Ahead of the LGT Climate Conference, two featured speakers - Tom Kline of Climate Tech Partners and Tom McQuillen of ReGen Ventures share insights into the kinds of technologies attracting capital, the signals they look for when it comes to investing and how Australia can play a pivotal role in scaling solutions, globally.

Tom McQuillen, partner at ReGen Ventures, believes the most transformative climate technologies will outperform incumbents on cost and performance—not just sustainability. “We don’t invest in anything that requires a green premium,” he says. “The Tesla Model S wasn’t bought because it was sustainable, it was the fastest four-door car on the planet.”

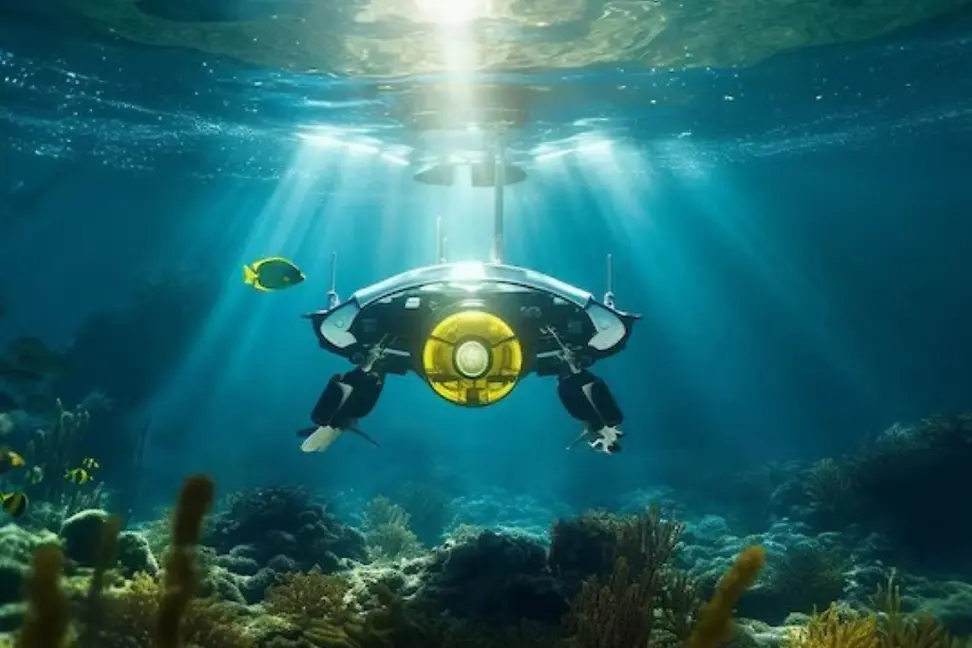

This philosophy underpins ReGen’s investments in companies like unlisted BurnBot, which builds fire-breathing robots for precision burning. “BurnBot is 10x more efficient than hand crews,” McQuillen notes. The company recently raised a USD $34 million Series B and is expanding into Australia to help prevent catastrophic bushfires. Another portfolio company, Ulysses, builds autonomous underwater drones for ocean restoration and offshore wind inspection. “They can do in a day what takes human dive teams a full year,” he adds.

Tom Kline of Climate Tech Partners emphasises the importance of customer validation. Through its industry partnership model, Climate Tech Partners helps de-risk and accelerate climate solutions by deeply understanding customer pain points and matching startups with corporates that are ready to adopt that solution. “The strongest signal is when a corporate sees a startup’s solution as directly solving a decarbonisation or operational challenge and reduces costs,” he says. His firm prioritises:

Kline also stresses the importance of founder capability. “In climate tech, commercialisation often depends on how well startups can embed with enterprise customers,” he says.

While ReGen Ventures’ portfolio is largely global, both investors see Australia as a compelling destination for climate tech deployment and scale. “Australia has world-class research institutions, a rapidly growing tech ecosystem and corporates under pressure to decarbonise,” says Kline. “Add deep pools of capital from our superannuation system and proximity to Asia, and you have a compelling launchpad.”

Australia’s energy grid, one of the most complex in the world, offers a unique test bed for technologies that integrate renewables and stabilise networks. Kline points to Energy Exemplar (PLEXOS), an energy market modelling platform that scaled globally and was acquired for $1.6 billion. “It shows how solutions proven in Australia’s system can deliver enormous value worldwide.”

McQuillen sees opportunity in building Australia’s hardware tech stack. “We’ve shown we can build globally competitive software companies like Atlassian and Canva,” he says. “Now we need to do the same for advanced manufacturing, robotics and power electronics.”

Both investors agree that policy stability and infrastructure investment are critical. “Ambitious targets are important, but long-term confidence is built on consistent policy,” says Kline. He advocates for more support to help startups embed with enterprise customers, which de-risks investment and accelerates decarbonisation.

McQuillen highlights the National Reconstruction Fund and the Advanced Manufacturing Readiness Facility in Sydney as positive steps. “But we need to double down,” he says. “Australia must create its own version of El Segundo, where hard-tech manufacturing is scaling rapidly in the US. That’s where the next century will be won.”

Climate tech is no longer a niche - it’s a frontier for innovation and investment. Whether through robotics, grid integration or ocean restoration, the technologies attracting capital today are those that solve real problems faster and cheaper than legacy systems. Australia, with its natural advantages and growing ambition, is well-positioned to host and scale these solutions. The opportunity is global, but the role Australia plays could be transformative.

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.