Investment decisions are shaped by various philosophies and methodologies known as investment styles. These styles serve as frameworks for investors to select companies that align with their strategies and goals.

One such prominent investment style is quality investing, which focuses on evaluating companies based on key ‘quality’ characteristics. Unlike some other investment styles that may prioritise short-term gains, quality investing aims to identify financially robust companies that offer sustainable and attractive returns over the long-term.

In contrast to growth investing, which can lead to impressive but often volatile short-term gains, quality investing takes a more measured approach. It seeks out companies that demonstrate financial health, stability and consistent growth potential. This strategy relies on a blend of hard and soft criteria to assess a company's viability as a long-term investment. It’s important to note that quality companies do indeed fall into both the ‘growth’ and ‘value’ investment universe.

The hard criteria in quality investing are primarily financial metrics that gauge a company's fiscal strength and stability. A few of these metrics include:

In addition to financial metrics, quality investing considers qualitative factors that contribute to a company's overall sustainability and success. These soft criteria include:

Pricing power is one of, if not the most, important characteristics of a quality business in our view. Companies with pricing power demonstrate a sustainable economic moat – durable competitive advantages that allow them to pass on costs to consumers without sacrificing market share. Brands that consumers rely on, and trust, often have the pricing power to maintain their customer base too – such as luxury goods companies. As an example, Microsoft Office is depended on by businesses globally for their operations. Microsoft is able to raise prices without triggering a significant switch to competitor products such as Google’s offering because they have significant pricing power.

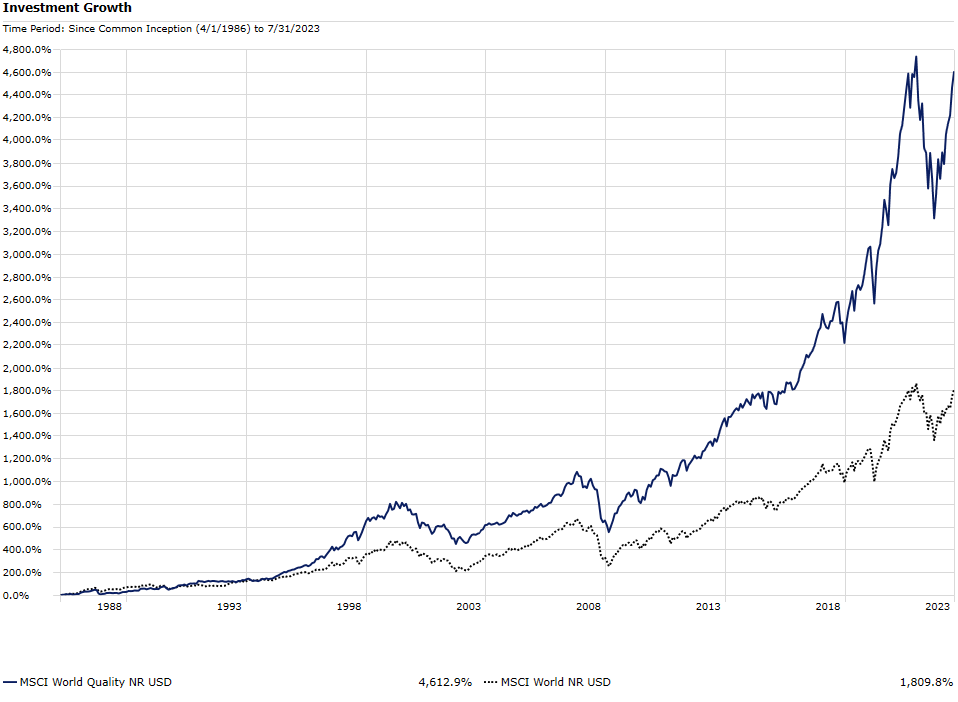

In the face of market fluctuations and economic challenges, quality investing shines as a strategy that prioritises long-term stability and growth. The graph below shows quality investing in comparison to market weighted world stock markets over the long-term.

Given all of the market uncertainty, quality companies offer the opportunity to provide strong returns in rising markets but also have the more defensive characteristics in down markets to weather the storm.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.