While charity portfolios have traditionally been compared to a composite of market indices (FTSE All Share, FTSE World ex UK, etc) very few charities, if any, will have commitments that move in line with investment markets. As a result, comparing a charity’s portfolio performance against a target with reference to inflation, i.e. inflation plus income, is arguably a more appropriate benchmark, particularly for organisations that aim to exist for generations or in perpetuity. It unambiguously states what the charity needs from their portfolio to achieve their goals. Most charities with a long-term perspective are particularly sensitive to the negative effects of inflation: if portfolio values do not at least grow in line with inflation, the real value of reserves is eroded over time, reducing the positive impact the charity can affect. For investment managers, a performance benchmark which is inflation-plus-income represents a far more challenging performance hurdle than simple market benchmarks, since the target is typically positive even during periods of market weakness. However, it is arguably a more honest and relevant measure.

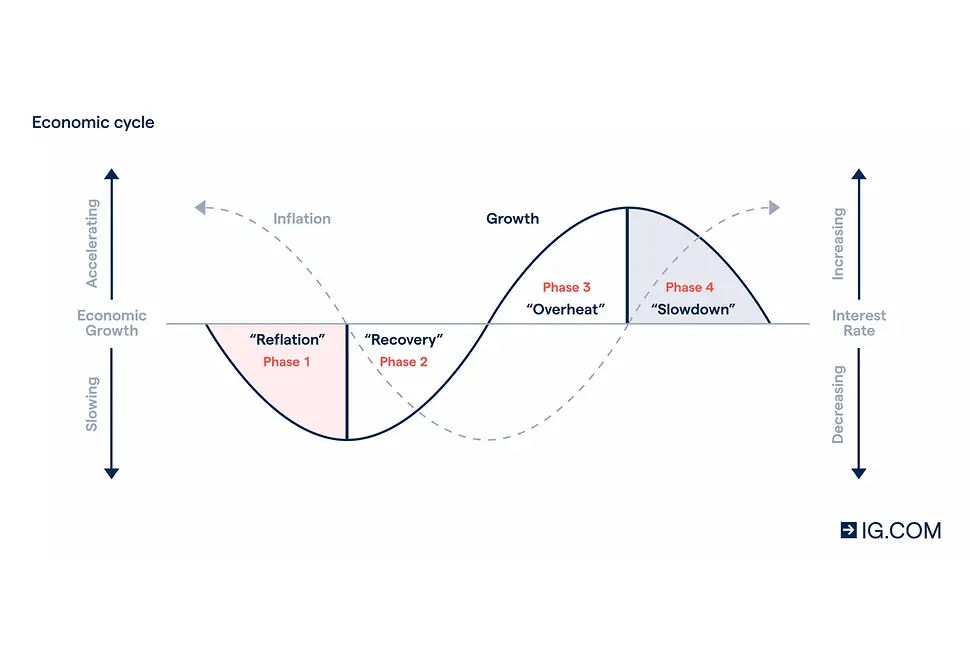

A business cycle covers periods of economic expansion and contraction. Growth phases bring about lower unemployment and rising wages, boosting consumer confidence. People tend to borrow and spend more rather than saving or paying down debt. This increase in spending, especially when goods and services are in limited supply, pushes prices upwards, fuelling inflation.

When economic growth overshoots, inflation may rise above the 2% target, causing economies to “overheat.” Central banks respond by raising interest rates to reduce borrowing, encourage saving or the paying down of debt, ultimately slowing spending. This intervention seeks to bring inflation under control, initiating a “slowdown” phase before the next business cycle begins.

Investment markets are forward-looking, trying to anticipate future trends and “stay ahead of the curve.” Because there is a lag between changes in interest rates and observed inflation, it is normal for inflation rates to be high even when the economy is already cooling, a phenomenon often seen in the “reflation” phase. The opposite can also be true.

Recent decades show business cycles generally last longer, with growth phases outlasting slowdowns. Therefore, measuring portfolio performance relative to inflation is most meaningful over extended timeframes, at least one full business cycle, typically 7–8 years.

Unless the charity has a spend-down mandate, it is vital for charities with investments, to maintain the real value of their to preserve their mission for future generations. By benchmarking against inflation plus income over entire business cycles, they can ensure that investment strategies are aligned with both current and future needs, offering a more robust measure of true success.

Charities that adopt inflation-plus-income benchmarks typically complement them with disciplined spending policies. These policies define how much of the portfolio can be drawn down annually to fund operations or grant-making, expressed as a percentage of the portfolio’s value. When aligned with inflation-aware benchmarks, spending policies can help ensure that withdrawals do not compromise future financial health. This balance between spending and preservation is especially important for permanently endowed charities, where capital drawdown is not an option but there is a desire to increase impact in real terms or where the goal is to maintain intergenerational equity, ensuring that future beneficiaries are not disadvantaged by today’s decisions.

Benchmarking this way also enhances transparency in reporting to stakeholders. Donors, trustees, and beneficiaries increasingly expect clear, mission-aligned explanations of how funds are managed. Unlike market indices, which can be abstract, an inflation-based benchmark is intuitive and directly tied to the charity’s objectives. It allows stakeholders to understand whether the organisation is truly preserving its ability to deliver impact over time, fostering trust and reinforcing the charity’s commitment to prudent stewardship.

Finally, as inflation dynamics evolve, influenced by factors such as (de)globalisation, technological disruption, and demographic shifts, charities must remain agile in their investment approach. Traditional benchmarks may fall short in a world where inflation can be driven by supply chain shocks – which we saw as the west came out of Covid-19 restrictions while the east maintained a zero-tolerance approach - or policy changes, such as tariffs, rather than traditional demand-side pressures. Regularly reviewing the inflation-plus-income benchmark and considering macroeconomic developments ensures that it remains relevant and effective. This adaptability is key to sustaining charitable missions in an increasingly complex financial environment.

For charities committed to long-term impact, benchmarking against inflation plus income is more than a financial metric, it’s a reflection of purpose. It ensures that investment strategies are not only resilient through economic cycles but also aligned with the enduring mission to serve future generations. In a world of shifting markets and evolving inflation dynamics, this benchmark offers clarity, discipline, and relevance. By embracing it, charitable organisations can navigate complexity with confidence, safeguard their reserves, and deliver sustainable value where it matters most, but performance against such a benchmark should be reviewed over a full business cycle.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.