It’s been a remarkable month for financial markets which have experienced historic levels of volatility and a near-unprecedented V-shaped recovery, all in the space of about 21 trading days since ‘Liberation Day’! The ‘Liberation Day’ sell-off across both bonds and equities saw increased market volatility. Throughout this period, we have focussed on parsing macro, market, and political developments through our constraints-based framework and our disciplined set of macro and market signposts.

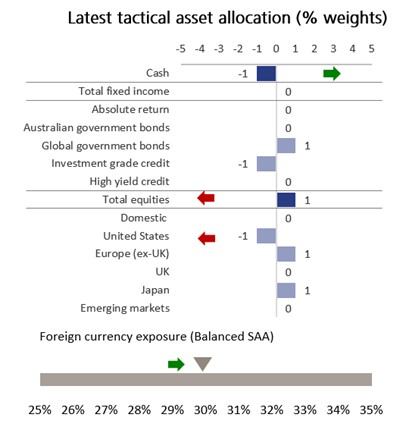

This process gave us the confidence in mid-April that the material constraints of the bond market, the US voter, and a multi-polar world had started to bind US President Trump, marking a near-term peak in US trade policy uncertainty. We subsequently took the opportunity to lean into battered equity markets, initiating an overweight to European equities and lifting our total equity overweight to +3. Having now captured much of the benefit from the recent rebound in equities, we trim our equity overweight.

Since the more aggressive-than-anticipated US tariff announcements in early April, President Trump has repeatedly moderated his trade policy stance. After announcing his 90-day reciprocal tariff reprieve (which was our key trigger for leaning in), he subsequently exempted a range of consumer electronics from tariffs, introduced further exemptions for autos, and is actively engaging with wide-ranging trade negotiations across the US' major trading partners, including China.

Markets have moved rapidly to price in our views on ‘peak trade uncertainty' and to reflect these progressive de-escalations. Since bottoming on 9 April, the S&P 500 index is trading roughly 13% higher, Japan's TOPIX is roughly 11% higher, the MSCI Europe ex-UK index is roughly 10% higher, and the S&P/ASX 300 index is roughly 9% higher.

The speed and scale of this rally has surprised most investors, including ourselves. For some context, in 2020 markets took roughly six months to recover their February 2020 pre-COVID levels. This time around, the S&P 500 took only 21 trading days to recover to its pre-‘Liberation Day' level. Markets seem to have broadly priced out US trade risks to earnings and the broader US and global economy. This seems overly optimistic to us. We agree that US trade uncertainty has peaked but we cannot escape the fact that 10% across-the-board tariffs, 25% sectoral tariffs (steel, aluminium, autos), and an effective embargo of US-China bilateral trade are all still actively in place! The near-term implications are unclear but likely negative for corporate earnings and the economy.

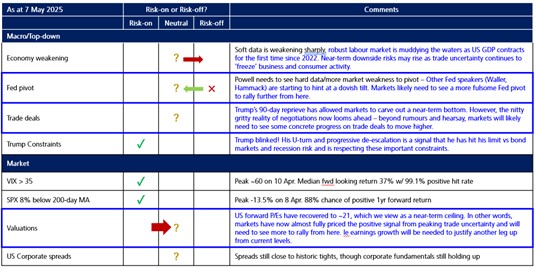

Accordingly, we have updated our signpost analysis. Out of respect for this recent historic rally, the still-high levels of trade and earnings uncertainty that persist, we believe a more modest (but still constructive) equity overweight is more appropriate in the current environment. Having aviated, navigated, and communicated for most of last month, it's now time to prepare for landing.

Having aviated, navigated, and communicated for most of last month, it’s now time to prepare for landing

We remain broadly constructive on ex-US equity markets, and have chosen to trim our equities position via selling into the US equity rally, initiating a modest underweight position to the region in order to maintain our overweight preference for Japan and Europe. This reflects a number of considerations:

We have also neutralised our underweight position in FX exposure, locking in some of the Australian dollar's rally from USD0.59 to USD0.65.

Could we be a bit early in taking profits, could the equity rally continue, and could markets re-engage with the US exceptionalism thesis that drives significant US equity outperformance again? Maybe, particularly if trade tensions ease significantly in coming days and weeks, and/or we get more optimistic guidance from US corporates. However, we believe that much of this improvement in the outlook has already been priced in and valuations have returned to historically high levels. It is prudent investment discipline to re-evaluate our views and take some chips off the table in the face of the historic rally we've seen.

We still retain a modestly constructive +1 equities overweight, and are still positioned to benefit should markets move higher or the outlook brightens substantially from here. In our view, the key catalysts that we are watching for which could spark another leg higher for markets include:

While we keenly await these key signposts, our latest TAA move frees up plenty of additional dry powder to lean into any equity market weakness from here. As we have seen over the past few months, flexibility and optionality are the astute investor's best friends in times of heightened volatility and uncertainty. We are now well positioned to capitalise on any further buying opportunities should they eventuate. Just as we got greedy when the world got overly fearful in April (by leaning into equities), we are now getting a bit more conservative as the world gets ‘more greedy'.

As we wrote in our 9 April 2025 Special Report Staying the Course, we continue to encourage investors to adopt a disciplined, staged approach to rebalancing towards their appropriate strategic or tactical asset allocation targets.

We continue to maintain a flexible and nimble stance given the still-high levels of volatility and uncertainty that are likely in coming weeks and months, as markets parse through the various macro, market, and policy developments that come our way.

The speed and scale of the post-‘Liberation Day’ rally has surprised most investors, including ourselves! Markets may have over-priced the peak in US policy uncertainty

Accordingly, we trim our +3 equity overweight to +1, maintaining a broadly constructive stance but taking some chips off the table in the face of a historic rally and still-high levels of economic and earnings uncertainty

Our updated signposts indicate this more cautiously optimistic stance is warranted

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.