June marks the 3-year anniversary of the IFSL CAF ESG Fund range, a milestone for a project that was five years in the making. Born out of a strong partnership between LGT and CAF, the trio of funds has grown significantly, with approximately £215 million now invested in the funds. From the outset, the goal was clear: to create responsible investment funds that are accessible to everyone—not just in terms of logistics but also affordability.

The CAF ESG Fund range offers three distinct strategies tailored to varying risk tolerances:

Cautious

Income & Growth

Growth

This diversified approach ensures that investors with different financial goals and risk preferences can find a suitable option within the fund range.

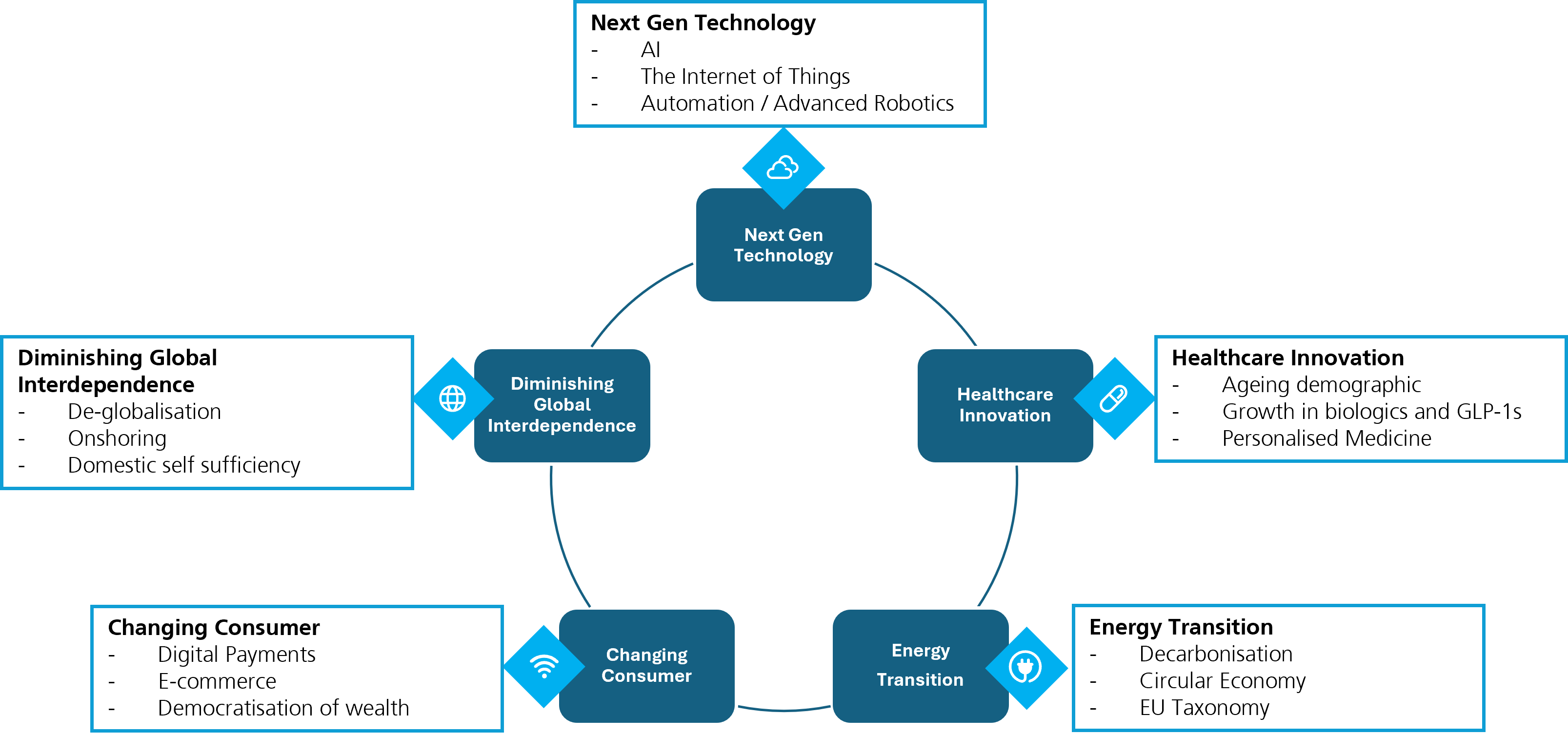

At the heart of the CAF ESG Funds is a commitment to quality sustainable growth. The investment philosophy centres on identifying opportunities rooted in long-term structural growth trends. These trends help investors understand how the world is evolving and how LGT positions investments for future returns.

The funds employ a bottom-up investment approach, focusing on individual company fundamentals. This is complemented by a thematic overlay, which examines broader trends shaping industries and economies. By combining these approaches, the funds aim to identify investments that are not only worthwhile today but are also positioned for long-term success.

One of the key principles driving the funds is the belief that companies capable of sustainably growing their revenues, profitability, and cash flows will ultimately see their value reflected in their share prices.

Currently, we believe five structural trends stand out, we will focus on next gen technology below:

In 2025, artificial intelligence (AI) has emerged as a transformative force, with its understanding and implementation growing exponentially. To illustrate the importance of structural trends, consider the evolution of smartphones. Back in 2007, Apple released its first iPhone, followed shortly by Android in 2008. At the time, the mobile market was crowded, with many companies vying for dominance. Fast forward 15 years, and Apple has emerged as the market leader.

As investors, what was clear was the staying power and transformative potential of smartphones. This is where examining the supply chain becomes critical. Companies like TSMC and ASML, which are integral to the production of advanced chips used in smartphones, AI, and other technologies, are held within the CAF portfolios. Their pivotal roles in the supply chain—working with giants like Apple and Nvidia—make them key drivers of innovation and growth.

Underpinning the CAF ESG Fund range is a robust Responsible Investment Policy, which is integral to its ethical framework. This policy allows the funds to screen investments against a wide range of controversies and sectors, ensuring alignment with the values of charity clients.

The policy was shaped through extensive discussions with existing charity clients during the fund’s construction. As considerations and client priorities shift, the policy is able to adapt to reflect these changes, ensuring that the funds remain aligned with stakeholder values as these evolve over time.

The first half of 2025 has been challenging for global markets. Escalating geopolitical tensions and the impact of Trump’s turbulent tariff policies have created uncertainty and volatility. Key sectors have faced headwinds:

Healthcare has underperformed, driven by pricing pressures from Trump’s rhetoric.

Technology has experienced a correction due to high valuations but is slowly recovering.

The CAF funds maintain a 5-12% allocation to alternatives, an asset class that offers diversification and returns distinct from traditional equities providing a different source and a higher level of income from traditional equities and fixed interest.

A cornerstone of the CAF ESG Fund range is its commitment to stewardship, led by LGT’s dedicated stewardship team. This team works closely with fund managers and research analysts to enhance the resilience of portfolio companies.

While the fund managers focus on selecting quality, well-valued companies, the stewardship team uses its platform to drive positive change through proxy voting and shareholder proposals. The goal is to make companies more transparent, improve governance, and ensure long-term sustainability.

LGT defines strong governance through three key pillars:

Climate Change

Fairer Societies

Nature & Biodiversity

By focusing on these areas, the stewardship team aims to create more resilient companies that can thrive in a rapidly changing world.

The CAF ESG Fund range exemplifies the concept of purpose-driven wealth management. By leveraging scale and expertise, the funds act as catalysts for positive change, driving outcomes that align with both financial and responsible investment goals.

As the funds celebrate their third anniversary, they continue to demonstrate that investing responsibly doesn’t mean sacrificing returns. Instead, it means aligning investments with values, embracing innovation, and building a more sustainable future.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.