When discussing central bank policy, it is crucial to not only look at interest rates, but to understand their effect on broader financial conditions. This ambiguous term encompasses the availability of credit, stock market performance, exchange rates and commodity prices.

As we have noted in previous Briefs, following recent Federal Reserve (Fed) meetings, the next move for interest rates will be lower. While the timing of these rate cuts is still uncertain, the general consensus is that rates will be cut at some point this year, which has helped keep bond yields lower relative to levels seen in the second half of last year.

As such, the mere expectation of interest rate cuts has already led to financial conditions loosening. This means it is less expensive for businesses and individuals to access credit and financing. This could stimulate the economy by encouraging spending and investment.

To understand how loosening financial conditions affects everyone, we explore the UK residential housing market. The Bank of England (BoE)’s latest Monetary Policy Report provides some useful insight into this.

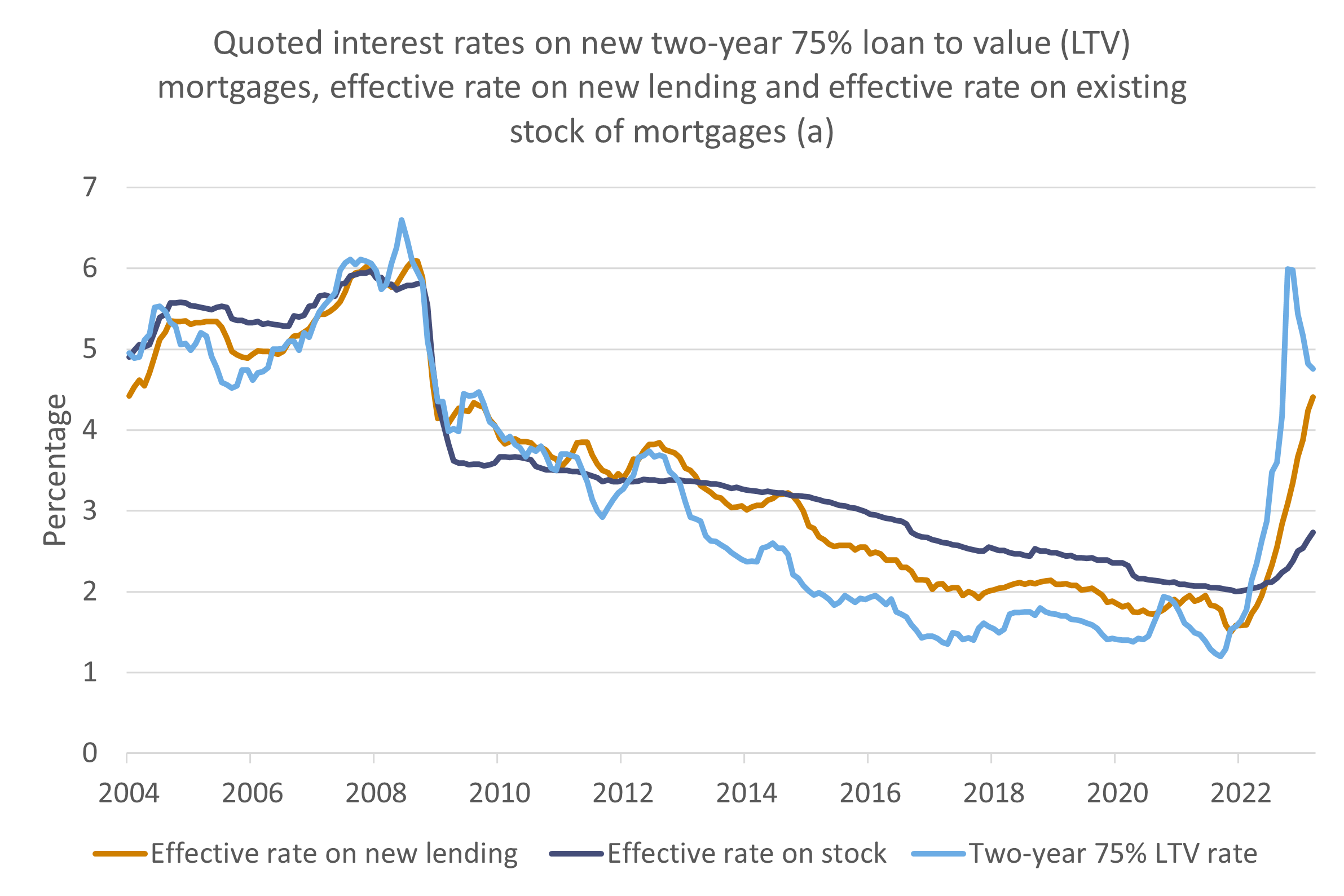

Last May, the BoE’s report illustrated the variable lags of increasing interest rates1. For example, the rates locked in on existing mortgages were below 3%, compared with the rough indication of 4.5% on new mortgages.

(a) The latest data points are March 2023. The Bank’s quoted and effective rates series are weighted averages of rates from a sample of banks and building societies with products meeting the specific criteria, such as being widely accessible. The data are sterling-only monthly averages and are not seasonally adjusted.

Fast forward to today, so far the BoE has kept interest rates unchanged, but expectations of rate cuts this year have driven mortgage rates lower. Mortgage rates, which rose sharply to above 6% in October 2022 under Liz Truss’s leadership, as well as in parts of 2023, have since fallen below 5% and are continuing to decline due to expected rate cuts.

As a result, house prices have seen a notable shift, halting their decline and showing signs of improvement. This positive shift in sentiment is evident in the latest data from Halifax and Nationwide, both of which closely monitor prices in the initial stages of the house-buying process. Their findings serve as reliable indicators for the overall trajectory of official house prices. Mortgage approval numbers are also ticking up, as financial conditions soften and cheaper mortgages become more available, spurring housing activity.

Why is this important? Following the swiftest rate hiking cycle in decades, market participants expected a sharp downturn in house prices in the UK. The job market remained buoyant, which meant transactions were subdued but most people were able to retain their houses. Now, because of rate cut expectations, this may well encourage more people into the property market, representing a good opportunity for first-time home buyers to get on the housing ladder. The material increase in rental costs has also made purchasing a home a more attractive proposition. As such, we could see a so-called soft-landing for the housing market.

Rising housing activity will also have a positive trickle-down effect to other parts of the economy.

Moving house often involves the need for essentials such as moving supplies and transportation, as well as the possibility of needing to furnish and renovate a new home. Durable goods, expensive household furniture, and the construction industry are just some of the sectors likely to experience an uptick in activity. All this lifts growth and stimulates the overall economy. Additionally, lower interest rates and the opportunity to re-mortgage at more favourable rates will result in individuals having more disposable income over time. The BoE acknowledges this in its latest report, having revised its UK growth forecasts upwards to a cumulative 1% by 20262.

It is important to stress this is not necessarily good news for all homeowners. Over 1 million UK households were due to reach the end of their fixed-rate terms in 20233 and a further 1.5 million in 20244. The BoE forecast that for the average mortgage in 2023, monthly interest payments would increase by about £200 a month if their mortgage rates rose by 3%5. This is typical for homeowners paying 1% to 2% on their fixed-rate mortgages, who are then forced to refinance with rates between 4% or 5%.

The housing market is an important indicator for future economic activity. Lower mortgage rates alleviate pressure on disposable income and leads to an uptick in transactions. This then trickles through to other related sectors, which helps fuel growth. Loosening financial conditions will help stimulate economic activity and should provide a welcome boost to the housing market. While interest rates remain historically high for the moment, one must remember it is always darkest before the dawn.

[1] Bank of England Monetary Policy Report, May 2023: https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2023/may/monetary-policy-report-may-2023.pdf

[2] Bank of England Monetary Policy Report, February 2024: https://www.bankofengland.co.uk/monetary-policy-report/2024/february-2024#report-february

[3] Bank of England Monetary Policy Report, May 2023: https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2023/may/monetary-policy-report-may-2023.pdf

[4] Telegraph: https://www.telegraph.co.uk/money/property/mortgages/remortgaging-guide-interest-rates-calculator/

[5] Bank of England Monetary Report, May 2023: https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2023/may/monetary-policy-report-may-2023.pdf

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.