To many of us, this winter has felt especially long. This is not just related to the ongoing cost of living crisis, as weather effects have not exactly helped to lift spirits. While February did give us some unseasonably warm weather, this was followed by the wettest March in forty years. As such, it is no surprise to see many booked to travel to sunnier destinations. Personally, I always find it rather satisfying after take-off when you climb above the dark clouds and are presented with sunny blue skies as the plane approaches cruising altitude.

Listening to the Federal Reserve (Fed) and the Bank of England (BoE) over the past two weeks, it seems that they believe the conditions are right for them to move to cruising speed and engage autopilot.

While we touched upon the Fed last week and the conditions in the UK the prior week, the BoE published their latest forecasts this week when announcing their recent rate decision. As was widely expected, they increased rates by a further 0.25%, taking them to 4.5%. This represents a cumulative tightening of 4.4% since they first started raising rates in December 2021. While less than the 5% that the Fed has hiked by, this nonetheless represents one of the most aggressive hiking cycles in the BoE history.

The latest report represents another uplift from the gloomy forecasts that the BoE provided six months ago. They now expect the UK to avoid a recession altogether, with growth flat over the first half of the year (excluding the extra bank holiday impact) and picking up moderately after that. The entire growth projection over the forecast horizon has been increased by more than 2%, representing the biggest revision in the history of the independent central bank. As such, this prompted plenty of questions surrounding their credibility, especially given inflation remains well above their target, in what turned out to be a rather heated press conference.

When discussing the headline inflation numbers, many pointed out that the UK is still in double digit territory, relative to the falling headline number in both the US and Eurozone which have fallen substantially since their peak. Governor Bailey asked them to focus on core inflation, pointing out that many of the differences in the headline number can be attributed to changes in the consumer energy markets. On a core basis, the differences are much smaller and inflation is due to fall markedly next month as energy base effects kick in.

In terms of growth, the sharp decline in gas prices since the summer of last year means that the squeeze to real incomes is less severe than previously feared. While this has benefited growth, this also means that they expect a smaller increase in unemployment and inflation to move back to target at a slower pace. As such, they kept the following statement in their summary: “If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required”. However, they also forecast that inflation will be below target towards the end of the forecast horizon.

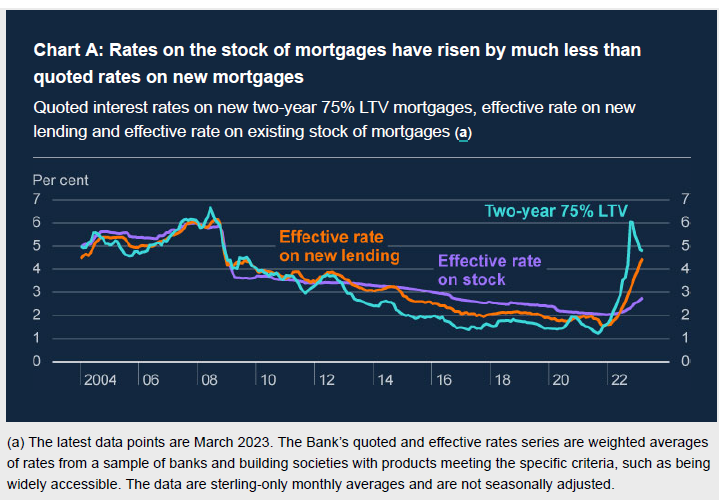

Governor Bailey spent some time at the start of the press conference qualifying their latest rate hiking decision, but, in my view, he really emphasised the long and variable lags of monetary policy. We have touched upon this in previous missives, but the below chart presented during the conference shows that most of the impact of the rate hikes is yet to be felt.

As more and more households re-mortgage at higher rates, this will undoubtably put the brakes on other discretionary expenditure. Furthermore, while growth forecasts have been revised upwards, the BoE only expects the economy to grow by 0.25% this year and 0.75% the following year. This would be a growth path below what would be considered the normal economic trend, or ‘soft landing’.

Putting it all together, it seems that both the BoE and the Fed are putting increasing weight on the lags. Following the recent banking turmoil, the Fed has become more attuned to these effects. The BoE appears to have raised rates to maintain credibility in light of the recent economic upside surprises. At the same time, it fears that the economic drag will be pronounced as interest rate hikes are felt more broadly over coming quarters.

As such it does appear like ‘our pilots’ have announced that we are now at cruising speed. However, they may be subject to pockets of turbulence which could result in some modest tweaks. While cruising speed, or the peak in rates, was the main debate in the past, investors are now more focussed on the potential storm clouds ahead and hence see the Fed changing course before the year is out. While the BoE is not facing the same issues in its financial system, it is dealing with more supply shocks, meaning it may have to maintain its course for longer.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.