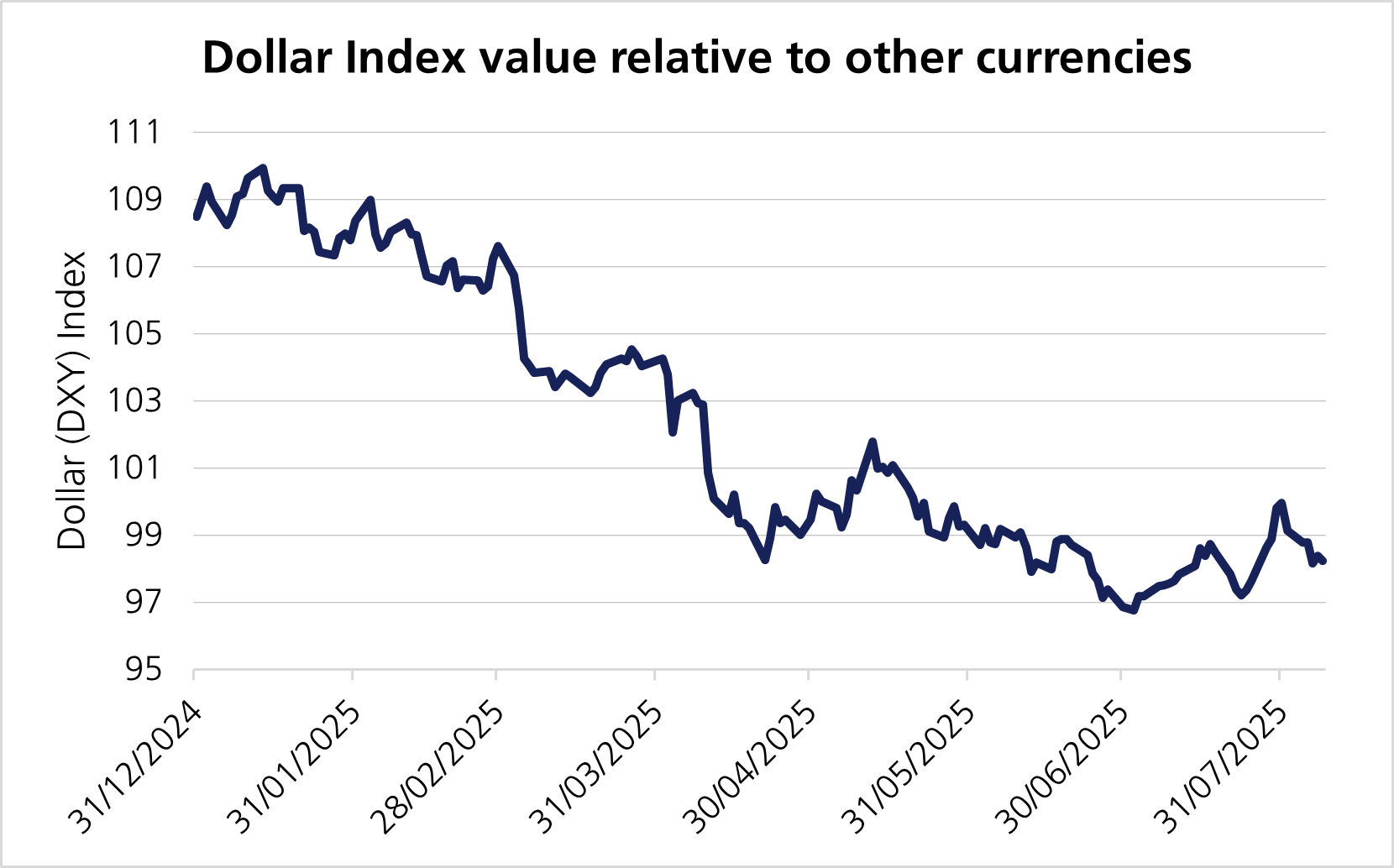

President Donald Trump’s chaotic rollout of tariffs has had an enormous impact across asset classes this year. But none have felt the impact as much as the dollar, which got off to its worst first half of the year in more than half a century. The greenback weakened by more than 10% in the first six months of the year. The last time the dollar registered such poor performance was in 1973, when the US stopped linking the dollar to the price of gold.1

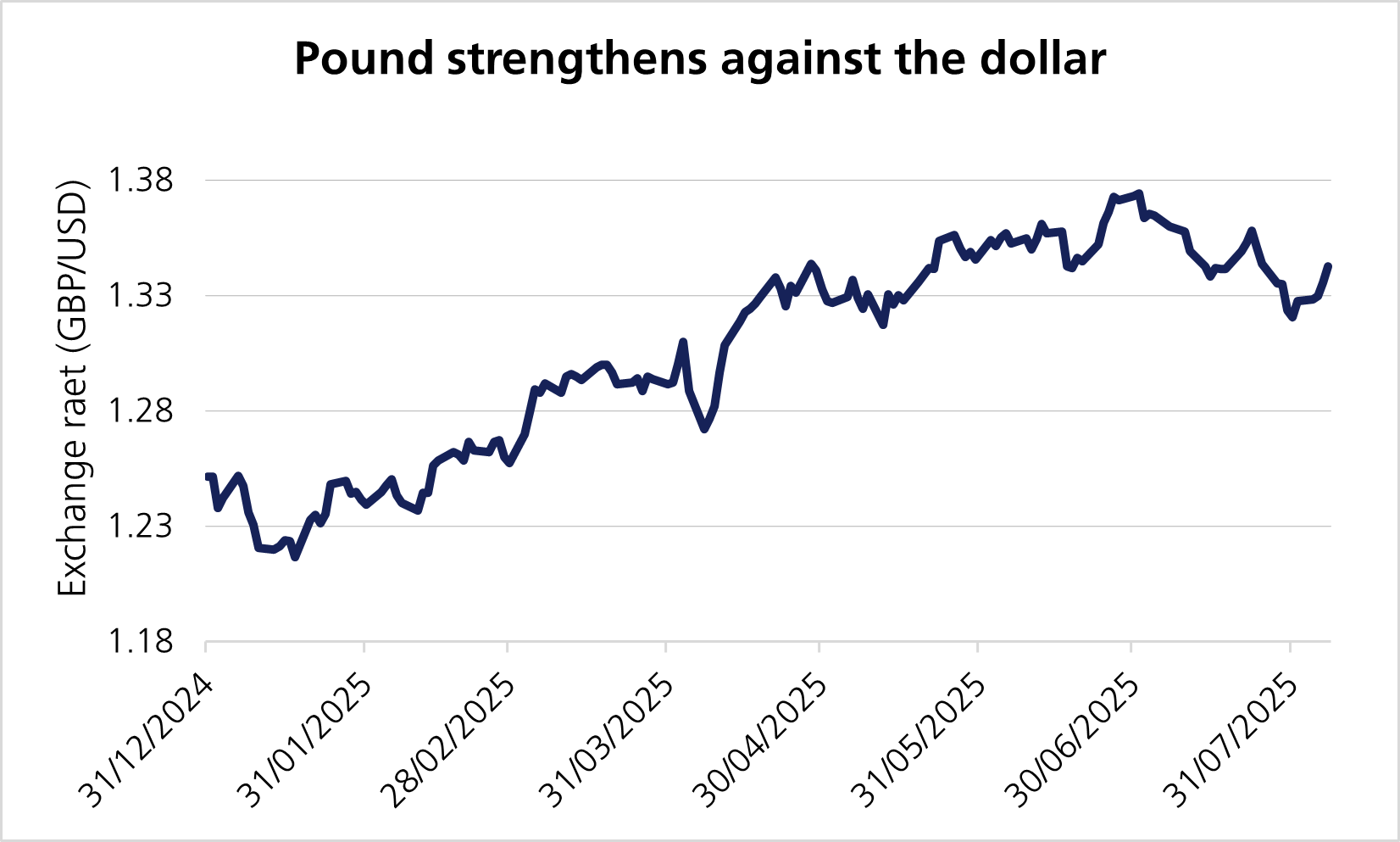

Dollar weakness this year is particularly stark when compared to the British pound, which has led some to argue this is a sign of relative strength in the UK economy or in sterling itself. This week we take a closer look at the cable trade this year – the exchange rate between the dollar and the pound – and delve into the dynamics at play for one of the world’s most traded pairs in foreign exchange (FX) markets.

The recent appreciation in the pound vs the dollar – seen with the euro, Australian dollar and others – is primarily driven by broad-based dollar weakness rather than any specific factors relating to the UK. Underlying macroeconomic data in the UK has remained subdued, with muted growth, persistent inflation pressures and cautious Bank of England (BoE) guidance about future rate cuts.

There are several key drivers that have weakened the dollar relative to a basket of currencies, which we outline below.

The first half of the year saw US GDP growth of around 1% on average, but most economists expect this to move down slightly in coming quarters over uncertainty about how tariffs will weigh on business capex and the end consumer. Meanwhile the core PCE (Personal Consumption Expenditures) index – the Federal Reserve (Fed)’s preferred inflation gauge – came closer to the Fed’s target of 2%, reaching 2.7% in May. Although it is still too early to assess the tariff impact on inflation, most economists believe the impact will become evident in the next few years, keeping inflation persistently above the Fed’s target.2

There has also been a shift in market expectations of future Fed rate cuts, with markets increasingly pricing in the chances of a Fed cut at its next meeting in September following recent weaker-than-expected jobs report.3 The Fed’s policymaking arm, the Federal Open Market Committee (FOMC), has remained steadfast against lowering interest rates for some time – inflation remains above the Fed’s 2% target rate, and Fed Chairman Jerome Powell has said the Fed is waiting to see how tariffs will impact inflation before considering more cuts. But the softer-than-expected jobs report on 1 August – which weighed on the dollar further – has also led markets to price in a 90% chance of a rate cut at the Fed’s September meeting.4

The US fiscal situation continues to deteriorate, with the Senate passing Trump’s so-called “big, beautiful bill”, a bill that will substantially raise the US deficit levels. Some economists are forecasting this package of tax cuts will elevate the deficit to 6.5% to 7% of GDP over the next few years5 and could add an estimated $3.3 trillion to the national debt over 10 years.6 This increased debt means the US government will issue more Treasuries, but investors are concerned over the US government’s ability to repay this substantial debt. This in turn has led to a loss in confidence in not only US Treasury markets, but in the dollar itself as investors rotate into other asset classes as global risk appetite improves.

Global investors have been increasing their outright US dollar exposure over the past decade. Despite global money managers’ and pension funds’ obligations in local currencies, they have been reluctant to hedge their dollar, primarily because the dollar has acted as a natural hedge for their portfolios – when markets fell, the dollar appreciated. However, since the start of this year, a softening dollar has adversely impacted returns for foreign investors in US assets. As a result, foreign investors have started hedging more of their portfolio. And since the dollar declined along with US risk assets, it lost its natural hedging protection. This ultimately encouraged more investors to hedge.

So the recent pound appreciation against the dollar is primarily a story about the weakening dollar, rather than about the state of the UK economy or policy.

Whilst there is no doubt that the rally in the dollar over the past few years has resulted in an overvalued greenback, we do believe the recent weakness mentioned above may slow and even reverse in the next six-to-12 months. Tariff concerns subsiding, strong US corporate earnings growth relative to other developed markets, and expectations that the US economic growth will outpace other developed markets all suggest that the pace of the weakening dollar may slow or even stop, resulting in a more range bound dollar/sterling rate.

The UK meanwhile remains exposed to several structural and cyclical challenges that could weigh on sterling, such as political uncertainty, subdued productivity and less policy flexibility.

It is important to remember that equity markets are efficient, and global companies’ share prices are influenced by currency movements. If the dollar does continue to weaken against the pound, share prices of some companies, such as Apple, could experience a boost as their overseas earnings in dollar terms would go up. Currencies are difficult to predict, but demonstrate good mean reverting characteristics, meaning they tend to return to a long-term average or equilibrium level after periods of divergence.

At LGT, our philosophy is to keep our equity exposure unhedged. However, we do closely monitor portfolio exposure and sensitivity to FX moves. We believe in the long-term growth potential of equity markets and view short-term volatility as an opportunity to buy quality assets at discounted prices. By remaining unhedged, we stay fully aligned with the market’s natural growth trajectory, allowing us to better capture the upside. That is not to say we do not take advantage of extreme currency moves – we hedged part of our dollar exposure during the Liz Truss debacle when we believed the pound was oversold.

[1] NYTimes: The Dollar Has Its Worst Start to a Year Since 1973

[2] JPMorgan: Macro & Markets Midyear Outlook

[3] Forbes: Fed Expected To Cut Interest Rates In September

[4] Deutsche Bank

[5] Deutsche Bank

[6] BBC: The key items in Trump's 'big, beautiful bill'

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.