In a year marked by trade tensions and political uncertainty, the Federal Reserve (Fed) maintained a steady policy stance throughout the first half of 2025, holding interest rates unchanged despite volatility stemming from President Donald Trump’s tariffs and subsequent renegotiations with some of the US’s largest trading partners. This complicated the economic backdrop, with inflation impacts feeding through as the year progressed.

As the tariff volatility subsided, the Fed’s focus shifted toward the labour market, where emerging signs of weakness became harder to ignore. The decisive moment came in August at the Jackson Hole symposium, where Chairman Jerome Powell signalled a shift in the Fed’s priorities: placing maximum employment ahead of inflation. This marked a shift because inflation had been at the top of the Fed’s priorities in recent years.

Consequently, in September, the Fed embarked on the first 0.25% rate cut of the year, followed by a second in October. The October cut was particularly notable given that policymakers only had a partial view of the economy, as the US government shutdown had forced key agencies that track labour market, employment and home-building activity to close for a record 43 days. When the Fed met on 10 December, it still lacked crucial up-to-date labour data. Nonfarm payrolls, which track the number of paid workers in the economy and are usually released on the first Friday of each month, were delayed by the shutdown and are not scheduled for release until 16 December.

At the December meeting, the Fed cut rates by 0.25%, the third consecutive rate cut this year, bringing rates to 3.75%. The decision was reached by a more unified vote by the Federal Open Market Committee (FOMC) members than markets had anticipated. The vote was 9-3 for a 0.25% rate cut, compared to some forecasters’ predictions for a more divisive vote, with some expecting a 7-5 split. Of the three dissenters, two members voted for no cuts, whilst the other, Donald Trump's recent appointee, Stephen Miran, voted for a larger 0.50% cut as expected. While inflation was mentioned as an important factor for the Fed’s decision making, officials noted that the recent overshoot around 3% had been driven largely by tariff-induced price pressures. Should price pressures become more broad-based, this could lead the Fed to hit the brakes.

The so-called dot plots, which show Fed members’ projections for future rate cuts, indicate only one 0.25% cut in 2026 and one in 2027. Some economists believe this latest reduction was the last rate cut of Powell’s tenure, which ends in May, but ongoing labour market weakness could prompt the Fed to act in the next few months.1

The Fed has faced repeated pressure from the White House to lower rates this year, with tariffs and the government shutdown complicating the central bank’s job. In September, Trump appointed Miran, one of his top economic advisers, to fill a four-month term that unexpectedly opened after Governor Adriana Kugler stepped down early from her role. Since joining the Fed’s board, Miran has advocated for larger rate cuts, warning that the central bank risks inducing a recession if it does not lower interest rates, while brushing off concerns about elevated inflation. Meanwhile, Lisa Cook continues to be embroiled in an investigation over mortgage fraud. She can still serve on the Fed's board until the Supreme Court decides whether Trump can fire her when it meets in January to discuss her case.

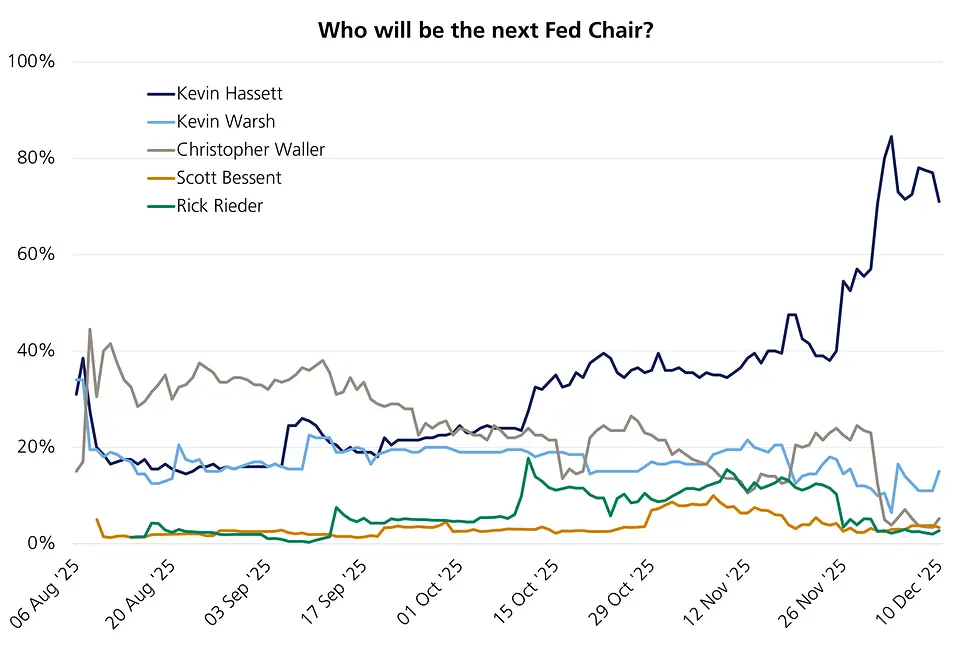

Meanwhile, Trump’s team is preparing to select Powell’s successor, with Kevin Hassett now widely assumed to be Trump’s next chair nominee, given comments in recent weeks. This likely means that current Treasury Secretary Scott Bessent, Christopher Waller and Rick Rieder are out of the running, as can be seen by the betting odds in the chart below.2

The White House’s sustained pressure on the Fed all year to lower interest rates has brought the issue of the Fed’s independence into question. If Hassett is nominated, this will do little to appease investors’ concerns, many of whom believe Hassett, a long-time Trump ally, may care more about following the president’s demands than preserving the Fed’s independence.3 That said, when asked earlier this week how many rate cuts there should be in 2026, Hassett struck a cautious tone, saying, “What you need to do is watch the data.”4 The latest split vote in the December meeting continues to show the institution is led by data and risks to the economy rather than political pressure.

As 2025 draws to a close, the Fed finds itself at a crossroads. It has navigated a difficult mix of tariff aftershocks, a lack of data transparency and overt political pressure while cautiously easing rates and prioritising its maximum employment mandate. Yet questions about its independence, the direction of future policy and the composition of its leadership remain unresolved. Currently, the market is pricing in two rate cuts next year, versus the one in the Fed’s projections, setting the stage for some potential repricing. How these tensions are managed in 2026 as a new chair is appointed will set the tone for markets.

[1] Deutsche Bank

[2] Who will be the next Fed chair? | The Week UK

[3] One of Trump’s most consequential decisions just got more complicated | CNN Business

[4] Deutsche Bank

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.