The end of November marks the Thanksgiving holiday in the US, which is accompanied by Black Friday sales. Whilst a long established and significant retailing week in the US, this sale period has also been successfully exported to the UK – credited to the growth and dominance of Amazon from 2010 onwards.

The origins of Black Friday are traced back to Thanksgiving in Philadelphia in the 1950s. On the Saturday of the Thanksgiving weekend, crowds descended onto the city to watch the Army-Navy football game. The surge in crowds meant the local police had to work longer shifts to help deal with human and traffic congestion – they referred to that day as Black Friday. Retailers have since put a more positive spin on the phrase and by the 1980s, it was understood that the weekend of sales helped retailers go from the ‘red’ (accounting loss) to the ‘black’ (profit). The timing of Black Friday sales also works in retailers' favour, with the proximity to Christmas allowing shoppers to capitalise on discounts for gift purchases.

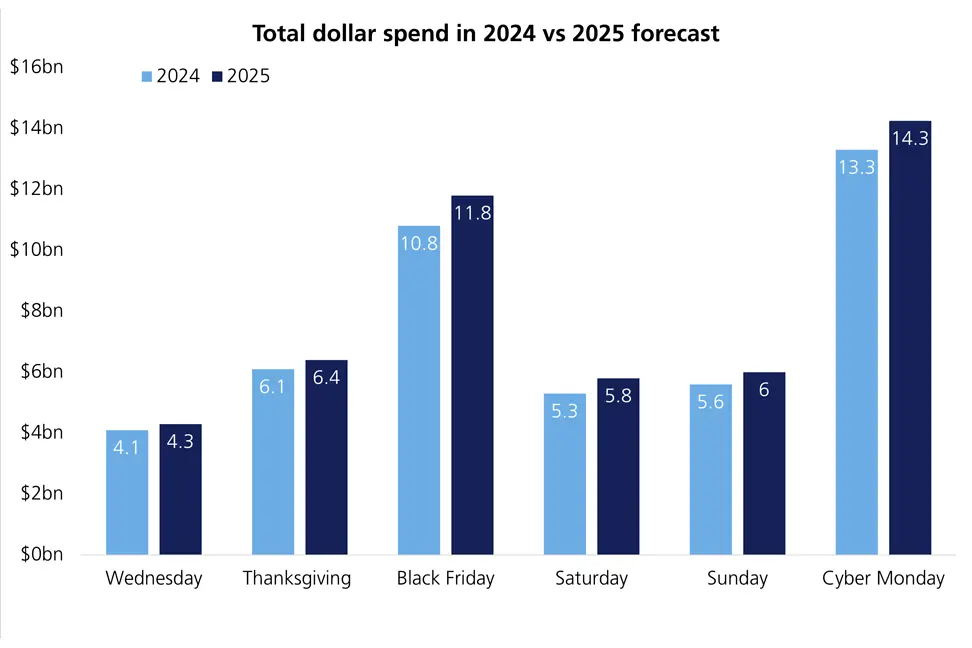

Often when we think of Black Friday, particularly in the US, there are vivid connotations of consumers queuing outside stores before then fighting over heavily discounted electronics. This is now somewhat outdated as consumers have continued to shift their spending from physical stores to online. Since 2005, the final day of the Black Friday sales period has been called Cyber Monday, initially coined to promote online shopping. Cyber Monday is now the most significant retailing day in the Black Friday week, accounting for 30% of the spend across the week and is now 20% higher than the official Black Friday.

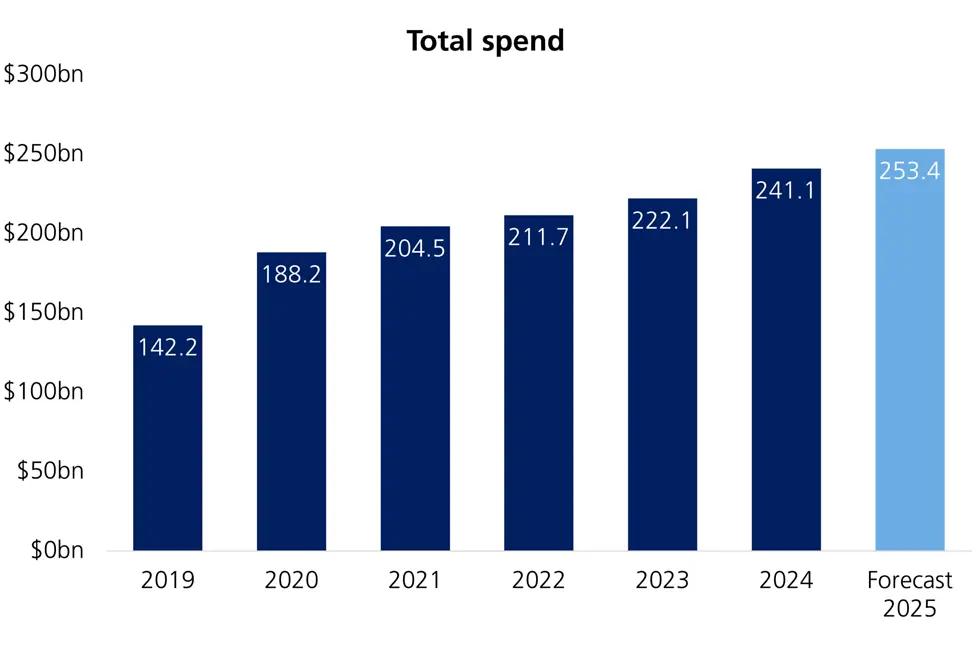

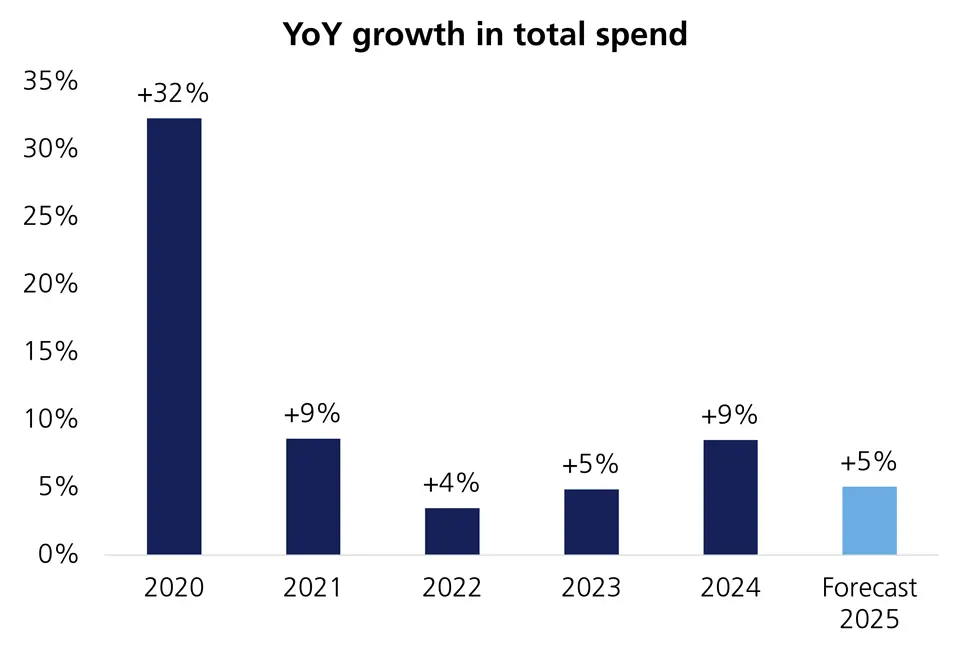

Given this holiday period’s significance in retailers’ calendars, economists and investment analysts use it as a barometer when gauging consumers’ overall health, particularly in the US. There has been consistent growth in total spend since 2019, and each year has broken new records, but the year-on-year growth has slowed from a very buoyant Covid lockdown period. In 2020, it was well documented that consumers in developed economies had elevated levels of disposable income following the inability to spend on other discretionary areas, particularly travel and leisure.

|

|

Following the extremely strong Covid years in 2020-2021, consumers have had to contend with a significant uptick in inflation globally. What has also added to the complexity for retailers, particularly in the US, has been the widespread introduction of US tariffs. Retailers in developed countries have typically relied on less expensive imported goods from countries such as China. But the tariffs mean these imported goods are now materially more expensive compared to prior years. The conundrum for retailers is to decide how much of the inflated cost can be passed on to and absorbed by the consumer.

In the US and UK, there has also been the issue of flat real wage growth over the past couple of years – i.e. consumer’s spending power when accounting for the impact of inflation. If real wage growth was more widespread, retailers would probably have more success protecting their margins by passing on these higher costs. This is supported by data from Salesforce1, which confirmed that whilst average selling prices were up 7% year-on-year, order volumes declined 1% in the same time frame. Based on retail intelligence and traffic data from RetailNext,2 in-store traffic was down 3.6% year-on-year. This early data is helpful, but further insight on how the traditional physical retailers have performed will come out when those listed companies report their next set of earnings in early 2026.

The ongoing shift from spending in physical stores to online is a well-known and established trend. What is more interesting following this year’s Black Friday period has been the increased adoption of artificial intelligence (AI) by consumers using large language models (LLMs) such as ChatGPT and Google’s Gemini to assist their search. Adobe confirmed that in November the spend on mobile devices grew 7.2% year-on-year and now stands at 53% of the share of expenditure. Furthermore, there was a staggering 758% year-on-year increase in AI traffic – consumers who began their retail search on an AI platform, who were then ultimately referred to the retailer.

The adoption of AI and the continued growth in online shopping have bolstered the consumer’s toolkit – consumers are becoming more specific in their hunt for bargains and appear to be savvier and more precise when shopping. Indeed, there is a greater awareness of retailers’ pricing tactics, as retailers seek to exploit psychological pricing strategies. Consumers can now not only compare prices easily across retailers, but they can also use third party sites to investigate the historic pricing of a good. This often reveals how genuine the discount is.

With consumers shopping online in greater numbers, it has never been easier or quicker to search for a better price or alternative. This means the historic bricks and mortar retailers, such as Walmart, Costco or Target, are no longer able to rely on significant footfall and convenience to the captive consumer. Now, even when in a physical store, consumers can quickly assess the price of a good. Retailers have therefore had to adapt their strategies as consumers evolved.

The Black Friday period remains critical for retailers both online and physical, but the landscape continues to evolve. The shift from physical stores to online shopping shows no signs of slowing, and AI-powered search tools are accelerating this trend – empowering consumers to compare prices, verify discounts and find better deals with unprecedented ease.

For retailers, 2025 has been particularly challenging. The combination of lingering inflation, widespread tariffs, and flat real wage growth has squeezed margins and consumer spending power. Traditional pricing strategies are increasingly transparent to tech-savvy shoppers who can instantly fact-check “Black Friday deals” and compare alternatives across platforms.

The retailers who thrive will be those who adapt to this new reality – competing not just on price but on genuine value, seamless online experiences and the strategic use of AI to meet consumers where they are. As Black Friday data continues to serve as a barometer for consumer health, this year’s results underscore a clear message – the power balance has shifted decisively toward the informed, digitally-enabled consumer.

[1] Source: Black Friday Data Shows Online Sales Strong, Store Results Mixed

[2] Source: Black Friday Data Shows Online Sales Strong, Store Results Mixed

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.