Recent reports show that, in both the US and the UK, core inflation numbers, which exclude the food and energy effects, increased more than expected to 6.3% Year over Year.

Over the summer, investors were becoming more confident that the Federal Reserve (Fed) would not only win its fight against inflation, but also achieve the elusive "soft landing" given the recent run of resilient economic data in the US. While Chair Powell stressed the Fed’s commitment to tackle inflation at the Jackson Hole Symposium, this merely had the effect of reversing the bond rally that took place since their June meeting.

Since the June peak of 9.1%, US headline CPI Year over Year (YoY) has been coming down and declined to 8.3% in August, according to the report released earlier this week. Meanwhile, in the UK, headline inflation also declined from just above 10% to just below. However, as they say, the devil is in the detail.

Across both reports, the core inflation numbers, which exclude the food and energy effects, both increased more than expected to 6.3% YoY. In the US, core pressures over the month of August were twice as much as that which was forecast and rose by 0.6% over the period. In general, central banks tend to place a greater weight on these measures as it gives a better sense of underlying price pressures.

The US CPI release took markets by surprise, with bond yields moving materially higher and equities falling sharply. The S&P 500 index fell by 4.3% and the NASDAQ composite fell 5.2% on the day of its release, the biggest fall since June 2020. The futures market moved to price in terminal rates of 4.5%, relative to 4% prior to the report. Furthermore, they are also pricing in that rates will stay elevated for a longer period of time, thus raising the risks of a recession over the medium term.

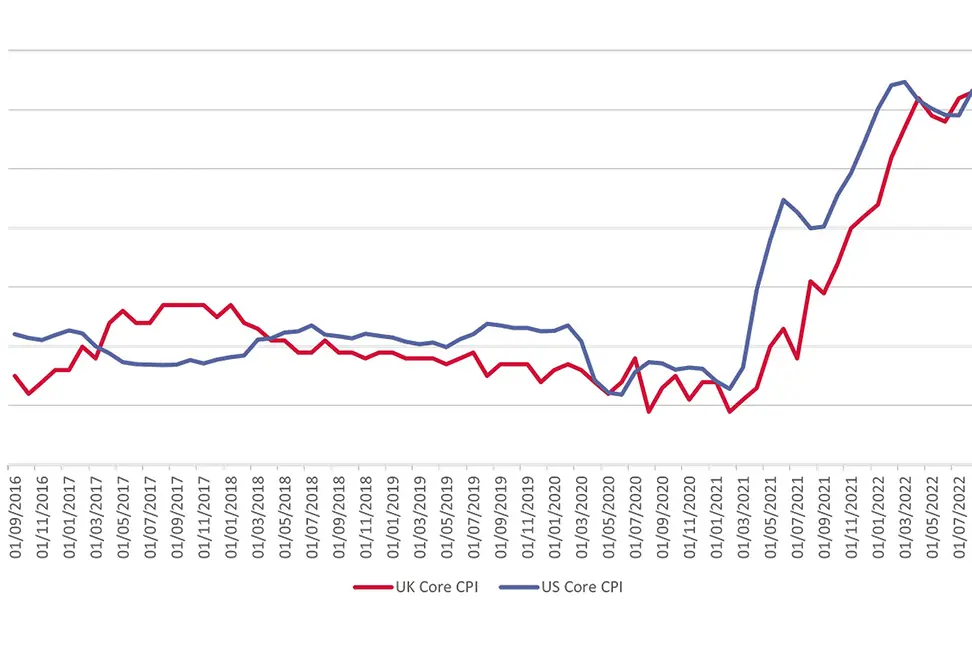

Given the same level of Core CPI YoY in both the US and the UK, are the underlying drivers of inflation the same and are they likely to follow the same trajectory?

Source: ONS, Bureau of Labor Statistics

Looking at the core picture, it shows that the UK saw a greater lagged effect of core price pressures than the US. A lot of this can be attributed to the delay in easing of COVID related restrictions and thus a delay of the substitution from goods to services. Another big factor includes the stimulus cheques provided by the US government, providing a massive boost to consumption at a time when supply chains were disrupted. However, looking closer to the current picture, some differences start to emerge.

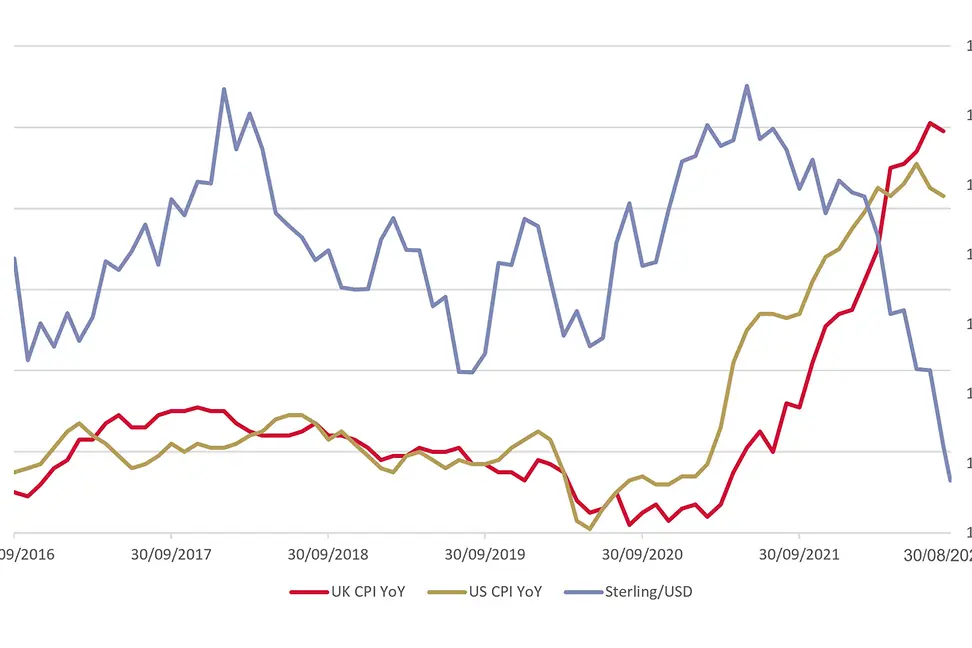

Source: ONS, Bureau of Labor Statistics, Bloomberg

The dollar strength and/or sterling weakness we have seen this year will continue to be a material driver of the how inflation differs. When the dollar strengthens, the US economy exports some of its inflationary pressures, as it tends to push commodity prices down that tend to be priced in dollars and allows for cheaper imports where possible.

The converse is true for the UK: the weakness in the pound makes fighting inflation much more challenging as, in essence, it starts to import some of the inflationary pressures. Thus, the outlook for consumers is widely different.

While real wages have declined across both regions, the UK is facing a much more pronounced cost of living crisis, despite the much-welcomed support from the Government’s plan to cap energy prices. Food prices remain high and the higher cost of energy for the UK relative to that of the US means the pass-through effect from packaging to food production and raw material cost is much greater.

In essence, this means a greater degree of inflation in the UK is supply-driven compared with the US. To illustrate the differences, consider the following:

Over recent weeks, pubs in the UK, and hospitality more generally, have issued stark warnings about inflationary pressures. Some pubs warned that the price of a pint would have to rise from around £5 to £20 to survive this winter. While these service prices feed into core inflation, this illustrates that it is driven more by supply issues than by strong underlying demand.

Retail sales data released in the last two days illustrates the point further. In the US, retail sales (excluding gas and autos) rose by 0.3% over the month of August[1] while in the UK a similar measure (excluding petrol) fell by a larger than expected 1.6%[2].

These differences show just how difficult the challenge faced by the Bank of England (BoE) is next Thursday. While the Fed looks set to raise rates by at least 0.75% next Wednesday, given the recent inflation report, and is likely continue hiking until rates reach above 4%, the BoE will have to continue raising rates despite more signs of a recession on the horizon. It needs to ensure that it limits the degree of imported inflation. As such, the BoE and even the European Central Bank may find themselves with little choice but to follow the Fed on their hiking path.

[1] US census bureau

[2] The Office for National Statistics

Read more from The Brief.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.