Treasurer Chalmers delivered the Government’s fourth Federal Budget on 25 March 2025.

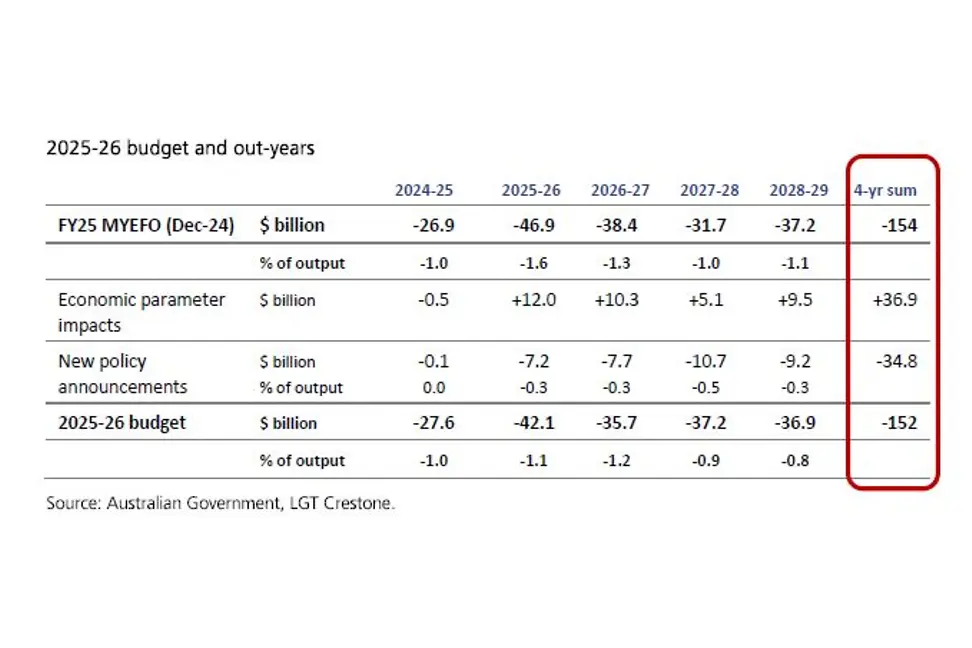

Following two years of budget surpluses (averaging $19 billion), forecasts for 2024-25 and for the next four years reveal a return to persistent deficits of around $36 billion per year (or around 1.2% of GDP), without any obvious glidepath to improvement. The continued strength in the jobs market (and elevated commodity prices) delivered a boost to the budget bottom-line of $37 billion over the four out-years to 2028-29. However, this has been promptly allocated to $35 billion of new spending across modest additional tax cuts (a budget-night surprise) and largely preannounced spending across health, electricity rebates, wages, student loan forgiveness and modest additional infrastructure works.

Despite virtually no change in the budget outlook, deficits of a little over 1% compare favourably to offshore, especially the US (closer to 6% of GDP) and even Europe (at 3%). And the near-term fiscal stimulus is relatively modest for a ‘pre-election' budget at only 0.3% of GDP . Nonetheless, there's little here that makes the RBA's task of getting inflation (and rates) down any easier (…that would be a budget that doesn't add to near-term growth). Moreover, in a largely ‘hand to mouth' budget (where everything coming in went straight out again), it's more about the lost opportunity for productivity-enhancing reforms, and the almost negligent lack of focus directed at repairing Australia's now entrenched structural deficits. Few would flinch at some targeted spending if it were accompanied by reforms directed at improving productivity and our long-term living standards

In a largely ‘hand to mouth’ budget, it’s more about the lost opportunity for productivity-enhancing reforms, and the almost negligent lack of focus directed at repairing Australia’s now entrenched structural deficits.

Understandably, a pre-election budget. Yet, when did just allocating the economic windfall become acceptable as the inspiration for re-election. The ‘deck chairs have now been rearranged'. There was no meaningful reform to address persistent structural deficits. Let's move on to the numbers.

The 2025-26 budget forecasts a deficit of $42.1 billion (1.5% of GDP, see table over), a modest improvement from the Dec-24 MYEFO forecast of $46.9 billion. This is driven by a more resilient economy that delivers $12.0 billion to the bottom line, albeit the government then allocates 60% to new spending ($7.2 billion). The 2025-26 deficit - the largest deficit since the pandemic - also shows a deterioration from an expected $27.6 billion deficit (1.0%) in the current 2024-25 year, which follows the prior two budget surpluses. Off balance sheet spending masks an even greater fiscal deterioration.

Thereafter, out to 2028-29, the bottom line is little different, with the deficit improving to 1.1% in 2028-29 from 1.5% in 2025-26, albeit identical to the MYEFO ‘end point'. Ostensibly, better revenue and lower expenses are simply re-allocated to new spending across the outyears, leaving the budget figuring little changed. That spending is not funded by saving, but largely by a better economic outlook.

In terms of the outlook, the economic forecasts are modestly upgraded, with growth expected to improve from 1.5% in 2024-25 to 2.25% in 2025-26. This is a slightly stronger forecast recovery (due to the impact of cyclone Alfred in lowering 2024-25). Together with a reduced peak in the unemployment rate (4.25% compared with 4.5% at MYEFO) and faster wage growth, these more upbeat assumptions contribute significantly to the improved budget bottom-line, that funds the additional $35 billion in budget spending over the budget's out-years.

| Economy: | +36.9bn |

| Tax cuts: | -$17.1bn |

| Medicare: | -$7.9bn |

| PBS: | -$1.8bn |

| Energy bills: | -$1.8bn |

| Wages: | -$7.6bn |

| Saving (4 yrs): | +$2.1bn |

Reflecting the fact that the Government was not planning to have a Budget prior to the election, the key policies from this year's budget had been mostly pre-flagged, geared towards the imminent campaign, and are absent any meaningful structural reforms. In total, there are roughly $35 billion worth of new spending measures over the next five years contained in this budget:

The key policies from this year’s budget had been mostly pre-flagged, geared towards the imminent campaign, and are absent any meaningful structural reforms.

Savings measures were hard to find…

The $82 billion rise in gross debt in 2025-26 is potentially a truer reflection of the fiscal easing between this year and next.

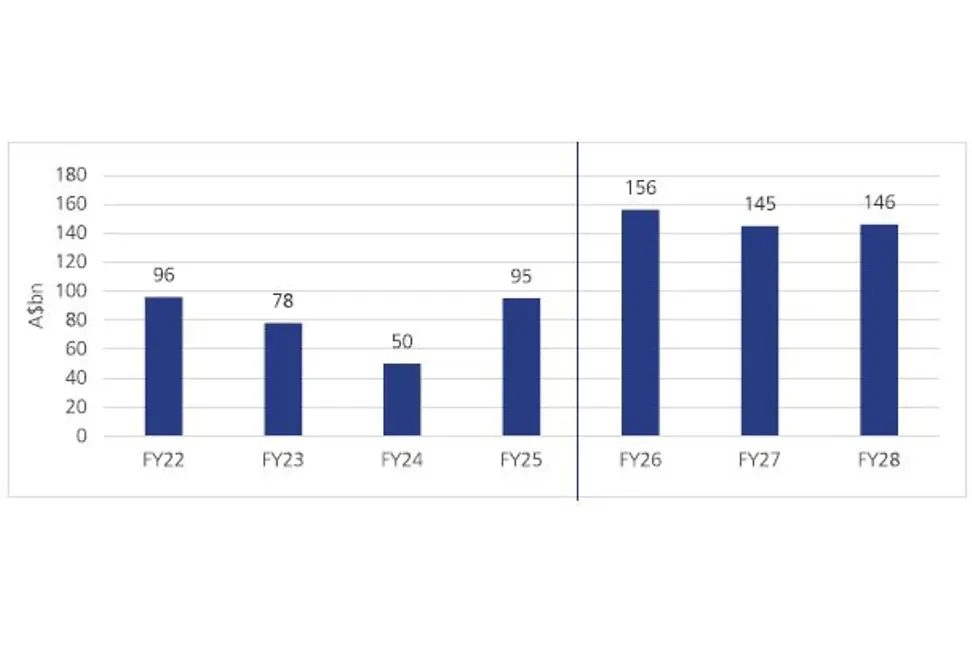

The Government forecasts gross debt on issue to rise relatively sharply from $940 billion in the current year to $1,022 billion in 2025-26 (33.7% of GDP), rising further to $1,223 billion in 2028-29, where the debt to GDP ratio is forecast to peak at 36.8%. The $82 billion rise in gross debt in 2025-26 is potentially a truer reflection of the fiscal easing between this year and next.

Although Australia's debt to GDP ratio is favourable versus other developed nations, the deteriorating fiscal position means the market is expecting Australian Commonwealth Government Bond (ACGB) issuance to increase, with next year's gross ACGB issuance expected to be around $156 billion. The large fiscal borrowing may impact bond yields initially but is not unexpected by the market.

Australia’s notional debt issuance is expected to remain elevated over the next few years.

Because the government thought it was going to the polls earlier, it had already released most of its policies, including expanded bulk billing, funding the upgrade to Queensland's Bruce Highway, and bailing out the Whyalla steelworks in South Australia. Over the past week, it preannounced the lower cost of prescription drugs and extension of the existing Energy Bill Relief program. The Coalition has promised to match all of this spending. In contrast, the Coalition will not support the additional tax cuts announced on budget night, raising this as an issue for the election (likely in May).

The consumer (aka voter) is clearly at the top of the list of winners in this pre-election budget. The additional tax cut measures are initially worth $268 pa from 1 July 2026, rising to $536 pa from 1 July 2027. The government will also cut 20% off all student loan debts, raise the minimum repayment threshold and reduce repayment rates to help ease cost pressures for university students. Given a greater propensity for lower income cohorts to spend, at the margin, these will moderately assist the consumer and the consumer discretionary sector. Until recently, most of the Stage 3 tax cuts had been saved, but recent data from the Commonwealth Bank showed that discretionary spending across all age cohorts increased during Q4 2024 vis-à-vis the Q2. Although the consumer will not see the additional $5-$10 per week till next financial year, when combined with prospective rate cuts – the market is priced for 66bps of cuts by year end – it should entrench the recovery in consumer confidence, which is at its highest levels since March 2022. Nonetheless, these measures are “modest” as the Government tries to balance cost-of-living relief against the inflationary consequences – Barrenjoey estimate that it will boost household pre-tax incomes by 0.14% in FY27 and just 0.3% in FY28. Whilst “slowing” bracket creep, the small incremental windfall means bigger-ticket retailers are unlikely to benefit, with any additional spend likely to go towards food and beverage, fuel and clothing (as opposed to home-related spend).

The consumer (aka voter) is clearly at the top of the list of winners in this pre-election budget.

It's worth highlighting that the consumer discretionary backdrop is very different to last year's budget. In the weeks prior to last year's budget, the sector was up ~6%, only to give it all back by the end of May. Although the sector has rallied ~30% since then, it has fallen ~10% from its recent highs, underperforming the broader market. Consequently, valuations are broadly similar to this time last year.

For infrastructure, the other key staple in recent budgets, there was only an additional $17bn in new spending over the next 10 years. The current public sector binge on infrastructure has passed its peak. Infrastructure Partners Australia noted that last year's state and federal budgets were confronted with growing fiscal constraints and sustained cost of living pressures. Consequently, there were few “infrastructure surprises, with the majority of spending directed towards the existing pipeline”. Last night's Budget stayed consistent with that message

The current (large) public sector binge on infrastructure has passed its peak. Infrastructure Partners Australia noted that last year’s state and federal budgets were confronted with growing fiscal constraints.

The healthcare sector saw the only other major funding change of note (pre-announced) with the extension to GP bulk-billing incentives for all Medicare-eligible patients from 1 November 2025. This should support a lift in GP visits with flow-on benefits to pathology, imaging and PBS prescriptions. No additions to pathology indexation were announced. Overall, however, there was nothing in this Budget which should be considered material for exposed names in terms of volumes for private hospital or GP-adjacent providers.

For housing, the Help to Buy scheme designed to assist first home buyers is being expanded but the impact on listed residential developers will likely be non-existent. Although the Treasurer explicitly called out the supermarkets, it's difficult to see how they can boost competition to a level that materially impacts the sector, and whilst “empowering the ACCC” is within their purview, the same organisation has already handed down its Final Report into Supermarkets Inquiry 2024-25.

The stock market is not the economy…

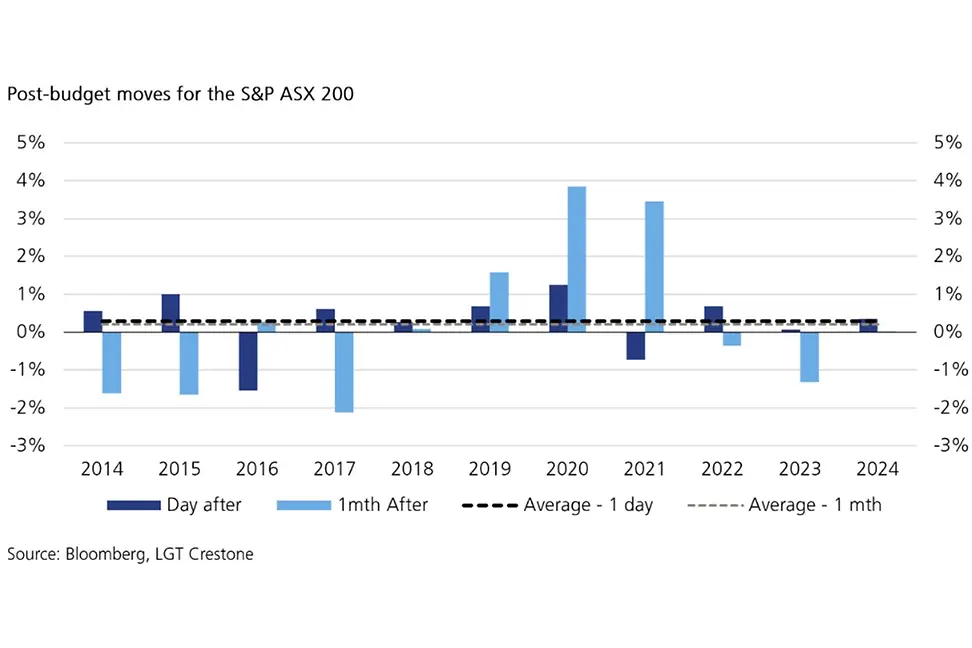

… The average return for the S&P/ASX 200 index on the day after the federal budget is just 0.29%, substantially below the average daily move of almost 1% over the past year

Turning to the equity market, this Budget seems unlikely to materially influence domestic equity markets, as viewed through the budget's impact on the aggregate economy, inflation, or monetary policy. As noted previously, the stock market is not the economy. According to the Australian Bureau of Statistics, organisations with fewer than 20 employees make up 44% of the workforce, contribute 48% of profits, and represent 34% of economic output. As such, when it comes to the budget and its focus, we can often overplay the equity market impact at a stock and a sector level. There are not any ASX-listed companies with less than 20 employees. Furthermore, the stock market derives only 55-60% of its revenue directly from Australia, with the rest repatriated from offshore sources (i.e., not exposed to the Australian economy or the federal budget). Arguably, the bigger implications are what the budget does to interest rate or currency expectations. This is also reflected in returns data over the past decade.

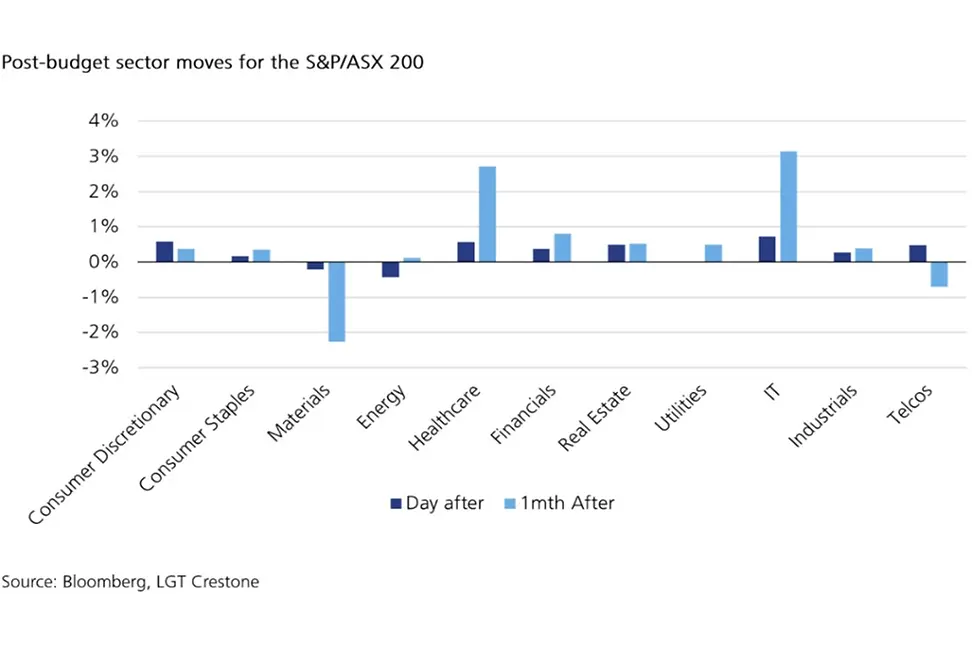

The average return for the S&P/ASX 200 index on the day after the federal budget is just 0.29%, substantially below the average daily move of almost 1% over the past year. The average return for the month following is just 0.2%. On average, the Australian Equity market is up 1.8% in the month prior to the Federal Budget. At a sector level, healthcare typically performs strongly in the month following the federal budget. Similarly, the IT sector performs strongly, although it is unlikely that this is budget-related, given the nature of the index's IT sector. The materials sector shows the weakest post budget performance, posting a negative one-month performance nine out of the past eleven budgets.

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.