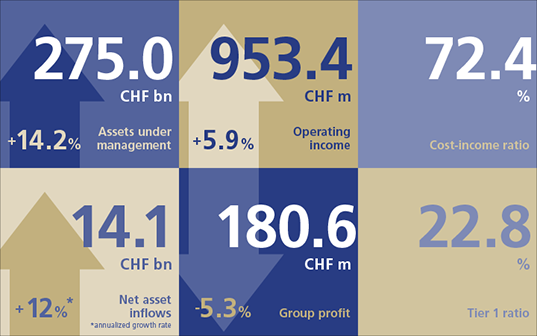

LGT, the international Private Banking and Asset Management Group owned by the Princely House of Liechtenstein, achieved significant growth in the first half of 2021 and delivered group profit of CHF 180.6 million. Assets under management grew 14% to CHF 275.0 billion as at the end of June 2021 on the back of favorable market developments and high levels of client activity. Very high net asset inflows of CHF 14.1 billion (+12% on an annualized basis) and strong investment performance contributed to this result. LGT is confident that it will remain on its sustainable growth path in the second half of 2021.

LGT continued to expand its client business in the first half of 2021, while providing clients with enhanced access to its investment expertise in various asset classes. Favorable market conditions and strong interest in LGT’s sustainable investment solutions contributed to broad-based revenue growth for the group. At the same time, LGT made further investments to strengthen its advisory services and investment processes, and to expand its digital platforms.

Driven by high transaction volumes, an increase in income from the brokerage business and the higher asset base compared with the prior-year period, income from services rose 21% to CHF 692 million. Income from trading activities and other operating income was CHF 159.5 million (down 14%) as foreign currency hedging offset higher revenues from trading activities, especially derivatives trading for clients in Asia. Net interest income was CHF 101.9 million, down 28% compared with the prior-year period, reflecting the persistently low interest rate environment. Overall, total operating income increased 6% to CHF 953.4 million.

LGT continued to make significant investments in the expansion of its business in the first half of 2021. A 17% increase in personnel expenses to CHF 562.6 million reflects organic staff growth as well as higher accruals for long-term performance-based compensation. At CHF 127.7 million, business and office expenses fell 5% compared with the first half of 2020, as travel and marketing costs decreased due to the pandemic, while IT and advisory expenses increased. Overall, total operating expenses rose 12% to CHF 690.2 million.

The cost-income ratio stood at 72.4% as at the end of June 2021, compared with 75.0% as at 31 December 2020 and 68.6% as at 30 June 2020. LGT achieved a group profit of CHF 180.6 million for the first half of 2021, 5% below the excellent result for the prior-year period.

LGT is very well capitalized with the tier 1 capital ratio at 22.8% as at 30 June 2021 compared with 21.9% as at the end of 2020, and has a high level of liquidity.

Broad-based net new asset growth of 12% (annualized)

LGT recorded very strong net asset inflows of CHF 14.1 billion in the first half of 2021, corresponding to an annualized growth rate of 12%. Both Private Banking and Asset Management contributed to this result with strong net asset inflows in all regions. The acceleration in growth seen in the second half of 2020 thus continued in the first half of 2021.

Net asset inflows, positive market and investment performance as well as foreign currency effects resulted in a 14% increase in assets under management to CHF 275.0 billion as at 30 June 2021 compared with the end of 2020. LGT Private Banking in this context exceeded the CHF 200 billion mark for assets under management for the first time, and the group’s asset management unit LGT Capital Partners grew its asset base to over CHF 70 billion as at the end of June 2021.

Strategy and outlook

LGT is confident that it will remain on its sustainable growth path in the second half of 2021 and expects the positive trends to continue in both established and in growth markets. In German-speaking Europe, LGT completed the acquisition of UBS’s wealth management business in Austria at the end of July 2021 and strengthened its position in Germany with the acquisition of a strategic minority stake in the digital asset manager LIQID. Among other benefits, LGT expects this cooperation to provide impetus for the further digitalization of its own services. London-based LGT Vestra, in which LGT acquired a majority stake in 2016 and full ownership in 2020, has developed into an important and highly successful pillar of the group. In the Middle East and Asia, LGT is one of the leading private banks and has over the last five years doubled its headcount to around 1000 and tripled assets under management to over CHF 76 billion. Alongside its geographic expansion, LGT has also continuously invested in its investment expertise in all asset classes, in digital solutions and processes, and in enhancing its services for ultra-high-net-worth clients.

In terms of the split of LGT’s three business units, the impact investing unit Lightrock has already been fully spun off from the group, while LGT Private Banking and LGT Capital Partners are now operating under separate management structures, and their new legal setup will come into effect in 2022. These steps will further sharpen the focus of the individual businesses and are expected to result in additional growth momentum.

H.S.H. Prince Max von und zu Liechtenstein, Chairman LGT, said: "Building on the strong growth of the recent past, we have once again delivered very good first-half results in the year of our 100th anniversary. Since its foundation, LGT has developed into an internationally broad-based and respected institution and continues to grow in all regions. Our recent exceptionally strong net new asset growth underscores the appeal of the LGT brand, which reflects outstanding investment expertise. More importantly, it highlights the trust that our clients place in us and for which we are very grateful. We will continue to invest in the quality of our advice, our solutions and services, as well as in our employees, to whom we owe our success."

Media release: LGT half-year results 2021

Communiqué de presse: LGT résultats semestriels 2021

Comunicato stampa: LGT dati semestrali 2021

Media release: LGT half-year results 2021 (simplified Chinese)

Media release: LGT half-year results 2021 (traditional Chinese)