Over recent months, we have written about some of the difficult questions surrounding sustainable development, covering high polluting and contentious sectors such as power and commodities. However, climate economics is a much broader concept and is something that will influence all areas of the global economy. In this note we will break down what carbon markets are and the increasingly interlinked nature of climate and economic outcomes in what we label climate economics.

As an industry we talk a lot about 'environmental costs' but that can often seem quite abstract without putting some numbers behind such bold statements. And so, to provide the context which supports the growing need to understand climate economics we can consider empirical studies such as the one published by Aon that estimated weather and climate related events cost the global economy $313billion in 2022 alone. The staggering numbers are no doubt influenced by anthropogenic activities and the lack of climate accountability. We often wonder if we will look back in years to come on the lack of accountability placed on businesses and policy makers as a major market inefficiency. It has arguably led to generations of misallocated capital which seemed productive, until the very real economic costs relating to the environment and society are accounted for. Time will answer this for us but as the impacts of unsustainable activities are being felt across the world, we should not just focus on the increasing societal will to do the right thing, but also the cold hard economic forces and market mechanisms that will incentivise change.

This feels especially timely as world leaders are meeting at COP 28, hosted this year in UAE, to work together to mitigate climate change. This year is significant in a number of ways but most importantly, it will be the first-year leaders will conduct a global stock take to see how we are progressing towards meeting the Paris Agreement. Although the current outlook of progress is likely to be bleak, we remain optimistic that many of our current climate mitigation requirements can be met with existing technologies and as policy makers and regulators continue to foster a more sustainable policy framework and innovative companies continue to improve the economic viability of these technologies that significant progress and new avenues for economic growth can be unlocked.

Carbon markets are an area of sustainability that is becoming increasingly important and as more of the global market comes into scope, it is important we understand what they are, how they work and the economics of an expanding carbon market.

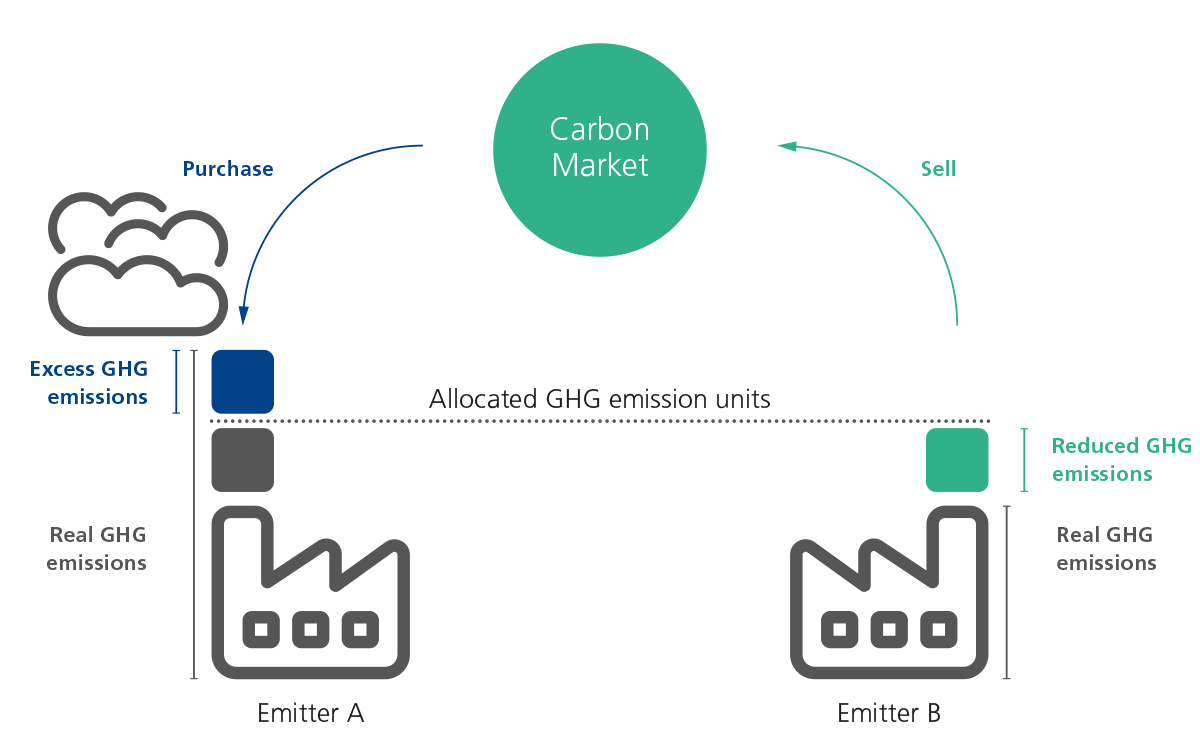

There are two types of carbon market, firstly the compliance market (or mandatory market) which is where governments set out the maximum amount of emissions to be released by their economy and allowances are divvied out and traded between companies.

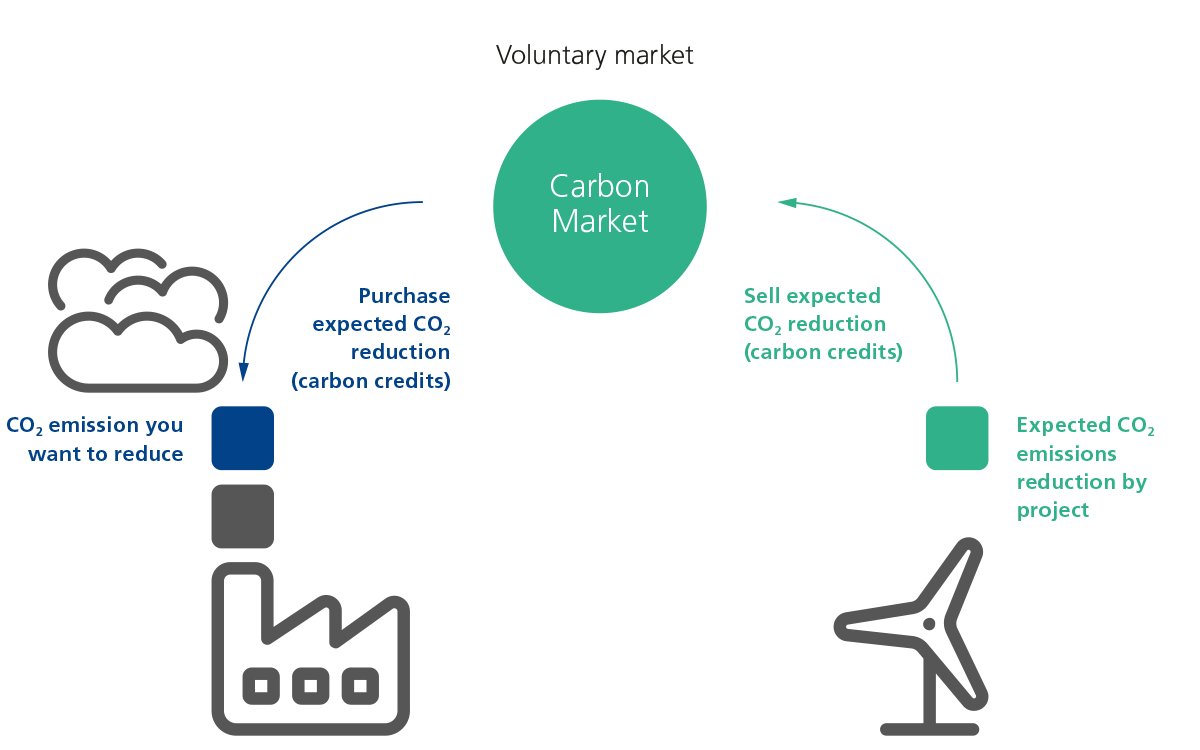

Secondly there is the better-known voluntary market where carbon offsets are created and bought typically by companies to help reach their sustainability targets of becoming carbon neutral or net zero.

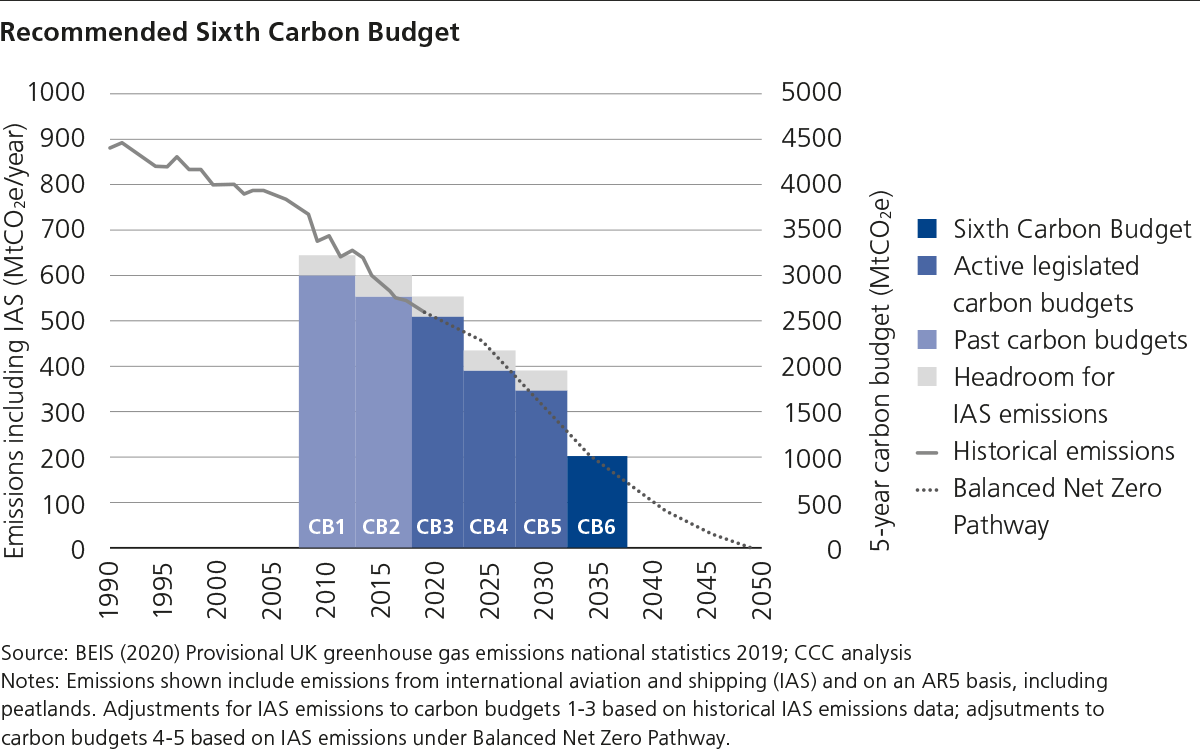

Compliance markets are created and regulated by government policy where they will dictate the maximum emissions limit and allocate credits across companies in high emitting sectors. These credits can then be held, bought or sold as companies look to ensure they are in a position to hand enough credits back to the government to cover their carbon footprint. If companies exceed their allowance, they will need to purchase additional credits, costing those with higher footprints more. Since 2008 the UK has set out legally binding 5-year carbon emission limits, and these have progressively ratcheted down, reducing the available credits and highlighting the journey all businesses must embark on.

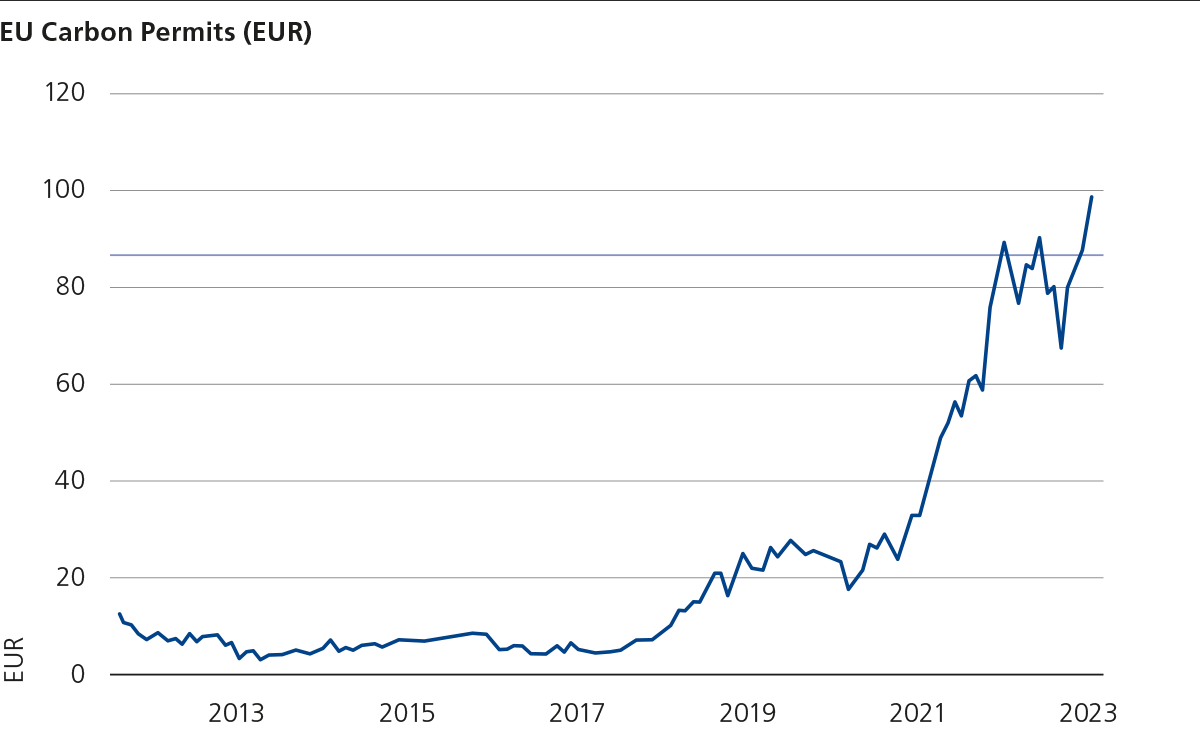

It is important for us to highlight that such mechanisms are in place today with the European Union generating over EUR300bn from environmental taxation in 2021 alone. Analysis has shown that some European Oil and gas companies are already paying upwards of 10% of operating profits in carbon emitting related costs, such as buying additional carbon credits and it seems that the cost of such polluting activities is set to increase notably over the coming decades as the overall budget falls. But the main message is that it is here now and being felt by companies and investors alike.

Outcomes are yet worse for those who fail to cover their carbon footprint with sufficient credits (either awarded or purchased). For example, under the EU's Emission Trading Scheme, companies must pay EUR100 for every tonne of emissions above their allowance which is notably above the current prevailing carbon credit cost.

As things stand, there are areas of many company’s operations which remain difficult to decarbonise and will take some time to solve for, which we will aptly name unavoidable emissions. This is where the better-known voluntary carbon markets come into play.

The voluntary market allows corporates, governments and individuals to achieve climate commitments through the creation and sales of carbon offsets which provide funding for projects which generate emission reductions or removals such as clean energy investments or reforestation (planting trees). Carbon offset certificates are created through a meticulous procedure involving project development, project validation/verification, project registration and carbon credit issuance. These credits can then be sold, traded and ultimately retired, once they have been used. The voluntary market offers incentives for owners of environmental assets such as land to protect it, or use it in an environmentally productive manner, rather than further deplete natural resources for economic profits.

Less than a quarter of global carbon emissions are currently being priced under the scope of compliance markets, yet over 90% of emissions are under some form of climate commitment, for example net zero, set out by governments and set in law. Or put otherwise, despite significant global commitments, the vast majority of heavy polluters are not being held to account still. However, things are changing and there has been a proliferation of regional compliance markets over the last few years with more in consultation.

As more of our global emissions are brought into scope and limits for how much carbon can be released into the atmosphere gets lower over time, as we saw earlier with the UK's carbon ceilings, this will put upwards pressure on the cost of pollution and exert greater influence on corporate profits. It follows the simple economics of supply and demand - less supply but similar demand (lack of decarbonisation) then prices of carbon credits will rise. The price of EU carbon permits is a prime example of this. (According to the World Bank State and Trend of Carbon Pricing 2022).

Putting a financial cost on carbon is an important mechanism to ensure that polluters pay for the impact they have on the environment and society. Our historical hesitancy to do this will possibly be looked back upon as one of the great market inefficiencies which has resulted in human activities fundamentally changing the earth's climate and thus economy.

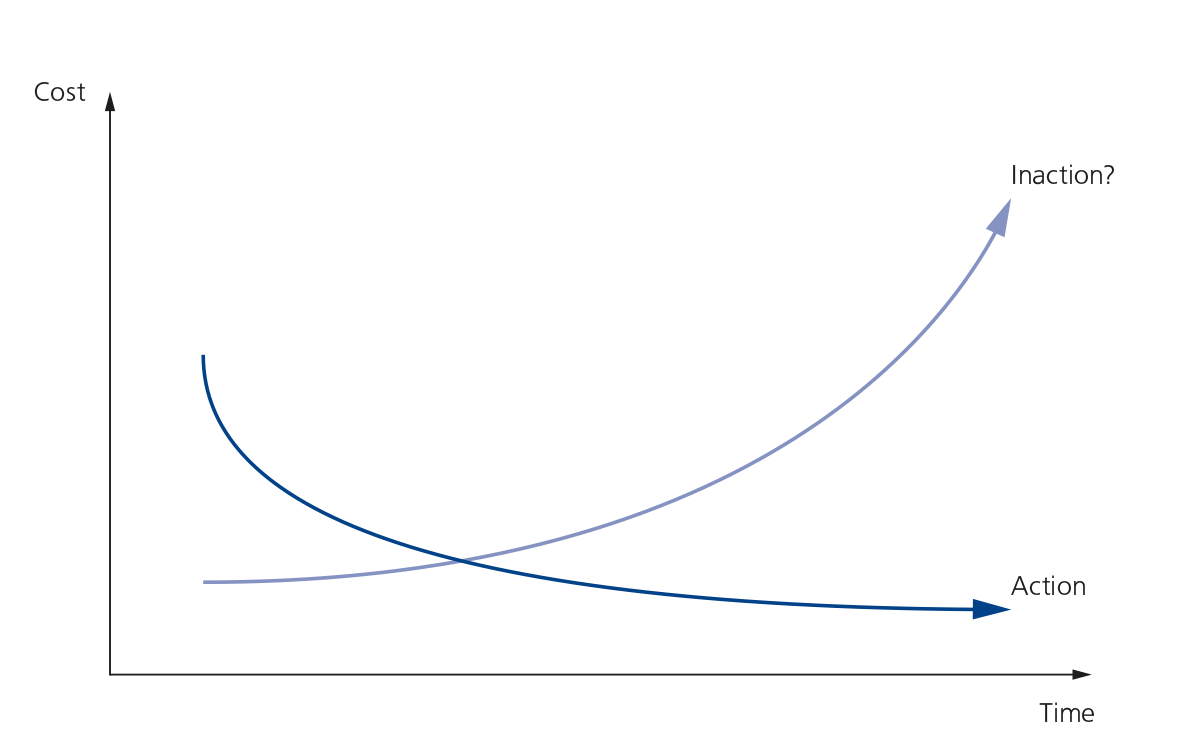

As an increasing number of governments around the world utilise carbon markets to progressively ratchet up their climate action and increase the cost of emitting (as they will reduce the supply of carbon credits towards 0 to meet net zero ambitions) companies will face an important decision, with both options imposing some form of costs. The decision ultimately lies between action and inaction and their associated costs will potentially deviate significantly over time.

On the one hand, the cost of action is of course capital investment in lower carbon assets such as conversion to renewable power or redesigning products, and this is something that companies and investors will feel early on as they will need to increase capital expenditure. But this is tolerable provided the investments are economically productive, i.e. do these decarbonised assets operate as good as, if not better than existing, carbon intensive assets? (With wind and solar being some of the cheapest forms of energy globally this can be beneficial over the long term for many). And so here we would suggest productive expenditure in decarbonisation can and will be tolerated by markets as a prudent way of progressing their business and enhancing their resilience.

On the other hand, is inaction. In this scenario, companies may fail to make the necessary capital investments, or lack the ability to do so as a result of poor financials. This heightens the risk that they will face a situation where they are unable to align with government set carbon budgets. Here the cost is clear and most importantly, unproductive. As earlier highlighted, companies are already bearing the brunt of heavy carbon footprints with the cost impacting the bottom line, a negative outcome for both the company and its investors. The reality of this scenario is that the cost is a penalty rather than an investment.

To us, the drivers of climate economics clearly favours taking action and making the necessary investments to ensure businesses can continue to deliver shareholders and other stakeholders with positive economic outcomes over the longer term.

As regulation and government policy continues to force the environmental costs associated with economic activity onto the balance sheets of businesses and individuals, climate impacts will become increasingly intertwined within broader economics, as we are already seeing with the example of European fossil fuel companies earlier. To some extent, some of the possible outcomes addressed here are just theory at this point, but as we look forward, the textbook for prudent and holistic economic and financial analysis that has existed through history must be updated. Climate economics will become a necessary part of how we measure and quantify risks as the global economy goes through one of the greatest transitions we are likely to ever observe.

We are strong believers that avoiding the difficult questions and divesting from all carbon intensive sectors is not always the answer. But it is crucial that we can identify those at risk of falling into the inaction camp and support those taking demonstrable action to mitigate clearly flagged risks to their businesses. An increased focus on decarbonisation is what we have focused on here but this is only one part of the puzzle companies must solve. It is probably clear to most readers that companies face many challenges, and some will fail as the economy evolves and we must endeavour to evolve how we assess the long term viability of the businesses we invest in on behalf of our clients. That is not to say investing in renewable energy companies is the answer to all our questions, instead it is about owning businesses which we believe are compatible with, and will thrive, in a low carbon, sustainable economy.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.