Geo-politics have come in ‘hot’ (again) as 2026 gets underway, and much hotter than we expected as we exited 2025. January alone has seen us navigating no less than five key geo-macro events, from the US’s abduction of the Venezuelan President to Trump’s threats to strike Iran and compulsorily ‘acquire’ NATO-aligned Greenland, outraging much of Europe. And then there’s the attack on the independence of the US Federal Reserve with its Chair Powell under investigation for fraud. Less controversially but adding more ‘angst’ to concerns about inappropriately ‘easy’ policy, new Japan Prime Minister (PM) Takaichi called a snap election. Closer to home, a hawkish Reserve Bank of Australia (RBA) – and strong inflation data – has flipped the rate outlook from cuts to hikes.

Will markets navigate 2026 in the same manner as 2025, ending materially higher? There are likely grave medium-term market implications from the US’s hostile assault on the post-war global order. Shorter-term, in 2026, there’s a strong argument for putting on geo-political ‘noise-cancelling’ headphones to avoid being distracted. Yet, we’d also argue this “ignorance is bliss” mentality does not extend to the macro, and could prove damaging for portfolios performance in H2 2026. Our ‘tariffs are disinflationary’ mantra for 2025 was instrumental in keeping us ‘risk on’ throughout, and we should make hay while the sun shines in H1 2026, while benign inflation and interest rate conditions persist, despite all the geo-political bluster.

But as we discussed in our 2026 Outlook, our view that reaccelerating growth will flag liquidity reversal by central banks later this year – the macro – poses the greatest risk to a repeat of 2025’s strong returns. Thus, H1 2026 should also be the time to future proof portfolios for more challenging times ahead. Seek resilience via truly diversified portfolios, that are not overexposed to US assets or the AI thematic, while ensuring inflation protection, particularly via sufficient private market assets.

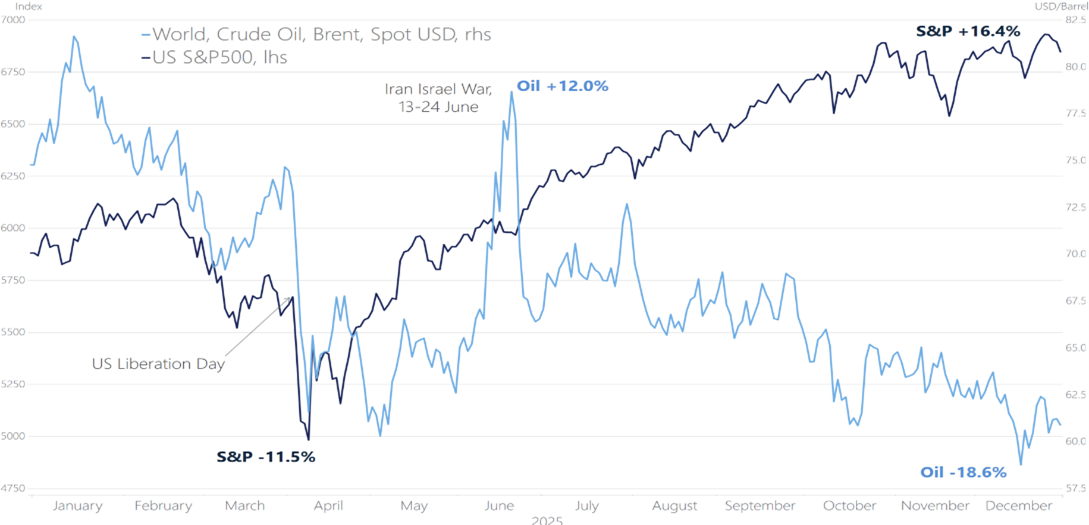

As Northern Trust notes, looking back at 2025, “the year’s great market performance is difficult to reconcile with an environment of high uncertainty”. Yet markets and economies largely navigated peak trade uncertainty (with escalating tariffs and shifting trade flows), mis-placed inflation worries from tariff-led price imposts as well as future debt and inflation worries regarding significant US tax cuts. The impact on oil prices of unrest in the Middle East also created volatility – thankfully to the downside, aiding our disinflation narrative. The promise of AI-related productivity (and capex-led growth) was also a positive force sustaining optimism regarding the outlook as 2025 unfolded.

Over the next three months, we are concerned with the build-up of risks. The Greenland stuff is just…stupid. But it could fracture the West for the first time since World War II. Fiscal prudence (SCOTUS decision on tariffs) and central bank independence (Fed under investigation) are at risk. And on top of that, we could have a significant oil shock from Iran.

BCA Geo-macro Research,

January 2026

Figure 1: Tariffs didn’t have a sustained market impact on equities, nor did geo-politics on oil

Indeed, despite one sharp bout of volatility in April (see Figure 1, below), 2025 was a standout year for markets. Global equities rose by around 20% – a third strong year – led by a resurgence in global tech stocks, while non-US markets such as Europe, Japan and emerging markets out-performed the US. Fixed income markets also delivered strong returns of 7-10% across global bonds and credit (albeit Australian fixed income, like domestic equities, underperformed). Un-listed assets such as infrastructure (circa 8%) and private credit (9-10%) also performed solidly, while non-oil commodity prices – gold (70%) and lithium (83%) especially – saw sharp gains.

As our journey through 2026 gets underway, we expect geo-political volatility and increasing scrutiny into the substance of the AI boom will persist. But we also believe these factors, particularly the former, will take a backseat to more fundamental macro drivers (rates/inflation) in the year ahead.

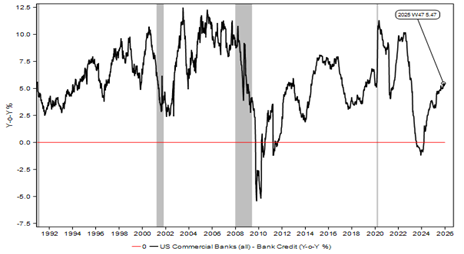

These drivers should initially present a constructive backdrop for markets through the first half of this year, as outlined below. Initially, softening (but only moderately below-trend) growth into early 2026 should keep inflation benign and keep central banks on an easing footing for a while longer. But before too long – potentially as Q2 2026 gets underway – we expect our theme of reflation to take centre stage. This second phase of the macro cycle is characterised by reaccelerating growth (rather than inflation), as the usual lagged impact of interest rate cuts from 2025 – and renewed global fiscal stimulus – drives a 2026 credit-led recovery in the non-AI economy, spurred by consumer and housing sectors, at the same time the AI capex cycle remains robust.

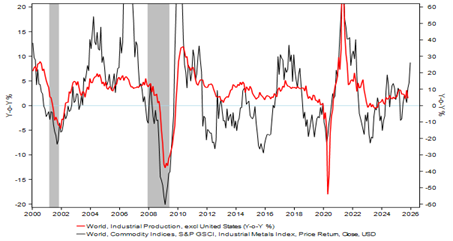

The third and final phase of the macro cycle – expected to emerge beyond mid-year (and persist into 2027) – is likely to prove more challenging for markets. Reaccelerating growth and a re-tightening of jobs markets globally, could drive a more inflationary ‘reflation’ impulse. The likelihood that reaccelerating growth will drive a focus on liquidity reversal by central banks later this year likely poses the greatest risk to a repeat of 2025’s strong returns. Monitoring that evolution will prove a key macro driver for returns as 2026 unfolds.

Global growth to slow further into early 2026: The US jobs market is slowing due to still-tight policy, the tariff-induced trade shock has slowed H2 2025 growth in Europe, Japan and the UK, while China has yet to stall its weak momentum. This will keep inflation benign and underpin further modest rate cuts (in the US, the UK, emerging markets among others).

Growth should reaccelerate beyond Q1 2026 – monetary policy acts with a lag, and with global central banks in 2025 amidst a meaningful cutting cycle, a credit-led recovery in the non-AI economy – led by consumer and housing sectors – remains our 2026 central case. Fiscal easing in the US, China, Europe will also support growth.

Challenges could arise in H2 2026 as jobs markets re-tighten – this would likely forestall any further rate cuts. And should inflation trends deteriorate, tighter monetary policy could eventually follow (as early as late 2026). The evolution to a more inflationary ‘reflation’ impulse, and reversal of liquidity, could pose challenges for both equity and bond markets later in 2026.

Despite our call that macro factors will take the lead in 2026, geo-politics have come in ‘hot’ as the year gets underway. January alone has seen us navigating no less than five key geo-macro events. This now appears to be life in a multi-polar world! At least for those developments with a truly geo-political bent - the US’s abduction of the Venezuelan President through to Trump’s threats to strike Iran and compulsorily ‘acquire’ NATO-aligned Greenland, as well as the attack on the independence of the US Fed – the market has taken the approach of putting on noise cancelling headphones.

As Barclay’s Research wrote earlier this year. “Noise cancellation is a technology designed to reduce unwanted ambient sounds, enhancing audio clarity and creating a quieter listening environment. Markets seem to apply a similar approach in an investing environment that has started to become disturbingly noisy”. Barclays also argue that noise cancellation, while beneficial for reducing disturbing background sound, comes with risks and drawbacks. We would extend that to the realm of the macro phases we have laid out above. A ‘TACO’ filter may be appropriate for geo-political noise, but may not be the right approach for macro fundamentals. As we argue, they may be sound now – through phases one and two – but maintaining ‘situational awareness’ to the macro will be key to navigating more challenging market conditions should our macro phase three arrive.

Here are the five key geo-macro developments over the ‘summer break’.

The latest attempts by President Trump to cap US credit card fees, recent additional tariffs on various countries as well as US citizens being killed amidst Trump’s forced immigration removals are also worthy of note.

Venezuelan incursion (abducting the president) – On January 3, the US military and law enforcement conducted a special operation, capturing Venezuelan President Maduro and his wife (who were relocated to the US to be charged on drug-related offences). While a clear assault on post war global order, the market implications of removing a non-benevolent dictator are likely limited. Delivering higher output of US-led oil from Venezuela is a likely motivation, albeit the limited oil price response reflects that damaged infrastructure will take years to repair.

Iran regime instability – While far from US-led, the most significant protest in a number of years (and with protests targeted at the regime rather than the US or Isreal) saw Trump flag the possibility of militarily forcing regime change. This had the potential to create broader Middle East uncertainty, particularly given the significance of Iran as an oil exporter. In late January, President Trump boosted the US's naval presence in the region threatening to intervene in Iran if it does not sign a nuclear deal or fails to stop killing protesters.

Fed credibility attacked – The Trump Administration initiated criminal investigation into Fed Chair Powell. But bond market constraints, and a global uproar by other central banks officials, has led Trump to distance himself from the matter. The action is likely targeted at encouraging Powell to retire once he steps down from the Chair, rather than any imminent removal process. The market is also awaiting the Supreme Court’s decision on whether Governor Cook can continue to vote while she is investigated for fraud, as well as Trump’s reciprocal tariffs.

Japan’s PM calls a snap election – New PM Takaichi surprised markets in January with her decision to dissolve the Lower House and call an election for February 8th. This has led to speculation of greater fiscal stimulus and more market-friendly growth, driving the local equity market 5% higher in the following days. Speculation about the earlier timing for Bank of Japan (BoJ) rate hikes – and a relatively hawkish post January meeting statement – has seen a sharp 20-30 basis point (bps) rise in bond yields together with a stronger Japanese yen.

Greenland’s ‘compulsory acquisition’ – Trump initially set publicly announced deadlines for Greenland’s ‘acquisition’. In the wake of additional escalating tariff threats on Europe to demand negotiation, this too has been ‘walked back’ by Trump, reversing equity market weakness at the time. Access to critical minerals is likely to have been a key driver, with Trump heralding additional access as he announced a deal had been reached.

Are Australia’s inflation woes a bellwether for other economies in H2 2026?

Closer to home, local markets have experienced volatility associated with increasing expectations that reaccelerating inflation will force the Reserve Bank of Australia (RBA) to reverse course from its well-announced rate cutting cycle to one of near-term rate hikes. A reacceleration in consumer and housing activity one the back of three rate cuts in 2025 (from 4.35% to 3.60%) has clearly and pleasingly led to a pickup in the private sector economy (which was in recession), with stronger

The path of least resistance would now appear to be a rate hike for the RBA in the first week of February, albeit the path of least regret is likely to not reverse course, and hold rates at a mildly restrictive stance, and await more clarity.

Figure 2: Macro phase two (growth-led reflation) supported by renewed leverage – US credit accelerating

consumers and housing activity in H2 2025. However, this also appears also to have stalled progress on moderating inflation, with the core trimmed measure rising from 2.7% (in the 2-3% target) in mid-2025 to 3.4% (above the target) end-2025 (released late January).

The path of least resistance would now appear to be a rate hike for the RBA in the first week of February, albeit the path of least regret is likely to not U-turn, and hold rates steady at a mildly restrictive stance, and await more clarity. While inflation is clearly too high, growth is far from above trend, employment growth is well below trend and there remains questions over the extent the consumer and housing sectors will sustain their current pick-up over coming quarters in the absence of rate cuts they were anticipating. During January, the shifting rates outlook has led to volatility and underperformance of Aussie government bonds and equity markets during the month, while the currency has strengthened to its highest level (USD0.70) in several years.

As we look to navigate 2026, we believe that trade and geo-political uncertainty are moderating as market-relevant risks, with market reactions thus far in January corroborating this view. Putting on noise cancelling headphones as it relates to geo-political bluster, viewed carefully through our constraints-based lens, has merit as a strategy over coming months.

We expect that strategy, as the first and second phases of our macro outlook play out, to allow us to ‘make hay while the sun shines’ in terms of harvesting returns in rising markets, as growth slows but doesn’t collapse, inflation moderates (except in Australia) and interest rates stay benign.

However, we would caution whether that same strategy will be appropriate as we transition to phase three of our macro outlook. Tuning out the noise when it’s macro fundamentals could prove problematic. As we wrote in our 2026 Outlook, Charles Kindleberger’s “Manias, Panics and Crashes” enduring conclusion was that while many forces can fuel a speculative upswing, there’s ultimately only one force that ends a bubble, namely, the withdrawal of liquidity.

With that in mind and noting a key feature of our H2 outlook is precisely the end of increasing liquidity, we see H1 2026 as a key time to future proof portfolios for the next phase of the cycle.

The near-term macro backdrop continues to look supportive, with fiscal and monetary policy both in various stages of easing. That said, with potential reflationary storm clouds beyond the horizon, we believe astute investors should use the current ‘sunny’ environment to interrogate their portfolios and build in adequate resilience ahead of future rainy days. Prudent portfolio diversification and active management will be important tools in the astute investor’s arsenal.

Figure 3: Macro phase three – global commodity prices flag higher world output (and less new stimulus)

We see the first half of 2026 as one where investors should:

review their exposure to narrow US mega-cap tech equities. We are fans of the AI thematic, but that is different from allowing portfolios to drift into an ‘over-exposed’ position via a collective of direct equities, less visible manager positions and private markets;

review the robustness of listed equity positions across sectors and regions, and examine whether reducing US exposure in favour of non-US markets, including Europe, Japan and emerging markets, is warranted given improved structural and cyclical outlooks;

ensure sufficient defence through active management, given concentration risks in listed indices, more dispersion tends to greater alpha below the market’s surface, in sectors and styles, such as small and mid-cap equities and quality;

have some exposure to fixed income given elevated starting yields (especially in Australia), while ensuring a focus on quality in the credit space; and

increase exposure to uncorrelated and real assets that provide volatility and inflation protection (such as infrastructure, commodities, low-beta hedge funds).

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.