The conventional wisdom behind raising interest rates is as follows: higher interest rates make the cost of borrowing more expensive, which tends to cool the housing market. Simultaneously, higher returns available on cash balances encourages consumers to save rather than spend, which should in theory reduce inflationary pressures. We witnessed this dynamic during the most recent central bank hiking cycle.

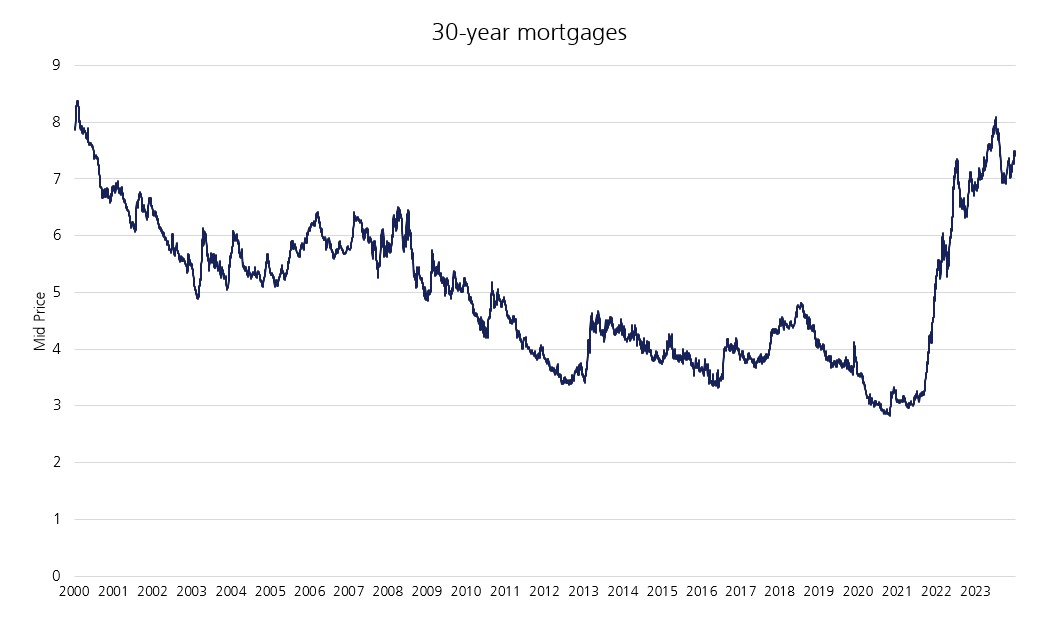

During the pandemic lockdowns, millions of people began working from home, which led many to reassess their living conditions. The working from home dynamic combined with 30-year mortgages in the US hovering near all-time lows of 3% encouraged many to move, in some cases from their small city apartments and into larger homes further out in the country.

But as inflation challenged economies, the Federal Reserve (Fed) began hiking interest rates, pushing mortgage rates from 3% at the start of 2022 to over 7% towards the end of last year, where they remain today. At current levels, mortgage rates are the highest in over two decades.1 This has made many homes unaffordable, ultimately weighing on housing activity. Buyers remain reluctant to purchase new homes at these high rates, which has effectively frozen the housing market and made renting more attractive. Consumers weighing the trade-off between renting versus buying a house is typical of a hiking cycle.

Households may want to purchase a property and move out of rental accommodation but are unable to as mortgage costs are too high. Combined with a strong labour market, this gives the landlords significant power, as they can raise existing rents without fear of tenants leaving.

Recent data shows new home sales in the US bounced back in March due to an abundance of inventory which helped drive prices lower.2 This data indicates sales have stabilised in recent months after weaker starts earlier this year, although the data is volatile. Demand remains strong, but buyers remain constrained by high mortgage rates and prices, which limits any momentum in the housing market.

This dynamic is worth exploring given markets have recently pushed back their expectation for Fed rate cuts in 2024 as inflation data remains strong, partly due to the sticky shelter component. In fact, stripping out food, energy and shelter, which comprise over 57% of the inflation basket, we note that inflation for the rest of basket has been hovering around 2% for many months. While central banks remain hesitant to embark on the rate cutting cycle for fear that they may fuel inflation, perhaps cutting rates at moderate pace could help bring the housing market in better balance and help them move closer to the 2% target.

If mortgage rates move below 7%, this may encourage more households to step back into the housing market. Ideally, this will happen gradually, which would help avoid a massive boom in the housing market and allow for a measured pickup from homebuilders, who can resume normal business activity. This could remove some pressure from rent inflation, helping bring down core inflation.

While conventional wisdom states rates should be kept elevated when inflation is above the target levels, if rental prices are a large driver of keeping inflation high, then perhaps maintaining this stance is counterproductive. Thankfully the Fed focuses on PCE (Personal Consumption Expenditures), which is less affected by rent anomalies, rather than CPI (Consumer Price Index) data. This should allow the Fed to look carefully at all data points as markets evolve.

[1] Freddie Mac, Bloomberg

[2] US Census Bureau and US Department of Housing and Urban Development

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.