Those fortunate enough to travel across the pond and visit the Big Apple, surf the beaches of Santa Monica or drive down Route 66 will have handled the green bills that popularised the term “Greenback”.

The US dollar has been printed in that colour since the mid-1860’s and the term is still popularised today. A law was passed nearly a century later requiring “In God We Trust” to be incorporated on all forms of US currency. Trust appears to be somewhat in short supply of late when it comes to the United States. While the recent banking crisis started with Silicon Valley Bank, it has continued to cause ripples in regional banks with First Republic Bank of California ultimately being acquired by JPMorgan in a deal announced earlier this week. Furthermore, other regional banks have been under pressure as investors continue to worry about broader viability of these smaller players given the slowdown in US growth momentum, commercial real estate exposure and stricter regulations due to be imposed in the wake of the crisis.

The balance between electioneering and national interest is also rearing its head. The impending debt ceiling, or limit on total government debt, has become a source of concern. Treasury Secretary Janet Yellen warned that without a compromise, resulting in the limit being raised, the US could default on its debt by the 1st of June. However, with an election in sight, the Republicans are taking a hard line and seeking spending cuts. This is not only in response to the large budget deficits that the US is running, and its broader fiscal trajectory, but also to score political points as spending cuts are generally not an election winner. The Democrats are clearly not keen on agreeing to these conditions and President Biden is due meet the Republican Speaker of the House, Kevin McCarthy, next week with hopes that the gaps between both sides can be bridged. However, history tends to show that these negotiations end up going to the wire, which is a risky strategy, and is likely to only serve in further eroding trust of the American people in their politicians.

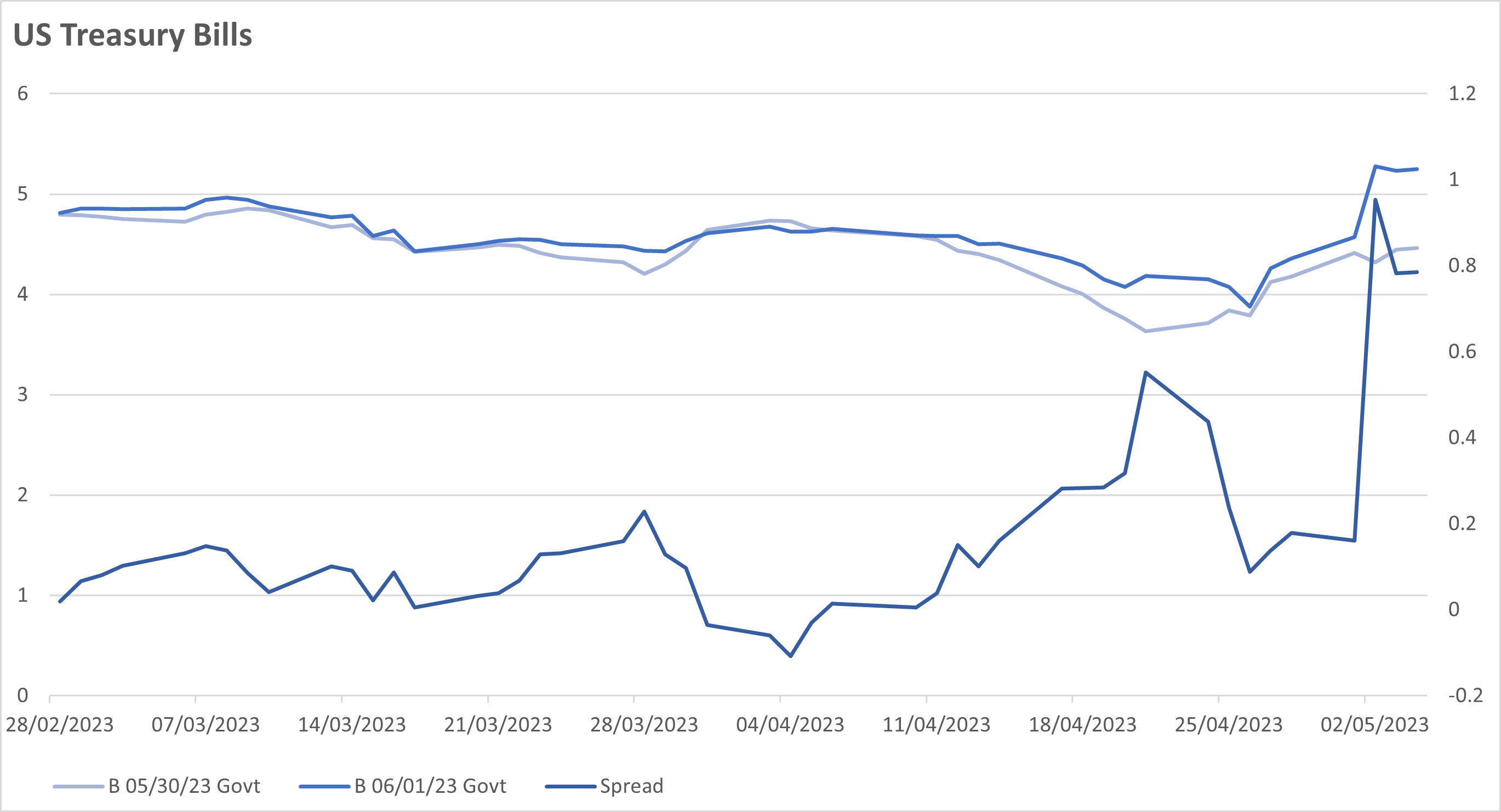

Investors are clearly assigning a non-trivial risk of these negotiations leading to the US technically defaulting, if only for a short period. As shown in the chart below, the yield differential between a US Treasury Bill maturing at the end of May versus one maturing on the 1st of June has increased materially and was close to 0.8% as of close yesterday.

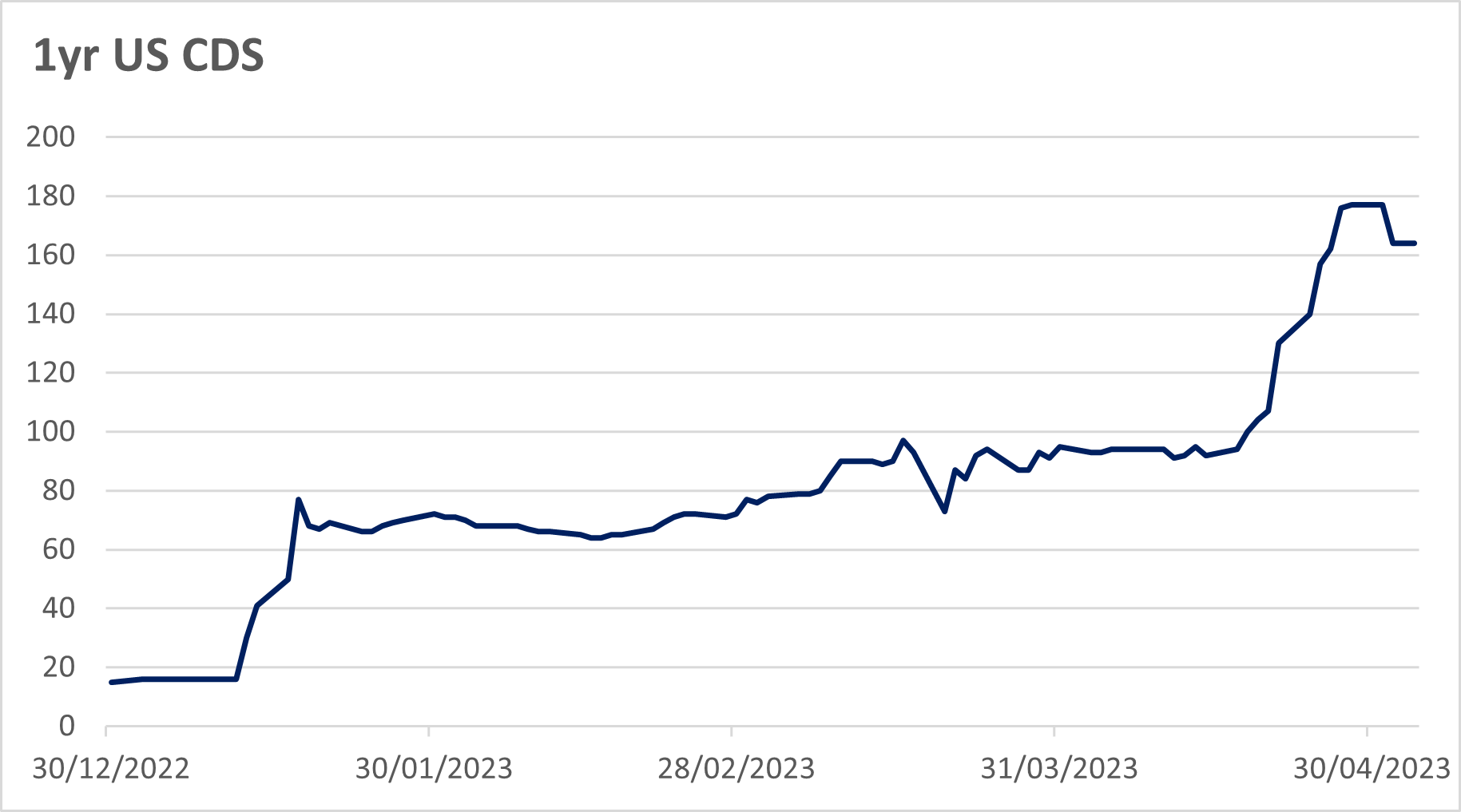

Another gauge of this is the one-year Credit Default Swap (CDS) of the US. Investors can use this instrument to hedge exposure and could stand to profit from it should the US default. Since the end of last year, the cost of this insurance policy, if one decided to buy protection, has increased tenfold. Therefore, if investors do not feel that they can trust their government, something the UK can relate to during the mini-budget crisis of last year, can they hope that the central bank steps in?

While both the Federal Reserve (Fed) and the European Central Bank (ECB) raised rates by 0.25% this week, the tone surrounding those decisions could not be more different. The Fed made its clearest signal yet that it is open to pausing rates at the next meeting having raised them by 5% cumulatively in just over a year. While inflation remains above target and the labour market remains tight, the Fed see signs of these easing over the coming quarters as the full effects of policy are truly felt. As we have written about before, it is the tightening of credit conditions in the wake of the banking crisis that make further rate hikes hard to justify. Next week, the Fed releases its Senior Loan Officer Survey which will show how credit conditions have evolved since it last did this survey in January. Ongoing negative headlines and sentiment surrounding regional banks, along with their sharp share falls, mean conditions are likely to have tightened further even after this latest survey. So, while the Fed warned that its inflation forecast doesn’t support rate cuts, this has not changed market pricing for rate cuts later this year. When it comes to debt ceiling, Chair Powell repeatedly warned of the risks but advised that as a fiscal matter, it is not part of their remit.

On the other hand, while the ECB did slow down the pace of its increases from 0.5% to 0.25%, it specifically said that this is not a pause and that they have more ground to cover. Given Eurozone banks, excluding the Swiss ones, have been largely unscathed by the recent event and core inflation is near its highs, the rather hawkish tone from the ECB continued.

Given this broader backdrop, it is not surprising that the greenback has lost some of its shine and investors prefer other currencies, or the shiniest asset of it all, gold. While the debt ceiling could well end up being a storm in a teacup, investors have become a bit more cautious about the unfolding events. As such, it might take some time before investors take comfort again in “the full faith and credit of the United States”.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.