When Sanae Takaichi assumed leadership of Japan’s Liberal Democratic Party (LDP) in October and subsequently became prime minister, it reverberated well beyond Tokyo. As Japan’s first female prime minister, Takaichi broke a significant political barrier and entered office with ambitious plans to revitalise the Japanese economy. However, the scale of these ambitions has been matched by the complexity of the challenges she now faces.

In addition to a challenging global backdrop marked by geopolitical upheaval, Takaichi faces numerous challenges at home, including rising inflation, an ageing population, and growing disquiet over immigration. Politically, her starting position has been fragile. The LDP only secured a minority government, meaning that translating her ambition into policy was never going to be easy. While her approval ratings rose to around 70% in the early months of her premiership, they have slipped since she called a snap election for 8 February.

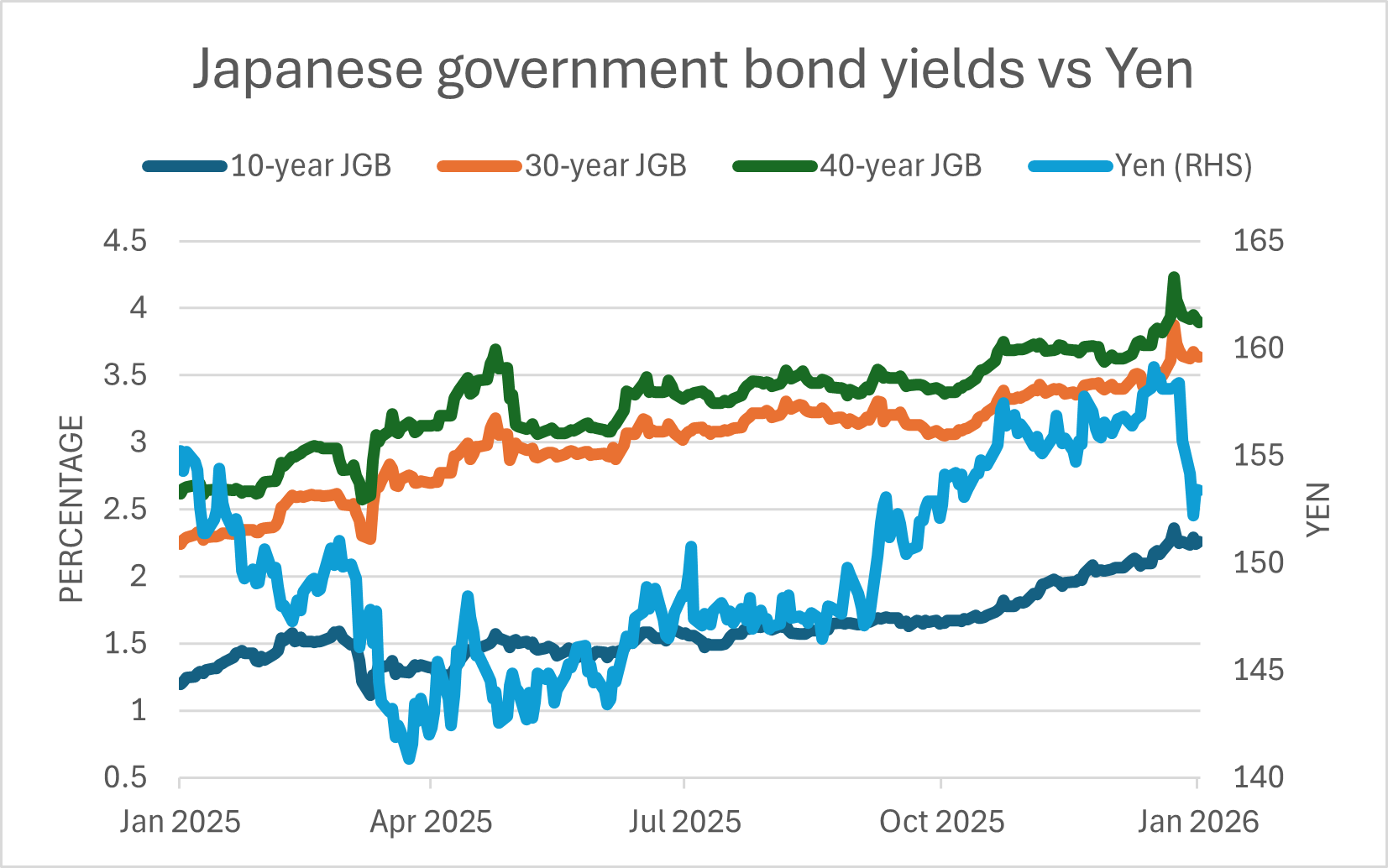

Fiscal expansion sits at the centre of Takaichi’s policy agenda, most notably through proposals for food-only consumption tax cuts at a time when inflation has been persistently above target. Investors are unnerved by these plans, given Japan’s enormous debt pile. Her decision to call a snap election amplified these concerns, triggering big swings across Japanese equity, fixed income and currency markets. By the close on 20 January, 30-year Japanese government bond (JGB) yields rose by nearly 0.27% to 3.84%, the largest daily increase since the maturity was first introduced in 1999.1 Forty-year bond yields meanwhile breached 4%. The domestic repricing did not stay confined to Japan, reverberating through global bond markets and weighing on developed market government debt worldwide.

The Bank of Japan (BoJ) met just a few days after this bout of market volatility. At its 23 January meeting, the BoJ left interest rates unchanged at 0.75% as widely expected, after hiking rates by 0.25% at the previous meeting. However, the decision at this meeting was not unanimous, with an 8-1 vote and the lone dissenter calling for another 0.25% increase. The BoJ reiterated its hawkish tilt, signalling that further hikes remain likely, while emphasising it would remain vigilant in closely monitoring inflation dynamics and yen volatility. Inflation is forecast to rise slightly from 2%. The central bank also indicated that it stands ready to intervene through additional government bond purchases should JGB or currency markets experience further dislocations.

Developments in Japanese bond markets have drawn increasing international scrutiny. Over the 25-26 January weekend, the Federal Reserve Bank of New York, acting on behalf of the US Treasury Department, contacted banks to inquire about the cost of exchanging yen for dollars. It was an unusual move that sparked a sharp rally in the yen and fuelled speculation that the US Treasury could be considering large-scale yen purchases.2 Meanwhile, the Topix has dropped 3% since the snap election was called and is up 4% so far this year through 29 January in local terms.

On the foreign policy front, relations between Japan and China have become more strained since Takaichi took office. On 7 November, she told Japan’s parliament that a Chinese use of force against self-ruled Taiwan – which is claimed by China as its own – could warrant a military response from Tokyo.3 These remarks came just one day after a cordial meeting with Chinese leader Xi Jinping on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit in South Korea. In response, China issued a travel warning advising its citizens not to travel to Japan,4 followed by a renewed warning on 26 January, after Takaichi declined to retract her remarks on Taiwan.5

Chinese tourists form a crucial pillar of Japan’s inbound tourism market, and were its biggest spenders last year, accounting for more than 20% of total inbound tourism expenditure and $11.7 billion in spending in 2025, according to the Japan Tourism Agency. While overall foreign arrivals hit a record 42.7 million last year, including 9.1 million from China, the impact of Beijing’s travel warning was immediate: Chinese arrivals plunged by 45.3% in December compared with a year earlier.6

Domestically, Takaichi’s government continues to pursue a firmer stance on immigration. On 23 January, several proposals were submitted calling for “zero” illegal immigration, stricter rules on land purchases by foreigners, and expanded Japanese-language education. One proposal went further, suggesting a cap on the proportion of foreign residents in the total population, aimed at slowing the pace of growth in inward migration.7

The world’s fifth-largest economy is undergoing a profound transition, moving from decades of near-zero inflation into an era of higher prices, tighter financial conditions and more policy trade-offs. Takaichi’s bid to secure a majority government and broader mandate underscores both the opportunity and the risk inherent in this shift, as Japan attempts to redefine its economic and strategic stance at home and abroad.

While this drew some comparisons to the UK’s experience under Liz Truss, the recent aggressive sell-off in government bonds in Japan offers a clear warning about the limits of market tolerance. It highlights the importance of carefully calibrating fiscal and monetary policy at a time when investor support can no longer be taken for granted. For Japan to flourish, credibility and stability will be as critical as political ambition. Nevertheless, as Takaichi tests the boundaries of her mandate, periods of heightened market volatility are likely to persist.

[1] Deutsche Bank, Bloomberg

[2] Tremors in Japan Prompt Treasury to Weigh Currency Intervention - The New York Times

[7] Japan's ruling bloc submits policy proposals on foreign residents to PM - Japan Today

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.