Agricultural Property Relief (APR) was introduced in 1984 to help farmers pass their land down through generations without having to pay IHT. It was introduced to ensure that farms were not forced to break up, thus allowing the land to remain in agricultural use. The Labour government has taken an alternative approach, suggesting that large estates should make a greater contribution to public finances. As such, as part of the October budget, it was announced that APR and Business Property Relief (BPR) would be reduced such that only 50% IHT relief would be available (currently 100%) from April 2026.

The result is that landowners and farmers will effectively be taxed 20% IHT on the value of their land and agricultural assets in excess of £1m, including the land, farmhouse, equipment and potentially even livestock. Click here for more information.

Those changes are now less than a year away. After almost 40 years of being exempt from IHT, farmers who intend to pass their farm to the next generation should review their situation now to mitigate the effects of these changes.

If written before October 2024, it is likely that landowners’ wills assume that all agricultural and business property is IHT exempt. From April 2026, this will no longer be the case and careful consideration should be given to the IHT implications.

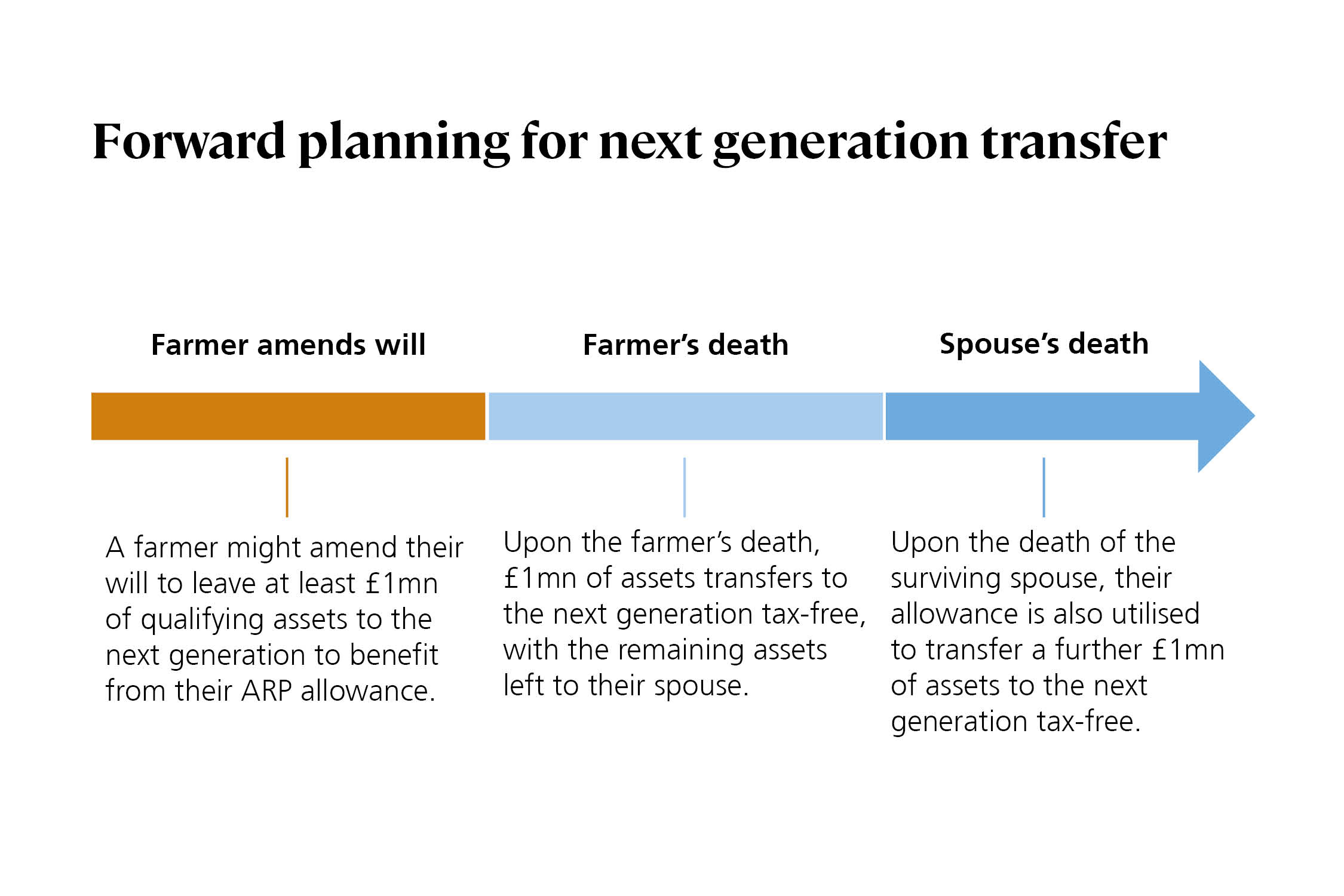

The new legislation introduces a £1m APR/BPR allowance per person. A couple can utilise both of their respective allowances to collectively pass £2m of assets to the next generation tax free if their wills are written with this in mind.

For example, if a farmer currently owns a farm and leaves it to their spouse, there will be no IHT payable on their death as spousal transfers are IHT exempt. Nothing will have been transferred to future generations, however. Their personal £1m APR allowance will also not have been utilised, and the allowance is not transferable to the other spouse. When the surviving spouse dies, the farm will pass to the next generation and their £1m allowance will be utilised, resulting in £1m passing tax free and the remainder being taxed at 20%.

However, by amending the farmer’s will to leave at least £1m of qualifying assets to the next generation, their allowance will be utilised, and part of the farm will pass to the next generation tax free on their death. When their spouse then dies, their allowance will also then be utilised and £1m will pass to the next generation tax free. In short, through forward planning, both allowances can be utilised.

Equally, if a farmer’s will currently bequests the whole farm to his or her children, it may make sense to gift £1m of qualifying assets to their spouse now (spousal transfers are exempt from Capital Gains Tax (CGT)), to ensure that the spouse’s £1m allowance is utilised on their death.

Careful consideration can ensure that for married couples or civil partners, both allowances are used and £2m of agricultural assets pass to the next generation tax free.

Clearly tax will not be the only factor to consider but gifting land and agricultural property during one’s lifetime may qualify as a Potentially Exempt Transfer (PET), which means that after 7 years it becomes tax exempt for IHT purposes.

The gift may qualify for Gift Hold-Over Relief, whereby the CGT can be deferred until the land is ultimately sold. In practice, it is possible that no CGT is payable on the gift and provided the donor lives 7 years, no IHT is payable either. The entire farm could be passed to the next generation with no tax liability.

Gifting the farm still leaves a potential IHT liability for 7 years. One option is to gift the farm and take a 7-year life insurance policy to cover the liability. For a farmer who is at or close to retirement, this could be a very attractive way to pass the farm to the next generation while protecting against the IHT liability. The premiums on a life insurance policy are likely to be more manageable from a cash flow perspective.

By way of example, if a £5m farm is gifted to the next generation, the first £1m would be exempt leaving £4m potentially chargeable for IHT at 20% if the donor was to die within 7 years – that is a tax liability of £800,000 for the first 3 years before tapering down and becoming exempt after 7 years.

Indicative quotes for a 70-year-old indicate that the total cost of all premiums over the 7-year period on a life insurance policy to cover that liability would be £26,400. That is equivalent to an effective IHT rate of 0.66% of the £4m taxable gift.1

For many farmers, gifting now may not be an option – because they do not yet have children, rely on the income from the farm or want to continue living in the main farmhouse. In that scenario, one option is to insure against the potential tax liability until they are at an age where they think they will be able to gift the farm to the next generation – or for their whole life, although that is likely to be considerably more expensive.

Indicative quotes for a 40-year-old farmer, who wants to insure the IHT liability of a £5m farm until they are 80, indicate that the cost to insure the £800,000 liability would be £80 a month.2 That is a total of £38,400 in premiums over the entire policy to remove the IHT liability – or an effective IHT rate of just under 1%.

This would allow a 40-year-old farmer to continue owning and farming the land until the age of 73, at which stage they could gift it to the next generation and start the 7-year clock. Assuming the conditions were met to qualify as a potentially exempt transfer (PET), this would ensure no IHT liability by the time they are 80 (under current legislation) when the policy expires.

The value of the farm (and the IHT liability) is likely to increase over such a long period. Linking the policy to inflation or increasing the policy at regular intervals are both options to cover the additional liability.

The above scenarios are designed to highlight some of the actions that landowners may wish to consider and should not be taken as advice. Professional advice is strongly recommended.

[1 and 2] Life Insurance quotes provided by Risk Assured. This is indicative only and assumes standard rates for a client that is a non-smoker and UK resident

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.