It has been a tumultuous few years for British homeowners, who have seen their borrowing costs shoot up due to the Bank of England (BoE)’s attempts to curb inflation. Lately, the picture is looking a little brighter. In recent weeks, more banks have launched fixed mortgage deals below 4%, offering respite to homeowners locked in higher floating rates, or those looking to remortgage from higher fixed rates set several years ago.

Earlier this month, the BoE reduced rates by 0.25%, representing a cumulative reduction of 1% since interest rates peaked at 5.25% in August 2023. Many investors expect another two rate cuts this year, implying that the BoE will carry on with its one-cut-per-quarter pace. However, the debate around how far and fast rates will come down has been fluid as increasing global trade tensions muddy the outlook.

One of the key indicators influencing the BoE was the release of UK inflation data for April, which was published earlier this week. Although inflation had been cooling for several months, economists and the BoE forecasted higher inflation because of changes in utility bills and other annual price increases that are effective in April.

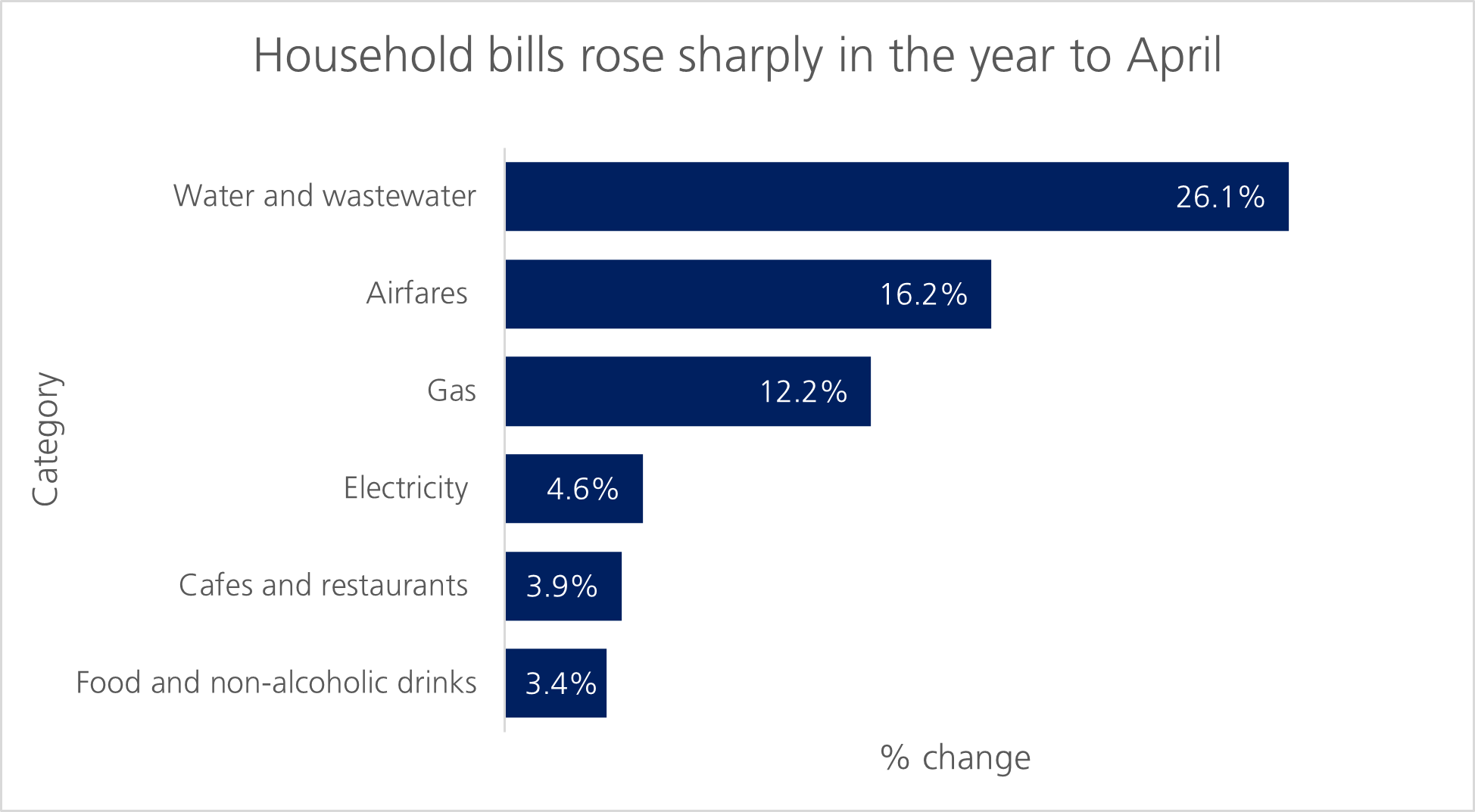

Factors impacting this latest CPI print are a staggering 26% rise in water bills; the new Office of Gas and Electricity Markets (Ofgem) price setting, which saw in April the annual bill for a household using a typical amount of gas and electricity rise to £1,849 per year, an increase of £1111; and increases in internet services and cable, cafes and restaurants and transportation/airfare.

Inflation from previous periods influences these numbers, which highlights the ripple effects of historical price increases. But this mix is further complicated by the timing of Easter this year, which led to higher flight costs over the school holidays in the UK.

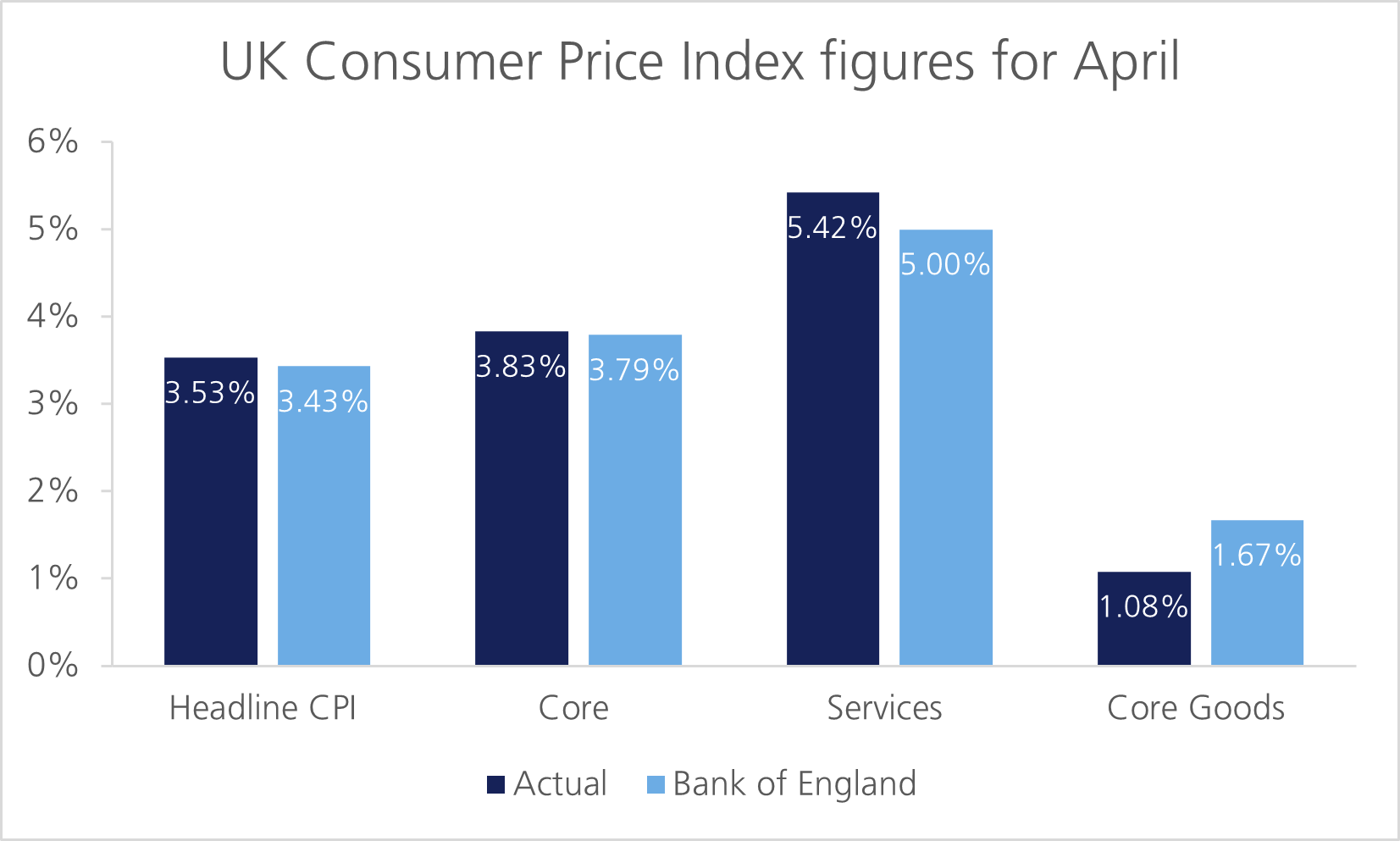

The increases in water, gas and electricity prices in April, along with a host of other bills, pushed inflation to 3.5% in April, up from 2.6% in March.2 The figures on a month-on-month basis meanwhile rose to 1.2% in April, relative to expectations of 1%.3 Core inflation—which excludes food and energy—and headline inflation experienced sharp increases, suggesting price increases across the board.

It is worth noting that the BoE has been predicting for some time that inflation would be higher in the summer of 2025 before gradually falling closer to its target level of 2% by mid-2026. In February, the BoE forecasted Consumer Price Index (CPI) inflation would hit 3.7% in the summer of 2025, but in its most recent report, revised projections to 3.4% in Q2 and 3.5% in Q3. So the actual figures are not far off the BoE’s original forecasts.

The key question now is whether this will alter the BoE’s interest rate path.

Huw Pill, chief economist at the BoE, said at a Barclays conference this week the “withdrawal of policy restriction has been running a little too fast of late, given the progress achieved thus far with returning inflation to target”. Pill, who opposed the quarter-point reduction earlier this month, advocated policymakers “skip” reducing rates rather than “halting” the process of lowering levels. “My starting point is that the pace of the Bank Rate reduction should be ‘cautious’, running slower than the 0.25% per quarter we have implemented since last August,” Pill said, as he justified his “courage not to act”.4

The BoE meanwhile stated that given the committee’s “evolving view of the medium-term outlook for inflation, a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate.”5 Although labour data has been poor, resulting in the head of the Office for National Statistics (ONS), Sir Ian Diamond, resigning,6 the BoE’s own forecasts were not wildly off the mark.

The BoE should get more clarity from alternative data sources as well as official sources over coming quarters. However, despite the higher inflation figures for April, there are green shoots. The trade framework the UK has put in place with the US along with closer ties to Europe has provided more scope for deflationary forces to work their way into the economy. The UK’s efforts to ease trade barriers could lower costs and friction, potentially shifting the balance between growth and inflation favourably. In theory, this could enable the BoE to carry on with its slow and steady rate cutting cycle.

[1] BBC: https://www.bbc.com/news/articles/cdd29v8mp9jo

[2] ONS: https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/april2025

[3] ONS: https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/april2025

[4] Bank of England: https://www.bankofengland.co.uk/-/media/boe/files/speech/2025/may/the-courage-not-to-act-remarks-by-huw-pill.pdf

[5] Bank of England: https://www.bankofengland.co.uk/monetary-policy-report/2025/may-2025

[6] BBC: https://www.bbc.com/news/articles/cx2qnzdvq25o

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.