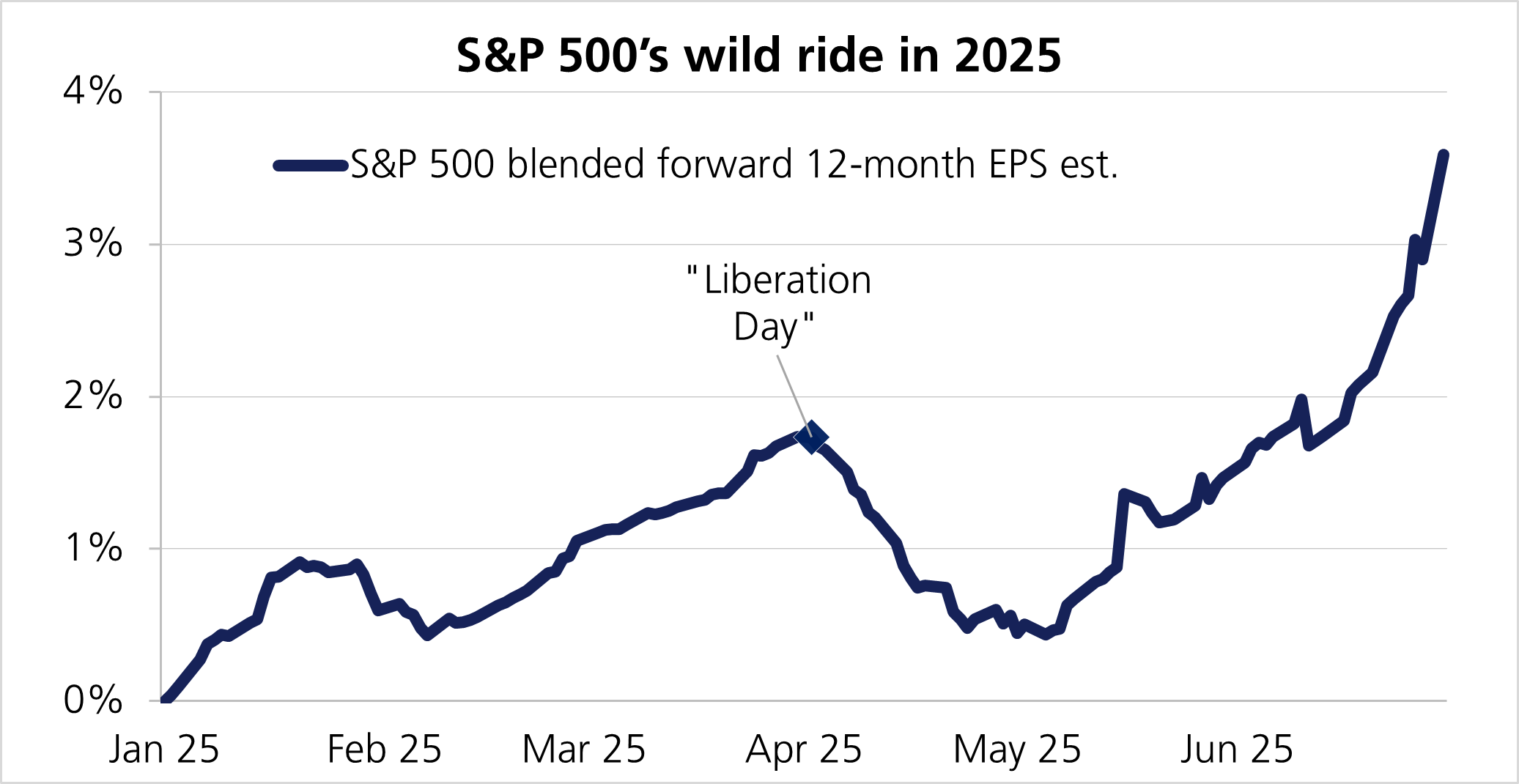

Gains in global equities over the second quarter masked the extreme volatility experienced in early April when President Donald Trump unveiled his sweeping tariffs on so-called Liberation Day. The tariffs prompted sharp declines across equity and bond markets worldwide, although Trump’s subsequent backtrack on tariffs along with a strong first quarter earnings season helped stocks and bonds recover. The dollar was the real victim of the quarter, as erratic policymaking from the US administration eroded confidence in the greenback.

Trump’s sweeping tariffs, which included a baseline tariff of 10% on all countries and higher rates for certain regions, elicited strong reactions both domestically and internationally. Equities experienced a sharp risk-off response, with the S&P 500 posting its fifth biggest two-day decline since World War II.1 The equity market sell-off in April led investors to seek safety in gold as recession concerns mounted. The surprise Liberation Day tariffs triggered fears of higher inflation and economic disruption, rattling investor confidence in US Treasuries—normally a safe haven. Yields on 10- and 30-year Treasuries rose by as much as 0.3% in a matter of days even as equity markets sold off. This led Trump to make a U-turn and announce a 90-day pause on most tariffs.

The recovery in bond markets soon spread to equity markets. The tariff rollback combined with a robust set of first quarter corporate earnings in the US helped reverse many of April’s losses. The S&P 500 rose 6.3% in May and 5.1% in June, ultimately ending the quarter up 10.9%,2 although given currency headwinds, the total return was 4.4% for sterling investors.

Stronger-than-expected macro data both in the US and Europe helped sentiment and alleviated concerns the US was facing an imminent recession. Stocks pushed higher as news of potential trade deals between countries filtered through, including frameworks between the US and the UK and the US and China. The deal between China and the US, which includes an agreement for Beijing to speed up exports of rare earth minerals, may help stabilise relations between the two countries following an escalating trade war where both sides slapped sky-high tariffs on each other’s goods.3

Following Germany’s pledges to boost defence spending, NATO (North Atlantic Treaty Organisation) allies promised to raise defence spending to 5% of GDP by 2035,4 which sent European equities higher. Germany’s DAX Index rose 7.9% in the second quarter and the Stoxx Europe 600 Index gained 3.3%. Performance in these markets is even more impressive in US dollar terms.

Asian equities saw large declines due to April’s tariffs, although experienced strong rebounds once the tariffs were paused. Hong Kong’s Hang Seng rose 5.8%, China’s Shanghai Composite gained 4.2% and Japan’s Topix returned 7.4% in the quarter.

After Trump’s initial bold claims that he would broker a deal between Russia and Ukraine in one day, more than five months into his second term, this looks as far away as ever. Both Russia and Ukraine remain firmly entrenched in their positions on territorial disputes and sovereignty.5 Meanwhile Israel’s attacks on three key Iranian nuclear facilities and subsequent twelve-day war led to a short-lived rise in oil prices in June, although Brent finished the quarter 10% lower at $67 a barrel.

The divergence in central bank’s paths continued as they embark on the challenging task of tariff-induced shocks on growth and inflation. The Federal Reserve (Fed) held rates steady at its meetings in May and June, sticking to a wait-and-see approach as officials prepare for how tariffs will impact prices. Fed Chairman Jerome Powell insisted he is not in a hurry to lower rates, saying in May the Fed is well positioned to respond in a “timely way to potential economic developments”.

The Bank of England (BoE) meanwhile lowered rates to 4.25% in May, carrying on with its 0.25% reduction every quarter since it began lowering rates last year. Although the latest cut was widely expected, policymakers were split, as concerns mount over how Trump’s tariffs will affect UK growth. Two out of the nine Monetary Policy Committee (MPC) members favoured a larger 0.50% cut, while two others voted to keep rates unchanged. Markets expect the BoE to maintain the current pace of one cut per quarter for the rest of the year.

The European Central Bank (ECB) cut rates twice in the quarter by 0.25% at each meeting, reducing its rates by half since peaking at 4% last year. While the rate cuts were anticipated by markets, the pace of futures cuts is likely to slow down as members become increasingly split on the path forward given rising trade tensions and the impact on global prices.

Trump’s aggressive trade and foreign policy rhetoric have further heightened global tensions and had a tremendous impact on the US dollar’s safe haven status. As a result, investors have been diverting assets from the dollar—seen as the world’s reserve currency—to other currencies and gold. This sent the dollar down 7% in the second quarter and down 10.7% so far this year, with the dollar index now having its worst first half performance since 1973.6 In the second quarter, the dollar lost ground against every other major G10 currency.7

Investors are pricing in rate cuts in the second half of 2025, leading to global yield curves steepening as investors grapple with mounting debt supply. Adding to these concerns is Trump’s so-called “big, beautiful bill”. This bill, which would extend Trump’s tax cuts from his first term, is projected to put the US on a path of even larger debt and deficits. This pushed 30-year Treasury yields 0.2% higher to 4.77%, while five-year Treasury yields declined by 0.15% to 3.8%. Overall, developed market government bonds delivered moderately positive returns over the quarter, as the income component remains a powerful driver of returns.

While equity markets ultimately ended the quarter in positive territory, the journey was anything but smooth. The sharp swings triggered by Trump’s aggressive tariff policy—and his subsequent reversal—highlight how vulnerable global markets remain to unpredictable policymaking. Although investor confidence rebounded on the back of strong corporate earnings and resilient macro data, this quarter served as a reminder of how challenging forecasting has become.

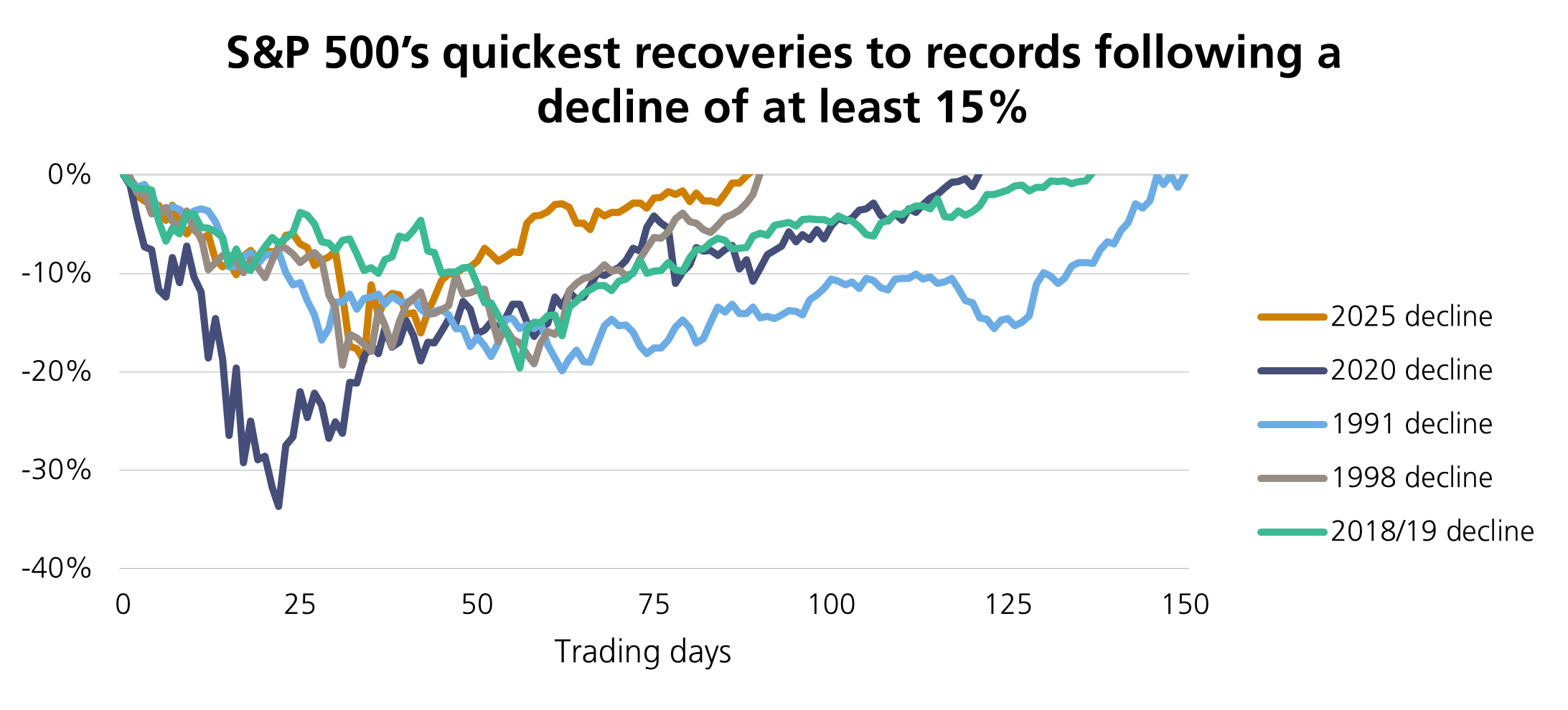

Yet despite the volatility, markets proved resilient. It has been a turbulent start to the year, but staying invested meant clients benefited from rising markets overall. With geopolitical risks unresolved and the US debt trajectory bringing increasing scrutiny, uncertainty remains. As this quarter has shown, maintaining a long-term outlook and a well-diversified portfolio continues to serve investors well, even as markets experience short-term shocks.

[1] Deutsche Bank, Bloomberg

[2] Deutsche Bank, Bloomberg

[3] NY Times: https://www.nytimes.com/2025/06/27/world/asia/us-china-trade.html

[4] NATO: https://www.nato.int/cps/en/natohq/topics_49198.htm

[5] NPR: https://www.npr.org/2025/06/02/nx-s1-5414522/ukraine-peace-talks-russia-trump-putin-istanbul

[6] Deutsche Bank, Bloomberg

[7] Deutsche Bank, Bloomberg

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.