Our Australian investment team’s view of the markets and insights into our latest strategic and tactical positions

A wave of caution has swept over markets as 2025 draws to a close. And there’s little doubt that this year has embodied much of the ‘disruption’ as well as the ‘opportunity’ we identified in last year’s outlook piece, “Navigating disruption, discovering opportunity”. Post the shock of Liberation Day, a cavalcade of geo-political events have largely proved ‘surmountable’, with trade deals struck, (some) global wars resolved and US bills and budgets passed. As forecast, tariffs have not been the inflation threat many thought, and with a much more moderate slowing in growth than expected, markets have delivered stellar returns in 2025. The opportunity has been to be remain constructive.

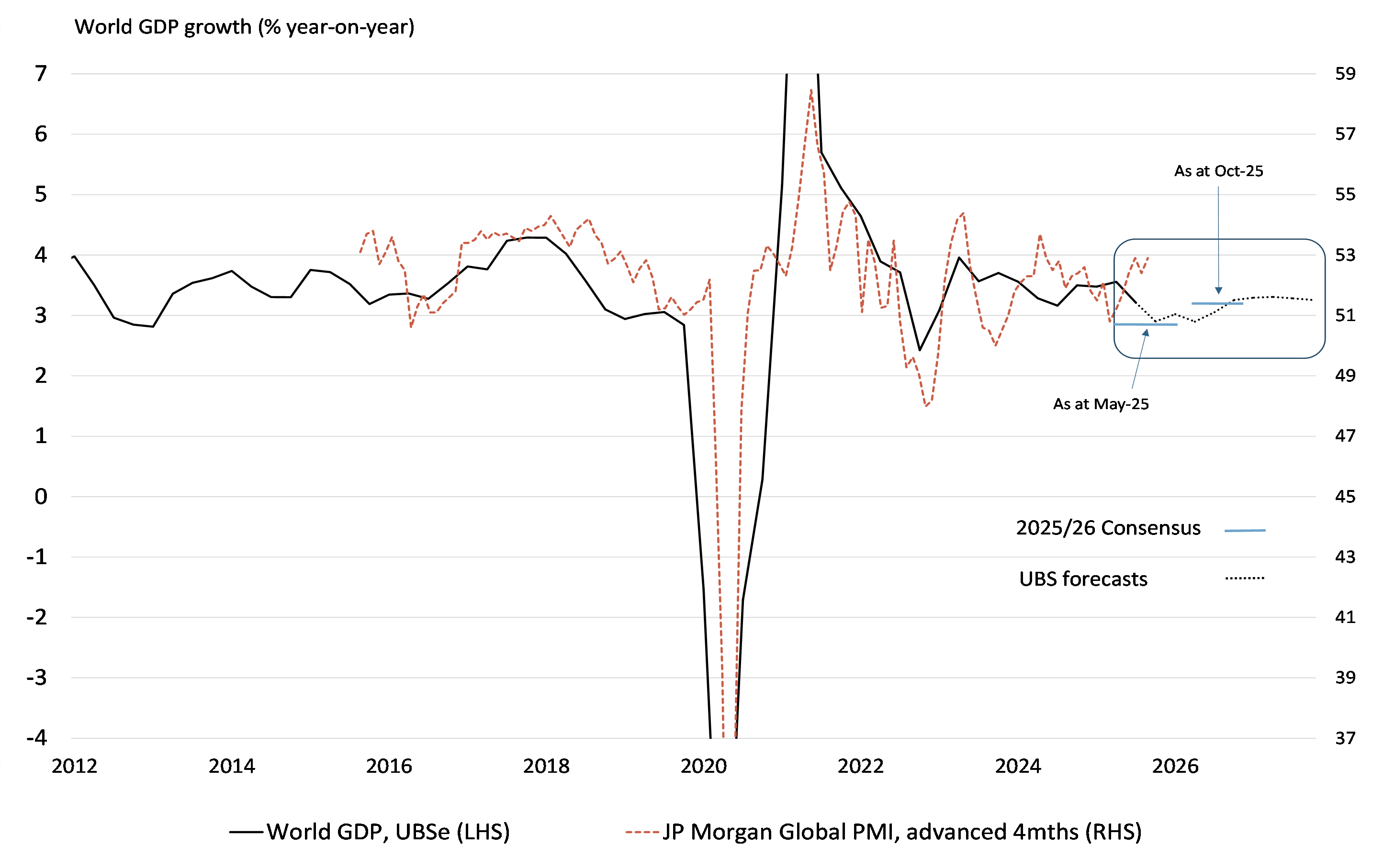

As we look ahead to 2026, battling questions around the longevity of artificial intelligence’s (AI) dominance, we anticipate geo-political volatility will persist, but take a backseat to more macro factors. While global activity faces further slowing into early 2026, as trade disruption weighs, we forecast a cyclical credit-led growth recovery to emerge by mid-year that brings an end to central bank rate cuts – a more reflationary environment that initially supports equity markets higher through H126, but turns more challenging as the threat of liquidity withdrawal resurfaces.

Reflecting this, we further position for reflation as 2026 gets underway, looking through the recent market jitters to add some additional equity risk – and move underweight fixed income – for the immediate period ahead. Few would deny the complex market we face, where active management and truly diversified portfolios will earn their keep. Even those sold on the AI revolution should ensure portfolios aren’t over-exposed. Equally, building in additional inflation protection for the next couple of years ahead should be paramount for those who value portfolio resilience.

Read the full PDF report:

December 2025 Core Offering

Charles Kindleberger’s “Manias, Panics and Crashes”, while penned in the late 1970s, reached the peak of its fame in the wake of the 2007–2009 Global Financial Crisis. His historical framework analysed periods of speculative excess – or bubbles – from the 1630 Tulip Mania to the 1929 Great Depression. His enduring thesis was that while many forces can fuel a speculative upswing, there’s ultimately only one force that ends a bubble, namely, the withdrawal of liquidity.

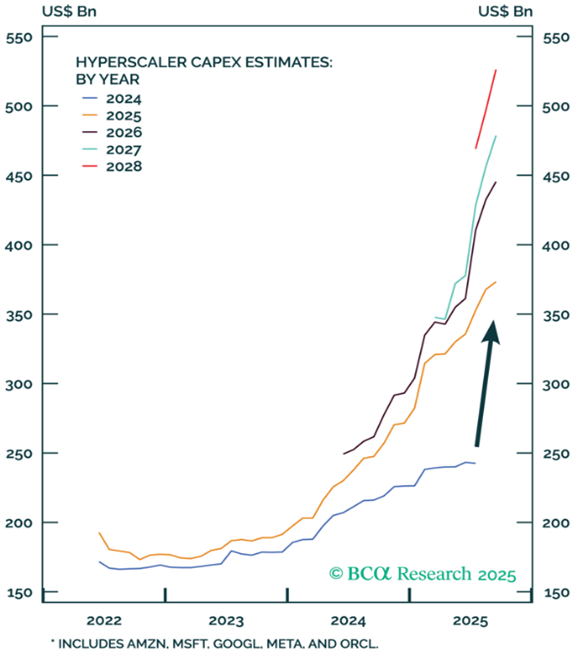

The performance of markets and economies as we traverse 2026 is likely to be intimately impacted by the durability of the AI thematic, from the performance of companies to the impact on economic growth of its unfolding capex pipeline. Judging the AI thematic’s path with confidence is near impossible (albeit watching semi-conductor margins for pressure may provide some warning).

Figure 1: Slower growth into early 2026 – but slowing has been much less austere than expected.

Source: LGT WM, UBS, JP Morgan, Bloomberg, Macrobond

Yet the ongoing macro backdrop of benign inflation and lower central bank rates, gives us some comfort that liquidity withdrawal – through Kindleberger’s lens – is not in our immediate future. However, it is now a risk we see emerging as we move beyond the middle of next year.

In our October Core Offerings, “Reflation risks rising”, we reaffirmed our central case preference to remain constructive on markets. As we wrote, “markets should be able to continue navigating higher as global growth slows (but doesn’t collapse), inflation stays benign (at least outside the US) and central banks trim rates just a few more times”. While the risk of a more sinister disinflationary shock wasn’t entirely dismissed, we took the opportunity to up-weight our perceived risk that over the coming year we may enter a period of ‘reflation’ – more growth and less disinflation.

As 2026 comes into view, we now elevate ‘reflation’ to our central case for the year ahead. While economists typically view reflation as a period where economies are recovering from below target inflation (or even deflation), financial markets more commonly see it as any period where growth is accelerating, and inflation is rising (from virtually any starting point). As discussed below, we see a period during H126 where the reflationary impulse is driven mostly by a moderate credit-led growth recovery. However, there is then a risk this gives way to a period where liquidity is no longer being added (rate cuts end), and the longevity of the upward market cycle becomes a focus.

Figure 2: Capex is set to boost economic activity in 2026…could the bullish narrative shift?

Source: FactSet, BCA Research

“We are not yet displaying ‘top of a bubble’ characteristics. Capex from hyperscalers has been rising aggressively. However, a key difference is the free cash flow available to the big firms today. Their net debt, their margins, and earnings are dramatically different to those in the 1990s. The number of M&A and IPO deals don’t suggest euphoria”.

UBS Outlook,

November 2026

We note the well-founded concerns around AI over-investment, revenue expectations, and whether Large Language Models (LLMs) like ChatGPT can ultimately add enough value to the broader economy to justify their expense. That said, while LLMs are the current posterchild for AI, we are also seeing development shift towards different paradigms, including agentic AI and integration with robotics. Advances in these areas could unlock further productivity gains, while the broader economy is rapidly rolling out and testing the real-world practicality of LLMs in the workplace.

We also see an important geo-political dimension beyond these private sector fundamentals – both the US and China openly view the race for AI supremacy as a key theatre within their broader geo-strategic rivalry. As such, both superpowers have invested heavily in supporting their national AI champions, with recent US government investments into Intel and the recent court ruling preserving Alphabet from break-up two key case studies. As this global race for AI rapidly adopts ‘Manhattan Project’-esque urgency, we expect both nations (and perhaps the Eurozone) to maintain a strong level of state support for AI investments over the medium-term, a dynamic which could provide further fuel to the AI ‘bubble’ and potentially sustain it for longer than might appear rational.

With global equities having another strong year – up 19% (14% in AUD terms) – despite a bear market in April, it likely increases the hurdle for a positive outcome in 2026. With AI euphoria having driven significant gains, and valuations full, we are faced with a 2026 outlook that may embody more measured returns. Indeed, if 2026 is to be the fourth consecutive year of positive returns, it would be the first such streak since 2003–07 (five years) and before that 1993–99 (seven years). The recent quantum of returns is also striking. On a rolling three-year basis, the ~80% cumulative return is close to ‘as good as it gets’ over the past 40 years. This does not preclude another year of solid returns, as seen during the late 1980s, 2006–07 and 2012. But it is also worth noting that investors were forced to confront meaningful drawdowns in the year after.

With investors increasingly focused on AI spending plans, AI financing plans, and AI productivity gains, this arguably sets investors up for a more volatile investment environment. Sure, that may seem hard to imagine given the Liberation Day sell off. But it is worth noting that investors have not seen a 5% or greater drawdown outside of this period since September 2024. For now, equities look likely to embrace numerous tailwinds that remain supportive for future gains – continued policy easing, ongoing AI capex buildout, the end of US Fed QT, record corporate margins, and a broadening of participation, as the earnings ‘delta’ between equity cohorts narrows e.g., between large cap tech and the S&P 500; between Europe and the US.

At a high level, although we continue to expect the US to remain ‘exceptional’, it is expected that other regions will, at the margin, become more attractive. Just as higher interest rates removed the TINA trade for equities (There is No Alternative), we think US geopolitical policies – as it relates to China’s technological access and European defence spending – has created alternative geographic access points for investors, at a time of record US dominance in equity markets. Japan is now a viable investment destination and although Emerging Markets have rarely seen both Indian and Chinese Equities perform well in tandem, it’s possible that both these regions perform better next year. This leads us to a constructive equity market outlook, cognisant and watchful for drawdowns, and looking to allocate marginal dollars to non-US equity markets.

If our base case for a reflationary economic backdrop proves too much, and the US economy overheats, it could make long end yields unpalatable for equities. The ‘AI bubble’ could burst, German fiscal stimulus may disappoint or take longer to permeate the economy. There are also US mid-term elections to navigate in H226, and the US labour market is showing signs of weakness. Some investor unease in credit markets, particularly the burgeoning private credit sector, also bear watching.

Fixed income investors should initially be beneficiaries of the near-term phase of moderating growth and further central bank cuts. Yield curves in major markets such as the US, UK, and Australia are expected to stay moderately steep, as long-term yields continue to respond to fiscal developments. A renewed reflation environment through 2026 could also add upside impetus to long-dated yields. Domestically, the Reserve Bank of Australia (RBA) is expected to remain data dependent ahead, focused on job market weakness to balance recent inflation surprises. The potential for more upside surprises in inflation means investors should not be complacent. Australian government bond yields may continue to underperform global peers, given the RBA’s more cautious stance.

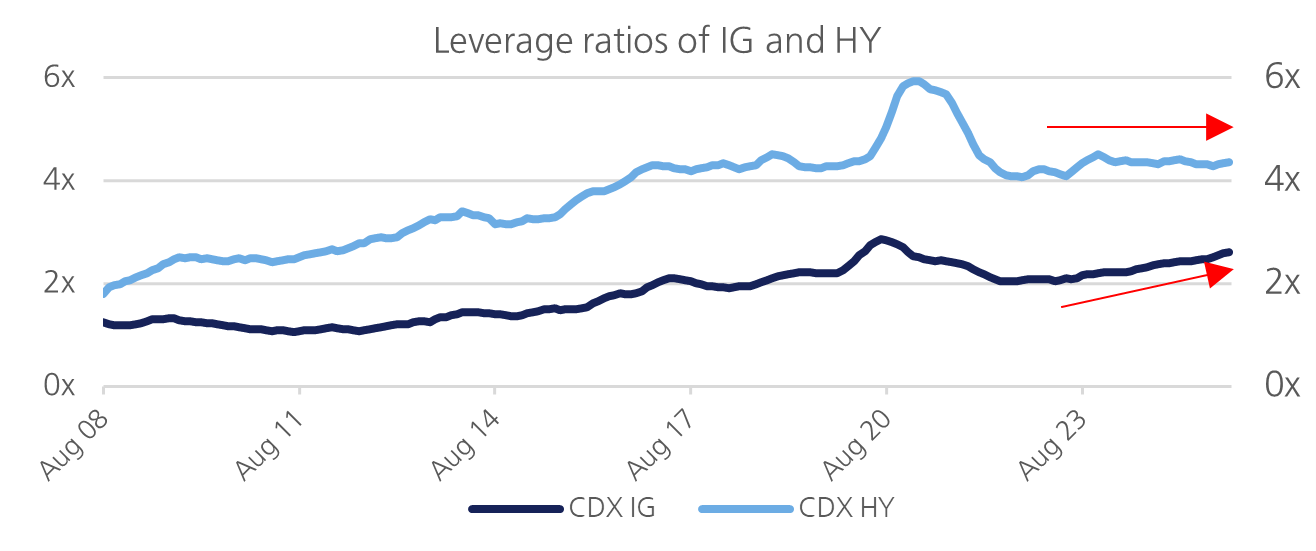

Within investment grade credit, fundamentals across corporate leverage and debt servicing remain healthy, supported by stable earnings. Credit spreads are close to their cycle lows, yet outright yields continue to attract demand. We anticipate robust supply in 2026, as borrowers seek to lock in funding. Floating-rate structures should remain popular, especially as policy rates base. Within investment grade credit, we will be closely monitoring leverage metrics, particularly to assess whether AI-related capital expenditure issuance remains at sustainable levels. We continue to maintain a quality bias in investment grade credit. While spreads may widen should macroeconomic conditions deteriorate, the underlying fundamentals should help protect portfolios. High yield markets present a more nuanced picture, being toward the richer end of history with yields below recent peaks, limiting return prospects. While carry income likely declines as final rate cuts are delivered, a reflationary environment through mid-2026 may benefit credit, generally.

Figure 3: Comparison of Debt/EBITDA for Investment Grade and High Yield credit - we continue to maintain a quality bias in investment grade credit.

Source: Bloomberg, Goldman Sachs.

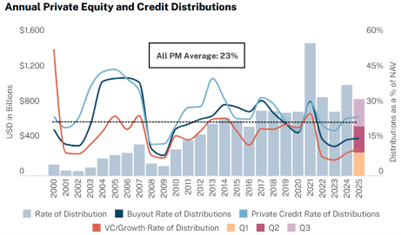

Private markets are experiencing similar challenges to public markets with some sectors also reporting stretched valuations and demonstrating high exposure to AI market themes. Some examples include investments in energy and data centre assets and technology financing. Alternative investments nonetheless do provide a differentiated source of portfolio resilience via infrastructure and hedge fund exposures.

Source: Hamilton Lane Data via Cobalt (October 2025)

As we look out to 2026, we are now increasingly convicted that reflation – a pick-up in the pulse of both growth and inflation – is the most likely scenario for economies and markets. We continue to believe that trade and geo-political uncertainty are moderating, reducing downside risks from these fronts. Furthermore, easing fiscal and monetary policy, as well as the ongoing roll-out of artificial intelligence (AI), should add further tailwinds to the global economy. As such, we maintain our constructive positioning, recognising that equity markets are expensive and vulnerable to downside shocks.

The Supreme Court’s expected ruling on the Trump Administration’s reciprocal tariffs is a key near-term event to monitor between now and Christmas. If the tariffs are struck down, that could lead to upward pressure on US bond yields as it would remove a key revenue pillar offsetting US fiscal stimulus.

More broadly, cooling labour markets and benign inflation outcomes should allow global central banks to maintain a dovish bias to see out 2025. We expect the pulse of easier global monetary policy to support a cyclical recovery for the global economy, particularly in more interest-rate sensitive areas such as the housing and industrial sectors. Further modest easing of mortgage rates in the US should help to further unlock the significant excess homeowners’ equity on US household balance sheets. In the meantime, the ongoing AI build-out is contributing as much to US economic growth as the US consumer (which typically makes up 66% of the US economy) and could circumvent US recessionary risks in the near-term.

We acknowledge the well-founded concerns around AI over-investment, revenue expectations, and whether Large Language Models (LLMs) like ChatGPT can ultimately add enough value to the broader economy to justify their expense. That said, while LLMs are the current posterchild for AI, we are also seeing development shift towards different paradigms, including agentic AI and integration with robotics. Advances in these areas could unlock further productivity gains, while the broader economy is rapidly rolling out and testing the real-world practicality of LLMs in the workplace. This should support a broadening of the admittedly extended equity rally to smaller and mid-sized companies and to regions outside the US. Of course, we also acknowledge the justified angst that a bubble may be forming amongst hyperscalers like the Magnificent 7.

Our overall expectation is that 2026 sees resilient economic activity supported by the lagged impact of monetary easing, imparting renewed underlying inflationary pressures as we enter 2026, limiting the extent to which central banks can cut and imparting upside risks to government bond yields.

We have further tilted our tactical positioning to reflect this view. We have closed our underweight to Australian equities and closed our overweight to high yield credit bonds. As a result, we are now positioned underweight cash, underweight fixed income, and overweight equities, with a preference for Japan and Europe.

Policy uncertainty has peaked. Our constraints-based framework tells us that trade and geo-political uncertainty has peaked, suggesting that the most intense period of risk may now be behind us. While these challenges remain an ongoing concern for markets and economies, and investors should prepare for further potential shocks, recent developments in international relations and trade negotiations point towards moderating global uncertainty. This reduction in downside risk should provide more confidence for policymakers and investors. Of course, we recognise that new risks can always emerge, but current trends imply a more constructive environment for global growth.

Central banks may be on hold beyond Q126. While policymakers should maintain a dovish line into Q1, a resilient US economy and rising reflationary risks may leave central banks on hold as the year progresses and the potential for rate hikes may come into the picture late in 2026.

Opportunities are ripe for ‘active’ hunters versus ‘passive’ gatherers: The best opportunities will likely lie beneath the broad index level, rewarding more active ‘hunter’ versus passive ‘gatherer’ investors. This has proven particularly true so far this year, and an active approach should continue to pay dividends amid increasing market concentration risks.

Fortune favours the bold: The current environment is likely to continue to favour investors who can digest and exploit the opportunities that come with market volatility. Prudent portfolio diversification and active management will be important tools in the astute investor’s arsenal.

Welcome to a multi-polar world: The global community is increasingly adjusting to a multi-polar world, an environment that will likely create more volatility and uncertainty but also present more growth and opportunities for investors who have put in the time and effort to understand how to navigate and invest in a multi-polar world.

The energy transition is growing more challenging: Policy uncertainty, cost, energy security, and more extreme physical impacts are likely to complicate an already-challenging energy transition.

The rise of artificial intelligence: AI presents significant challenges and opportunities for the global economy and human society.

Higher base rates increase investor options: We expect interest rates to remain higher-for-longer, particularly relative to the post-GFC zero rate policy environment. Higher base rates increase forward-looking returns across all asset classes, giving investors more options to build robust, multi-asset portfolios.

Read the full PDF report:

December 2025 Core Offering

Important information

About this article

This article has been authorised for distribution to ‘wholesale clients’ and ‘professional investors’ (within the meaning of the Corporations Act 2001 (Cth)) in Australia only.

This article has been prepared by LGT Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (LGT Wealth Management). The information contained in this article is provided for information purposes only and is not intended to constitute, nor to be construed as, a solicitation or an offer to buy or sell any financial product. To the extent that advice is provided in this article, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your ‘Personal Circumstances’). Before acting on any such general advice, LGT Wealth Management recommends that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the product before making any decision about whether to acquire the product.

Although the information and opinions contained in this article are based on sources we believe to be reliable, to the extent permitted by law, LGT Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this article is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances.

LGT Wealth Management, its associated entities, and any of its or their officers, employees and agents (LGT Wealth Management Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The LGT Wealth Management Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The LGT Wealth Management Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the LGT Wealth Management Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document.

Credit ratings contained in this article may be issued by credit rating agencies that are only authorised to provide credit ratings to persons classified as ‘wholesale clients’ under the Corporations Act 2001 (Cth) (Corporations Act). Accordingly, credit ratings in this report are not intended to be used or relied upon by persons who are classified as ‘retail clients’ under the Corporations Act. A credit rating expresses the opinion of the relevant credit rating agency on the relative ability of an entity to meet its financial commitments, in particular its debt obligations, and the likelihood of loss in the event of a default by that entity. There are various limitations associated with the use of credit ratings, for example, they do not directly address any risk other than credit risk, are based on information which may be unaudited, incomplete or misleading and are inherently forward-looking and include assumptions and predictions about future events. Credit ratings should not be considered statements of fact nor recommendations to buy, hold, or sell any financial product or make any other investment decisions.

The information provided in this article comprises a restatement, summary or extract of one or more research reports prepared by LGT Wealth Management’s third-party research providers or their related bodies corporate (Third-Party Research Reports). Where a restatement, summary or extract of a Third-Party Research Report has been included in this document that is attributable to a specific third-party research provider, the name of the relevant third-party research provider and details of their Third-Party Research Report have been referenced alongside the relevant restatement, summary or extract used by LGT Wealth Management in this document. Please contact your LGT Wealth Management investment adviser if you would like a copy of the relevant Third-Party Research Report.

A reference to Barrenjoey means Barrenjoey Markets Pty Limited or a related body corporate. A reference to Barclays means Barclays Bank PLC or a related body corporate.

This article has been authorised for distribution in Australia only. It is intended for the use of LGT Wealth Management clients and may not be distributed or reproduced without consent. © LGT Wealth Management Limited 2025.

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.