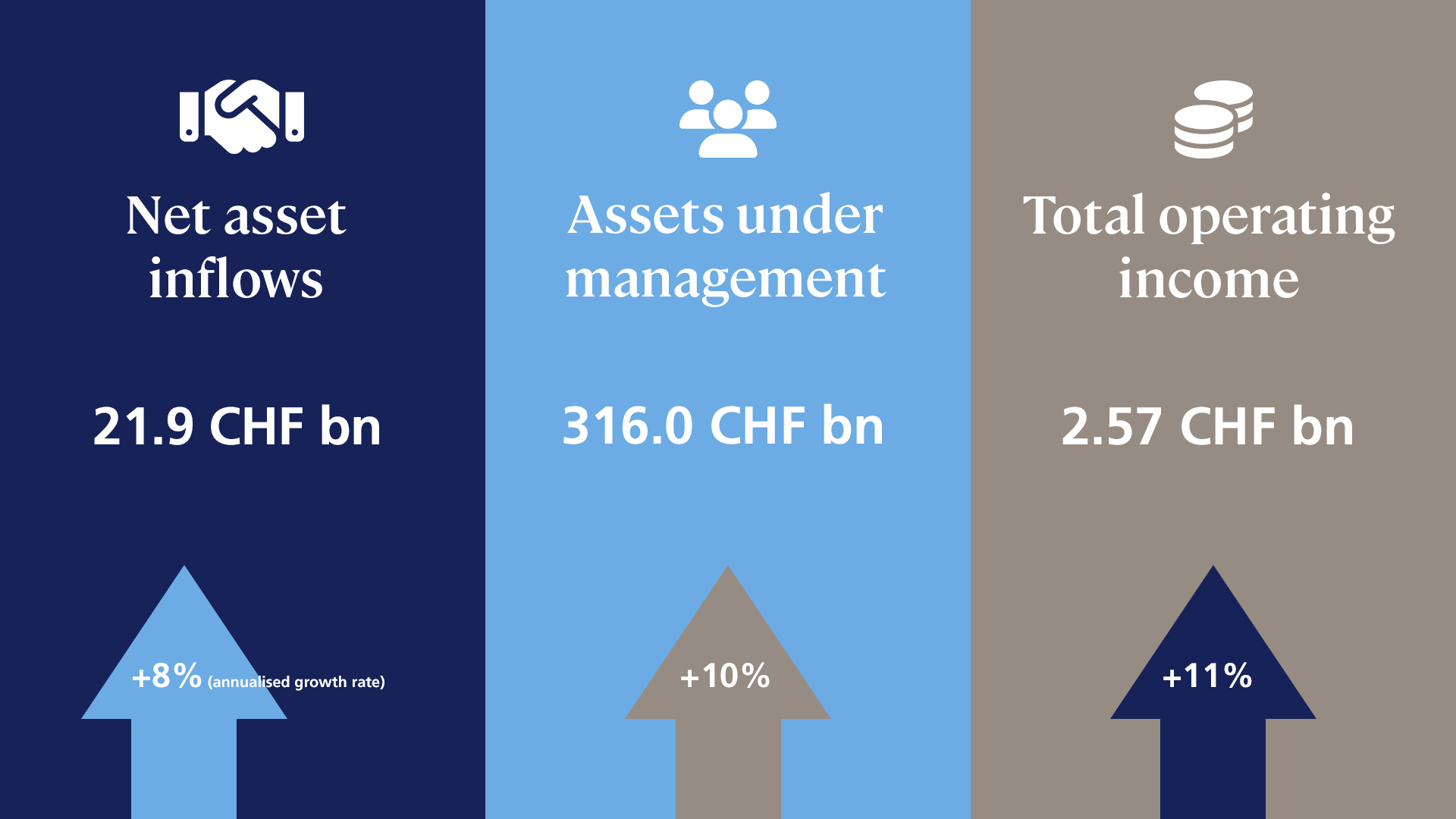

LGT, the international Private Banking and Asset Management group owned by the Princely Family of Liechtenstein, achieved further strong growth in 2023. Total operating income increased 11% compared with the previous year and amounted to CHF 2.57 billion. Group profit, which reflects a growth-related rise in oper-ating expenses, totalled CHF 375.3 million. Net asset inflows were again very strong at CHF 21.9 billion, correspond-ing to an organic growth rate of 8%. Assets under management rose 10% to CHF 316.0 billion, reaching the highest year-end level in LGT’s history. LGT is very well positioned to provide clients with in-depth wealth management ex-pertise in the international market, and is confident that it will continue to grow profitably in 2024.

In the 2023 financial year, financial markets were characterised by persistent geopolitical uncertainties, as well as inflationary and other economic trends that were difficult to forecast. Despite this challenging investment environment, income for the Group developed favourably across the board. LGT’s profitable growth path is a reflection of its systematic and continuous inter-national expansion of recent years, and its efforts to continuously expand its investment expertise and services, particularly in the areas of private markets and sustainable investing. Since September 2023, the results of the UK wealth management business acquired from abrdn have been reflected in LGT’s results.

The Group’s total operating income increased 11% in 2023 to CHF 2.57 billion. At CHF 1.56 billion, income from services was slightly lower than in the previous year (-2%) due to lower income from the brokerage business and a decrease in performance fees. Net interest income rose 33% to CHF 517.2 million, reflecting the positive interest rate environment and active balance sheet management. Income from trading activities and other operating income increased 50% to CHF 493.5 million, mainly driven by higher valuations of the bond portfolio and foreign exchange transactions.

Personnel expenses increased 12% to CHF 1.48 billion on the back of organic staff growth and recent acquisitions, as well as higher accruals for long-term performance-related compensation. Business and office expenses rose 17% to CHF 427.8 million, among other things due to increased digitalisation costs and higher project and consulting costs. Depreciation, amortisation and provisions rose to CHF 201.8 million, reflecting the value adjustment on a participation and higher provisions for operational risks.

The cost-income ratio was 74.2% as at the end of 2023, up 1.3 percentage points year-on-year. Group profit for the 2023 financial year amounted to CHF 375.3 million, which corresponds to a decrease of 11% compared with the previous year. LGT is very well capitalised with a tier 1 capital ratio of 19.9% as at the end of 2023 and has a high level of liquidity.

In 2023, LGT reported excellent organic net new money of CHF 21.9 billion, which corresponds to a strong growth rate of 8% (2022: 6%). All regions and both Private Banking and Asset Management contributed to the net new asset growth. As indicated in the results announcement for the first half of 2023, net new assets for the reporting year include an inflow of around CHF 7 billion from a large pension fund client of LGT Capital Partners.

Assets under management were up 10% and totalled CHF 316.0 billion as at 31 December 2023, compared with CHF 287.2 billion as at end-2022. In addition to the organic net new money growth, LGT’s acquisition of abrdn’s UK wealth management business contributed CHF 6.4 billion to this result. Positive market performance during the reporting period was offset by slightly higher negative foreign currency effects.

LGT is very well positioned to provide clients with in-depth wealth management expertise in the international market, and is confident that it will continue to grow profitably in 2024. By broadening its international presence in recent years, LGT has opened new avenues for growth. Private Banking’s recent expansion in the Asia-Pacific region, namely to Australia, India, Thai-land and Japan, is already delivering favourable results. Its entry into the German private banking market in the autumn of 2022 is also developing very positively: after opening a first office in Hamburg, LGT Private Banking is now also present in Cologne, Düsseldorf and Frankfurt, and plans to expand to further locations in 2024.

LGT Capital Partners also capitalised on its excellent market position last year to achieve further growth. The company now serves over 700 institutional clients at 15 locations worldwide, and during 2023 for the first time reached USD 100 billion in assets under management. In addition, LGT Capital Partners recently launched its new brand identity, highlighting the successful completion of the separation of the two LGT entities into standalone companies.

LGT is placing a strong focus on further developing its client platform. With the opening of the LGT Incubator and Accelerator Centre in Barcelona in the spring of 2023, it now has an innovation hub that will drive the development of modern digital ser-vices and products. The Centre’s primary focus is on applications that increase the efficiency and quality of digital banking ser-vices. LGT is also making significant investments to build its resources in the area of artificial intelligence.

Sustainability has been a priority for LGT for over 15 years, and it has set itself the goal of reducing greenhouse gas emissions from its operations and own investments to net zero by 2030. LGT also continues to pursue its goal of expanding its sustainable investments offering, which includes developing decarbonisation solutions for clients’ investment portfolios. LGT’s investment expertise was once again recognised last year with a number of awards, including the best Sustainability Offering award at the WealthBriefing Wealth for Good Awards 2023. In addition, LGT was named Best Private Bank for Alternatives for the fifth time at the prestigious Global Private Banking Awards organised by the Financial Times publications Professional Wealth Management and The Banker.

HSH Prince Max von und zu Liechtenstein, Chairman LGT, stated: “Our results for 2023 are further evidence of the high level of trust that our clients place in us, and of LGT’s strong competitive position. Thanks to our skilled employees, supported by digital solutions, our international presence and stable business model, we will continue to provide our clients with outstanding exper-tise, and sustainable wealth and investment solutions. We are confident that this will position us well for further growth.”

LGT Wealth Management UK LLP ("LGT Wealth Management") is a UK-based wealth management partnership which provides a comprehensive range of investment management, wealth planning and private investment office services. LGT Wealth Management employs over 650 staff and has offices in London, Jersey, Bristol, Edinburgh, Leeds, Birmingham and Manchester. www.lgtwm.com

LGT Wealth Management is part of LGT Group, a leading international private banking and asset management group that has been fully controlled by the Liechtenstein Princely Family for over 90 years. As at 31 December 2023, LGT managed assets of CHF 316.0 billion (USD 375.6 billion) for wealthy private individuals and institutional clients. LGT employs over 5600 people who work out of more than 30 locations in Europe, Asia, the Americas, Australia and the Middle East. www.lgt.com