

Our view is that the 2026 outlook tilts towards more reflationary scenarios, where resilient economic activity imparts renewed underlying inflationary pressures as we enter 2026, limiting the extent to which central banks can cut and imparting upside risks to government bond yields.

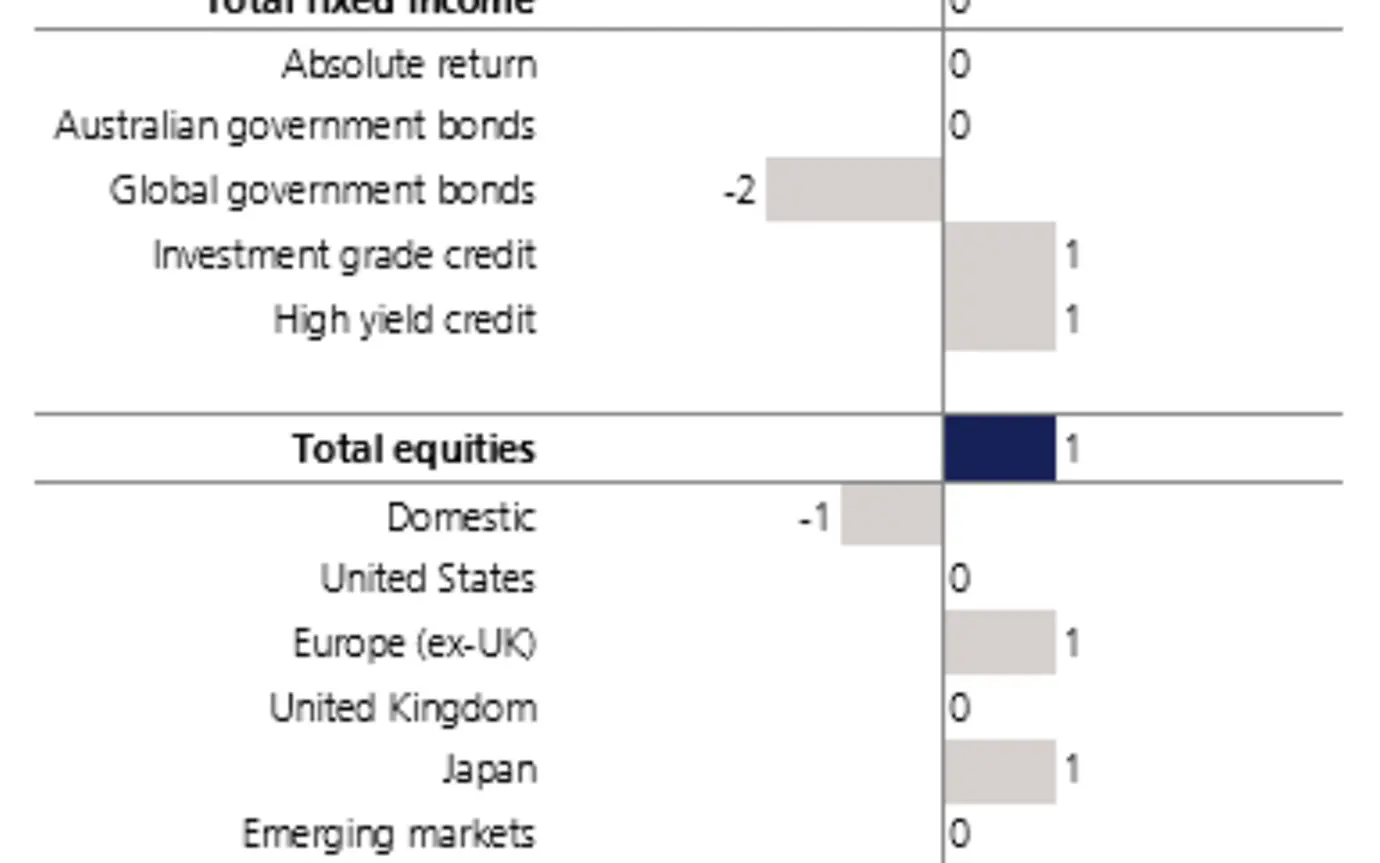

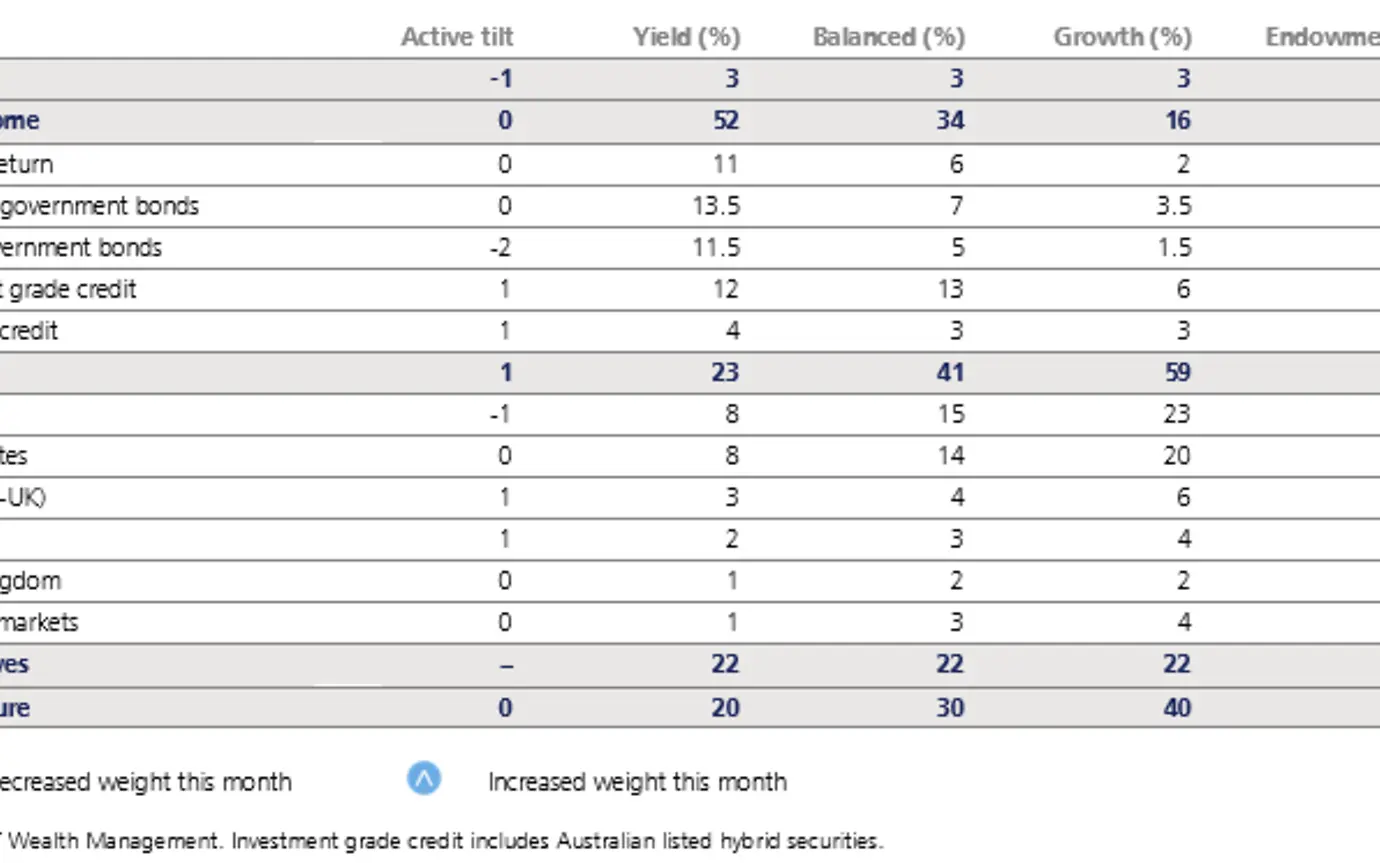

Reflecting this view, we maintain our overall tactical positioning. We retain our overweight to investment grade and high yield credit and our underweight to global government bonds. We also retain our modest overweight to global equities, with a preference for Japan and Europe.

Has policy uncertainty peaked? Our frameworks tell us that trade and geopolitical uncertainty has peaked, pointing to moderating (though still-present) risks to the global economy.

Reflationary risks are rising; US rate cuts could help unlock the significant levels of excess homeowners’ equity on US household balance sheets, supporting a transition to a leverage-driven cycle. In the meantime, the ongoing AI build-out has the potential to single-handedly support the US economy over the next 6–12 months. Both dynamics point to rising reflationary risks as we look to 2026, that is, an environment that should support equities and credit relative to bonds.

Can central banks keep cutting in 2026? Progress on inflation and the ultimately disinflationary impact of tariffs should allow central banks to continue cutting rates as we see out 2025. A resilient US economy and rising reflationary risks present a key challenge looking out to 2026, where we see a risk that markets are pricing in too many rate cuts.

Opportunities are ripe for ‘active’ hunters vs ‘passive’ gatherers: The best opportunities will likely lie beneath the broad index level, rewarding more active ‘hunter’ versus passive ‘gatherer’ investors. This has proven particularly true so far this year.

Fortune favours the bold: The current environment is likely to continue to favour investors who can digest and exploit the opportunities that come with market volatility. Prudent portfolio diversification and active management will be important tools in the astute investor’s arsenal.

Welcome to a multi-polar world: The global community is increasingly adjusting to a multi-polar world, an environment that will likely create more volatility and uncertainty but also present more growth and opportunities for investors.

The energy transition is growing more challenging: Policy uncertainty, cost, energy security, and more extreme physical impacts are likely to complicate an already-challenging energy transition.

The rise of artificial intelligence: AI presents significant challenges and opportunities for the global economy and human society.

Higher base rates increase investor options: We expect interest rates to remain higher-for-longer, particularly relative to the post-GFC zero rate policy environment. Higher base rates increase forward-looking returns across all asset classes, giving investors more options to build robust, multi-asset portfolios.

Our current tactical asset allocation views

We believe that trade and geo-political uncertainty have peaked, reducing left-tail (downside) risks to markets and the global economy. We also assess that risks are tilting towards more reflationary scenarios which could support risk assets but impart upward pressure on bond yields. That said, a disinflationary negative growth shock remains the key downside risk on our radar. Australia continues to be challenged by stagnant productivity.

The ongoing roll-out of AI presents a potentially enduring tailwind to productivity and earnings, though it brings with it clear societal risks.

Cash: We remain underweight cash this month, though we retain ample dry powder to deploy into any buying opportunities that may emerge.

Fixed income: We are neutral fixed income, favouring investment grade and high yield credit over global government bonds, reflecting our positioning for reflationary risks.

Equities: We remain overweight equities and retain our preference for European and Japanese equities. We are underweight domestic equities.

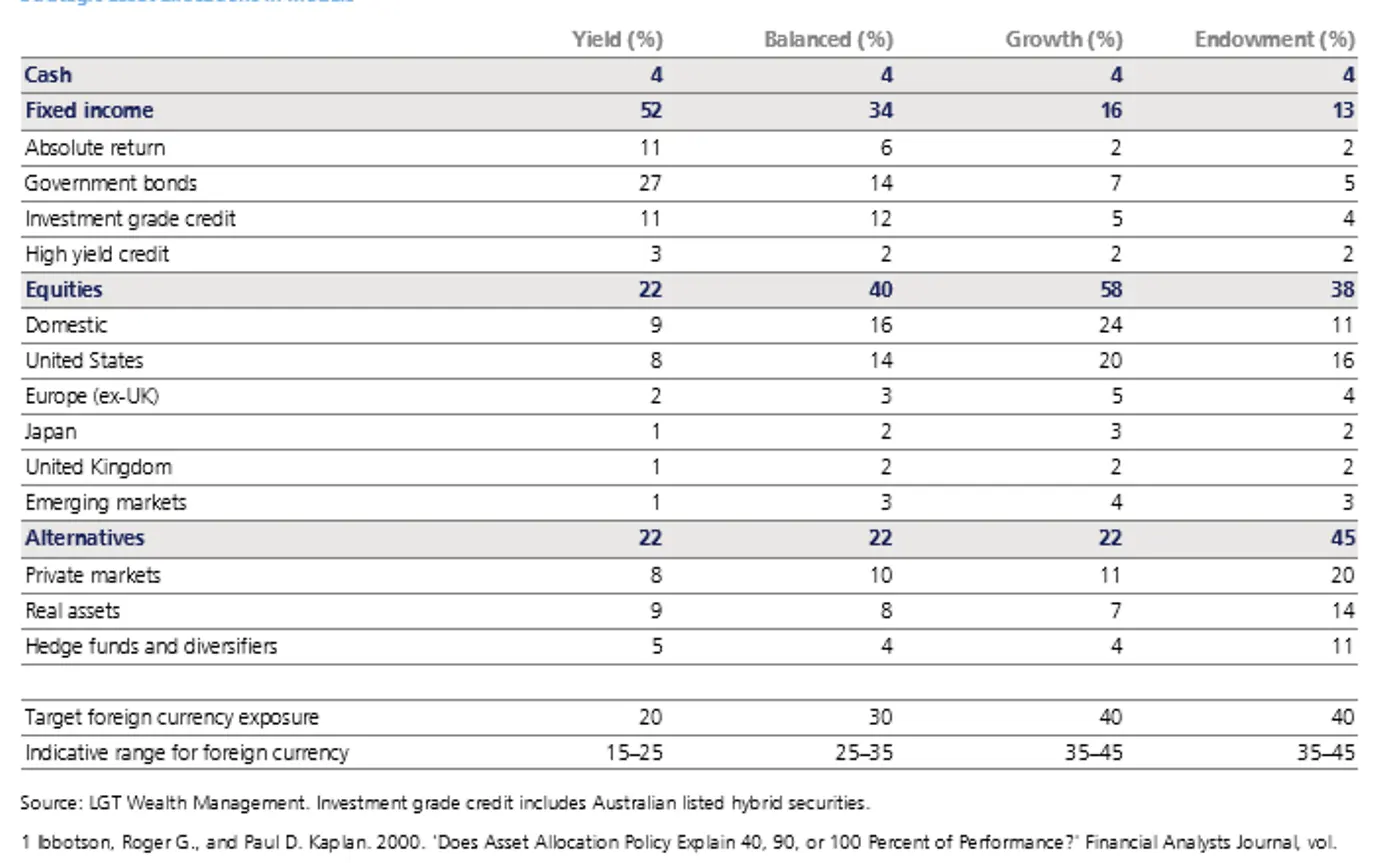

Active portfolio weights and active tactical asset allocation tilts

Source: LGT Wealth Management. Investment grade credit includes Australian listed hybrid securities.

We believe that the central component of successful long-term performance is a well-constructed strategic asset allocation (SAA). Empirical evidence suggests that a disciplined SAA is responsible for around 80% of overall investment performance over the long term1. Diversification plays a critical role within SAA. By diversifying your portfolio among assets that have dissimilar risk and return behaviour, lower overall portfolio risk can be achieved, and your portfolio can be better insulated during major market downswings.

We believe that SAAs encourage a disciplined approach to investment decision-making and help to remove emotion from these decisions. A thoughtfully designed SAA provides a long-term policy anchor for clients. Over the long term, we believe clients are best served by identifying the risk they can bear, then adjusting their return expectations accordingly. Return expectations may be anchored unrealistically. However, risk tolerance tends to remain more consistent through different cycles.

Strategic asset allocation is an important part of portfolio construction as it structures your portfolio at the asset class level to match your specific objectives and risk tolerance.

Furthermore, history has shown that a disciplined strategic asset allocation is responsible for around 80% of overall investment performance over the long term.

Download the full document here: Core offerings November

Important information About this document [Disclaimer] This document has been authorised for distribution to ‘wholesale clients’ and ‘professional investors’ (within the meaning of the Corporations Act 2001 (Cth)) in Australia only. This document has been prepared by LGT Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (LGT Wealth Management). The information contained in this document is provided for information purposes only and is not intended to constitute, nor to be construed as, a solicitation or an offer to buy or sell any financial product. To the extent that advice is provided in this document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your ‘Personal Circumstances’). Before acting on any such general advice, LGT Wealth Management recommends that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the product before making any decision about whether to acquire the product. Although the information and opinions contained in this document are based on sources we believe to be reliable, to the extent permitted by law, LGT Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances. LGT Wealth Management, its associated entities, and any of its or their officers, employees and agents (LGT Wealth Management Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The LGT Wealth Management Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The LGT Wealth Management Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the LGT Wealth Management Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document. Credit ratings contained in this report may be issued by credit rating agencies that are only authorised to provide credit ratings to persons classified as ‘wholesale clients’ under the Corporations Act 2001 (Cth) (Corporations Act). Accordingly, credit ratings in this report are not intended to be used or relied upon by persons who are classified as ‘retail clients’ under the Corporations Act. A credit rating expresses the opinion of the relevant credit rating agency on the relative ability of an entity to meet its financial commitments, in particular its debt obligations, and the likelihood of loss in the event of a default by that entity. There are various limitations associated with the use of credit ratings, for example, they do not directly address any risk other than credit risk, are based on information which may be unaudited, incomplete or misleading and are inherently forward-looking and include assumptions and predictions about future events. Credit ratings should not be considered statements of fact nor recommendations to buy, hold, or sell any financial product or make any other investment decisions. The information provided in this document comprises a restatement, summary or extract of one or more research reports prepared by LGT Wealth Management’s third-party research providers or their related bodies corporate (Third-Party Research Reports). Where a restatement, summary or extract of a Third-Party Research Report has been included in this document that is attributable to a specific third-party research provider, the name of the relevant third-party research provider and details of their Third-Party Research Report have been referenced alongside the relevant restatement, summary or extract used by LGT Wealth Management in this document. Please contact your LGT Wealth Management investment adviser if you would like a copy of the relevant Third-Party Research Report. A reference to Barrenjoey means Barrenjoey Markets Pty Limited or a related body corporate. A reference to Barclays means Barclays Bank PLC or a related body corporate. This document has been authorised for distribution in Australia only. It is intended for the use of LGT Wealth Management clients and may not be distributed or reproduced without consent. © LGT Wealth Management Limited 2025. |

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.