The news in the UK can at times feel as though it is on a repeat cycle . Situation: a highly anticipated inflation report is due to come out. Outcome: the release subsequently shows that inflation pressures did not moderate as expected. Repeat.

Core price pressures are now moving up to new multi-decade highs. Banks and building societies are quickly withdrawing their existing fixed rates rate mortgage deals in expectation that rates will have to rise further, and the papers are full of articles talking about the impending time bomb homeowners are facing as they look to re-mortgage. This hardly paints a promising picture for the Conservative Party as they were hoping to cut taxes ahead of the next general election to boost their standing. Furthermore, given the inflationary backdrop, they are not in a position to justify fiscal policy loosening as they would be subject to the ire of homeowners who would likely see their borrowing costs rise further.

Prime Minister Rishi Sunak was eventually elected the leader of the Conservative Party following a tumultuous time in UK politics last year. In the wake of the mini-budget, Rishi swooped in, promising to restore the UK credibility and focus on “sound finances”. This message was well received by financial markets with the pound bouncing off its lows and the gilt market stabilising. The Bank of England (BoE) was seen as the saviour back then, intervening in the gilt market, but now it is seen as having fallen behind the curve and gotten the forecasts all wrong. Perhaps we can draw some lessons from the Prime Minister’s exercise regime.

Rishi has been very open about his regime, starting his day with a Peloton class. The company sells spin bikes for home use with live classes offering a variety of classes and music options. During the classes, you balance your leg speed with force resistance in order to maximise your output. For more advanced users, the instructors would then advise you to increase resistance further to achieve a stable level of speed and output.

It seems like the BoE misjudged their output, resulting in interest rates remaining too low, or insufficient resistance, to restore stability.

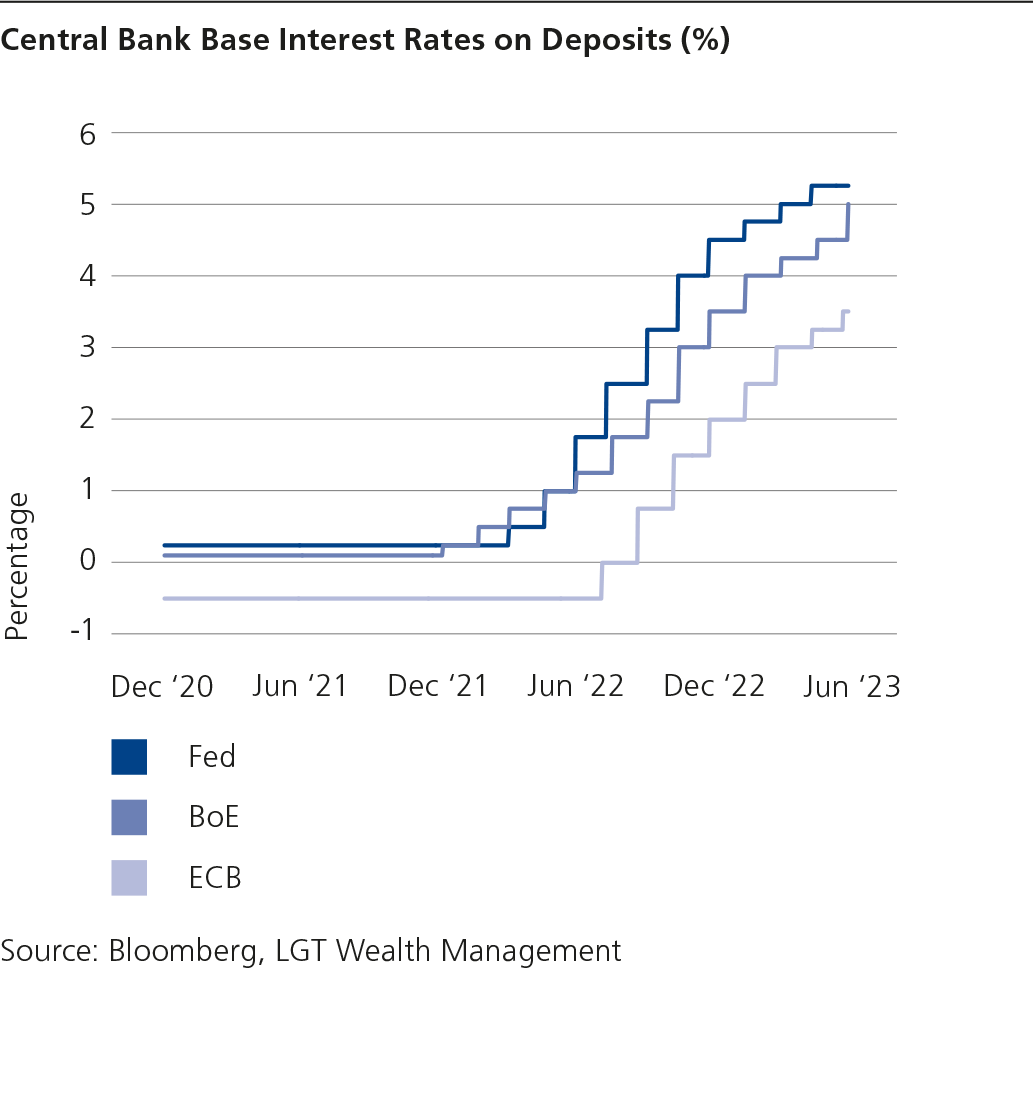

While the Bank of England did have the first mover advantage and started raising rates before the US Federal Reserve (Fed) and the European Central Bank did, its grapple on inflation is poorer relative to these peers. So why are we facing the issues?

Going back to last year, the BoE forecasted last that the UK would face its longest recession, albeit a relatively shallow one. This was then driven by enormous increases in energy costs, and as such, they forecasted one of the largest squeezes in living standards in modern UK history with real wages declining. Given this backdrop, and the financial stability concerns in the wake of the mini budget, it opted for smaller increases and a cautious approach. This was in contrast to the Fed and ECB who persisted with their larger increases. However, government intervention to cap energy costs meant the impact was not as pronounced and gas prices have declined materially since the peak last summer. Arguably, they did not sufficiently offset this fiscal injection in the economy.

Furthermore, the strength of the labour market resulted in much larger pay settlements, despite the overall economic (at least when adjusted for inflation) output being stagnant. This has perhaps changed the nature of price setting in the economy, reinforced by strike action. In addition, the lags of monetary policy appear longer, so by opting for a slow and steady approach, they may now have to do more. This is especially problematic given the news that the level of debt now matches output for the first time in over half a century.

This week, the BoE sought to re-establish its inflation credibility by increasing the increment to 0.5% from 0.25%. This pushed rates up from 4.5% to 5%. The text surrounding the decision continues to warn of further hikes if inflation persistence continues. After being perceived to be on the back foot, it now wants to show that it is taking this fight seriously. However, given the lags of a hiking cycle that started eighteen months ago, it now risks a deeper recession. Not something any political party would like to contend with leading up to an election.

The BoE has recently announced that it would accept an independent review of its economic forecasting as a result of its poor record on getting inflation back to target. This begs a question for the PM, given his instructor did not seem to fully understand what level of resistance was right for the beat of the economy, will he continue to listen to his instructor or opt for a new one?

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.