Australians will hopefully be enjoying well-earned backyard barbecues with friends and family this summer, where many will swap stories of overseas holidays recently enjoyed or planned for the not-too-distant future. A topic that will often come up in these conversations is the Australian dollar and the favourable (or not so favourable) exchange rates that holidaymakers experienced.

Movements in the Australian dollar and other foreign currencies are probably the most visible and impactful aspect of financial markets for the public, and it should come as no surprise that foreign currency exposure has significant implications for investment strategy and asset allocation too.

In this Observations piece, we outline why investors should adopt a deliberate and purposeful approach to managing foreign currency exposure. We introduce a total portfolio framework for doing so and explain why it is viewed as state of the art by most sophisticated investors. We also present several ways that investors can implement this total portfolio approach in their own portfolios.

It will come as no surprise to most Australian investors that the Australian dollar is a volatile currency. Relative to the US dollar, the Australian dollar has fluctuated between USD 0.56 and USD 1.11 over the past 20 years. Relative to the basket of currencies in the MSCI World ex-Australia Index (the most common way for Australian investors to gain exposure to global equity markets), the Australian dollar has had an average volatility of around 10% per annum over the same period.

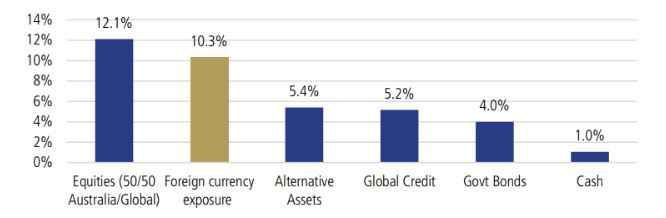

Foreign currency exposure is the second most volatile standalone component of a multi-asset investment portfolio.

Volatility of various assets over the past 20 years

This statistic means that foreign currency (FX) exposure is the second most volatile stand-alone risk contributor to investment portfolios, behind only equities. This fact is often obscured because many investors tend to think of overseas assets, such as international equities or international fixed income, as a singular entity. However, in reality, investing overseas exposes us to two key factors-the underlying return of the asset and the FX exposure of the asset translated back to our local currency.

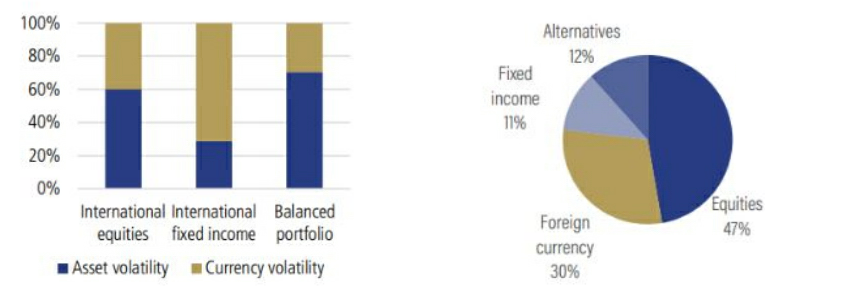

Applying this lens allows us to decompose the stand-alone contributions of underlying asset volatility and currency volatility in international equities, international fixed income, and LGT Crestone's Balanced Model Portfolio, which comprises a diversified mix of equities, fixed income, and alternative assets.

The two charts below illustrate this analysis, based on historical data over the past 20 years. On an individual asset class basis, currency volatility dominates asset class volatility in fixed income (which is why most investors fully hedge their international fixed income exposures), while it is a lesser proportion of equity or Balanced Portfolio volatility. That said, as the pie chart below illustrates, FX volatility is still the second largest stand-alone contributor to a balanced multi-asset portfolio's volatility.

But the diversifying benefits of the Australian dollar has been of great benefit to investors over the years.

Before proceeding further, it is important to note that the analyses above ignore the diversification benefits of FX exposure. One of the many blessings of being domiciled in Australia is that our currency is cyclical. The Australian dollar tends to strengthen when the economy is growing and foreign equity returns are positive. It also tends to depreciate when foreign equity returns are negative, thus cushioning the loss experienced when translated back to our local currency.

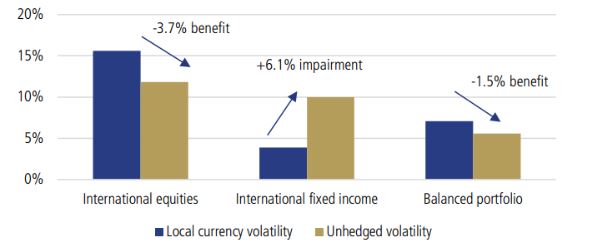

This valuable attribute means that gaining exposure to foreign currency tends to provide a diversifying benefit from an Australian perspective, reducing the realised volatility of portfolios. The chart below illustrates the diversification benefits that FX exposure brings. In this example, it shows that FX exposure actually reduced the Australian dollar volatility of international equities by 3.7% per annum, and reduced the Australian dollar volatility of a balanced portfolio by 1.5% per annum. Conversely, FX exposure acted as a detriment to an international fixed income allocation, increasing realised volatility by 6.1% per annum.

So, investors should take a purposeful approach to managing foreign currency exposure.

Effect of foreign currency exposure on portfolio volatility over the past 20 years

The current common industry practice for currency hedging results in… 'rule of thumb' hedging rules.

The stand-alone volatility and potential diversification benefits of FX exposure mean that Australian investors would be wise to:

Typically, many investors consider currency management through the lens of asset class-specific hedge ratios. A common rule of thumb is to fully hedge international fixed income and alternative exposures and apply a static hedge ratio (50:50 being the most prevalent) for international equity exposures. Under this approach, the total portfolio exposure to foreign currency is a passive by-product of the underlying allocation to equities.

A total portfolio approach allows investors to consider wider opportunity sets and improve portfolio efficiency.

However, sophisticated Australian investors are increasingly treating FX exposure as a stand-alone asset class when constructing portfolios, determining a deliberate strategic allocation for FX exposure independent of the underlying assets in the portfolio. This 'unbundling' of FX risk has been aided by several key developments over the past 10 years:

Some of the largest and most sophisticated investors target a customised basket of foreign currencies. They then engage in transactions in derivative markets to transform the underlying currency exposures of their physical investments into the desired currency exposure.

Solving for an optimal currency exposure depends on the underlying asset allocation, investment objectives, and the assumptions used (as well as whether these are historical or forward-looking).

This 'total portfolio' approach to currency management has several key benefits:

However, adopting this approach also increases the complexity of an investor's portfolio, and does require investors to address several key issues:

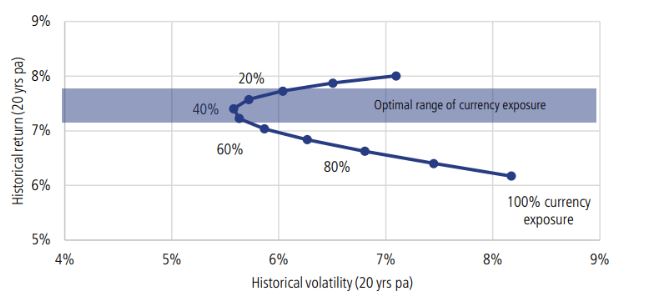

The chart on the following page applies this 'total portfolio' analysis to LGT Crestone's Balanced Model Portfolio. By allowing the use of derivatives, such as FX forwards, we can analyse the impact on portfolio volatility of being fully hedged back to Australian dollars (with zero FX exposure) and being fully exposed to FX by overlaying currency exposure (based on MSCI World ex-Australia weights) on the portfolio.

The results of our historical analysis suggest an optimal range of currency exposure for a balanced portfolio that sits between 20% and 50%, with a midpoint of 30%-35% FX exposure providing a respectable boost to risk-adjusted returns over the long term. Importantly, the results of this analysis will vary significantly depending on the underlying asset allocation and the forward-looking risk and return assumptions, and whether historical or forward-looking diversification benefit assumptions are used. In addition to a target allocation, investors also typically adopt an allowable range of FX exposure, to enable them to take advantage of situations where the Australian dollar may be under- or over-valued.

Assessing the optimal level of currency exposure for a balanced strategic asset allocation

Implementation considerations

After determining the desired FX exposure through this analysis, investors can choose from the following primary methods of implementing their FX exposure:

The most appropriate implementation strategy will depend on the underlying asset allocation, the availability of hedged and/or unhedged vehicles (such as managed or exchange-traded-funds), and the investor's willingness and capacity to utilise derivative instruments like FX forwards. In addition, investors should be cognisant of several key considerations:

Generally, a more diversified FX exposure should lead to a more efficient total portfolio outcome. This would favour international equity, geographically diversified alternative assets, or multiple FX forwards (though these may be complex to implement) as the more efficient vehicles for obtaining FX exposure.

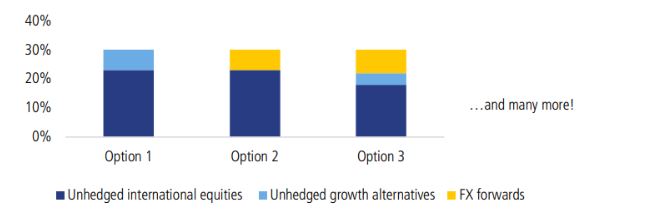

As an example, LGT Crestone's Balanced Model Portfolio has a 23% strategic allocation to international equities and 11% allocation to international growth alternatives (private markets and real assets), as at December 2023. As the chart on the following page shows, there is a multitude of ways an investor could implement a 30% FX exposure target in this portfolio. This demonstrates the flexibility that the total portfolio approach to FX management provides investors when constructing their portfolios.

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.