It appears from every incremental data point we receive, markets are more convinced the interest rate hiking cycle has reached its peak, despite some hawkish rhetoric from Federal Reserve (Fed) Chairman Jerome Powell last week.

Both the US and the UK had small downside surprises with inflation data this week, boosting confidence that the Fed and the Bank of England (BoE) are finally finished with their interest rate hiking cycles. The small misses for US and UK Consumer Price Index (CPI) this week also indicate that the move in rates is likely to be a cut, rather than a hike. These lower-than-expected figures buoyed both equity and fixed income markets, with the S&P 500 posting its strongest advance since April and the Russell 2000 having its best day in over a year on 14th November.

In the UK, inflation slowed to two-year lows of 4.6%, benefiting from falling energy prices.

This all but guarantees Prime Minister, Rishi Sunak, will meet his pledge to half inflation by year-end. The Conservative party and Sunak himself will no doubt take credit for this as a much-needed win for the party, just days after yet another complete cabinet overhaul. However, the Government played little part in helping bring inflation down, with almost all of the decline since January largely due to easing utilities, energy and gas bills following Ofgem’s energy price cap. This, coupled with the BoE’s interest rate hikes, contributed to curbing inflation, rather than any specific policies from 10 Downing Street.

In the US, the main CPI release was 0% in October (vs 0.1% expected). Encouragingly, it did not just miss on the headline basis, a result of some energy effects wearing off, but also on the core basis. Core CPI, which excludes food and energy, came in at 0.2% for October (vs 0.3% expected). The good news continued for the yearly figures, with CPI falling to 3.2% year-on-year (vs. 3.3% expected). Core CPI meanwhile dropped to 4% year-on-year (vs 4.1% expected).

Looking at the data more closely, and keeping in mind long and variable lags, shows the Fed is perhaps further along in its inflation fight than initial numbers indicate.

The CPI figures excluding-food, energy and shelter show it is actually 2%, which is the Fed’s target inflation figure. This poses the risk that the Fed may be keeping policy tight for too long using backward looking data.

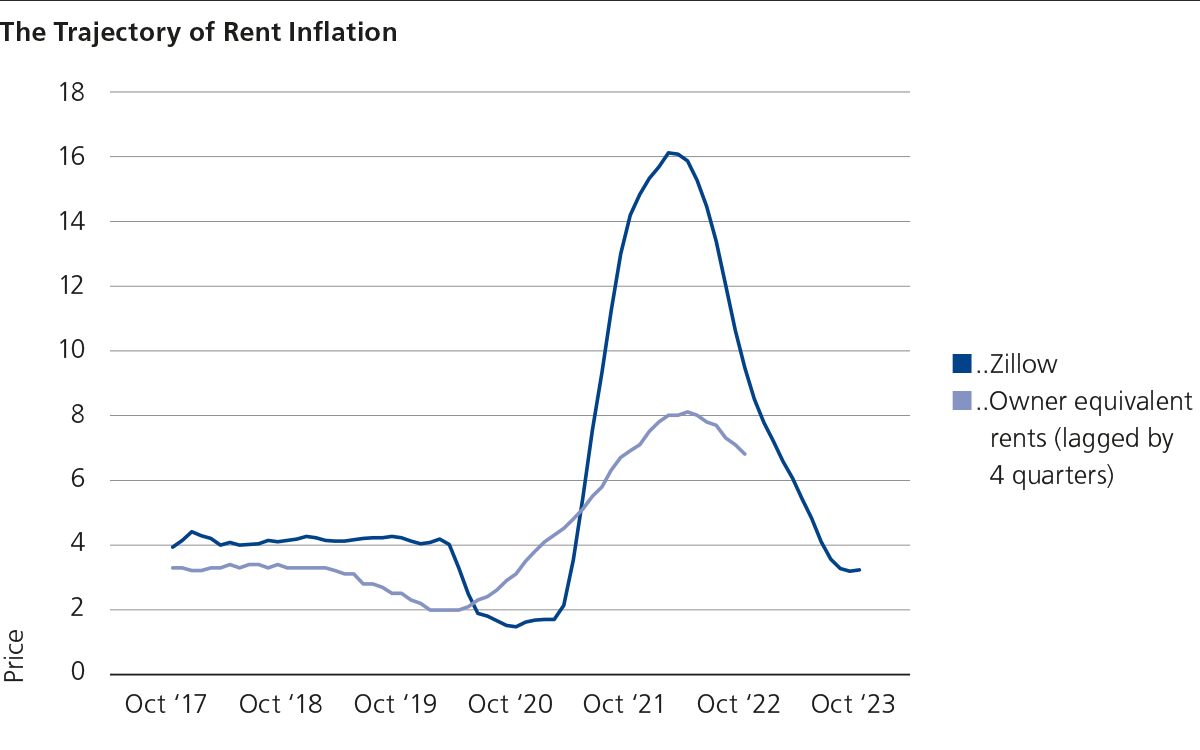

We cite a very interesting December 2022 academic paper on rent indices by the Federal Reserve Bank of Cleveland. The paper concluded that Bureau Labour Statistics rental data – which is based on all renters – lags more timely indicators by approximately four quarters. The Core Logic SFRI and Zillow Observed Rent Index, that just focus on new renters. These provide a much more accurate picture of where rent inflation is. Given shelter comprises 32% of the CPI, precise rental data is crucial for accurate inflation measurement.

The chart below compares the Zillow index with the Owner Equivalent Rents component of CPI. We lagged the latter by fourth quarters to illustrate the trajectory based on the aforementioned paper. This shows a clear downward trend in shelter component of inflation going forward.

We believe that the rents component highlights the possibility that the Fed may be at risk of policy error if they stick to the higher for long mantra. An interest rate cut so soon is highly unlikely, as headline inflation is priced into markets and labour markets remain tight. However, it may mean that once the cutting cycle starts, central banks may ultimately cut more than its Dot plot shows. This is reminiscent of an old adage that central bankers go up using the stairs but move down using the lift.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.