The Australian fixed income market has undergone a renaissance. What was once a narrow, single-sector market focused primarily on government bonds has evolved into a broad, diversified investment universe. Today, investors can access multiple sectors, including semi-government, supranational, and corporate credit bonds, each offering distinct benefits and characteristics.

This wasn’t always the case. In the early 1980s, the corporate credit represented only a small portion of Australia’s capital markets, with total non-government bond issuance amounting to less than AUD 1 billion. This limited depth and breadth led not only to low liquidity but also to low awareness, particularly among retail investors, since the market was largely viewed as the domain of institutions.

Today, the Australian bond market exceeds AUD 2 trillion in size, with corporate bonds accounting for roughly half of the total issuance. Growth has been driven by demand from superannuation funds and banks, while foreign investors have been drawn to Australia’s stable regulatory environment, strong credit profile, and relatively attractive yields. More recently, the phasing out of bank hybrids and higher outright yields have encouraged greater participation from the wealth sector. This diversification of the investor base has further strengthened the depth and resilience of the Australian bond market.

Over the coming few quarters, the global macro backdrop should be relatively supportive for fixed income assets, as H225 global growth slows, inflation remains benign and most central banks continue to modestly trim interest rates. But as we wrote in our October Core Offerings, we are now assigning a higher probability to a global ‘reflation’ scenario emerging from mid-2026, one in which central banks face renewed growth momentum, complicating their efforts to deliver further rate cuts beyond mid-2026. This is a scenario where global bond yields could retrace higher toward the top of their recent ranges. Importantly, we anticipate the impact of this will be concentrated in the US, where the fiscal dynamics are less robust, central bank independence is more at risk, and an AI-induced growth upswing has more potential to pressure cyclical inflation higher.

Within this backdrop, and as we discuss in this month’s Core Offerings, Australia’s fixed income market remains well positioned. A now structurally deeper and more resilient market – helped by a more robust starting fiscal position than many key global economies – should combine with a likely less challenging cyclical pick-up in growth and inflation during 2026, to see both sovereign and corporate exposures deliver strong diversifying returns to portfolios.

Australia’s recent strong Q3 inflation print will certainly challenge those expecting a rate cut this month, coming in above the market’s and the Reserve Bank of Australia’s (RBA) forecast. Adding pressure to the near-term rates outlook is our belief that after a year and a half of a ‘per capita’ recession (and mid-2024 private sector activity near zero), that Australia is now amidst a mild cyclical growth recovery, led by an improving consumer and housing sector. Despite this, from an inflation perspective (which lags the growth cycle), Australia remains ‘late cycle’. After several years of robust employment gains, job vacancies are now easing, and the unemployment rate has risen to 4.5% from a cycle low of 3.5%. Wage growth, while still elevated, is showing signs of peaking as businesses respond to slowing revenue growth and higher operating costs.

Reflecting this, and with the RBA still forecasting below-trend growth over the coming year, core inflation (which has already halved from a peak of over 6% mid 2022 to 3% in Q3) should still return to the mid-point of the 2-3% inflation target during 2026. This suggests further modest rate cuts remain the most likely direction for policy, as the RBA returns rates to a more neutral setting (from 3.6% currently, to around 3.0%). This should still see duration exposures perform well, with elevated yields continuing to attract both domestic and offshore investors.

The demand side of the equation

In the Australian bond market, the investor base has broadened significantly, an evolution driven by both supply and demand dynamics. The Australian credit market presents a compelling opportunity to gain exposure to high-quality issuers, with Australian banks among the most highly regulated and best-capitalised globally. Investors can access these opportunities within a market characterised by a stable macroeconomic backdrop, a consistent issuance pipeline, lower volatility, and an attractive credit spread premium relative to other regions.

This favourable environment, together with the increasingly diversified investment universe outlined earlier, provides investors with ample scope to remain active and fully invested. These advantages extend to both domestic and offshore investors. Notably, recent new-issue data highlight growing participation from Asia-based investors, who have become increasingly active in the Australian market. As offshore participants are typically more accustomed to fixed-rate structures, demand in recent transactions has tended to skew towards fixed-rate tranches.

Figure 1: Australian credit spreads reflect an attractive premium to other regions

Source: Bloomberg, as at 24 October 2025.

On the supply side, the Australian credit market has experienced a notable surge in issuance this year, ranking fourth globally, with CAD issuance recently overtaking AUD issuance, and the market now sitting behind EUR, USD, and CAD year to date. While investment grade spreads remain near historically tight levels (see Figure 1, above), outright yield levels have continued to attract strong investor demand. This supportive backdrop has given local issuers, both financial and corporate, the confidence to bring new transactions to market, including innovative formats across different maturities and parts of the capital structure.

The Australian market has also welcomed a growing number of new participants over recent years, including offshore borrowers, known as “Kangaroo” issuers, who are increasingly turning to Australia as an attractive funding source. Their presence has further enhanced diversification within investors’ fixed income portfolios, broadening the pool of high-quality investment grade issuers available in the domestic market.

Investor demand for exposure to high-quality, investment grade issuers has driven significant growth in the Australian corporate subordinated debt market. Issuing investment grade bonds that are subordinated within the capital structure allows issuers to receive equity credit from rating agencies, helping them maintain investment grade status, while offering investors an additional yield premium.

The Australian Prudential Regulation Authority’s (APRA) decision to phase out the AUD 40 billion bank AT1 hybrid market by 2032 will reshape fixed income portfolios for our investor base. We have previously discussed the implications of this change (see “Phasing out of Bank Hybrids…where to next?”, February 2025)”, which unfortunately removes a well-recognised and historically popular investment opportunity. Bank hybrids have been favoured due to the familiarity of major bank issuers and their historically attractive credit spread pickup, although spreads have now compressed considerably in the wake of that decision.

With APRA’s policy now formalised, issuers are opting to call rather than refinance existing hybrids. For instance, Westpac redeemed its Westpac Capital Notes 5 (WBCPH) in September. As the call risk has been removed and hybrids transition to Tier 2 classification from 2027 onwards, credit spreads have tightened sharply, with many now trading below BBSW +200 basis points.

We believe investors should adopt a more active approach to managing hybrid exposures, taking advantage of capital gains opportunities before call dates, when spreads remain tight and liquidity is still strong.

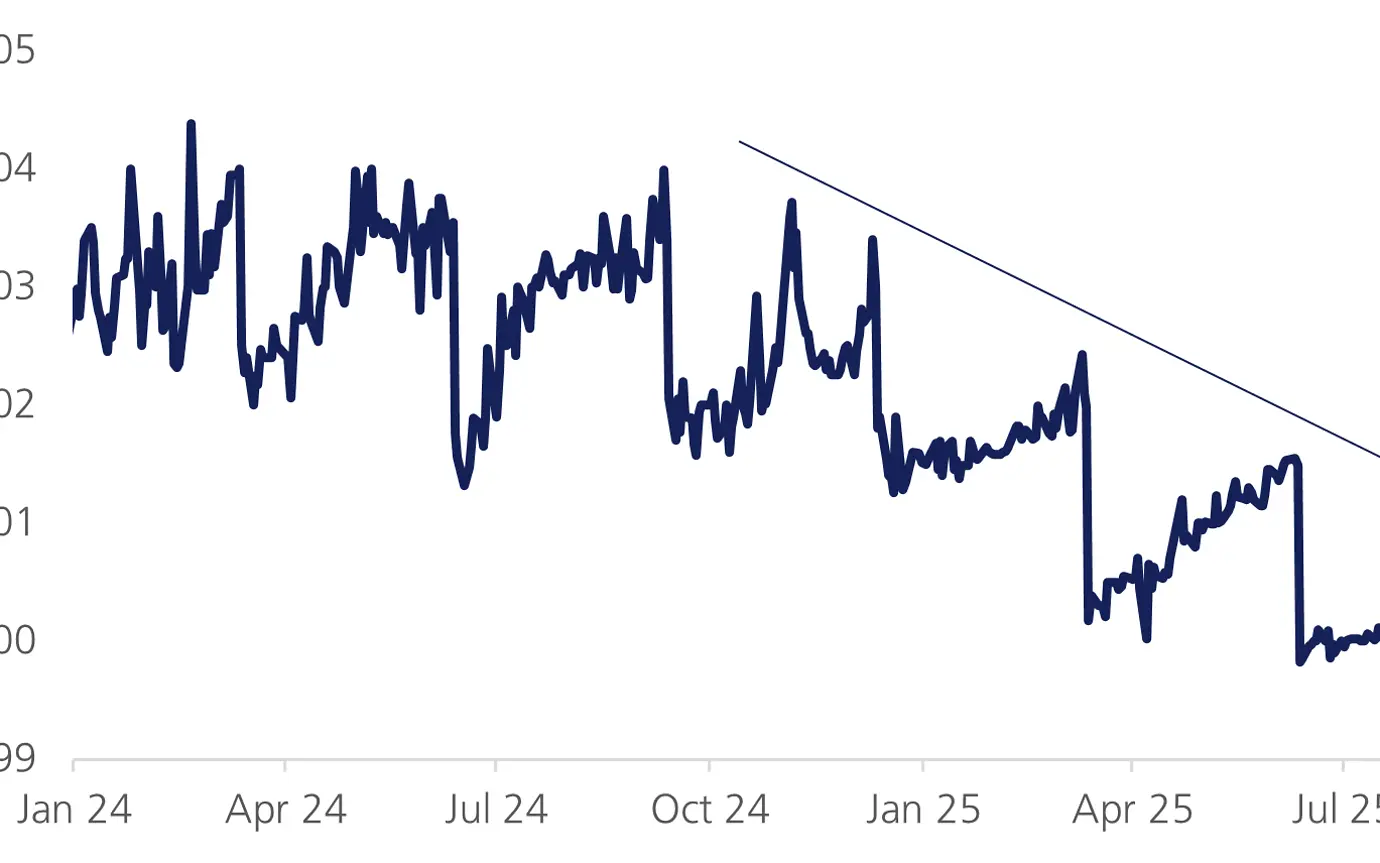

Figure 3: WBCPH Price – with call risk removed, credit spreads have tightened sharply

Source: Bloomberg

As illustrated in the chart above, hybrids typically trade closer to par as they near their call date, while liquidity diminishes as active investors exit their positions earlier. For those prepared to manage timing actively, there are opportunities to realise capital gains ahead of redemption, especially as hybrid credit spreads have continued to compress.

While we may lament the phasing out of bank hybrids, we remain confident that this shift will prompt investors to look more broadly across the Australian fixed income landscape. The market offers a diverse and evolving opportunity set that continues to deliver strong fundamentals and compelling value.

The Australian investment grade fixed income market stands out for its ability to provide steady and predictable income, lower volatility through market cycles, and meaningful diversification benefits within multi-asset portfolios. These characteristics remain as important as ever, helping investors navigate a multi-polar, changing global environment, where neutral interest rates are likely to stay higher for longer.

In our view, this backdrop reinforces the case for maintaining an active, well-diversified allocation to Australian fixed income as a core component of long-term portfolio strategy. The market is continuing to evolve and provide investors with new opportunities for investment.

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.