Since Donald Trump’s inauguration, the United States entered a new era of erratic policymaking that knows neither friend nor foe—only America first. Four months into his term, President Trump issued more than 150 executive orders that began to reshape the geopolitical and economic landscape. Key policies introduced so far include increased tariff rates and restricted immigration, which are expected to distort macroeconomic measures such as consumer prices, economic growth and employment, ultimately leading to more uncertainty.

Predicting US macroeconomic variables became difficult as a stroke of a pen in the White House often changed business conditions fundamentally. Previously useful indicators derived from soft survey and hard data turned volatile, frequently surprising market participants in direction and magnitude. For example, CPI inflation and the unemployment rate have remained surprisingly calm, while the first GDP print of this year turned negative. Such seemingly contradicting data movements mean forecasting during the political and macroeconomic turbulence will be challenging.

Tariffs increase the price of foreign goods, which should lead to consumer price inflation. Yet inflation has declined since Trump’s inauguration. We expect the transmission of elevated tariffs on inflation will take a few months for various reasons. Firms tend to draw on their inventories before they raise prices to remain competitive, and the pass-through from imported raw materials and intermediary goods prices to consumer goods (and later services) prices generally takes time.

Early signals, however, suggest that inflationary pressures are rising. Prices paid by purchasing managers for manufactured goods and for services have risen significantly in the recent months. We expect that these pressures will materialise more visibly over the summer, potentially lifting inflation from 2.4% in May to 2.8% in June, and further out to a peak of 3.3% in September. These emerging price pressures support the Federal Reserve’s cautious and data-dependent approach to monetary policy.

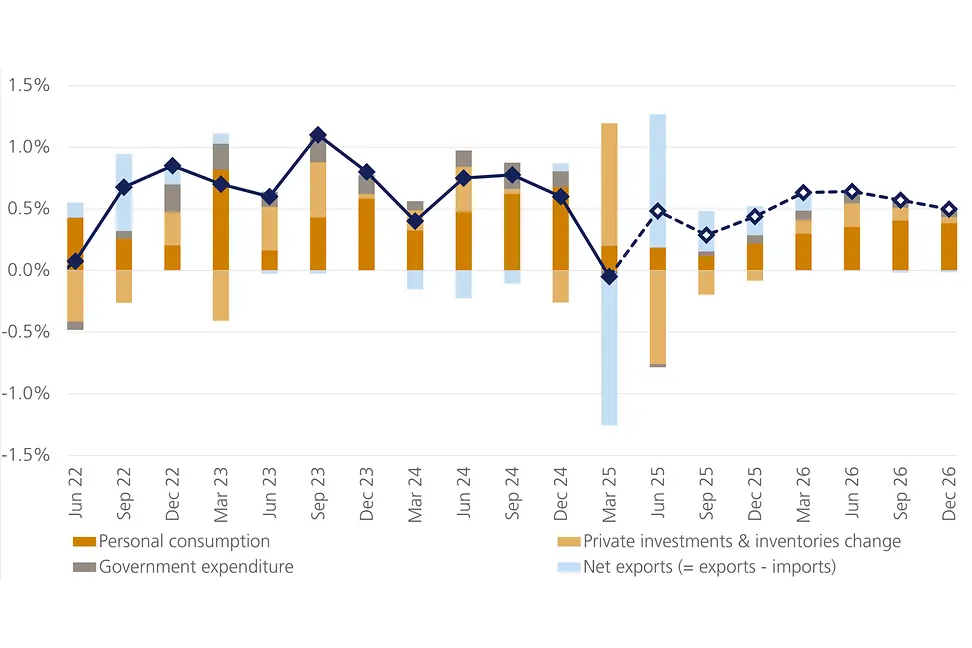

During the first days of his second term, Trump announced broad tariff rates to reshore manufacturing and reduce trade deficits. While the scale of tariffs unveiled on his so-called Liberation Day was stunning, their introduction was widely expected. In anticipation of tariffs, consumers and businesses frontloaded imports and filled up their inventories. As shown in Figure 1, the surge in imports dragged down net exports, which weighed on first quarter GDP by -1.2 percentage points (rising imports means more goods were imported rather than produced domestically, which weighs on GDP if more goods are not exported simultaneously). This was partially countered by a positive contribution of inventories. Ultimately, GDP declined by 0.1% quarter-over-quarter, lifted close to zero by the personal consumption and fixed investment components. We expect the trade policy effects to largely reverse in the current quarter. Inventories will likely be reduced, dragging on overall private investments, and imports will fall, which, we expect, results in an overall Q2 GDP growth of 0.5%.

Note: The projections presented are based on current data and assumptions and are subject to change. They should not be interpreted as guarantees of future performance, as unforeseen economic, political, or market developments may impact outcomes.

In the recent years, immigration has been a key driver of US GDP growth by boosting consumption and investment while dampening wage costs. However, the new administration’s restrictive stance, as evidenced with the developing situation in Los Angeles, is now weighing on growth. At the same time, reduced immigration is curbing labour supply, potentially mitigating a rise in the unemployment rate.

We project the unemployment rate will rise moderately, from 4.2% in May to 4.5% by year-end. The largely resilient labour market would remove pressure on the Federal Reserve (Fed) to act quickly, giving policymakers time to weigh tariff-induced inflation against its economic damage before resuming rate cuts. Markets are currently pricing in two quarter point cuts by year-end.

Beyond their delayed impact to price inflation, tariffs are already dampening economic activity due to heightened uncertainty. Rapid and unpredictable shifts in the US trade policy are unsettling consumers and businesses alike as it limits their forward planning. In such an environment, they postpone consumption and investment decisions until economic conditions stabilise.

The fallout is already reflected in sentiment data. The Consumer Sentiment Index of the University of Michigan is currently at levels seen during the recent inflation crisis, and the Conference Board’s Consumer Confidence is also still slightly depressed despite a strong recovery from its slump in the first four months of 2025.

In this turbulent economic landscape, clarity is hard to come by. Yet by focusing on the vital drivers of growth and inflation, we can chart a path forward. As Trump’s trade policy shifts introduce large swings in trade and inventories, focusing on private consumption and fixed investments—which account for 68% and 18% of GDP respectively —provides a clearer picture of the current state of the US economy. While private fixed investment grew strongly in Q1, driven by large spending on information processing equipment, consumption growth slowed. We expect both GDP components to decelerate below trend, though not enough to tip the US economy into recession. Overall, we forecast that increased tariffs, reduced immigration and prolonged uncertainty will reduce US GDP growth to around 1.2% and increase inflation towards 3.1% in 2025 and anticipate the Fed will cut rates two more times towards year-end.

[1] Federal Reserve Bank of St Louis, Bureau of Economic Analysis: https://fred.stlouisfed.org/release/tables?rid=53&eid=13146#snid=13148

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.