President Donald Trump’s first term in the White House saw unusually high staff turnover among senior aides and cabinet officials, creating a volatile backdrop for investors when assessing the administration’s priorities. In his second term, we have witnessed a shift in his governing style, as the US president has adopted a more discreet approach, favouring private negotiation and strategic appointments rather than overt personnel changes. It reminded me of the popular competition show, The Traitors, where strategic gameplay and discretion can prove more effective than display.

While public dismissals have become less frequent in Trump’s administration, policy decisions – notably the use of tariffs – have been central in influencing global trade relations. These measures have at times blurred the line between ally and competitor, serving as an economic tool that can also test alignment and exert leverage.

In the process of assessing successors to the Federal Reserve (Fed) Chairman Jerome Powell, the administration has been closely examining who might prove reliable on policies before making a final choice. The Fed was designed to be independent from the White House so officials can set rates to control inflation without political pressure. Yet institutional independence has done little to insulate the Fed from White House pressure.

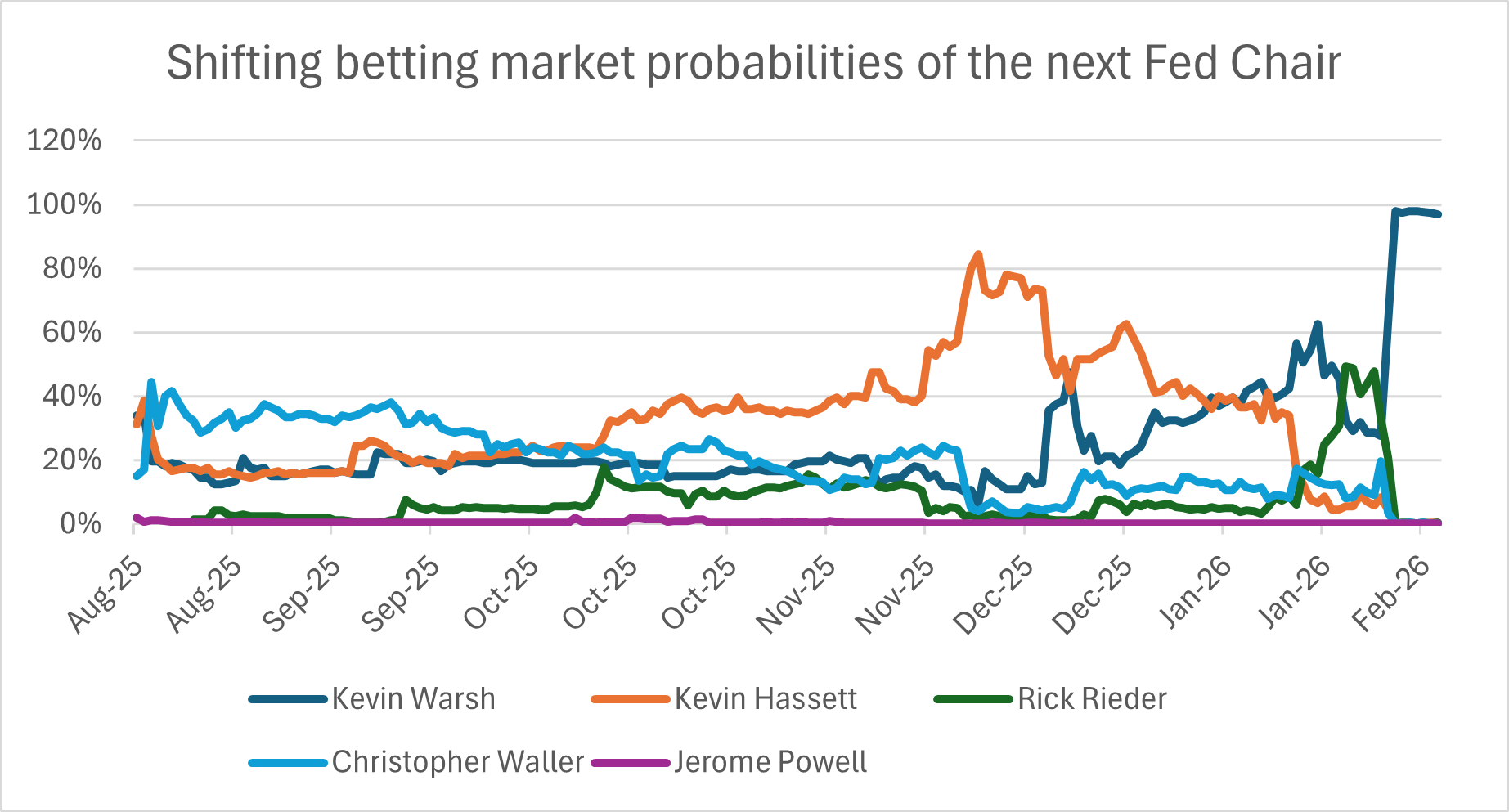

Figures such as Kevin Hassett, Kevin Warsh, Christopher Waller and Rick Rieder were all publicly floated and scrutinised, as the White House weighed up their views on interest rates and institutional independence.

At the Davos conference in Switzerland, speaking about the timing of a new Fed chair announcement at the conference, Trump said, “Problem is they change once they get the job. They said everything I want to hear and then they get the job, they're locked in for six years, they get the job, and all of a sudden, ‘Let's raise rates a little bit.’ I call them, ‘Sir, we'd rather not talk about this.’ It's amazing how people change once they have the job. It's too bad, sort of disloyalty, but they got to do what they think is right.”1

The process concluded on 30 January, when Trump announced Warsh would succeed Powell as chairman of the central bank, pending Senate confirmation, putting the former central bank governor in a pivotal position at an institution increasingly at odds with the administration.2 Warsh, who was a front-runner to be Fed chair during Trump’s first term and was a Fed governor from 2006 to 2011, currently works with Stanley Druckenmiller and is a senior fellow at the Hoover Institution at Stanford.

Following the announcement of Warsh’s appointment, we saw sharp declines in precious metals, with gold and silver giving up most of their gains this year. The dollar, which had been weakening, bounced off lows. Investor concerns about debasement appear to be fading given Warsh has previously been vocal about his opposition to asset purchases, and would likely seek to reduce the Fed's balance sheet, enabling the central bank to adopt lower interest rates.

For now, Trump appears confident that Warsh will prove faithful. In a post on Truth Social, Trump praised Warsh, saying, “He will go down as one of the GREAT Fed Chairmen, maybe the best.” He continued, “On top of everything else, he is ‘central casting’ and will never let you down.” During follow-up remarks, Trump said that while he did not get a commitment from Warsh to cut rates, he expected he would do so. “He certainly wants to cut rates, I’ve been watching him for a long time.”3

Time will tell if Warsh remains faithful to the White House or to the Fed in maintaining its independence from political power.

[1] Davos 2026: Special Address by US President Donald J Trump | World Economic Forum

[2] Trump Picks Kevin Warsh as Next Fed Chair - The New York Times

[3] Trump Picks Kevin Warsh as Next Fed Chair - The New York Times

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.