A look inside the portfolios of the wealthiest investors reveals a structural shift toward private equity and credit.Written by Michelle Bowes and published in the AFR.

Surging asset prices have led to an additional 70,000 Australians crossing the $1 million in investible assets threshold to achieve “high net worth” status in the past year and they have an increasing appetite for investing in private markets.

This represents a rise of 10 per cent, and untroubled by volatile financial markets, the collective investible assets of high net worth (HNW) Australians increased by 18 per cent to reach $4 trillion for the first time, up from $3.39 trillion in 2024.

“The amount of wealth that that segment manages is immense, an 18 per cent increase year-on-year, that is remarkable,” says Michael Chisholm, chief executive of HNW adviser LGT Wealth Management.

The LGT Wealth Management/Investment Trends 2025 State of Wealth report defines “high net worth” Australians as those with at least $1 million in investible assets excluding any debt, their home, their business (if they own one) and their superannuation (unless it is in a self-managed super fund).

The group is then split further into four subsets, all of which grew in number in 2025.

The number of emerging affluent those with $1-$2.5 million in investible assets increased by 34,000, while the number of established affluent with $2.5-$5 million in investible assets grew by 20,000.

The advanced HNW – classified as those with $5-$10 million in investible assets increased by 11,000 and the ranks of the ultra HNW (UHNW) with more than $10 million in investible assets swelled by 7000.

A growing number of wealthy Australians are planning to pass on their wealth while still living, the survey of more than 1000 HNW Australians found.

The report found the percentage that have already given an early inheritance or plan to do so has increased from 52 per cent in 2023 to 59 per cent in 2025, “catalysed by rising house prices and cost of living pressures”.

But tax and estate management costs remain the biggest concern across all cohorts when it comes to wealth transfers.

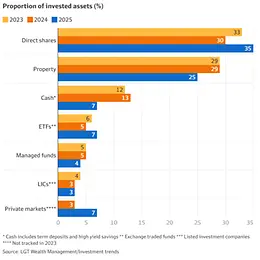

Listed equities and property remain mainstays of Australian HNW portfolios, but Chisholm says a structural shift is taking place, with alternative assets especially private market assets such as private equity and private credit moving from strategic satellite allocations.

“Private markets are now a core part of portfolio construction,” Chisholm says, something that reflects not only an “appetite for diversification” but also “a shift towards a more institutional mindset.”

Investment allocation to private markets has now reached 7 per cent across all HNWs, up from 3 per cent in 2024.

The number of wealthy investors putting money into private markets has also grown, from 146,000 last year to 171,000 in 2025.

In the next 12 months Investment Trends expects $10.3 billion of HNW investment to flow into private equity, outstripped by the $15.1 billion it expects will flow into private credit.

HNW investors are attracted to the higher returns on offer from private markets (when compared to public markets) and the diversification benefits, but “are prioritising resilient income opportunities and experienced managers who can manage risk through the cycle”, the report says.

“Accessing these opportunities takes expertise and deep due diligence. Private credit can offer attractive returns, but success depends on knowing who you’re investing with and how they manage risk. In this space, the details make all the difference.”

The report says the growing appetite for private credit is “likely driven by the desire to generate healthy income flows as interest rates trend down”.

Although returns have been healthy across asset classes, Viola says that the idea that double-digit year-on-year returns are normal is a fallacy.

It will take some time for the memories of Trump’s “liberation day” tariff announcements that shook public markets to the core in April fade, but HNW Australians held their nerve – two-thirds said they made no major adjustments during the Trump slump.

“What’s striking is how calm investors have been,” Chisholm says.

“Staying the course takes discipline and perspective, and Australia’s wealthy are showing both. They’re thinking more like global institutions – measured, diversified, and focused on long-term goals – while leaning on advice and making informed decisions with family and legacy in mind.”

Overall, 66 per cent of all HNW investors made portfolio changes of 10 per cent or less through 2025, the lowest level since 2017.

To that end, directly held equities remain the core holding in HNW portfolios, with equities and direct property still collectively accounting for more than half of all HNW asset holdings.

But exposure to property among rich Australians has fallen in recent years.

In 2023 and 2024 property represented 29 per cent of all HNW investment assets, but that figure fell to 25 per cent this year. Cash exposures have also fallen as lower interest rates limited returns.

ETFs continue to grow in popularity and James says his clients are moving their exposure to large-cap Australian equities away from direct ownership to holding via ETFs.

But when it comes to international shares, he says his clients “like owning direct equities, and they also benefit from compounding as opposed to managed funds where distributions are paid out”.

The wealthy are also putting their money where their mouths are when it comes to sustainable investing. On average, 35 per cent of their portfolios aligned to responsible investments and 30 per cent of HNWs have now adopted sustainable investment strategies.

Personal values and ethics remain the leading motivation, cited by 65 per cent of HNWs and 60 per cent of UHNWs, but they are unwilling to compromise on returns.

“Investors expect market-level returns at a minimum – that’s non-negotiable,” Chisholm says.

“What’s changing is that many now also want their money to reflect what matters to them. Environmental or social outcomes are an additional benefit, not an alternative to performance.”

Female investors are the driving force behind sustainable investing, with the report finding that 37 per cent choose investments based on ethical or ESG considerations, compared with 29 per cent of men.

Women also allocate a higher share of their portfolios to responsible investments – 40 per cent compared to 34 per cent for men.

“Women stand to become a defining force behind the next wave of wealth creation,” Chisholm says.

“As they continue to control more wealth, they’re using that influence to back investments that perform well and make a difference.”

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.