Earnings season – the time of year when companies report their quarterly or annual results – offers investors a unique and valuable opportunity to look under the bonnet of corporates and take a sense check. Although earnings only represent a small snapshot in time, they can also provide vital insight into whether a particular fundamental story or theme is playing out in specific companies or sectors. Crucially, earnings allow us to closely inspect companies’ results to see how they are performing and if there is anything happening that warrants deeper inspection or scrutiny.

Earnings effectively function like a pit stop in a Formula 1 race – the brief, high intensity moment during the race when the car pulls into the pit lane for maintenance and adjustments before continuing the race. But this most recent second quarter earnings have been particularly scrutinised given heightened volatility, geopolitical uncertainty, and how President Donald Trump’s tariffs have impacted companies around the world.

This week, we take a closer look at the second quarter earnings season, discuss what stood out, and what the potential outlook is for the rest of the year.

At the headline level, the resilience of the US market remains remarkable. Despite all the news, noise, and new geopolitical uncertainty that has arrived in 2025, the S&P 500 still managed to grow sales by 6% and earnings 12% over the year.

But for us, two themes rose above the noise: tech giants opening their wallets, and the return of tariffs as a headline risk.

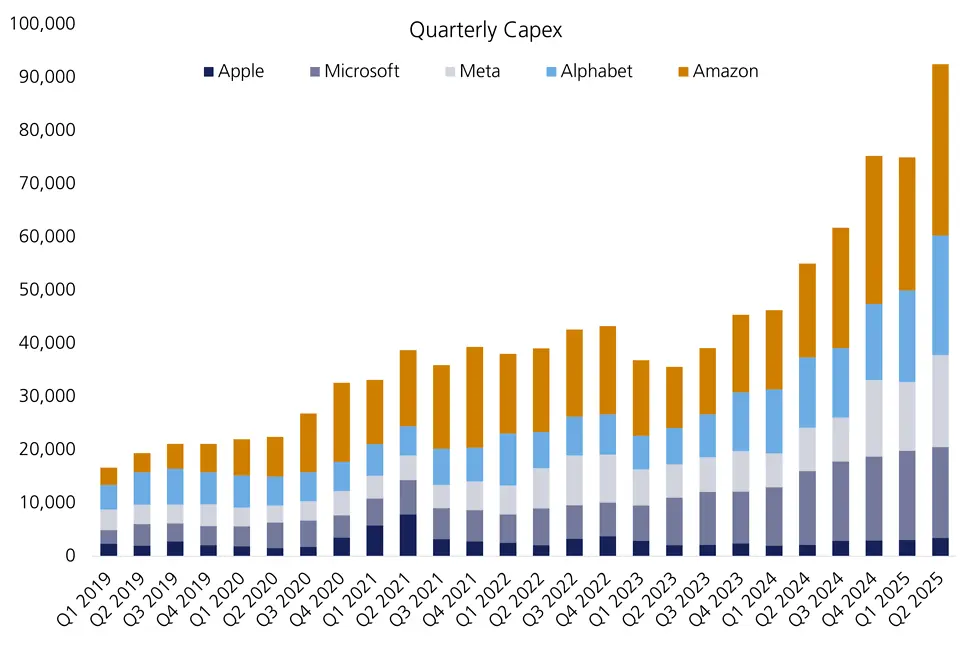

The AI wave powered on, with some of the biggest companies in the world now spending more money to capture this opportunity than the GDP of many mid-sized countries. The five biggest capex spenders will be familiar to all: Alphabet, Amazon, Apple, Meta and Microsoft.

While these companies have grown sales extensively over the last few years, capex spending is outpacing sales by some margin. For these big five spenders, capex has gone from 10% of sales in Q4 2022 (when ChatGPT was first released) to 19% of sales now, and research and development (R&D) to sales has ticked up from 13% of sales to 15%. Another way to think about this – for every dollar of sales these companies bring through the door, they send 19 cents back out the door in capex/investing and another 15 cents in R&D – so 34 cents of every dollar of sales must be spent to stay competitive. Capex and R&D are not a bad thing – they are simply the price of doing business to remain competitive. However, the emergence of AI has meant this price has gone up for these companies, and they need to spend more to remain at the front of the pack.

So that begs the question, where’s the return on all this AI spending?

The companies that have seemed to benefit the most over the last few years have been Nvidia and TSMC, who as of this quarter have revenue growing 56% and 39% YoY respectively, as the demand for AI chips and graphics processing units has exploded since the launch of ChatGPT.

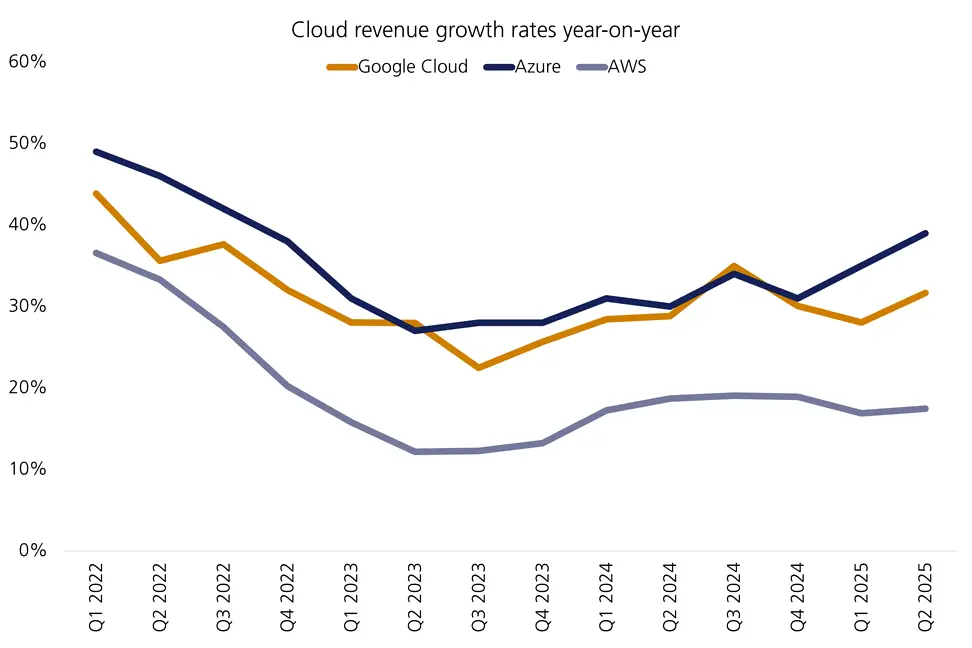

But what bang for their buck are the big spenders getting? The first place it might start to show up is in their cloud businesses, as it is logically the easiest place to integrate and distribute their AI products and capabilities.

Amazon, Microsoft and Google have the three biggest cloud businesses in the world, and this earnings season, we saw cloud business growth accelerate. Google had the most notable acceleration while Microsoft had solid growth. Amazon’s momentum was less noticeable. The question now is will we see AI investment translate into sustainable sales growth for these cloud providers in the future?

We’re in the very early stages of AI integration, and most companies are still figuring out the best way to monetise this opportunity, but the reality is that there’s no such thing as a free lunch. At some point, this enormous spend on capex and R&D will need to translate to returns. If returns don’t start to appear, we expect these companies to slow the pace of spending and become more targeted with their investments. However, in the meantime, mega tech companies have incredibly profitable businesses models which give them the deep pockets for all this spending, putting them in an enviable position compared to companies in other sectors. AI isn’t just an exciting opportunity – it is a watershed moment for the global economy, and will redefine industries, reshape societies and rewrite the rules of innovation.

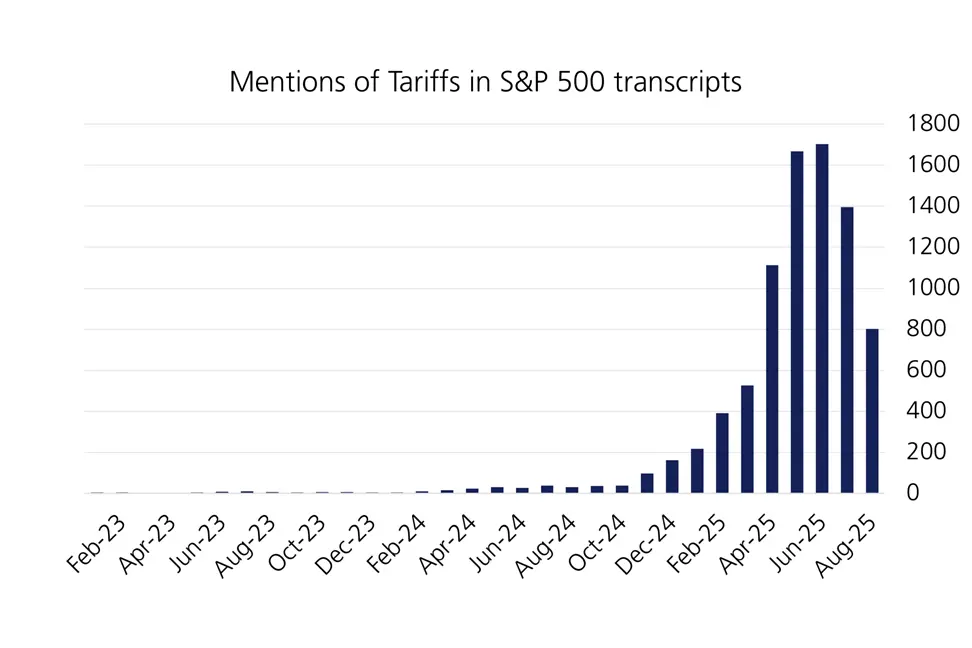

It may seem like a lifetime ago, but so-called Liberation Day on 2 April and the ensuing tariffs have become increasingly more important and visible for companies and investors. The broad, sweeping, and frankly confusing widespread tariffs have since been tempered to more reasonable levels as negotiations between the US government and its trading partners have progressed.

These added costs and trade disruptions have very real effects, and companies are acutely aware of that reality. Mentions of tariffs have been on the rise since Trump was elected in November 2024 and peaked just after Liberation Day.

But given tariffs were announced after the first quarter ended, the second quarter results are the first time we’re seeing them show up in company financials. From what we’ve seen, tariffs are going to affect companies very differently depending on the nature of their business.

For Ford, the material intensive car manufacturer, management stated there were $800 million of tariff costs in the quarter, which is more than the $511 million they reported in operating profit for Q2.

Apple similarly had $800 million of tariff-related costs in the quarter on its smartphones and software. But Apple also reported over $28 billion in operating profit and so the impact was relatively small.

It is clear mega-cap companies will have an easier time absorbing tariff costs. Amazon’s CEO almost brushed aside a tariff-related question on the online retailer’s earnings call: “There continues to be a lot of noise about the impact that tariffs will have on retail prices and consumption. Much of it thus far has been wrong and misreported. As we said before, it's impossible to know what will happen.”

These are just the first signs of direct costs of tariffs to companies. We are yet to see how tariffs impact economic growth, consumers, global supply chains and trading partners, although all of this will become more clearer in upcoming earnings. One thing we do know is that tariffs represent a change in global trade conditions, and they will not impact companies equally. For some they are a very real headwind, others a passing breeze.

This earnings season highlighted the different ways companies are preparing for the future, whether investing heavily in the technology of tomorrow or navigating changing trade winds today. The road ahead may be uneven, but for investors willing to look past the noise, there are opportunities. Patience and a focus on long-term investing help us navigate the short-term ups and downs seen across markets.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.