The September 2025 Investment Symposiums highlighted the resurgence of macroeconomic factors as key market drivers amid persistent volatility, with opportunities emerging in AI, infrastructure, and energy-linked investments. LGT’s CIO Scott Haslem and other experts emphasized a constructive yet cautious outlook, advocating for strategic diversification and active management in response to geopolitical shifts, inflation risks, and evolving global power dynamics. The panel discussions underscored the importance of adapting portfolios to a multipolar world, focusing on quality assets, inflation-resilient infrastructure, and selective equity exposures beyond the US.

We recently held our Investment Symposium in Adelaide and Perth during September. The event included a macroeconomic and market update from LGT’s Chief Investment Officer, Scott Haslem. Our Head of Asset Allocation, Matthew Tan then hosted a fireside with Adam Creighton, Chief Economist of The Institute of Public Affairs, to discuss how the current local and global geopolitical conditions are impacting investment decisions. Todd Hoare, Head of Public Markets then hosted a panel to examine how macroeconomic and geopolitical forces are influencing equity valuations, the evolving role of private capital in infrastructure and technology, and how energy security and sustainability are reshaping long-term investment strategies. This discussion included insights from Lazard Asset Management’s Ronald Temple, Partners Group’s Esther Peiner, KKR’s Aaron Tan, and Pendal Group’s Amy Xie Patrick. The view from the symposium is that ‘macro’ factors are re-taking centre stage as trade and geopolitical uncertainty peak. However, volatility will likely persist, but these conditions are presenting market opportunities.

The macro matters again: Trade and geopolitical risks remain; however, we have likely passed peak uncertainty for both, clearing the way for more traditional ‘macro’ factors (economic growth, inflation, interest rates) to be the key driver for markets over the next 12 months.

Geopolitical shifts: The world is transitioning from a unipolar to a more complex multipolar environment, with significant implications for long-term investment strategy. Domestic political and social tensions are also feeding into the ‘two-level game’ driving broader international relations. This more complicated world requires investors to ‘level up’.

Opportunities abound for astute investors: Significant investment opportunities are emerging in AI, energy-linked infrastructure, and climate adaption across public and private markets.

Fixed income reframed: Bonds are becoming less defensive; understanding macro fundamentals is key to portfolio construction.

Constructive outlook: Acknowledging global angst around expensive markets, slowing economies, and political risks, LGT maintains a broadly constructive stance, emphasising the importance of strategic asset allocation, diversification, and ensuring the flexibility to respond to emerging risks and opportunities.

Scott Haslem, CIO of LGT Wealth Management, opened the Symposium with a presentation on what’s been occurring in markets this year and what he thinks investors should focus on in the coming year. Scott iterated that filtering out the ‘noise’ is just as important as looking at the key signals and indicators with portfolio positioning.

The investment team has been navigating disruption over the past nine months. The impact of ‘Liberation Day’ tariffs, escalation and de-escalation of geopolitical tensions and President Trump’s ‘One Big Beautiful (tax) Bill’ has caused a lot of angst in markets, particularly within bond markets. Scott spoke to how the team made tactical changes through its constraints-based lens to preserve capital and lean into market opportunities over this period.

Scott believes this coming year will be constructive but there are going to be head winds—tariff, deficit, inflation and valuation issues remain, “we think it’s a year to be constructive. To be invested. To be truly diversified across portfolios and to trust your strategic asset allocation and look for market opportunities.” He speaks to the reasons for the team’s view on being constructive these include:

we are passed peak trade uncertainty

the US response to the Iranian situation has reduced future geopolitical tensions

there hasn’t been much inflation prior to the tariff impact

central banks have been trimming interest rates

balance sheets of corporates and consumers around the world appear in good shape.

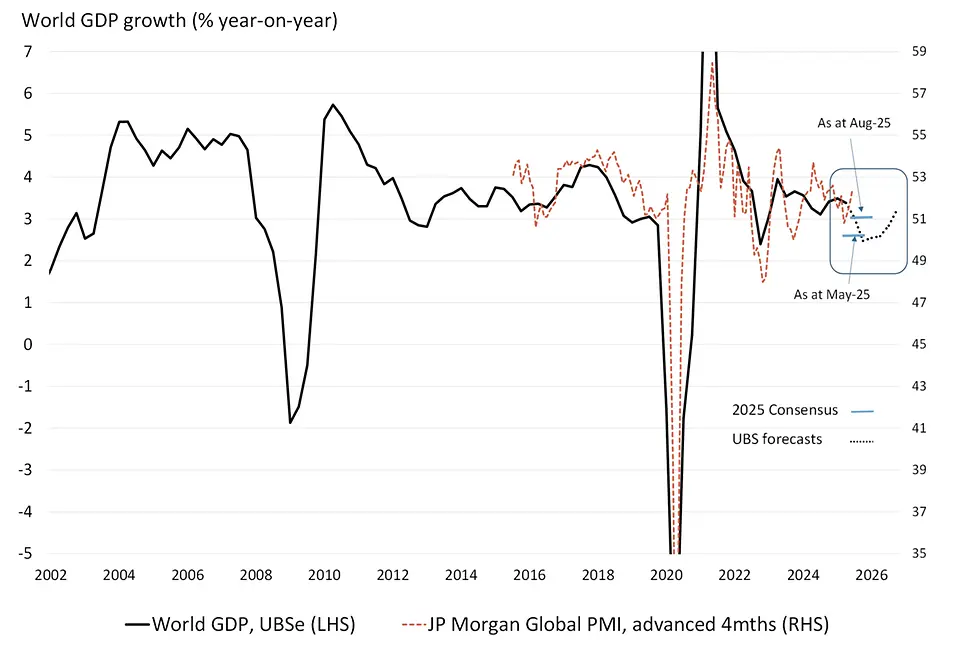

Macro constructive—could H2 weakness give way to a 2026 recovery?

Source: FactSet, Macrobond, UBS, JPMorgan, Bloomberg, LGT.

Conversely, he speaks to what is concerning the investment team when it comes to the market outlook. He firstly speaks to the implications of tariffs on markets. Although tariffs have come in below what the market was thinking he notes that there is a cost to tariffs as they are a form of tax on consumers and ultimately slow growth. He notes that we already seeing a decline in US consumer spending a slowdown in US jobs growth. He expects more trade disruption over the second half of the year in Europe and Japan and other places which will “likely slow growth at a rate more than people are anticipating.”

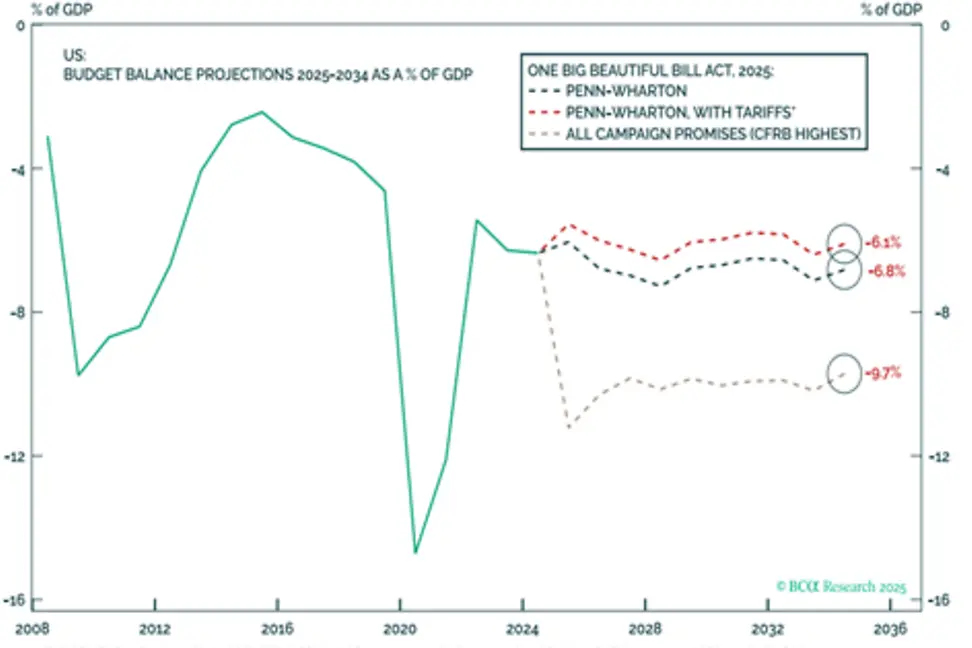

The second point of concern is Trump’s passed ‘One Big Beautiful (tax) Bill’ (OBBB). Scott spoke to the bond market’s initial reaction earlier this year when it was passed. He points out that the budget is ‘fiscally conservative’ based on estimates that over a ten-year period the cost of the OBBB should be around $3.4 trillion over 10 years but the tariff revenue that President Trump is raising is estimated to be around $4.0 trillion. His concern is with the level of deficits which currently sit around 6% may remain a concern for bond markets.

Positive signals—Trump tax cuts pass (but no one fixed the deficit)

Based on these two considerations, Scott believes that tariffs will likely slow growth and interest rates will remain high—the consequence of these two factors is that global growth will slow down in the second half of the year.

He also expects weaker data will maintain the dispersion we are seeing around regions of the world. He believes it’s a positive story for Australia in terms of growth as we are seeing a lift in consumer confidence and more optimism about housing as the RBA continues cutting rates. He cautions however that productivity remains a concern. Scott expects Australia to grow around 2% next which means we are past the worst (growth last year was a mere 1%). However, we are unlikely to reach our past trend growth due to our current productivity quagmire, while any future China stimulus will be less resource intensive for Australia than in the past.

China growth has held up quite well in H1 2025, with lots of pre-tariff purchasing of exports and the Government has been trying to encourage consumers to buy more durables. However, Scott believes the second half growth will significantly slow (ahead of more stimulus in October) as these supports to growth fade. In Europe and Japan, he believes it’s more a structural story, “in Europe we are seeing significant stimulus growth around defence and infrastructure in particular, similarly in Japan there is a good macro story in terms consumer confidence and growth in wages and with the regulator placing pressure on companies to unlock shareholder value to remove cross-share holdings which is lifting corporate profitably.”

Scott believes that while we have already journeyed a fair way with central bank rate cuts, there are more cuts ahead, creating a supportive backdrop for markets.

The team are constructive with their outlook which means they are underweight cash and deploying selectively into opportunities. The team leaned into equity markets post ‘Liberation Day’ (using 50% of their risk budget), recently trimming back to a more conservative positioning (at 20% of the risk budget). The reason being that valuations remain expensive and that investors are not being compensated as much for taking on equity risk. The overvaluation is mainly in US equities while Europe, Japan and Asia have less extreme valuations. The investment team as a result are allocating their tactical positioning to those countries outside of the US based on a macro story and more attractive valuations.

More specifically, Scott and the team believe that US small to mid-caps below the US-listed ‘Magnificent 7’ technology stocks should provide more value. Scott does speak to the current Artificial Intelligence (AI) dominance in the US equities market making reference to a BCA analyst’s description that AI “has become a magical sugar fairy riding on a rainbow-coloured unicorn that will expand profit margins as the cantankerous labour force is replaced by killer robots”. He referred to the AI segment ‘hyperscalers’ of the market noting it’s weighting scale and that investment in this area has doubled over the past two years. The US as result “doesn’t look like a market you should be naked of based on the level of sales growth in tech and communications services”.

Equities—Stay neutral US on AI (and other) themes (including non-Mag7)

Source: BCA, LGT.

In terms of fixed income, the team are neutral on government bonds based on their view that the US Government hasn’t fixed its debt problems and concern regarding the US central banks’ (Fed) independence. There is currently some scrutiny over the current Trump Administration’s, ‘apparent’ control over the Fed’s decision making as the senate is influencing Trump—as we have previously inferred is that this may ‘force the Fed’s hand’ with future interest rates. Scott also holds the view that steeper yield curves are a reflection that fixed income is ‘income’ and less defensive in nature.

Scott notes the importance of unlisted alternatives namely in infrastructure, real estate, and private credit and private equity to provide defensive characteristics within a portfolio. These uncorrelated assets are providing alternative forms of returns and the team are expanding on and continue to diversify their exposure within this asset class.

Head of Asset Allocation at LGT, Matthew Tan hosted a fireside chat with Adam Creighton, Chief Economist at the Institute of Public Affairs which he joined after 13 years as a journalist at The Australian where he was economics editor and Washington correspondent

Matt opened the conversation reiterating LGT’s long-held view that the world is transitioning from a unipolar to a more complex multipolar environment, with significant implications for long-term investment strategy. Matt further noted that this is not necessarily a bearish view but a more complicated world does require investors to ‘level up’.

Matt opened the conversation with Adam by discussing some of the key catalysts or events that he believes have driven us to where we are today? Adam believes that “unlike the 90s and 2000s which was relatively peaceful aside from 9/11 and the Global Financial Crisis, we are now living in a decade of rage and disruption.” More specifically, he believes that the response to the COVID pandemic has had more of an impact on society than anything else since World War II, as it has led to “a massive decline in respect and belief in society’s elites and experts by a very large share of the population.” He talked to the increase in political and social tensions across the globe as seen in the rise in local protests and far-right movements. His belief is that this at least partly stems from the economic and social dislocation seen over the two years during COVID, including in Australia.

Adam referred to declining trust in health authorities because of the pandemic, particularly within the US, “there used to be enormous trust in… public health authorities, according to the Pew and Edelman surveys this used to be around 90% and has now fallen to around 50%.”. He believes this has a serious consequence not just on the health policy makers but universities, mainstream media and civil servants. His overall view, including in Australia is that voters didn’t always agree with the policy makers during that time and question if they made the right decisions for their constituents.

Secondly, Adam discusses the significant rise in immigration across Western counties post the pandemic. He spoke to the example in the UK where they voted on BREXIT in 2016 to try and reduce immigrants from the European Union however since COVID “around 4 million immigrants in three years” have entered the country. He noted that this has caused problems in terms of social cohesion, placing pressure on services such as health, infrastructure, housing. He also talked to the rise in protests on migration across France and Germany.

Adam believes Australia’s current increase in immigration is also causing issues on a political but also an economic front, “there’s been extraordinary immigration to Australia over the past few years which has had a deleterious impact on our productivity and GDP growth.” He referred to Australia’s decline of GDP per capita over the past nine of 11 quarters which is he sees as partly due to a significant rise in lower-skilled workers.

In light of Adam’s observations, Matt noted the importance of understanding these domestic political and social tensions when evaluating global dynamics. He referenced the political science concept of “Two-level game theory”, where domestic politics can have a sizeable impact on international relations. In other words, “the domestic politics in a country can impact how much leeway its policymakers have to deal with foreign countries, which can in turn impact different countries interact with each other”.

The two then discuss how they see the domestic and international front evolving looking forward. Adam concurred with LGT’s house view that the world is becoming more multipolar, noting that despite its relative deterioration, the US remains by far the most powerful country in the world. He believes that despite the general negative sentiment from Australia and Europe from elites towards the Trump Administration there is still a high demand for skilled workers to enter the US. Adam puts this down to a competitive US income tax system noting that in some US states there is no tax at all which in comparison to Australia’s relatively higher taxation system, making it more alluring for skilled migrants and businesses. He thinks Australia’s PAYG taxation system is a deterrent for skilled workers— “it’s no wonder any one talented leaves Australia given the enormous income tax rates.”

Adam thinks the most interesting shift is happening in Europe. Noting that if you go back to 2007 the Europe Union and the US had a roughly equal share of global GDP at around 27% which meant they were both major contributors. Fast-forwarding to today, the European’s GDP contribution has fallen to around 18%. Conversely, the US has dropped a little but is maintaining its relative heft at around 25% of GDP. For context, Adam noted the US after World War II was a “colossus at 50% of GDP, it’s now struggling and can’t impose its will on basically anyplace in the world anymore”.

He recognised China’s important to global growth too, noting its significant rise in global GDP contribution over this period. He believes China will remain “enormously powerful” but also recognises the rise of India’s population which expected to rise to around 1.4–1.5 billion and Africa’s population growth which will also impact economies in the future.

As a result, he expects potentially significant shifts in global power dynamics over the next 15 years. This shift is causing issues for countries like Australia which has traditionally been aligned with the US in terms of policy and defence however its increasingly economically dependent on China and elsewhere for trade, “we are in this horrible situation where the US elites want us to spend more on military and be ‘anti-China’ yet we pay our way by selling things to China on a very large scale.”

Adam believes like LGT that there will be a lot of dispersion and volatility in markets as result of these shifts however they will present market opportunities. He also sees potential for significant global growth.

On this end he does see a decline in fiat currencies like the US dollar, a shift which he believes is evident in the rise of bitcoin and gold prices. Simply put, more investors are putting their money in different currencies which he believes is a result of uncertainty around what the governments can do with money “[they] can print hundreds of billions of dollars of units whenever it feels like which comes back to COVID—a lot more ordinary people understand that governments can create money out of thin air which does have consequences on faith in fiat currencies.”

He also foresees a debt crisis believing that governments are borrowing too much money at high interest rates and they will like struggle to pay back these debts. Referring to the US’s current 6% deficit like Scott Haslem, LGT’s CIO, he believes this level of debt is not sustainable. He also foresees similar debt problems in the UK and Europe with Australia’s fiscal situation not too far behind.

Matthew Tan noted that LGT maintains a broadly constructive stance, emphasising the importance of strategic asset allocation, diversification, and ensuring the flexibility to respond to emerging risks and opportunities.

He noted that an important aspect of this is to focus as much on the opportunities as the risks—people tend to fixate on downside risks and forget that we should expect significant nominal growth in this world too. The volume of expenditure that needs to be made on economic resilience, defence, the energy transition, and other areas is a clear example of this, and LGT sees potential profitable opportunities stemming from this spending.

He then highlighted several actions LGT has already taken to prepare client portfolios for a changing world, including:

Tilting client portfolios heavily towards secular growth opportunities around infrastructure, AI, and energy transition-related investments across both equities and in the alternatives space, where LGT has built strong relationships with the best managers in the business.

Further increasing our conviction in the ability for high quality active managers to add value over and above passive benchmarks.

Adopting a total portfolio approach that not only analyses the underlying risk factors driving different asset classes but also applies to currency management to make sure clients are optimising the diversification benefits of the Australian dollar.

He then referred to how the team incorporate their in-house framework for assessing geopolitical risks to determine how these risks may impact investment markets. He highlighted LGT’s use of a constraints-based framework, which focusses less on what policymakers say (their preferences) and more on the material constraints that dictate what they can achieve. He used the recent examples of UK PM Liz Truss in 2022 and ‘Liberation Day’ to highlight this—the bond market proved to be the fulcrum constraint in both these instances, forcing both policymakers to back down from their most extreme preferences.

“The most important thing is not to panic…we’ve worked really hard to fully incorporate a rising political and geopolitical risk environment into our investment process and believe we have the right frameworks for managing them”

Our Head of Public Markets, Todd Hoare, hosted a panel discussion and framed the discussion around three relevant questions for portfolios right now:

1) How persistent is inflation and what does that mean for rates?

2) What constitutes ‘defensive’ at an asset class level?

3) How is AI reshaping the current investing cycle?

The panel featured insights from four of our top portfolio managers including, Lazard’s Ron Temple, Partners Group’s Esther Peiner, KKR’s Aaron Tan, and Pendal’s Amy Xie Patrick.

The conclusion, whilst clearly nuanced, is that being constructively invested, selectively diversified and attune to major market shifts—be it rates, geopolitics, or technological—should be front of mind for investors. The panel delivered a coherent, cross-asset message: stay invested, diversify intelligently, and price political risk explicitly. Inflation is no longer the fire of 2022, but its embers are hot enough—especially in the US—that portfolios should look to protect capital via quality credit, infrastructure cash flows, selective equity geography/sector exposures, and disciplined FX management. That is precisely the playbook clients need in a multipolar, AI-accelerated, policy-volatile world.

Ron’s base case is that the US is the global outlier—tariff policy is inflationary in the US but disinflationary or neutral elsewhere. He expects US core inflation to re-accelerate over the back half of 2025 and early 2026 as corporates balance the competing impacts of margins and market share. He further contends that the Fed’s dual mandate is being compromised by the US Administration’s immigration stance—a shrinking labour force, courtesy of forced deportations, may also contain upward pressure on the unemployment rate.

Amy challenged the persistence of inflationary pressures, suggesting that the US labour market has cooled enough already that the wage-price feedback loop looks contained. Crucially, China’s excess capacity and discounting in traded goods provides a global offset to the one-off increase in goods prices. Although Ron and Amy agreed that the path of US rates is lower, Ron believes the market is likely over-pricing Fed cuts.

The net of this is that the panel sketched a range of plausible inflation paths with the US skewed higher than peers, and some debate around the near-term trajectory which resonates with Scott’s view that inflation volatility is the risk that matters. The conclusion for investors is that they may have to accept higher inflation tails in the US than in Europe/Japan; model more dispersion and timing risk rather than a uniform glide to 2% inflation.

There was also discussion around a non-trivial risk to the Fed’s independence that could cheapen the dollar’s ‘anti-inflation’ credibility and result in long-end yields staying higher than they otherwise would.

Amy’s reminder was blunt: correlation regimes shift. The negative stock-bond correlation that lulled allocators for 20+ years is not a law of nature. In a world of unstable inflation expectations, bonds can sell off alongside equities—as 2022 showed. The “defensive” value of fixed income must be earned via macro diagnostics (inflation, growth, jobs), curve positioning and quality credit selection, and not simply assumed. For Fixed Income allocations, Amy suggested tilting fixed income to quality spread and active curve/rate strategies, not relying on duration alone for ballast.

Esther reframed infrastructure not as a static, GDP-linked asset but as a contractual cash-flow factory wired to inflation pass-through and secular demand—especially power-constrained AI data infrastructure. Hyperscalers are offering long-dated, CPI-linked “base-plus” returns for dependable power-dense capacity and uptime. The scarce inputs aren’t racks or land; they’re electrons (and to a degree, water) and the grid connections to deliver them. In doing so, investors can build a “cashflow factory” that both cushions against macro shocks and compounds returns through the growth of essential services—from power and water to logistics and digital networks. This perspective echoed Scott’s suggestion for greater unlisted defensive exposures (infrastructure, private credit) to replace some of the lost diversification of the traditional 60/40 portfolio.

The question to Aaron was a simple, yet poignant one—where are we in the AI Hype cycle? His answer echoed Scott’s in that he believes we’re past the initial euphoria stage but still very early in the economic adoption curve. Capex is real and likely to remain heavy and as model capability improves, so too will a broader productivity dividend that remains in front of us, not behind.

KKR is following developments in the foundational large language models (LLM) space, where they believe that winner-take-most dynamics aren’t settled. KKR sees strong potential in GenAI when harnessed appropriately, for example in the tools space—that is, coding copilots and research agents, which in some cases are driving 2–3x developer productivity and materially compressing research cycles. Amy corroborated this perspective telling the audience that her team is actively implementing AI tools into their day-to-day work, and are seeing faster, cleaner macro inference, and better policy reaction mapping.

In terms of portfolio implications, the panel suggested implementing a positive AI view through several channels: cash-rich enablers of compute and power, vertical software stacks where data/control points are defensible, and infrastructure that solves the energy bottleneck. In contrast, there was a call to stay selective on “application” hype and watch unit-economics and data moats.

Ron’s suggested dovetailed with Scott’s: tilt incremental dollars to non-US exposures. Ron differs slightly from LGT’s neutral Emerging Market stance in that he favours EM ex-China beneficiaries of supply-chain rewiring, orthodox policy and better near-term earnings growth. Similarly to LGT, he believes the structural drivers for Japan are compelling, where governance reform is unlocking returns on capital and household cash (still >50% of assets) will be re-directed toward equities in an attempt to protect purchasing power. He was cautionary towards the US equity market on valuation and concentration. That doesn’t argue for zero US exposure—especially given AI leadership—but Ron did suggest looking for mid-cap and non-market cap exposures that are more reasonably priced. Europe remains an intriguing investment destination on fiscal and capex impulses (defence, infrastructure), albeit a journey that remains in its infancy.

An audience question allowed the panel to probe the USD’s reserve status and hedging. The group’s answer was measured. There is no obvious alternative now—the Euro is the most credible over time, but that path is long. In the interim, hedging matters more than theory—especially for Australians overweight the US. Gold has a role as tail-risk insurance when trust in fiat currencies erode. However, it doesn’t compound nor spin off cash, but payoff when policy credibility is challenged (i.e. Fed independence). Bitcoin drew scepticism from the panel as a reserve currency—Esther presented a differentiated perspective, characterising it effectively as a power-price derivative in a market with high merchant risk—not the bedrock you want for reserve status.

IMPORTANT NOTE This document has been prepared by LGT Wealth Management Limited (ABN 50 005 311 937, AFS Licence No. 231127) (LGT Wealth Management). The information contained in this document is of a general nature and is provided for information purposes only. It is not intended to constitute advice, nor to influence a person in making a decision in relation to any financial product. To the extent that advice is provided in this document, it is general advice only and has been prepared without taking into account your objectives, financial situation or needs (your Personal Circumstances). Before acting on any such general advice, we recommend that you obtain professional advice and consider the appropriateness of the advice having regard to your Personal Circumstances. If the advice relates to the acquisition, or possible acquisition of a financial product, you should obtain and consider a Product Disclosure Statement (PDS) or other disclosure document relating to the financial product before making any decision about whether to acquire it. Although the information and opinions contained in this document are based on sources we believe to be reliable, to the extent permitted by law, LGT Wealth Management and its associated entities do not warrant, represent or guarantee, expressly or impliedly, that the information contained in this document is accurate, complete, reliable or current. The information is subject to change without notice and we are under no obligation to update it. Past performance is not a reliable indicator of future performance. If you intend to rely on the information, you should independently verify and assess the accuracy and completeness and obtain professional advice regarding its suitability for your Personal Circumstances. LGT Wealth Management, its associated entities, and any of its or their officers, employees and agents (LGT Group) may receive commissions and distribution fees relating to any financial products referred to in this document. The LGT Group may also hold, or have held, interests in any such financial products and may at any time make purchases or sales in them as principal or agent. The LGT Group may have, or may have had in the past, a relationship with the issuers of financial products referred to in this document. To the extent possible, the LGT Group accepts no liability for any loss or damage relating to any use or reliance on the information in this document. Credit ratings contained in this report may be issued by credit rating agencies that are only authorised to provide credit ratings to persons classified as ‘wholesale clients’ under the Corporations Act 2001 (Cth) (Corporations Act). Accordingly, credit ratings in this report are not intended to be used or relied upon by persons who are classified as ‘retail clients’ under the Corporations Act. A credit rating expresses the opinion of the relevant credit rating agency on the relative ability of an entity to meet its financial commitments, in particular its debt obligations, and the likelihood of loss in the event of a default by that entity. There are various limitations associated with the use of credit ratings, for example, they do not directly address any risk other than credit risk, are based on information which may be unaudited, incomplete or misleading and are inherently forward-looking and include assumptions and predictions about future events. Credit ratings should not be considered statements of fact nor recommendations to buy, hold, or sell any financial product or make any other investment decisions. This document has been authorised for distribution in Australia only. It is intended for the use of LGT Wealth Management clients and may not be distributed or reproduced without consent. © LGT Wealth Management Limited 2025. |

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.