There is an opportunity set building in the investment trust sector, one that medium-to-long term investors should pay close attention to.

Investment trusts are collective investment funds publicly traded on stock exchanges that invest in a diversified portfolio of assets such as stocks, bonds and real estate. Investors have two measures to assess the value of an investment trust. The price of the shares trading in the market and the net asset value (NAV), a measure of the underlying investments. A discount between the share price and NAV could indicate an issue with the underlying investments that is not reflected in the share price, or there could be other factors causing the discount, potentially making it an attractive buying opportunity.

One of the key advantages of an investment trust is the permanent capital nature of the structure. This means investment trusts can cater to much more illiquid investment strategies. It’s this part of the market that has seen the most growth, particularly with the promise of a reliable income stream alongside historically low interest rates. Over the past five years, there has been substantial issuance in sectors such as infrastructure, renewable energy, shipping and song royalties. In the past decade, the industry has seen strong performance and raised over £80 billion through initial public offerings and secondary share issues.

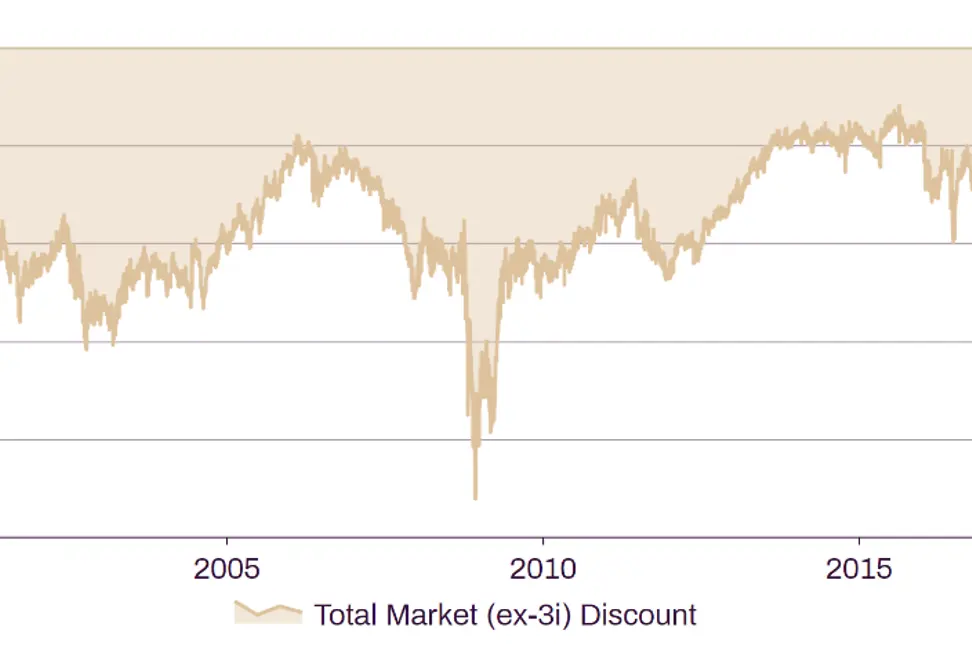

Right now, the discount between the shares and the NAV are historically wide.

Indeed, it is difficult to find investment trusts, irrespective on investment strategy, trading on a premium:

Decades of ultra-low interest rates and a low cost of capital made it an ideal time to start alternative income investment trusts. However, if we move away from a world of ultra-low interest rates, the lure of the income generated by these investment trusts is much less compelling to investors.

Investor sentiment is another factor affecting investment trusts.

Pension funds, wealth managers and large institutional investors currently do not view the UK as somewhere to park long-term capital, a view exasperated by the disastrous mini budget from last autumn which spurred significant outflows from the UK. While some investment trusts discounts may be due to their underlying investments, we believe investor sentiment is undoubtedly a significant contributor.

Regulations are also weighing on the sector. This week, Parliament discussed a Private Members Bill designed to ensure fairer cost disclosure of listed-closed ended investment trusts, which in its current form requires investors to double count the cost of their investment trust holdings. Transparency is key, but the MPs will argue there is no need to count them twice by requiring intermediaries, advisors, brokers and regulated funds to count them again in their own disclosures.

There have also been some high-profile governance issues in sectors such as social housing which haven’t helped.

In certain segments of the investment trust market, we feel the discounts represent attractive levels. On an opportunity cost basis, sectors associated with income such as core infrastructure may look less attractive today. However, investors with long-term time horizons have been benefiting from the uncorrelated nature of the asset class alongside inflation linkage from underlying cash flows for decades.

Discounts in the investment trust world are also attracting activist capital, as activists recognise the value opportunity. This represents an additional pool of capital to help drive fundamental improvements in governance. It will also improve liquidity in the shares.

We must reiterate, we will never invest in an investment trust solely because it is trading at a discount to NAV. Investors must undertake deep due diligence in getting comfortable with the underlying investment case, particularly in some of the newer niche investment strategies. We do, however, see evidence of several catalysts that give us confidence in the future of the wider sector.

Tom Jemmett recently made the cut for Citywire’s coveted Wealth Manager Top 100 list for 2023. This is Tom’s fifth consecutive appearance in the list, testament to his skill and impact in the industry. You can read Tom’s profile here.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.