Just 15 months ago, Sir Keir Starmer entered Downing Street with Labour’s second-largest majority in history. Disenchanted with 14 years of Conservative rule, Britons voiced their discontent at the polling stations in July 2024, handing Labour a significant majority and a tall order – to boost growth, reform welfare, and control regulation all without raising taxes.

Since then, Starmer has seen his popularity drop, as the prime minister struggles with an economy that is barely growing and a rebellion within his own party over welfare reforms. This about-turn is a stark reminder that while all political honeymoons are short, the Labour leader’s has been particularly fleeting.1

Part of Labour’s manifesto pledge included no tax increases, with Starmer’s government prioritising sensible management of the economy and public finances. One year ago, Chancellor Rachel Reeves delivered her first budget to the House of Commons, which included additional spending and substantial increases in National Insurance Contributions. Labour technically kept its pledge – the government raised taxes on employers, not on employees. Reeves said she hoped these measures would be a one-off. “This is not the sort of budget we would want to repeat,” she said at the time.2

During the first budget, Labour also introduced self-imposed fiscal rules to balance the budget, aiming to have tax revenue cover day-to-day spending and debt fall as a share of the economy within five years. While touting fiscal responsibility, the rules only gave her £10 billion of wiggle room in her budget, leaving almost no headroom.

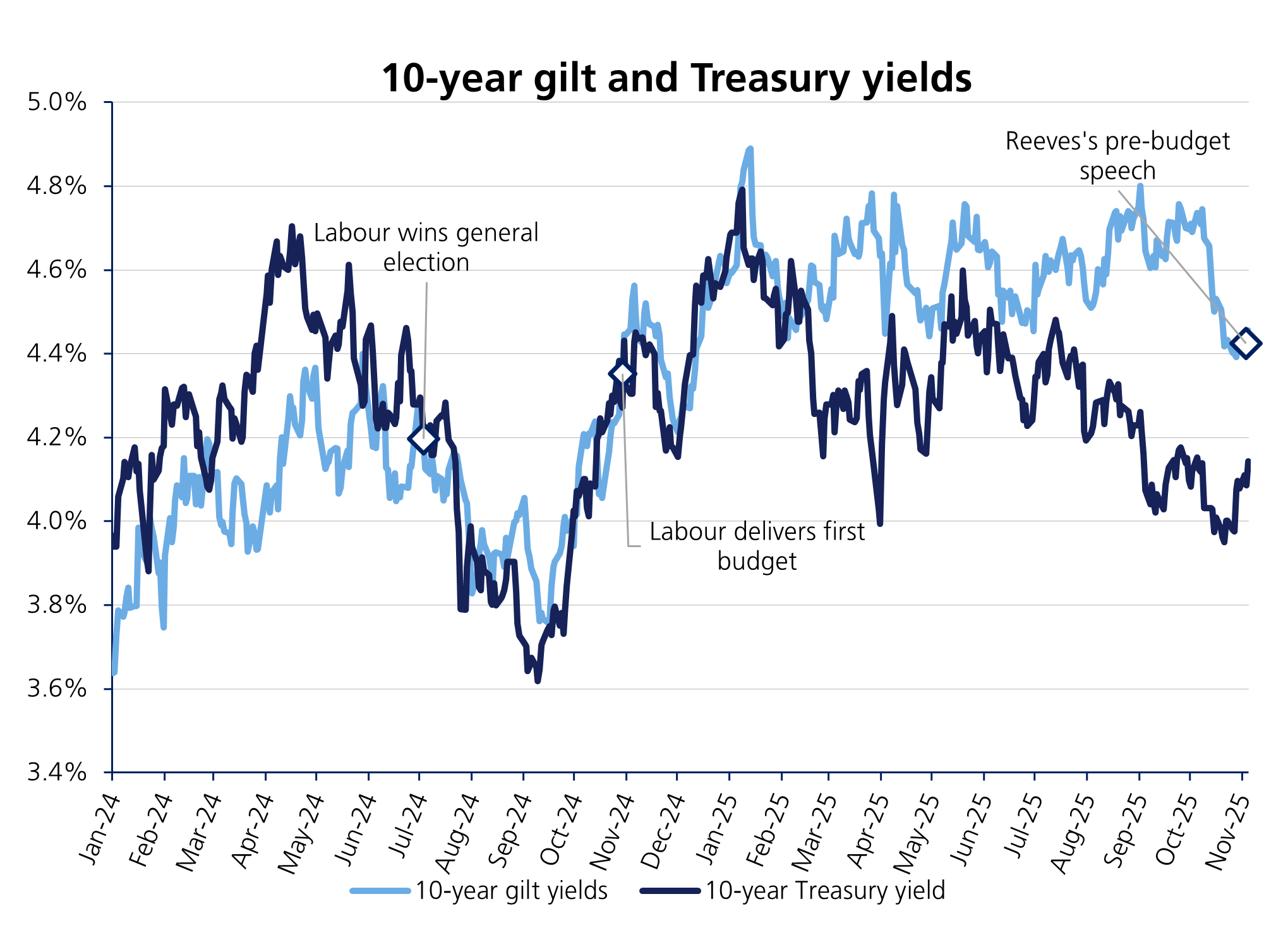

However, bond markets – rattled after Liz Truss’s disastrous handling of the economy back in 2022 – viewed the increased expenditure combined with pay settlements for public workers as a sign that the Labour government’s plans were not credible. Due to the new self-imposed rules, as soon as gilt yields rose, the cost of servicing new debt increased, effectively wiping out the £10 billion buffer Reeves had left herself under the new fiscal rules. This will be further complicated by expected revisions to productivity rates by the Office for Budget Responsibility (OBR), which would dampen growth forecasts and result in a bigger hole in the government’s budget.

Now, facing a slowing economy and dwindling fiscal space, Reeves has been forced to reconsider her earlier stance. Rather unusually, she opted to make a statement three weeks ahead of this year’s budget to set out her position. In her 4 November speech, she refused to rule out further tax increases, which would be a clear departure from her party’s manifesto pledges. During her speech, she emphasised that rising borrowing costs – now the highest in the G7 – are a major policy concern, with £1 in every £10 of taxpayers’ money going to pay interest rather than services. Consequently, her budget will likely focus on fiscal discipline and limiting bond issuance to restore market confidence and lower funding costs over time.

Another factor worth considering – while taxes will not be welcome by voters, if the BoE reduces rates at a faster pace, it will have a positive knock-on effect on homeowners looking to remortgage as the interest payments on their mortgages will likely come down. Perhaps this is something the chancellor is counting on.

On 6 November, the Bank of England (BoE) deviated from its once-a-quarter rate-cutting cycle by opting not to reduce rates, holding them firm at 4%, further highlighting the challenges this government faces in reducing borrowing costs. However, it was a very close call, with four of the nine-strong Monetary Policy Committee voting to lower rates by 0.25%. This shows that if inflation continues to fall, interest rates will follow suit in due course.

Gilt yields rose following the first budget last year, but since the start of October, gilt yields have begun to fall on these expectations that the BoE would reduce rates further, as inflation remained steady for three months in a row. A further reduction in interest rates by the BoE could give the chancellor a little more headroom. However, the BoE only influences short-dated interest rates – investor perception have an outsized influence on long-maturity gilt yields. Meanwhile the pound weakened to a six-month low against the dollar as markets anticipate these rate cuts.

It appears the chancellor hopes that raising taxes may result in lower borrowing costs. At a time when Labour’s polling is so low, this seems like a gamble worth taking to restore the UK’s international credibility but it comes at the expense of the government’s own credibility.

[1] Keir Starmer approval rating: the opinion polls tracked

[2] This is not a Budget we want to repeat, says Rachel Reeves - BBC News

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.