Following a year of weak growth and high inflation, next year will see moderating price pressures drive further rate cuts. Growth is set to pick up, but tax increases and political headwinds could dampen sentiment.

Following a year of weak growth and high inflation, next year will see moderating price pressures drive further rate cuts. Growth is set to pick up, but tax increases and political headwinds could dampen sentiment.

Looking back at 2025, the UK struggled to shake off sluggish growth and sticky inflation. Following solid growth in the first quarter, fiscal and tariff concerns, along with weak consumption, weighed on growth for the rest of the year. While inflation pressures moderated over the first quarter, they steadily rose throughout the summer, as some of the newly elected Labour Party’s tax increases added to inflationary pressures, particularly in the food and drink sectors. The Labour Party, which secured a landslide victory in July 2024, fell out of favour shortly afterwards, setting the scene for a more challenging political backdrop.

Looking ahead to 2026, there are three key themes to look out for in the UK.

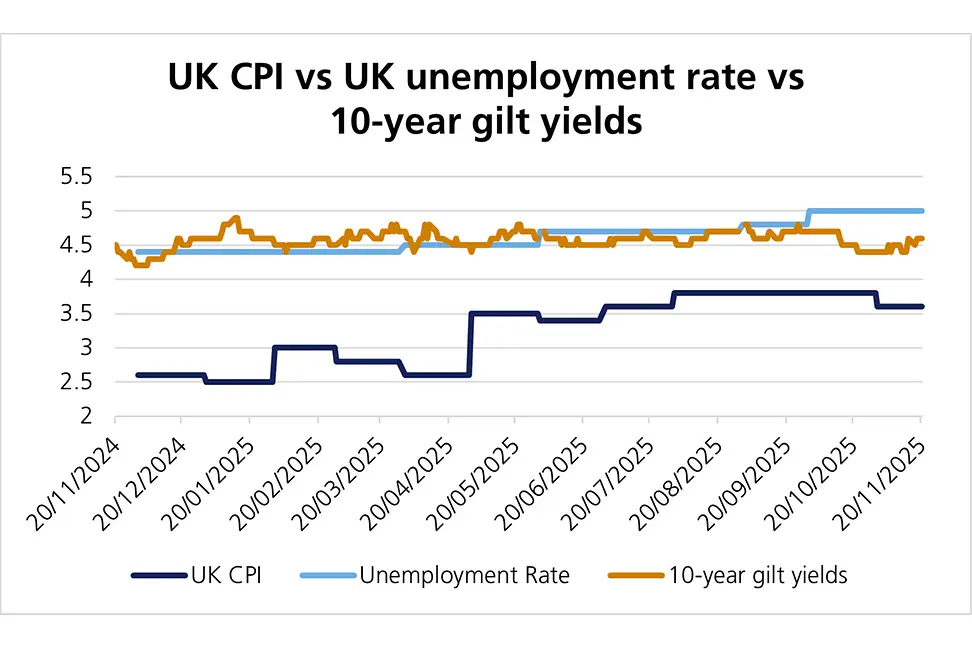

Inflation fell to 3.2% for the year to November, the lowest level in eight months. The decline is positive and provides further evidence that inflation has peaked, although it remains well above the Bank of England (BoE)’s target rate of 2%. We believe inflation is set to trend moderately lower over the course of 2026, providing scope for the BoE to reduce rates over the year to around 3.25%. The unemployment rate has ticked up to around 5%, the highest rate since the pandemic, fuelling further speculation that the BoE will lower interest rates.1 However, bringing inflation down may prove difficult as some of Labour’s tax increases filter through – many argue that increases in employers’ National Insurance Contributions (NICs) have contributed to keeping inflation firmly above target. As a result, the BoE will face the challenge of balancing weak growth with persistently elevated inflation.

Among developed market counterparts, the UK faces a complicated fiscal outlook with recent tax increases expected to weigh on consumption. As the government struggles to cut expenditure, largely due to increased disability benefits and a National Health Service facing the strain of an ageing population, the UK bond markets and international investors are taking notice. UK gilt yields are among the highest in the G7 with a relatively steep curve, indicating investors remain concerned over the country’s fiscal sustainability. Meanwhile, the country’s large fiscal deficit, lack of reserve currency status and heavy reliance on foreign investors make it particularly vulnerable compared to other advanced economies. In the latest budget, the Chancellor announced plans to raise taxes further, thereby increasing the fiscal headroom to £22 billion from £10 billion, which reduces the risk of further tax increases.

Would you like to learn more about what investors should expect from 2026?

Voters handed Labour a significant majority in July 2024 and a monumental task – to boost growth, reform welfare and control regulation, all without raising taxes. Two budgets later, both of which included tax increases, have seen the Labour government’s popularity decline, leading to murmurs of replacing the prime minister. The historic two-party system in the UK has seen voter share decline in both parties, as voters defect to previously fringe parties such as Reform, overseen by former UK Independence Party (UKIP) leader and Brexit campaigner Nigel Farage, and left-wing parties such as the Green Party led by Zack Polanski. Although the Labour government does not have to call a general election until August 2029, we may witness this political discord gather steam in 2026. Reports about dislodging the prime minister are exposing deep tensions in the British government, with reported discontent coming from several rival factions across the Labour Party2, including from the so-called soft left which could erode investor confidence further.

Given the country’s sluggish economic backdrop, sterling only saw moderate gains versus the US dollar. While high interest rates offered some support, it weakened versus the euro. The pound benefited from investors moderating their risk, as they sought alternatives to the dollar, which further bolstered demand for sterling. Looking ahead to 2026, sterling’s direction will be shaped by fiscal policy, interest rate developments, and broader global market developments such as geopolitics and cross-border capital flows. Ongoing divergence in growth outlooks and monetary policy between the UK and other major economies will remain key drivers for sterling in 2026.

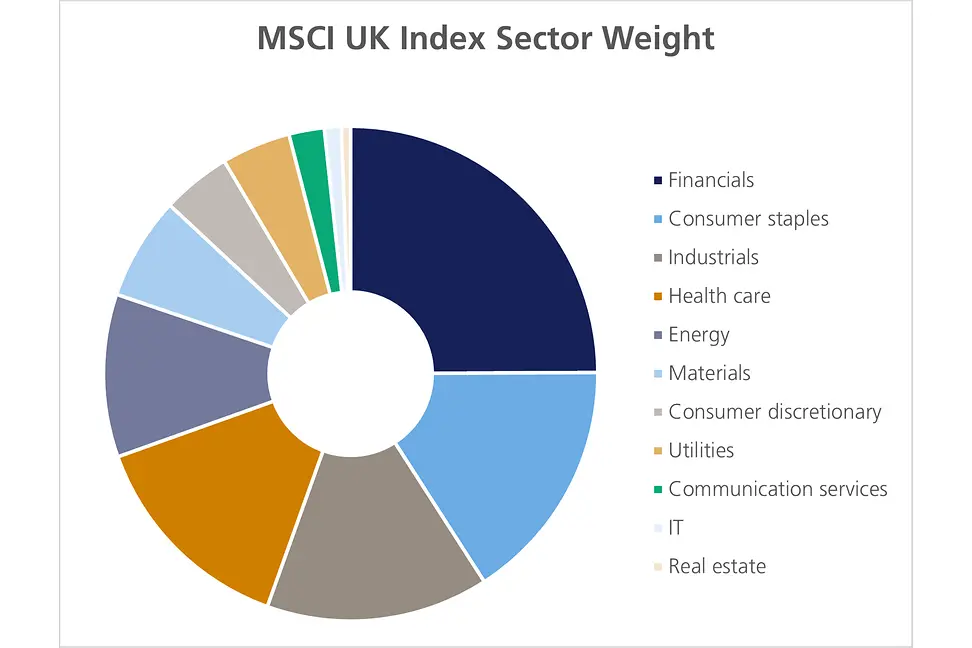

UK equities posted solid performance in 2025, with international investors diversifying beyond US technology stocks and finding value in UK large-cap shares, which trade at relatively low valuations. The MSCI UK Index benefited from companies across a variety of sectors, including energy, financial and consumer staples, many of which derive significant earnings from overseas. UK large-cap stocks appear well placed to benefit from global growth. Looking ahead, equity performance will be determined by fiscal and monetary policy, the health of the global economy and ongoing geopolitical developments.

The outlook for the UK remains challenging as the country grapples with high inflation, complex fiscal constraints and a shifting political landscape. While falling inflation offers some scope for the central bank to lower policy rates, the government’s limited fiscal flexibility and heightened reliance on foreign investment continue to amplify market sensitivities. At the same time, political disillusionment and fragmentation suggest further instability ahead. The UK economy faces a precarious balancing act – navigating inflationary pressures, fiscal headwinds and political uncertainty in a rapidly evolving global environment.

[1] Office for National Statistics

[2] The five Labour factions plotting against Starmer

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.