As we came into the new year, the initial news flow boosted optimism that the torrid environment that investors faced in 2022 would improve. A combination of mild weather and an abandonment of the zero-COVID policies in China gave some positive momentum on both the supply and demand side of the economy.

On top of this, it seemed like the rate hikes last year were having the desired effect of cooling demand and moderating price pressures, prompting the US Federal Reserve (Fed) to tighten policy at a smaller increment. This raised the prospect that the US could achieve a soft landing however, conversely, a recent string of better economic data has questioned this view.

Nonetheless, rather than focussing on the most recent data, let’s take a step back and examine the reasons for the current situation. The pandemic, outside of the obvious health implications, resulted in havoc across global supply chains in a highly interconnected world. This first affected the goods side in several ways. Firstly, products like hand sanitiser, pasta and toilet roll quickly became in short supply. After a while, this evolved to house projects and garden furniture. Subsequently, as venues started to reopen, this moved to cars as public transport was feared. While these seem like obvious transitions in hindsight, managing a business in this environment proved highly challenging, especially with global trading partners adopting different approaches to health emergency.

Given households have now moved towards people facing consumer sectors, including travel and restaurants, inventory levels at these “goods” companies are appearing elevated at a time when sales are declining. Typically, this results in fallen prices for such goods. Furthermore, given the swift increases in interest costs, housing investment has fallen sharply. This backdrop gives some credence to Fed Chair, Jerome Powell’s statement that the disinflationary process has begun.

As we mark the devastating one-year anniversary of the Russian invasion of Ukraine today, and reflect on the humanitarian tragedy that it is, households have predominantly seen the impact of this crisis in terms of rising food and energy costs. The economic shock of this war is still being felt today. For British households and the government, when the Office of Gas and Electricity Market (Ofgem) announces the updated energy price cap on Monday, this will see prices decline as wholesale gas prices decline materially. Energy has been the largest contributor to inflation, and while a moderation of these is very welcome, consumers have seen a squeeze on real incomes and not all of these price increases are likely to reverse.

While these shocks seem unique, they are now showing more signs of classic cyclical behaviour. However, the most challenging shock for central bankers has been the tight labour market. Early retirement, increased long term illness, and low wage jobs moving back and forth from services to manufacturing has driven wages higher. Recent unemployment data showed it hitting multi decade lows with many more jobs added than anticipated. The combination of headline catching job cuts, but on aggregate a tight labour market, means that the Fed will likely err on the side of keeping monetary policy tight.

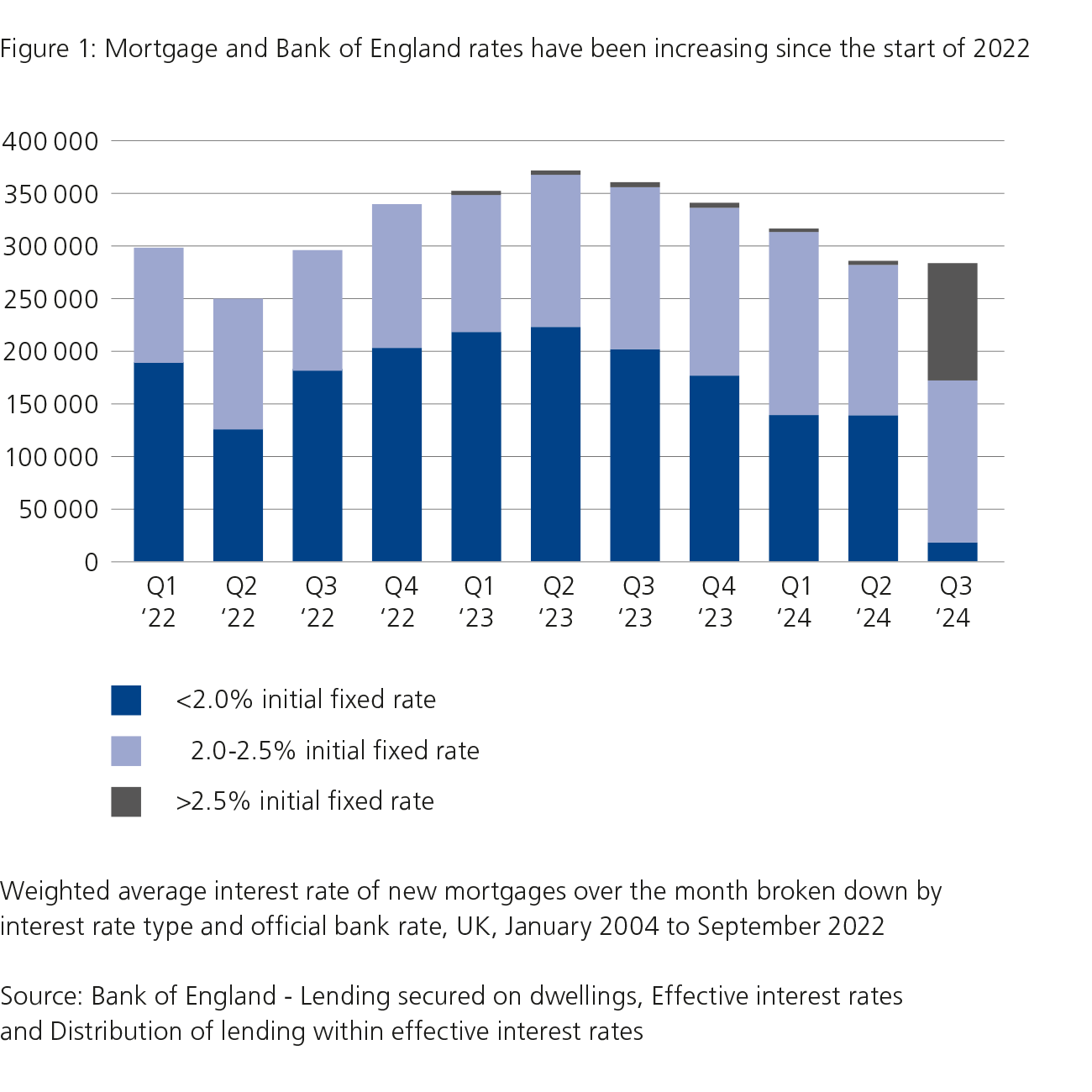

The most recent communications from central bankers talk to the “long and variable lags” of monetary policy. The chart below from the Office of National statistics illustrates these lags. As households in the UK see their mortgage come up to renewal, they are facing much higher refinancing costs. This will weigh on consumption as more of their salary will go on housing costs, ultimately dampening the demand for holidays and other discretionary spending over time. This is also required to create more slack in the labour market and position it in better balance.

While markets were cheering that we are nearing the end of rate hiking cycle, the prospect of a slightly higher peak rates and keeping rates elevated for longer, has brought the recent market optimism to question. Given inflation is still well above central bank targets, they will remain vigilant on how it progresses throughout the year. While recent data showed the economy bouncing off its low levels, we would encourage investors to focus on the wider picture.

[1] www.ons.gov.uk/peoplepopulationandcommunity/housing/articles/howincreasesinhousingcostsimpacthouseholds/2023-01-09

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.