On 2 April 2025, US President Donald Trump announced a minimum 10% across-the-board tariff on goods imports into the US and a slew of targeted reciprocal tariffs against a range of major trading partners. More commonly known as 'Liberation Day', this event and the subsequent period saw significant market volatility in investment markets. In addition to this there has been a surge in geo-political disruptions. There are now more diverse actors on the world stage, confirming our long-held view that we are now in a multi-polar world. As a result of this, we believe the astute investor requires a sound and disciplined framework for managing the impact of market volatility on their portfolio.

This paper outlines our strategic framework for navigating periods of significant volatility, illiquidity and uncertainty around events such as 'Liberation Day' and the initial COVID-19 period in March/April 2020. Our discussion focusses on investment decisions, liquidity management, and practical implementation. We expect higher inflation and higher nominal growth moving forward and for investment markets to deliver constructive returns but it won't be without volatility and dispersion across markets. These market conditions are challenging traditional correlation assumptions, necessitating a more nuanced understanding of asset behaviour.

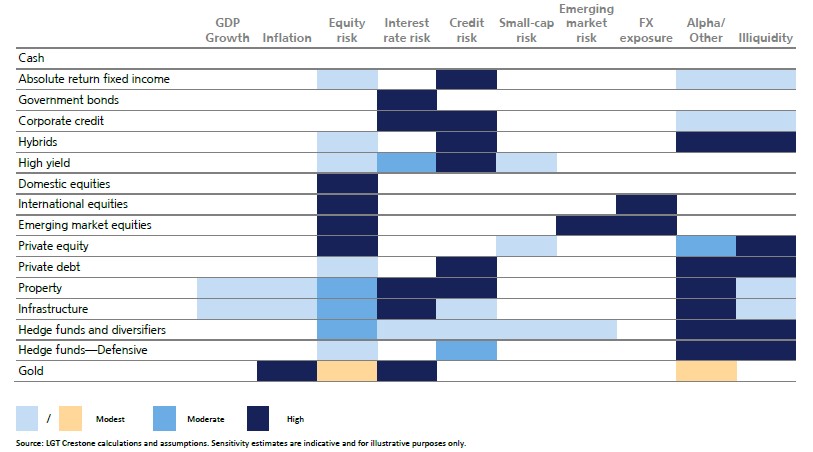

We continue to focus on ensuring there is diversification across the total portfolio and within asset classes. Our proprietary LGT Crestone multi asset risk factor framework, provides a robust methodology for evaluating asset classes beyond historical measures, enabling more informed asset allocation decisions. Where possible, investment portfolios should be considered on a 'whole of a portfolio' basis, including assets (if any) outside of LGT Crestone.

A key pillar of LGT Crestone's investment philosophy is Tactical Asset Allocation (TAA), which is the active management of a portfolio where we take underweight and overweight positions at an asset class level to take advantage of changing macro-economic and market conditions. We maintain a flexible and nimble approach to our TAA as its short-to-medium decisions (made within a 3-9 month timeframe) can potentially add returns (alpha) that exceed market returns (beta) and reduce risks in portfolios. This tool is particularly useful during periods of 'market dislocation'-this refers to periods where asset prices significantly deviate from their fair or intrinsic value due to abnormal market conditions. We provide further insight into the TAA decisions below.

FX exposure provides investors with diversification benefits.

Investors should adopt a purposeful approach when managing FX exposure. Sophisticated investors are increasingly treating currency as a stand-alone asset class when building portfolios. This means that they are determining a deliberate strategic allocation for FX exposure that is independent of the underlying assets in the portfolio.

The benefits of adopting a total portfolio approach is that it allows investors to target a level of currency exposure that is specifically aligned to their investment objectives; it provides greater flexibility to pursue the best investment opportunities around the globe without being constrained by the availability of hedged vehicles; and it improves portfolio efficiency by simultaneously opening the investment opportunity set and explicitly targeting the diversification benefits of FX exposure.

After determining the desired FX exposure, investors can choose from several implementation methods, including balancing the mix of hedged or unhedged vehicles or unit trusts across equity and alternative asset classes; hedging back FX exposure to Australian dollars by using FX forwards or other derivatives; or balancing the repayment profiles of any loans or liabilities denominated in foreign currency.

The impact on portfolio returns, as a result of these TAA changes, saw a 0.10% to 0.20% uplift in performance across most diversified multi-asset portfolios. While it doesn't sound like much, this equates to a roughly 2% annualised rate of additional return over a 6-week period, showcasing the substantial benefits that active and disciplined tactical management can add to portfolios during periods of market volatility.

In our 2025 outlook "Navigating disruption, discovering opportunity", we discussed the likelihood we would see more market volatility and more challenged market returns. The recent volatility was a good reminder of the importance of having cash or liquidity to be nimbler and more tactical when responding to market conditions.

Liquidity is typically cash or cash equivalents, along with assets or securities which are typically easy to convert into cash in a timely manner. Some examples of liquid assets include equities, bond and other exchange traded securities. It's important to have diversified liquid assets in a portfolio as some liquid assets may respond differently in times of market stress. This was evident during Global Financial Crisis and the initial COVID-19 period in March 2020. Over these periods, traditionally defensive and liquid assets such as government bonds were not as readily able to be converted into cash. Having multiple sources of liquidity can be beneficial during periods of market volatility.

These sources can also include managed funds which can be converted into cash typically within around 5-10 business days. However, this may take longer during periods of market volatility and dislocation. The inclusion of a small exposure to exchange-traded funds (ETFs) also enables swift implementation of tactical changes and provides a level of liquidity in the form of income through dividends

Ideally, investment portfolios are diversified with most multi-asset portfolios having an exposure to a combination of listed equities, bonds and cash (direct and/or managed funds) between 30% to 50%. This generally means that cash can be raised relatively easily within 5-7 business days. Even if your portfolio is concentrated in a single asset class, having some liquidity is always prudent, even useful in periods of volatility.

Firstly, the most significant hurdle is to overcome any behavioural biases. A disciplined strategy of portfolio rebalancing helps to reduce the burden of decision making, particularly in periods of volatility. And it's in these periods when portfolio exposures move away from Strategic/Tactical Asset Allocations, and in some instances is an outworking of having a diversified portfolio that has investments in asset classes which are less or even negatively correlated to equities, such as hedge funds and other alternative asset classes including private markets and real assets. That is, liquid asset classes including equities and bonds are daily priced and exhibit significant changes in price during periods of volatility, whilst many alternative asset classes are less frequently priced or valued leading to what's often referred to as the denominator effect, where the value of liquid assets typically fall more than illiquid assets, with illiquid or less frequently priced or valued asset classes become a larger allocation.

Where there is a disciplined rebalancing policy at worst this could mean using or generating liquidity to buy equities after a significant fall e.g. Liberation Day to ensure that the overall portfolio remains at its SAA and participates fully in any rally; conversely a rebalancing policy also maintains the discipline of trimming winners and rebalancing into assets or asset classes that are underweight as equity markets rise. If nothing else even without periods of volatility to encourage rebalancing, investors often forget to look at their cash balances which tend to creep steadily higher, as income and dividends along with other returns of capital - without rebalancing, this ever-increasing cash balance becomes a performance drag on portfolios.

The other psychological barrier for investors is to (1) sell assets and (2) pay tax on any capital gains when raising liquidity; again, a rebalancing policy helps in this regard. Australian investors are somewhat fortunate where any assets that are sold that have been held for more than one year receive a tax concession, whereby taxation at that point is at half of the marginal tax rate. This makes the decision much easier. A TAA framework can also help here, both to help raise the level of liquidity and position the overall portfolio to add alpha and/or dampen risk.

With respect to less liquid asset classes such as alternatives, these asset classes often contain a mix of illiquid and semi liquid investments, some producing income which provide a source of liquidity, and others which can be managed to provide liquidity on a semi-regular basis particularly "evergreen" type funds. These have timeframes where new monies can be invested either monthly or quarterly, and investments can be redeemed typically quarterly (and in some cases also needing a notice period). For these asset classes, liquidity management is nuanced and requires a little more detailed planning particularly for redemptions due to hard cut off dates and so on. Outside of close end funds where distributions and returns of capital can be irregular, for semi liquid fund (in "normal" periods) cutoff, redemption and payment dates are all known well in advance, even the less liquid parts of your investment portfolio can be sources of liquidity.

Beyond rebalancing, selling asset and holding cash, investors can tap into structured liquidity solutions. These types of products can be useful when volatility is high, and the price of liquid assets is falling. Structured solutions also allow delayed repayment when prices have recovered, generally without even a 1-2 day wait.

LGT Crestone offers some alternative structured solutions to access liquidity:

Often referred to as margin lending, a Lombard facility allows you to borrow against liquid assets in your investment portfolio, such as direct securities and/or managed funds. The facility can be helpful if you are looking to improve diversification within your investment portfolio. But it can also be beneficial if you want to enhance your portfolio's investment returns, or if you need access to liquidity so you can take advantage of investment opportunities during periods of market volatility. Our Lombard facility allows you to borrow in several major currencies, and as you only pay an interest rate on any actual borrowings you undertake, it can be a cost-effective tool for overall liquidity planning.

Lombard facility example

In the recent market volatility, a client owns a predominantly direct Australian Equity portfolio which has been held for a significant amount of time with a large capital gain, and wishes to diversify this exposure without selling shares and triggering capital gains. In this situation, the client wishes to use their Lombard facility to take advantage of potential market dislocation where there may lower prices in global equity markets.

In this scenario and assuming that the large majority of the Australian shares held are ASX50 names, the loan to value (LTV) available on these assets will typically allow clients to lend to the value of their current portfolio with a level of low to moderate level of gearing to invest into global equity funds as desired.

Our Mortgages facilities provide another source of potential liquidity and can be used for any of the same purposes described in the Lombard section above. In the case of a mortgage, borrowing is instead secured by a client's premier residential property. Just as with Lombard, borrowing under a Mortgages facility can be in several major currencies, but without any of the concern for potential margin calls that can occur with a margin loan. Especially in volatile times the relative stability of residential property prices can make a Mortgage facility an especially powerful liquidity source.

LGT Crestone's Multi-asset Portfolio Solution (MAPS) provides a way to ensure that the topics put forward in this paper are being implemented in your portfolio. MAPs can be used in conjunction with a Lombard or a Mortgage facility, either on a multi-asset or single asset class basis, independently or alongside an advisory portfolio. MAPS is a discretionary investment offering developed under the governance of the LGT Crestone Investment Committee. MAPS includes both single-asset and multi-asset portfolios aligned with the firm's Chief Investment Office (CIO) House View. MAPS portfolios are managed and rebalanced in-house by our CIO team under the governance of our Investment Committee.

The rigour and discipline of LGT Crestone's Chief Investment Office largely takes out the emotion of investing in volatile periods, often rebalancing and making thoughtful decisions from both a risk and alpha perspective through Tactical Asset Allocation.

Investing through volatility requires a thoughtful blend of discipline, strategic foresight and tactical agility. By focusing on liquidity, flexibility, and practical implementation, investors can position themselves to navigate uncertainty and capture emerging opportunities. Advisors play a crucial role in guiding clients through this process, ensuring alignment with long-term objectives while remaining responsive to short-term dynamics.

Receive ongoing access to LGT Wealth Management’s insights and observations - a curated stream of thought leadership, market perspectives, and strategic updates designed to inform sophisticated investors.